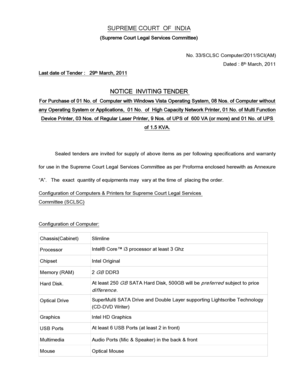

Get the free FOR THE YEAR ENDED AT DECEMBER 31, 2019

Get, Create, Make and Sign for form year ended

How to edit for form year ended online

Uncompromising security for your PDF editing and eSignature needs

How to fill out for form year ended

How to fill out for form year ended

Who needs for form year ended?

A Comprehensive Guide to the Form Year Ended Form

Understanding the 'Form Year Ended' concept

The 'Form Year Ended' form is an essential document typically associated with the financial reporting process at the conclusion of a financial year. This form serves as a formal declaration of various financial activities carried out within the preceding year. It is vital for ensuring compliance with legal requirements, providing transparency, and offering an overview of an individual or entity's financial position.

Year-end reporting plays a crucial role across various industries—including accounting, finance, and taxation—by helping stakeholders assess operational performance and adhere to fiscal prudence. Organizations and individuals alike must submit these forms to regulatory agencies, ensuring that all financial representations are accurate and up-to-date.

Preparing to fill out the year ended form

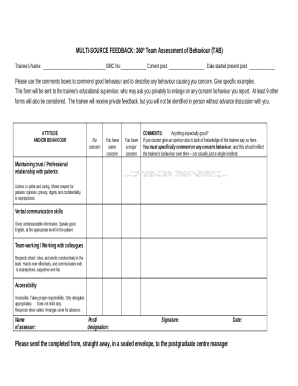

Filling out the Year Ended Form requires meticulous preparation and organization of relevant information. Start by gathering all necessary data, including personal identification information, financial details, and supporting documents that underpin the figures you'll report. This foundational step ensures you’re not scrambling at the last minute and saves you from errors that could arise from overlooking crucial elements.

Understanding the structure of the form and its individual sections is equally critical. Familiarize yourself with the form layout to prevent confusion when entering information. Knowing key terms and definitions—such as gross income, deductions, credits, and net income—will aid you in accurately filling out each part of the form.

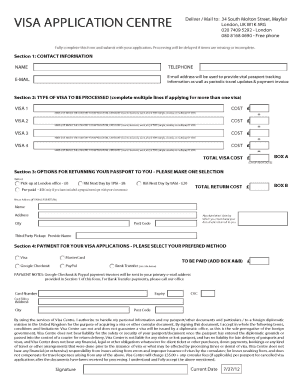

Step-by-step guide to completing the year ended form

Completing the Year Ended Form can appear daunting, but breaking it down into manageable steps simplifies the process. Start by accurately recording your basic information. Ensure that your personal details are correct, including your legal name and address. If you’re filing as a business entity, include entity-specific information such as the business name and identification number to avoid confusion during processing.

Next, you’ll report the income you’ve earned over the year. Categorize all income sources, ensuring that you include wages, dividends, interest, and any other revenue-generating activity. Accurate reporting is vital; misrepresentation can lead to audits or penalties. Keep records of all income documentation to support your declarations.

Following income reporting, itemizing deductions and credits is crucial for tax optimization. Familiarize yourself with common deductions that you may qualify for, such as student loan interest or mortgage interest. Understanding available credits, such as the earned income tax credit, can significantly affect your tax liability.

Finally, ensure that all your calculations are correct. Use tools like pdfFiller's interactive calculation features to minimize the risk of errors. Double-check your total income, deductions, and credits to ensure they're accurately reflected before finalizing your form.

Customizing the year ended form

Once you've filled out the form, pdfFiller provides several editing options to help you customize the document to fit your needs. You can easily modify the content, rearranging sections if necessary, or adding any additional notes that may aid in further clarifying your financial situation.

Another significant aspect of using pdfFiller is the ability to add digital signatures, ensuring that your document is authenticated. This feature saves time and enhances security, allowing your form to be submitted confidently, and making it valid for acceptance by relevant authorities.

Moreover, pdfFiller enables real-time collaboration. This means your team or financial advisor can view and edit the form simultaneously. This integrated approach enhances clarity and eases communication when working on more complex financial documentation.

After completing your form

Once you have filled out and customized your Year Ended Form, it’s vital to review your submission thoroughly. Conducting a final checklist ensures that your form is complete and accurate before sending it off. Common mistakes to avoid include missing signatures, incorrect figures, or failing to include necessary attachments, all of which can delay processing.

After submission, each agency has different processing times, so it’s essential to check for confirmation once your form is submitted. Keep an eye out for any follow-up actions that may be required, as agencies might request additional information to clarify your submission.

Maintaining your year-end documentation

Once your Year Ended Form is submitted, effective documentation management becomes crucial. Storing completed forms securely is essential for future reference or audits. Best practices include creating digital backups and securely storing physical copies to prevent any document loss.

Utilizing cloud solutions for storage provides an accessible and organized way to manage documentation. With applications like pdfFiller, you can have all your forms in one cloud-based location, making them easy to retrieve whenever necessary. Additionally, revisiting past Year Ended Forms allows you to draw comparisons that can help in tailoring future submissions based on past experiences.

Frequently asked questions (FAQs) about year ended forms

Filing Year Ended Forms often comes with its set of inquiries. Common concerns include how to accurately complete specific sections of the document or clarifications on tax implications. Moreover, many individuals seek troubleshooting tips to rectify potential issues they might encounter when filling out the forms.

Understanding the implications of your year-end report is crucial since submitting incorrect information can lead to penalties. Proactive engagement with available resources can provide guidance on the most pressing concerns regarding the form.

Additional considerations

When preparing to submit your Year Ended Form, it’s important to adhere to deadlines and submission timelines that vary based on the issuing agency. Keeping a calendar marked with these dates can help ensure you avoid late penalties and maintain compliance.

Additionally, be aware of state-specific variations in filing requirements. These may differ significantly based on your location and can impact both the form structure and deadlines. Utilizing pdfFiller can simplify state-related processing, as it offers updated forms and guidelines tailored to your jurisdiction.

To enhance efficiency, pdfFiller integrates tools designed to streamline year-end processing. Features such as pre-fill options, error-checking algorithms, and integrated e-signature functionality save time and reduce frustration when managing these essential documents.

Testimonials and success stories

Users consistently share positive experiences navigating the complexities of Year Ended Forms with the help of pdfFiller. Many have highlighted how the platform's intuitive interface and collaborative tools eased the daunting task of year-end reporting.

Success stories of users who streamlined their filing process and minimized errors emphasize the efficiency gained by utilizing pdfFiller. This not only enhances user experience but also highlights the significant impact of having a centralized document management solution that empowers users to take control of their year-end reporting process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send for form year ended for eSignature?

Can I sign the for form year ended electronically in Chrome?

How do I fill out for form year ended using my mobile device?

What is for form year ended?

Who is required to file for form year ended?

How to fill out for form year ended?

What is the purpose of for form year ended?

What information must be reported on for form year ended?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.