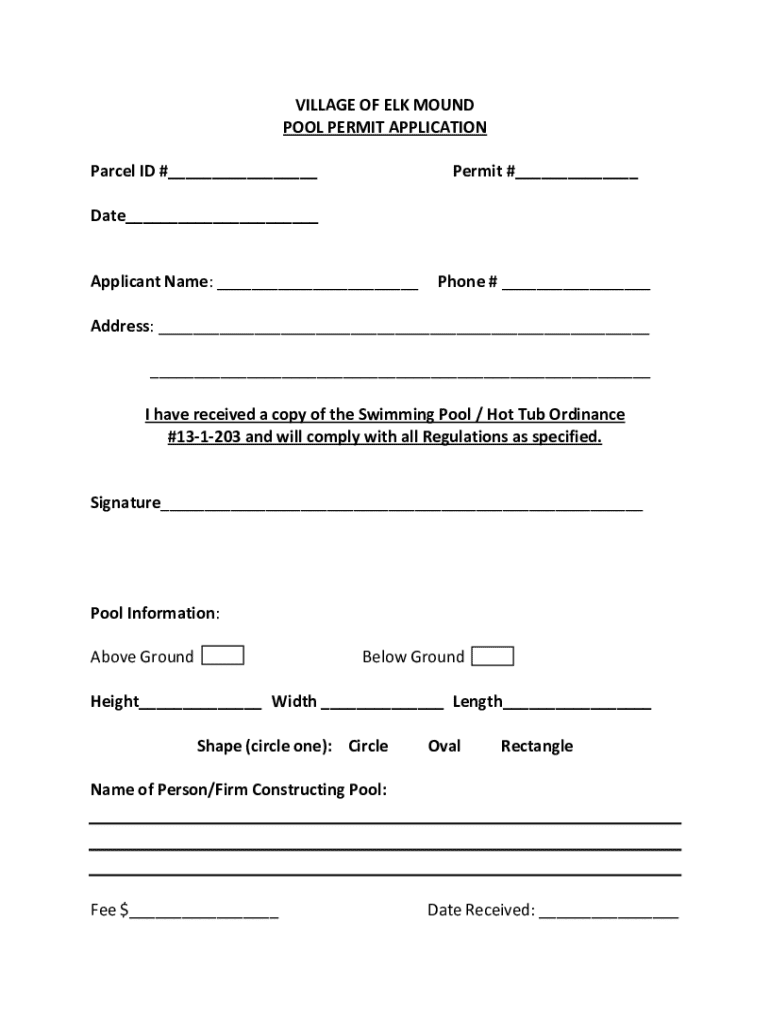

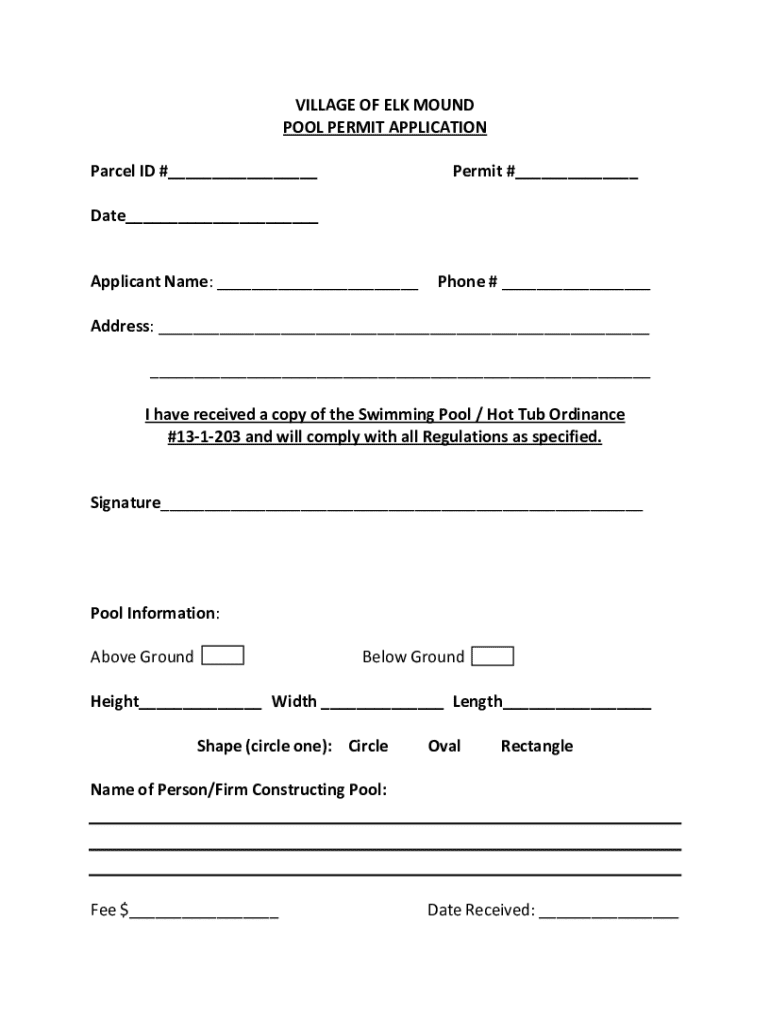

Get the free I have received a copy of the Swimming Pool / Hot Tub Ordinance

Get, Create, Make and Sign i have received a

Editing i have received a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out i have received a

How to fill out i have received a

Who needs i have received a?

Have Received a Form: A Complete Guide to Understanding and Managing Your Documents

Understanding the form you received

Receiving a form is often an essential step in various processes, whether for taxation, legal compliance, or regulatory purposes. Each form is designed to convey specific information, serve a purpose, or request action from the recipient. Understanding the significance of receiving a form can help streamline your compliance and ensure you follow necessary steps efficiently.

Common types of forms individuals receive include tax-related forms, legal documents, and regulatory compliance forms. These documents can influence financial situations, legal rights, or compliance with industry standards. Knowing the type of form you have received is the first step in effectively managing it.

Types of forms: identifying your document

Forms come in various types, each serving different functions. Here’s a breakdown of some prevalent types:

Contextualizing your specific form

Identifying the particular form you received comes with understanding its purpose. It could be for tax reporting, legal acknowledgment, or requesting information from you. Context matters, and being aware of the form's intent sets the stage for the actions that follow.

For example, if you received a tax-related form, it might require specific actions like completing supplementary documents or preparing your tax return accordingly. Legal documents could entail agreements you must sign or respond to, while regulatory forms may prompt compliance actions or submissions.

Why you might have received this form

Forms are generally sent by organizations, employers, government bodies, or other entities seeking information or compliance from you. The specific circumstances surrounding the form may vary greatly. Understanding who sent the form can provide insight into what actions may be required.

For example, if your employer sent you a W-2 form, it signifies tax reporting duties on your part. Alternatively, receiving a notice from a government agency could indicate regulatory changes that you must acknowledge or comply with accordingly. Knowing the sender allows you to tailor your response based on their needs.

Action steps after receiving a form

Upon receiving a form, an initial review is crucial. This ensures that you understand the essential components of the document. Key elements to analyze include dates, instructions provided, and any required signatures. Additionally, verifying the sender’s information helps confirm the form's legitimacy.

Next steps will vary depending on the type of form. If it’s a tax form, you will need to familiarize yourself with filing requirements and deadlines. Conversely, if it’s a legal document, understanding your response options and timelines is vital. Seeking professional advice from a tax advisor or lawyer may also be necessary based on the nature of the form.

Initial review: understanding key components of your form

Visualize your form as a roadmap to compliance. Identifying crucial components enhances clarity and enables timely action. Check for important dates, instructions outlined for completion, and necessary signatures. Noting the sender’s information is vital for legitimacy verification and future correspondence.

Understanding what each section communicates is paramount. For instance, in tax forms like the 1099, details like the amount received and the payer’s information are significant for accurate reporting. Similarly, in legal documents, key clauses may outline rights and responsibilities that require careful attention.

Next steps: what should you do?

Your immediate actions after reviewing the form depend largely on its type. If it’s a tax form, consider the following actions:

In the context of legal documents, your response options might range from signing to negotiating terms. Understanding timelines for response is equally important. Consulting professionals may also alleviate uncertainties surrounding your obligations based on the type of form received.

Managing your form: storage and organization

Once your form has been reviewed and necessary actions initiated, effective management through organization is crucial. Adopt best practices for both electronic and physical storage of forms. Whether you choose to file documents in a designated folder or employ cloud storage solutions, clarity and access are key.

Utilize tools and features offered by pdfFiller for efficient organization and retrieval of your forms. The platform allows you to annotate, arrange, and categorize your documents, ensuring a seamless filing system that can be accessed from anywhere.

Editing and updating information on your form

Occasionally, forms may require edits or updates due to changes in information or clerical errors. pdfFiller provides a streamlined way for users to make necessary adjustments. Use its editing features to modify text, insert annotations, or add required signatures.

To edit a form online using pdfFiller, upload your document, select the ‘Edit’ option, and apply your changes. With intuitive tools available, users can efficiently execute alterations, ensuring accuracy and compliance at all times.

Collaboration and sharing

In certain scenarios, collaboration becomes necessary when handling forms. Sharing with individuals or teams allows for shared input, review, and feedback. Whether it’s a tax document reviewed by a financial advisor or a legal form needing stakeholder signatures, collaboration enhances accuracy.

Utilizing pdfFiller’s collaborative tools allows seamless sharing of documents while preserving the original layout and data integrity. Using the annotation features, collaborators can provide inputs and feedback in real time, facilitating a more comprehensive and thorough review process.

Signing your form: understanding eSignatures

With high-tech conveniences come legal considerations surrounding electronic signatures. eSignatures carry the same legal standing as traditional handwritten signatures in most jurisdictions, making them increasingly popular for document signing.

To sign documents electronically using pdfFiller, simply upload your form, select the ‘Sign’ feature, and follow the prompts to create and apply your signature. The secure nature of eSignatures ensures the document remains protected and legally binding.

Common questions and troubleshooting

Having received a form can lead to several common questions. Firstly, if you find yourself querying the specifics surrounding your form type, recognize that clarity breeds compliance. Understanding tax implications or legal responsibilities should be prioritized.

General queries such as what to do if you lose your form also arise. Always contact the sender to request a duplicate, ensuring timely compliance with any deadlines associated with the original document.

Troubleshooting: what if you encounter issues?

When addressing issues related to your form, start by identifying the specific problem. For instance, if you notice missing information or incorrect details, document your findings and contact the sender or relevant authority for correction procedures.

Support services often provide assistance in troubleshooting form-related questions. pdfFiller’s customer support can guide users on how to navigate issues, ensuring compliance and proper documentation.

Exploring related topics

Noncompliance with forms can lead to significant risks, such as penalties associated with tax forms or legal ramifications surrounding legal documents. Understanding your responsibilities helps mitigate these risks, allowing you to manage deadlines effectively.

Additionally, it is essential to address concerns specific to international recipients. Students or nonresidents often face unique challenges regarding forms related to their immigration or taxation status. Gathering information tailored to their needs ensures proper navigation of international compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit i have received a in Chrome?

How do I edit i have received a straight from my smartphone?

Can I edit i have received a on an Android device?

What is i have received a?

Who is required to file i have received a?

How to fill out i have received a?

What is the purpose of i have received a?

What information must be reported on i have received a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.