Get the free BUSINESS TAX 990 - CAJE-Miami.org

Get, Create, Make and Sign business tax 990

Editing business tax 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business tax 990

How to fill out business tax 990

Who needs business tax 990?

Business Tax 990 Form: How-to Guide Long-Read

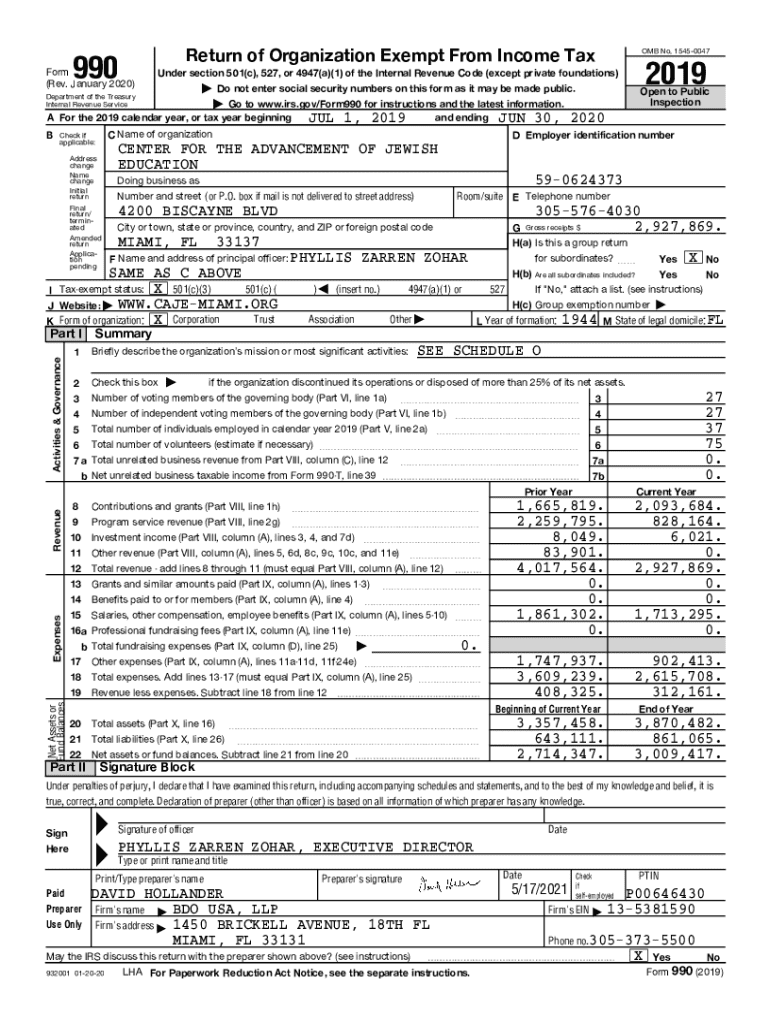

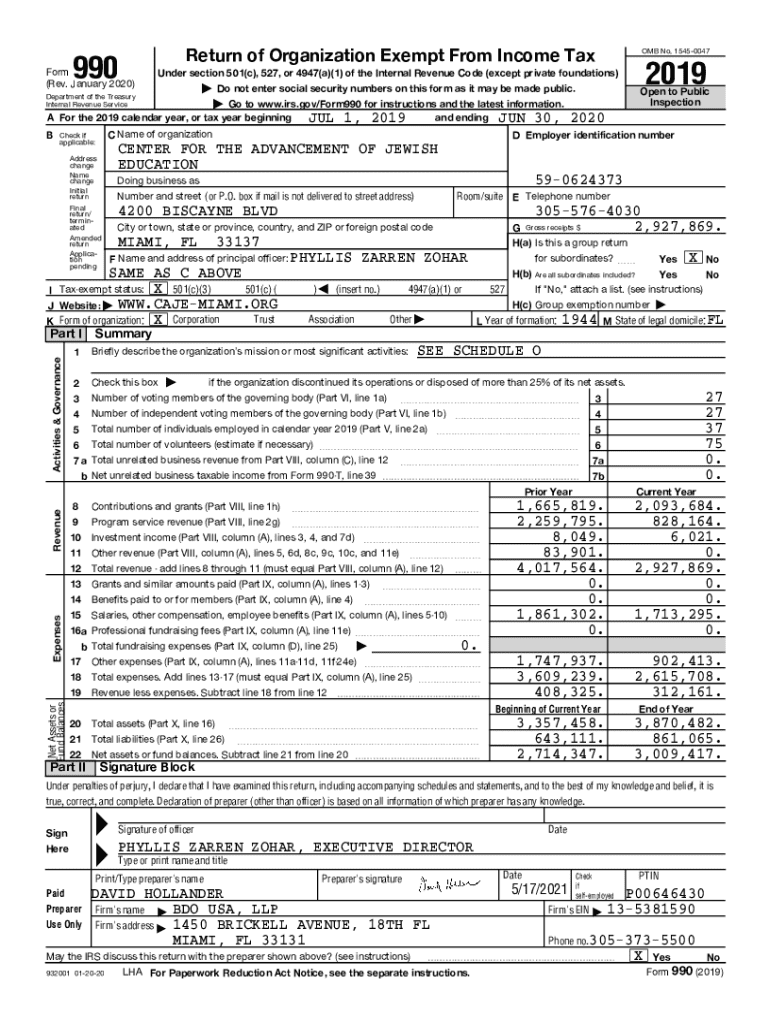

Overview of IRS Form 990

IRS Form 990 serves as an essential reporting document for tax-exempt organizations. Its primary purpose is to provide the IRS and the public with financial information, operational activities, and compliance details about nonprofits and certain businesses. When properly filled out, it reflects your organization's financial health and operational transparency, serving as a vital tool in securing trust from donors, stakeholders, and the community.

Understanding Form 990 is crucial, not just for compliance purposes but also for maintaining credibility and accountability in the nonprofit sector. As it reveals how organizations manage their funds, it significantly affects funding opportunities and public perception.

Filing requirements for Form 990

Not every organization is required to file Form 990. Understanding who must file is critical to ensure compliance and avoid penalties. Generally, most tax-exempt organizations with gross receipts over $200,000 or total assets over $500,000 are required to file. These parameters help determine whether an organization qualifies for Form 990, 990-EZ, or 990-N.

However, exemptions exist for certain types of organizations, which can include religious institutions or other qualifying entities. It’s imperative for organizations to stay updated on these regulations and consult IRS resources or tax professionals for assistance.

Preparing to file

Preparation is a crucial step before filing Form 990. Organizations must gather various details related to their structure, mission, and financial activities. Knowledge about your organization’s structure, mission, and activities is essential. The organizational information section will outline who you are and what you do, while financial reporting will detail your revenue, expenses, and overall assets.

In addition to core information, different schedules attached to Form 990 require specific details. Knowing which schedules apply to your organization can be daunting but is fundamental to accurate reporting.

Step-by-step instructions for completing Form 990

To successfully complete Form 990, organizations should begin by gathering necessary documents. This includes financial statements, governance documents like bylaws, policies, and any historical records that may play a role during reporting.

Once all documents are collected, the next step involves filling out the form section by section. Start with basic organizational information before diving into financial data reporting and tax compliance questions. The orderly completion of these sections ensures clarity and accuracy.

Submitting Form 990

Organizations can choose to file Form 990 electronically or via paper submission. Opting for electronic filing simplifies the process and ensures that your form is submitted securely. Utilizing the IRS's e-file system facilitates faster processing, while paper filing requires careful attention to postal services’ timelines.

Key deadlines are crucial to maintain compliance and avoid penalties. Generally, Form 990 is due on the 15th day of the 5th month after your organization's fiscal year-end. Extensions can be requested, but it's vital to file the proper forms to avoid issues.

Penalties for non-compliance

Failing to file Form 990 can have substantial consequences. Organizations may face financial penalties that can accumulate quickly, potentially leading to damage that impacts operational capacity. Additionally, recurrent failure to file may result in loss of tax-exempt status, which denotes a severe setback from a regulatory perspective.

To mitigate the risk of non-compliance, organizations should establish a diligent filing process, keeping a calendar of deadlines and utilizing service tools such as pdfFiller that provide reminders and resources required for compliance.

Public inspection regulations

Organizations must comply with public inspection regulations for Form 990. This ensures that Form 990 is accessible to the public, fostering transparency and trust. By making the form available to the public, organizations build confidence in their operations and stewardship of resources.

Providing access to these forms allows donors, community members, and stakeholders to evaluate the organization’s financial position and operational integrity, further solidifying their trust in the nonprofit sector.

Tools and resources for managing Form 990

Leveraging interactive tools available on pdfFiller can significantly enhance the form completion process. With templates, editing capabilities, and eSign features, the platform serves as an invaluable resource for organizations looking to streamline their Form 990 submissions. These features not only enhance efficiency but also provide an organized, collaborative environment for document management.

Collaboration strategies can aid teams in managing the complexities of Form 990. Utilizing shared workspaces allows individuals to contribute their insights in real-time, while designated roles ensure accountability, minimizing the risk of overlooked details.

FAQs about Form 990

Understanding common questions surrounding Form 990 is essential for effective filing. For instance, organizations may wonder what to do in the event of having no revenue. In such cases, it’s still essential to file a Form 990-N to maintain compliance. Similarly, transitions in leadership can require updated information and potentially different reporting details; diligence in keeping records accurate is crucial.

Mistakes are inevitable, but knowing how to address them post-submission is fundamental. Organizations typically can amend their filings by submitting a corrected Form 990.

The critical role of Form 990 in business and nonprofit sector

Form 990 plays an indispensable role not just in compliance but also in shaping an organization’s reputation. As a reflection of operational transparency and financial integrity, it is a cornerstone of nonprofit accountability. Funders and donors often use Form 990 to assess financial stability and operational efficacy before committing resources.

Beyond external impressions, analyzing Form 990 data provides organizations with critical insights that can shape better management practices and strategic decisions, leading to long-term sustainability and growth.

Next steps after filing

After submitting Form 990, organizations should engage in a post-submission review. Monitoring for any IRS notifications or follow-ups will ensure that any required actions are promptly addressed. Regular reflection on the submitted form can also aid organizations in improving future filings.

Moreover, the insights gained from Form 990 can be leveraged for future planning and optimization. Utilizing analysis of funding trends, operational expenditures, and engagement data fosters informed decision-making conducive to organizational success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit business tax 990 from Google Drive?

How can I send business tax 990 for eSignature?

How do I fill out the business tax 990 form on my smartphone?

What is business tax 990?

Who is required to file business tax 990?

How to fill out business tax 990?

What is the purpose of business tax 990?

What information must be reported on business tax 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.