Get the free NOTES TO THE UNAUDITED INTERIM FINANCIAL REPORT ...

Get, Create, Make and Sign notes to form unaudited

Editing notes to form unaudited online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notes to form unaudited

How to fill out notes to form unaudited

Who needs notes to form unaudited?

Comprehensive Guide to Notes to Form Unaudited Form

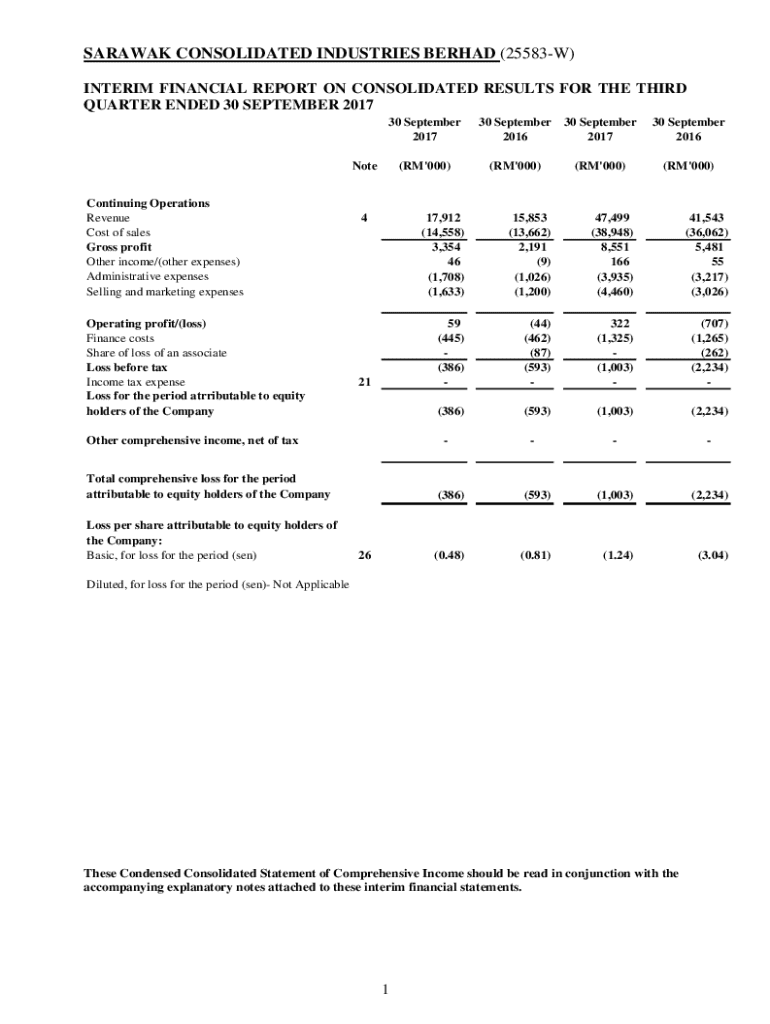

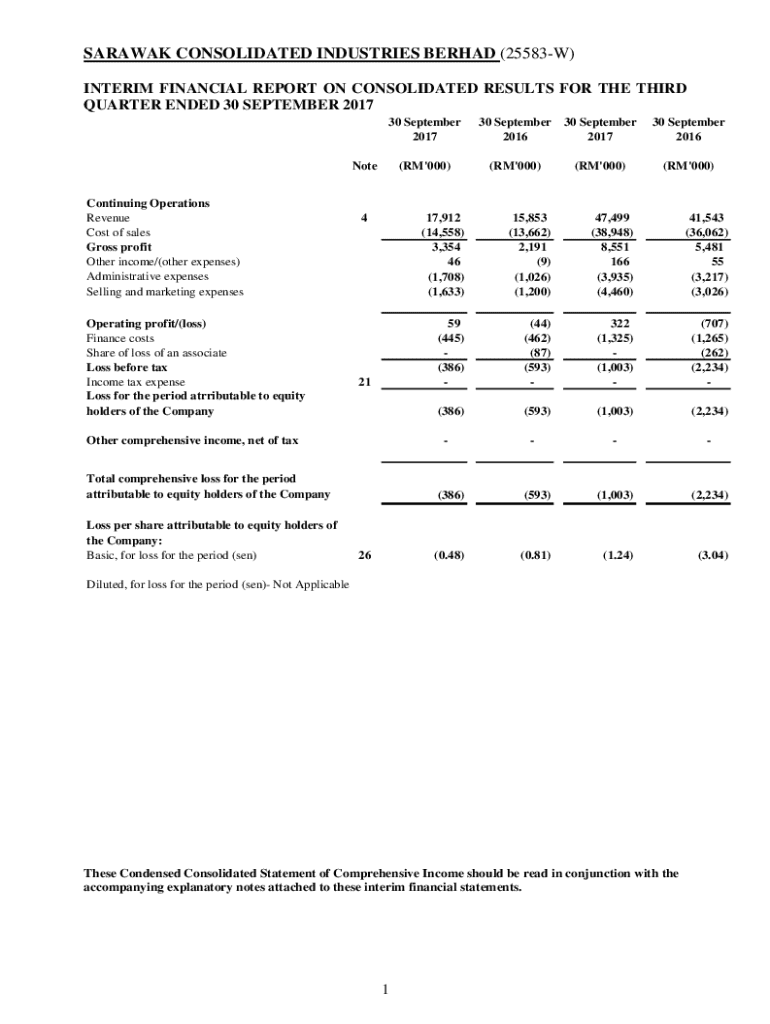

Understanding unaudited forms

An unaudited form refers to a financial document that has not undergone an audit by an external auditor but still provides crucial financial information regarding a company’s performance. These forms are vital for internal assessments as they allow management to review financial health without the additional costs associated with a full audit.

Unaudited forms play a significant role in financial reporting, especially for companies that require periodic updates on their financial status. They offer a snapshot of financial performance and standing, ensuring stakeholders are kept in the loop on critical metrics.

Key components of notes to unaudited forms

Notes accompanying unaudited forms act as invaluable paraphernalia, providing detailed explanations of figures presented in the financial statements. Each note delivers insights that help clarify the underlying assumptions, methodologies, and contexts of reported financial metrics.

Providing context for every figure is crucial, as it allows stakeholders to grasp not just the ‘what’ but the ‘why’ behind the numbers. This enhances transparency and informs decision-making processes, thus fostering trust and credibility.

Authority and objectives of unaudited forms

Unaudited forms adhere to specific legal requirements and standards, such as the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), depending on the jurisdiction. These regulations dictate how information must be presented, fostering consistency and reliability across financial reports.

The primary objective of providing detailed notes is to enhance understanding for stakeholders, including investors and management. By disclosing comprehensive information, companies mitigate risks of misinterpretation that could arise from a cursory glance at raw figures.

Summary of significant accounting policies

Unaudited forms often start with a summary of significant accounting policies, detailing methods and principles applied in preparing financial statements. Clarity here is vital, as it sets the framework for how financial results are derived.

Organizations may adopt distinct policies based on their industry or operational requirements. For instance, a manufacturing firm might focus on inventory costing methods, whereas a tech company might prioritize revenue recognition from software licensing.

Elements of financial reporting in unaudited forms

Financial reporting through unaudited forms typically includes detailed metrics such as revenue, expenses, and net income. These metrics offer a foundation for assessing organizational performance over time and are often accompanied by comparative figures from prior periods.

Terminology used in these reports needs to be carefully defined to avoid confusion. A clear understanding of terms such as 'EBITDA,' 'current assets,' and 'equity' is essential for stakeholders who may not have financial backgrounds.

Specific items to address in notes

Notes to unaudited forms should address specific items that require additional scrutiny or explanation. Here are several critical elements commonly discussed:

Format and presentation of notes

Formatting notes effectively is key to ensuring clarity and ease of understanding. Notes should be organized logically, often starting from the most critical disclosures to the less significant details.

Using concise writing, bullet points, and tables can significantly enhance readability. Be clear and direct, avoiding jargon wherever possible to ensure all stakeholders can comprehend the material provided.

Best practices for completing notes to unaudited forms

Engaging with relevant stakeholders during the preparation of notes is crucial. By including input from financial directors and department heads, companies can ensure that notes are comprehensive and accurate.

Creating a checklist that covers all required disclosures will help in maintaining completeness. These periodic updates to the notes ensure that they remain relevant and reflective of the business's current state.

Role of technology in managing unaudited forms

Technological advancements have streamlined the process of managing unaudited forms significantly. Software like pdfFiller offers essential features for document management, making collaboration seamless and efficient.

The ability to edit documents, digitally sign them, and share them effortlessly across teams saves time and reduces human error. Leveraging cloud-based platforms ensures that every user has access to the most current version of documents.

Common pitfalls to avoid

When preparing notes for unaudited forms, companies frequently make several missteps. One significant error is incomplete disclosures, leading to trust issues among stakeholders.

Not adhering to industry standards can result in non-compliance penalties, while a lack of regular review can lead to outdated or irrelevant information being shared, putting a company’s reputation at risk.

Case studies and examples

Several companies have successfully implemented effective notes in their unaudited forms. For example, Company XYZ provided clear explanations for their revenue streams, leading to improved understanding among stakeholders and a positive market response.

Conversely, Company ABC faced challenges when their notes were riddled with jargon, leading to misunderstandings and investor skepticism. Learning from such case studies offers critical insights into common errors and best practices.

Interactive tools & resources

To enhance the process of creating and managing unaudited forms, various tools and resources are available. pdfFiller provides templates specifically designed for unaudited forms, facilitating easy completion and management.

Additionally, interactive Q&A sections can assist users in filling out forms correctly, ensuring clarity and accuracy. This combination of user-friendly templates and proactive support creates an efficient document handling experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify notes to form unaudited without leaving Google Drive?

How can I edit notes to form unaudited on a smartphone?

How do I edit notes to form unaudited on an Android device?

What is notes to form unaudited?

Who is required to file notes to form unaudited?

How to fill out notes to form unaudited?

What is the purpose of notes to form unaudited?

What information must be reported on notes to form unaudited?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.