Get the free Dexter Community Schools 457 Plan

Get, Create, Make and Sign dexter community schools 457

How to edit dexter community schools 457 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dexter community schools 457

How to fill out dexter community schools 457

Who needs dexter community schools 457?

A Comprehensive Guide to the Dexter Community Schools 457 Form

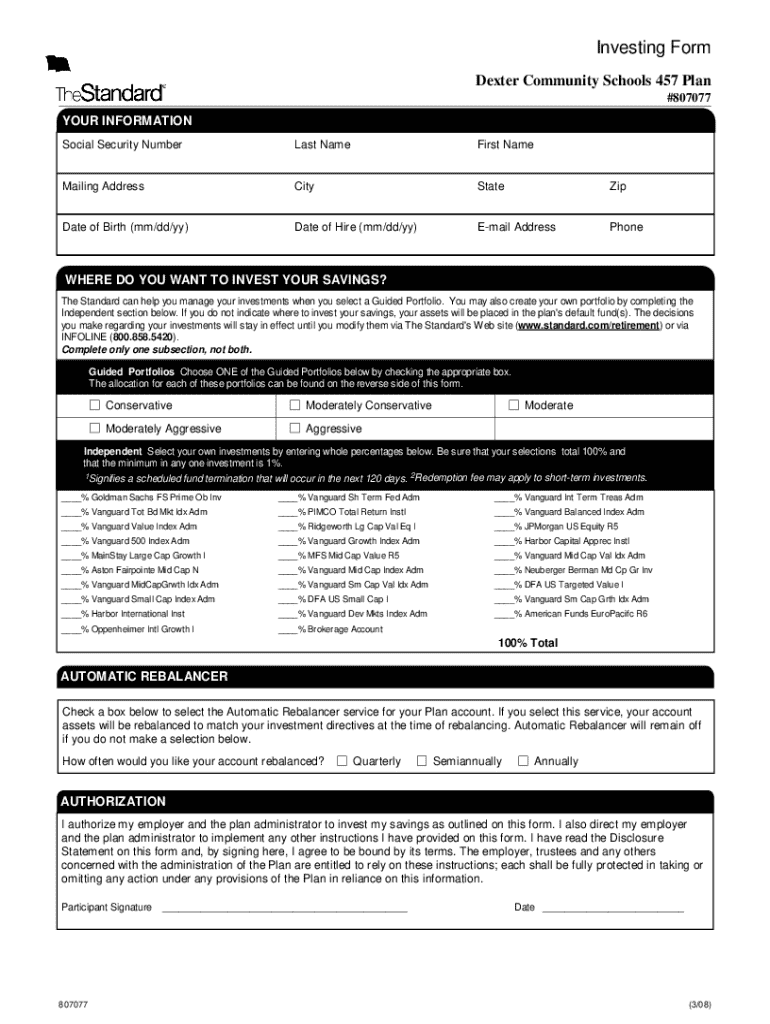

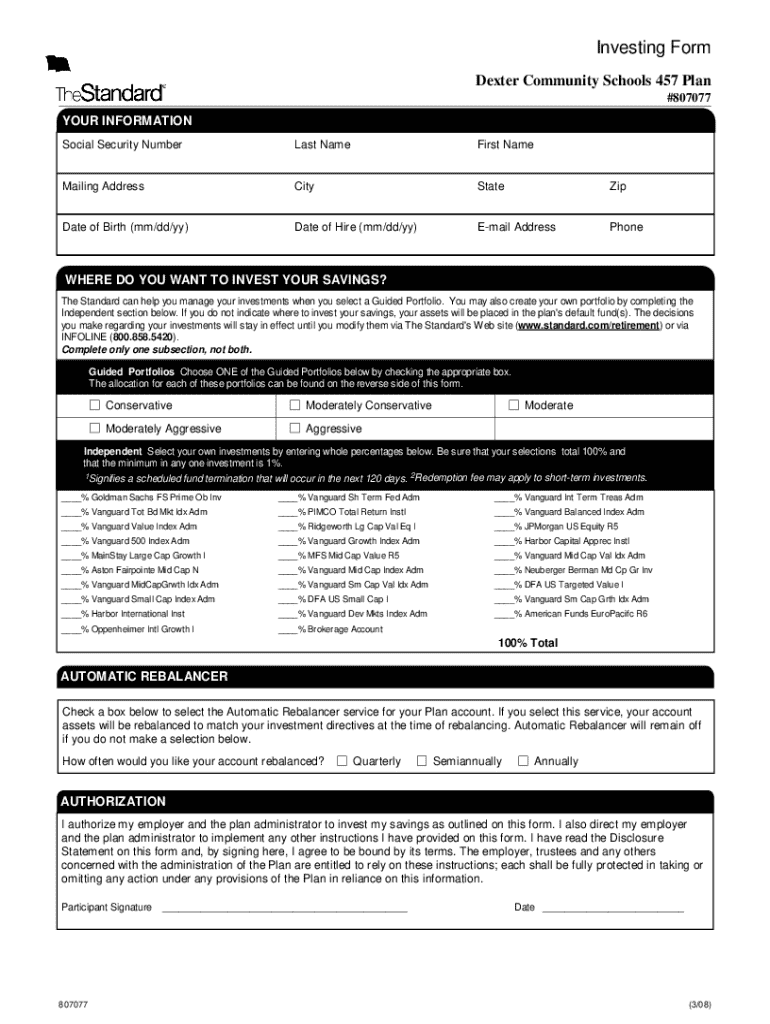

Overview of the Dexter Community Schools 457 Form

The Dexter Community Schools 457 Form is essential for employees seeking to manage their retirement savings effectively. This form serves as a vehicle through which eligible employees can enroll in the 457(b) deferred compensation plan, allowing them to set aside a portion of their income for retirement. It essentially provides a tax-advantaged way to save, ensuring that employees can build a nest egg for their post-work life while also enjoying potential tax benefits during their working years.

Understanding the 457 Form framework

The 457 plan has deep roots in the education sector, initially introduced to offer tax-deferred savings options to state and local government employees. Its history extends to providing employees with greater financial flexibility as they prepare for retirement. With these plans, participants are incentivized to save more, encouraging healthier financial habits.

Understanding key terms related to the 457 Form is crucial for maximizing its benefits. The concept of 'deferral' refers to delaying a portion of your salary to contribute to the 457 plan, which is not taxed until withdrawal. Meanwhile, the 'beneficiary designation' allows employees to specify who will receive their account funds upon passing, ensuring financial support for loved ones. Account contribution limits dictate how much can be deposited annually, currently set at a maximum of $19,500, with an additional catch-up contribution feature for those nearing retirement age.

Step-by-step guide to completing the Dexter Community Schools 457 Form

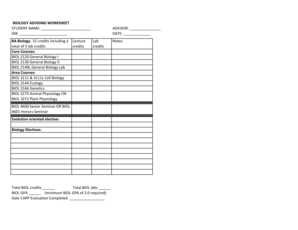

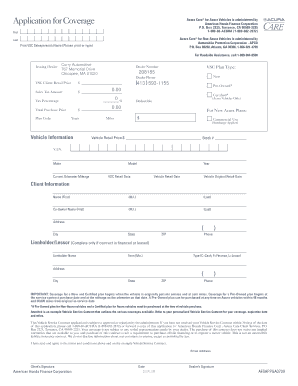

Filling out the Dexter Community Schools 457 Form may seem daunting, but by following a structured approach, it can be accomplished with ease. The first step is to gather all necessary information, which includes your employee identification number, personal contact information, and relevant financial data essential for making informed decisions about your contributions.

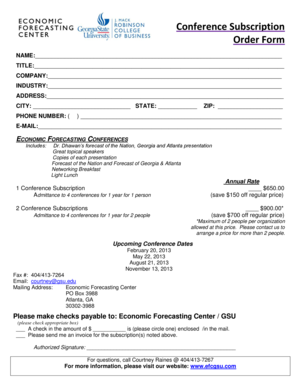

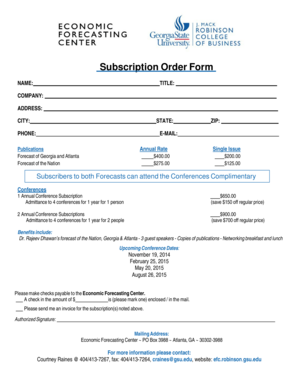

Next, access the 457 Form by visiting pdfFiller. The platform allows for an easy download of the form, along with other accessible resources to aid in filling it out. Once you have the form, pay attention to each section. Carefully input your details, and ensure you’re avoiding common mistakes, such as incorrect personal data or selecting the wrong contribution amount.

Finally, review your completed form using a checklist to ensure accuracy. Double-checking your information can prevent delays in processing and ensures that your contributions are effective right from the beginning.

Interactive tools for 457 Form management

pdfFiller provides various interactive tools that significantly streamline the management of your 457 Form. One standout feature is the platform’s editing functionality, which allows users to modify existing PDFs easily. With these tools, you can directly input changes, correct errors, and add any necessary signatures.

Moreover, the eSign capabilities streamline the submission process, enabling you to sign forms digitally. This means you can submit your completed 457 Form from anywhere, without the need for printing or physically visiting the school’s HR office. Additionally, tracking your form status demystifies the process, as you can stay informed about your submission every step of the way.

Editing and collaborating on your 457 Form

Editing your 457 Form with pdfFiller’s tools is straightforward. Once downloaded, you can easily make adjustments, whether correcting mistakes or altering your contribution plans. The robust editing suite offers a range of options from text adjustments to adding notes, enhancing clarity and precision.

For teams, inviting members for collaboration is a significant advantage. You can share the document within your department to gather feedback or make collective decisions on contribution amounts. Using comments and annotations provides clarity, ensuring that all relevant team members are on the same page regarding the completion of the form.

Submission guidelines for the Dexter Community Schools 457 Form

Upon completing the 457 Form, the next crucial step is submitting it correctly. You have options to submit either online through the Dexter Community Schools’ HR portal or via a physical copy delivered to the HR office. Each method is valid, but digital submission allows for quicker processing.

Be mindful of submission deadlines as well. This form typically follows a particular schedule aligned with the school’s payroll cycle, with significant dates communicated through internal memos or HR communications. Staying informed about these deadlines is vital to ensure your contributions are enacted promptly.

FAQs about the Dexter Community Schools 457 Form

Understanding potential concerns regarding the 457 Form can ease the process. For instance, if a mistake is made on your form, it’s essential to contact the HR department immediately to rectify it. Most corrections can be handled without major issues.

If you want to change your contribution amount after submission, the process typically involves submitting a new 457 Form with the updated figures. Lastly, for specific inquiries regarding the 457 Plan, don't hesitate to reach out to the designated contacts in the Dexter Community Schools’ HR Department.

Resources and support for working with the 457 Form

For comprehensive support while working with the Dexter Community Schools 457 Form, resources are readily available. The HR department is not only your go-to source for questions but also provides valuable insights and assistance throughout the process.

Furthermore, pdfFiller offers online tutorials and support specifically for users of their platform, making it easier to navigate the 457 Form’s complexities. Lastly, visiting community forums and help centers can present an opportunity to connect with fellow employees who might share their own tips and experiences.

Maximizing your benefits through the 457 Plan

Investing in your 457 Plan is about more than just completing a form; it’s about understanding the nuances of your investments and aligning them with your retirement planning goals. A good practice is to regularly reassess your contributions based on your financial situation and retirement aspirations, ensuring you’re on the right track.

Additionally, diversifying your investment choices and being proactive can lead to maximizing your retirement benefits. Engage with financial advisors or utilize online tools from pdfFiller to simulate different contribution scenarios and their potential long-term impacts.

Staying updated on changes to the 457 Plan

To maximize your benefits and stay informed about any updates, subscribe to newsletters and bulletins from Dexter Community Schools. Changes to the 457 Plan can affect your contributions or available investment options, so being proactive in seeking out this information ensures you’re making the best decisions for your future.

Consider leveraging digital platforms to receive timely updates. The integration of these avenues into your routine can be pivotal in maintaining awareness of your financial options regarding the 457 Plan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send dexter community schools 457 to be eSigned by others?

Where do I find dexter community schools 457?

Can I edit dexter community schools 457 on an Android device?

What is dexter community schools 457?

Who is required to file dexter community schools 457?

How to fill out dexter community schools 457?

What is the purpose of dexter community schools 457?

What information must be reported on dexter community schools 457?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.