Get the free New Hire Payroll Information Sheet.docx

Get, Create, Make and Sign new hire payroll information

Editing new hire payroll information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new hire payroll information

How to fill out new hire payroll information

Who needs new hire payroll information?

Comprehensive Guide to the New Hire Payroll Information Form

Overview of new hire payroll information

A new hire payroll information form is an essential document that collects crucial details needed to process payroll accurately. This form serves as the backbone of the employee payroll setup, ensuring that businesses possess the required information to pay their employees correctly and on time.

Accurate employee payroll details are vital, as they safeguard against potential errors that could lead to underpayment or overpayment, affecting both the employee's financial health and the company's reputation. pdfFiller enhances the efficiency of managing payroll documents, allowing HR departments to handle these forms with ease.

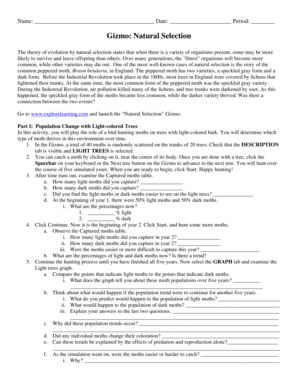

Key components of the new hire payroll information form

Understanding the key components of the new hire payroll information form is fundamental for both employers and new employees. This form generally contains several critical sections:

Step-by-step guide to completing the form using pdfFiller

Completing the new hire payroll information form can be simplified using pdfFiller. The platform offers an intuitive interface that guides users through the process.

Editing and customizing the new hire payroll information form

One of the standout features of pdfFiller is its suite of editing tools that allow for customization of the new hire payroll information form. Users can modify text fields, adjust formatting, and add any additional information necessary.

Collaboration is made easy as well, allowing team members to review form details and add comments for clarification. This transparency enhances the accuracy of documentation and helps resolve potential issues before submission.

eSigning the payroll information form with pdfFiller

The use of electronic signatures has transformed HR processes, streamlining the approval workflow for the new hire payroll information form. With pdfFiller, eSigning is straightforward.

To eSign the document, users simply follow the designated prompts on pdfFiller’s platform. Electronic signatures are valid and secure, ensuring that the signed forms are legally binding and recognized.

Common challenges and solutions

Filling out and submitting the new hire payroll information form may present several challenges for new employees and HR teams alike. Understanding and addressing these challenges proactively can ensure smoother onboarding.

Frequently asked questions (FAQs)

Navigating the new hire payroll information form can raise several questions, especially for those new to the workforce. Here are some common queries:

Related forms and templates

Besides the new hire payroll information form, several other forms are crucial for a comprehensive onboarding process, including:

Integrating all these forms into a seamless onboarding process powered by pdfFiller improves the overall experience for new hires and HR teams.

Compliance considerations

Employers must comply with state and federal regulations regarding payroll information. It's imperative to ensure that the payroll information form aligns with these regulations to avoid penalties or fines.

Furthermore, maintaining privacy and data protection for sensitive information is vital. Adopting best practices for handling employee data can foster trust and comply with legal obligations.

Quick tips for new hires

As a new hire, navigating payroll and other related documents can be challenging. Here are some quick tips to ease the process:

Contact information for further assistance

For any questions regarding the payroll form or broader payroll concerns, it's best to reach out directly to the HR department. They can provide specific guidance to clarify any uncertainties.

Additionally, users can access pdfFiller’s support resources for help navigating the platform or resolving issues related to document management.

Subscribe for updates on payroll and HR information

Staying informed about changes in payroll and HR practices is crucial. By subscribing to updates from pdfFiller, users can receive information on legal changes, best practices, and other vital payroll-related content.

Expect topics covering up-to-date compliance requirements, innovative HR solutions, and tips for efficient document management, ensuring that you remain at the forefront of payroll management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in new hire payroll information?

How do I make edits in new hire payroll information without leaving Chrome?

How do I fill out new hire payroll information using my mobile device?

What is new hire payroll information?

Who is required to file new hire payroll information?

How to fill out new hire payroll information?

What is the purpose of new hire payroll information?

What information must be reported on new hire payroll information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.