Get the free Unicorn AIM IHT & ISA Portfolio Service Important Information

Get, Create, Make and Sign unicorn aim iht amp

Editing unicorn aim iht amp online

Uncompromising security for your PDF editing and eSignature needs

How to fill out unicorn aim iht amp

How to fill out unicorn aim iht amp

Who needs unicorn aim iht amp?

Unicorn Aim IHT AMP Form: A Comprehensive Guide

Understanding the Unicorn Aim IHT AMP Form

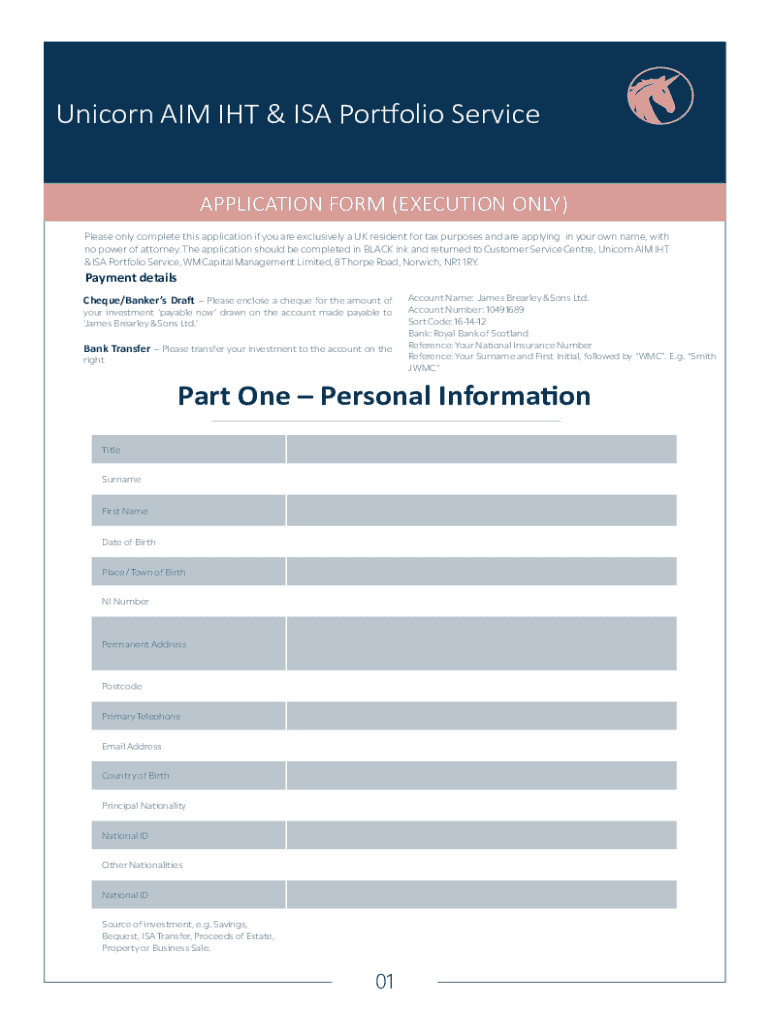

The Unicorn Aim IHT AMP Form is a pivotal document in the realm of financial and estate planning. Designed specifically to assist individuals and their advisors in documenting asset valuations and liabilities, this form plays a crucial role in managing inheritance tax (IHT) efficiently. The primary purpose of the Unicorn Aim Form is twofold: to simplify the assessment of a deceased's estate for tax purposes and to provide a clear structure that guides users in organizing relevant financial information.

The importance of this form cannot be overstated. As tax laws evolve, staying compliant with regulations is essential for individuals and families planning for the future. This document not only aids in the accurate reporting of assets but also enhances the efficiency of the inheritance tax process. Proper use of this form can expedite estate settlements and help beneficiaries understand their obligations clearly.

Key features of the Unicorn Aim IHT AMP Form

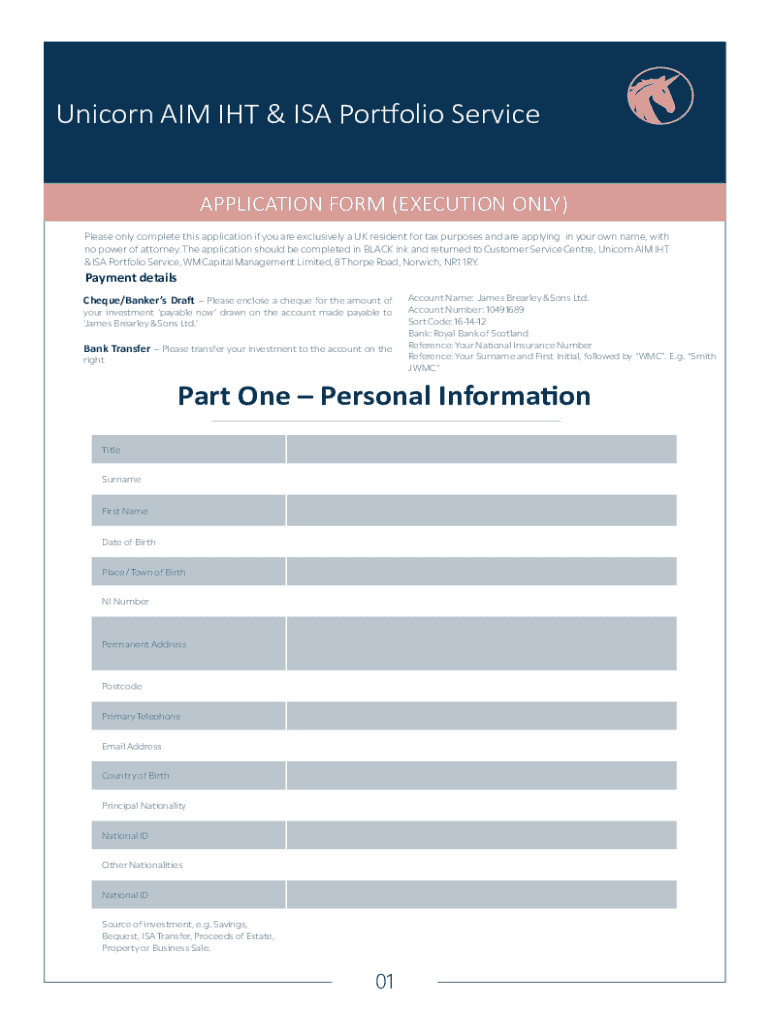

One of the standout features of the Unicorn Aim IHT AMP Form is its comprehensive data fields. Each field is carefully crafted to capture essential information such as personal details, a comprehensive listing of assets, and estimated liabilities. These data fields ensure accuracy and completeness when preparing for tax obligations, which can alleviate stress for individuals navigating this often complex process.

The user-friendly interface enhances the experience, making it straightforward for users of all technical abilities to fill out the form with ease. By utilizing a cloud-based platform, the Unicorn Aim Form becomes easily accessible to users, whether they're working alone or as part of a team. All data is securely stored, yet can be edited and accessed from virtually anywhere, ensuring flexibility in document management.

Step-by-step guide to filling out the Unicorn Aim IHT AMP Form

Before you dive into filling out the Unicorn Aim IHT AMP Form, ensure that you gather all necessary documents. Key documentation includes property deeds, bank statements, investments records, and any existing estate planning documents. Being adequately prepared will streamline the process and minimize errors during data entry.

Once you’re ready, proceed to fill each section meticulously. Start with the personal information section, which requests basic identifying details such as name, address, and contact information. Follow this with sections dedicated to asset reporting, where you will list real estate properties, bank accounts, investments, and personal property. Don't forget to detail any debts, loans, or liabilities to provide a true reflection of the estate's financial standing.

Lastly, estimate the inheritance tax applicable by utilizing the provided calculators based on asset valuations. This estimation can significantly aid in understanding what funds will be required for tax obligations. To ensure accuracy, double-check entered data for consistency and completeness, as mistakes can lead to unnecessary delays.

Editing the Unicorn Aim IHT AMP Form

In situations where modifications are necessary after submitting the Unicorn Aim IHT AMP Form, pdfFiller offers a seamless editing experience. Users can log into their accounts, locate the submitted form, and initiate changes without starting from scratch. This feature is essential for maintaining accuracy in an often-evolving financial landscape.

Moreover, the collaborative features of pdfFiller facilitate team projects where multiple stakeholders need to contribute information or review the form. Team members can simultaneously edit, add comments, and strategize over shared documents, ensuring everyone is on the same page. Utilizing pdfFiller’s editing tools accelerates the optimization of your form, allowing for effective and efficient document management.

eSigning the Unicorn Aim IHT AMP Form

Electronic signatures (eSignatures) have revolutionized the way we handle documents, ensuring that integrity and authenticity are maintained throughout the process. The Unicorn Aim IHT AMP Form supports eSigning, making it easier than ever to finalize your document without the need for physical signatures.

To eSign the form, simply navigate to the designated signing area in pdfFiller, follow the prompts to create or upload your signature, and place it on the form. This process is not only rapid but also legally binding, ensuring that your signed form holds the same weight as any traditionally signed document in the eyes of the law.

Managing and storing the Unicorn Aim IHT AMP Form

Proper management and storage of your Unicorn Aim IHT AMP Form are crucial for future reference and compliance. Utilizing cloud storage provided by pdfFiller not only secures your documents but also enables you to access them from anywhere, ensuring they are always available when needed.

Additionally, setting up version control allows for ongoing updates as asset valuations or liabilities change, keeping your document current. Sharing access with relevant stakeholders, such as financial advisors or family members, can further enhance collaboration and ensure that all parties are informed about updates to the estate.

Common pitfalls and troubleshooting tips

Filling out the Unicorn Aim IHT AMP Form can be straightforward, but there are common pitfalls that individuals should avoid. Missing key data fields or entering incorrect asset valuations can lead to valuable time lost and potential tax complications down the line. To make your experience smoother, always refer back to your gathered documentation to ensure all necessary information is included.

If you encounter technical difficulties with pdfFiller tools or during the submission process, don't hesitate to reach out to customer support. Their expertise can resolve any issues you might face, ensuring that your form is completed accurately and submitted on time.

Real-world applications of the Unicorn Aim IHT AMP Form

Real-world applications of the Unicorn Aim IHT AMP Form demonstrate its value in various situations, from individual estate planning to handling estates that require detailed financial documentation. For instance, individuals who have recently inherited a family estate have reported smoother transitions thanks to the structured approach provided by this form.

Furthermore, testimonials from users highlight how the form has simplified the often-daunting task of preparing for inheritance tax assessments. Positive feedback emphasizes the ease of use, clarity of instructions, and the ability to collaborate with financial advisors, showcasing its effectiveness in various scenarios.

Best practices for utilizing the Unicorn Aim IHT AMP Form

Maximizing efficiency while using the Unicorn Aim IHT AMP Form can significantly enhance your overall experience. One of the best practices is to leverage the collaborative features within pdfFiller. By inviting team members to contribute their expertise, whether they be estate planners, accountants, or family members, the process becomes constructive, leading to comprehensive document completion.

Additionally, prioritize document security when handling sensitive information related to finances and estates. By utilizing pdfFiller’s encryption and secure sharing features, you can ensure that your data remains confidential. Integrating the form into your overall financial planning workflow can also facilitate better management of resources, further streamlining the documentation processes.

Interactive tools and resources

pdfFiller enhances the experience of utilizing the Unicorn Aim IHT AMP Form by offering interactive tools that streamline document management. Users can benefit from built-in editing tools, templates, and additional forms that complement the Unicorn Aim Form, providing a holistic approach to document assistance.

Accessing frequently asked questions (FAQs) provides insightful guidance on navigating the complexities of the Unicorn Aim Form and related processes. These resources empower users to engage confidently, improving their ability to make informed decisions concerning their financial and estate planning needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find unicorn aim iht amp?

Can I create an eSignature for the unicorn aim iht amp in Gmail?

How do I complete unicorn aim iht amp on an iOS device?

What is unicorn aim iht amp?

Who is required to file unicorn aim iht amp?

How to fill out unicorn aim iht amp?

What is the purpose of unicorn aim iht amp?

What information must be reported on unicorn aim iht amp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.