Get the free Application for Individual Life Insurance Instructions for Use

Get, Create, Make and Sign application for individual life

How to edit application for individual life online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for individual life

How to fill out application for individual life

Who needs application for individual life?

Application for Individual Life Form: A Comprehensive Guide

Understanding individual life forms

Individual life forms refer to specific types of insurance policies designed to provide financial protection to individuals in case of death or serious illnesses. The importance of individual life forms cannot be overstated as they serve as a safety net for families, ensuring that their financial needs are met during challenging times.

There are various types of individual life insurance policies, including term life, whole life, and universal life insurance. Each type comes with its benefits tailored to different financial goals and personal circumstances. For instance, term life insurance provides coverage for a specific period, while whole life insurance offers lifelong coverage with an investment component.

According to recent statistics, approximately 54% of Americans are estimated to have life insurance coverage, highlighting the growing awareness of its importance. However, many individuals still lack adequate coverage, leaving their families vulnerable. Understanding these gaps is essential when considering an application for an individual life form.

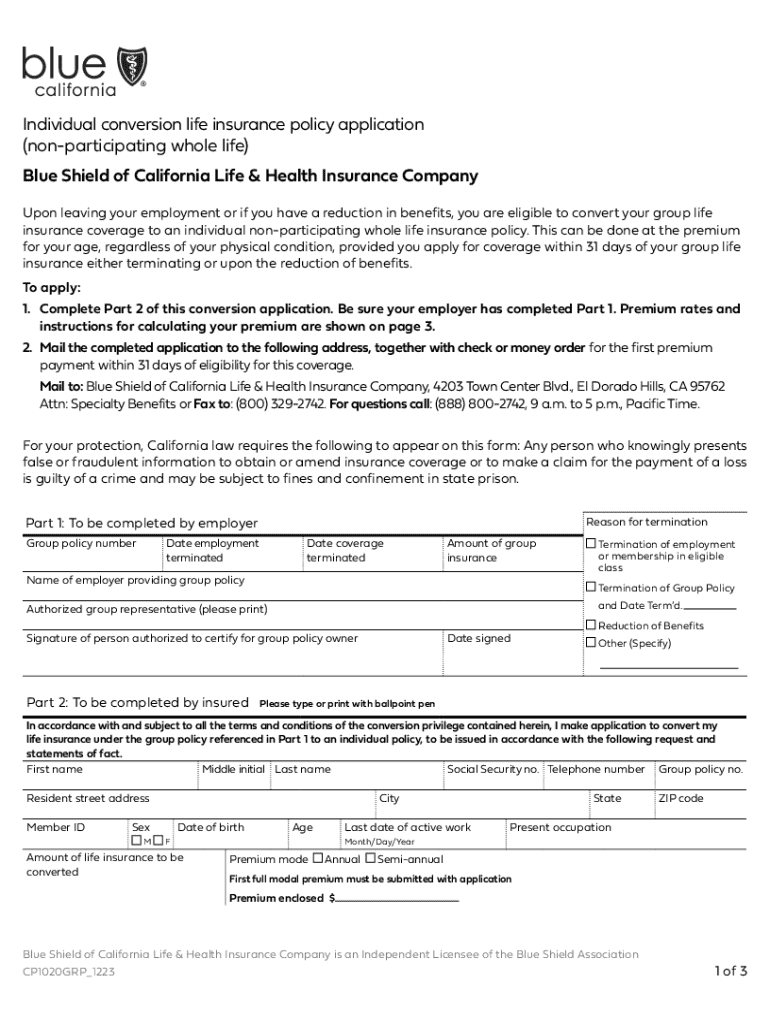

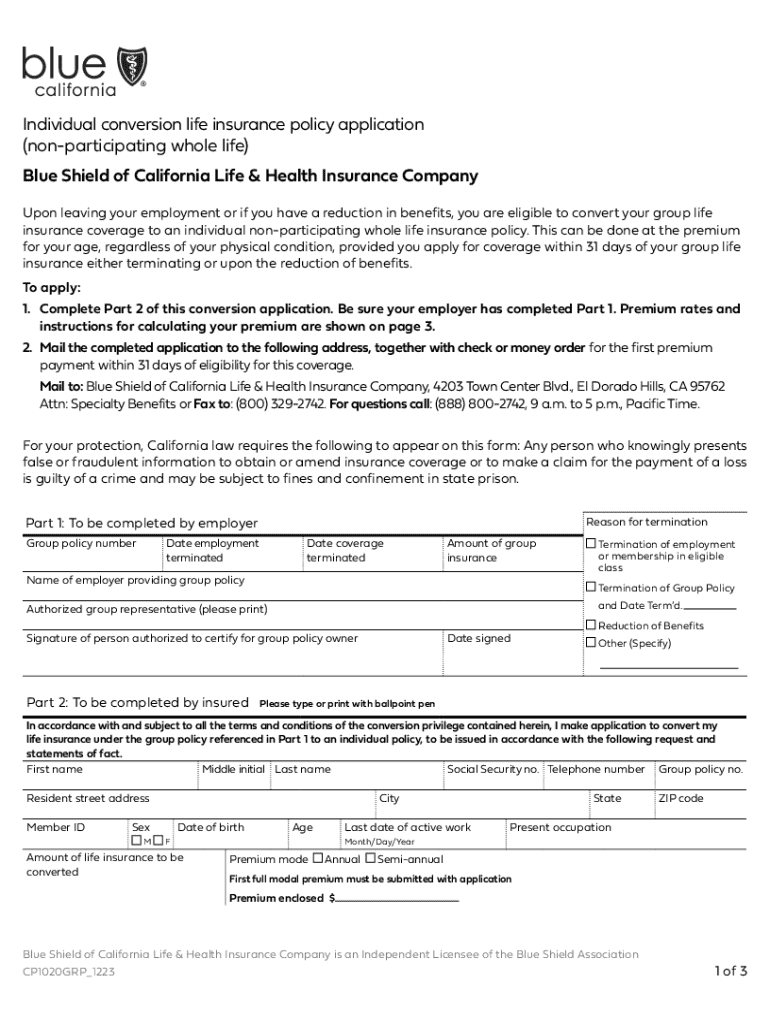

The application process: Step-by-step guide

Navigating the application process for individual life forms might seem daunting, but it can be broken down into manageable steps. The first step is preparing your information to ensure a smooth application experience.

Preparing your information

Before applying, gather the necessary documents, such as identification and names of beneficiaries. Personal details like age, health status, and lifestyle habits are typically required, and providing accurate information is crucial to avoid complications.

Choosing the right policy

Consider various factors when selecting an individual life insurance policy. Think about your financial needs, dependents’ requirements, and how much you can afford to pay in premiums. It’s advisable to compare different policies available in the market, assessing their coverage limits, exclusions, and additional features.

Completing the application form

Filling out the application form accurately is essential. Each section is designed to assess your eligibility based on your lifestyle and health. Pay particular attention to the health history section, as inaccuracies can lead to application denial or claim disputes.

Utilizing pdfFiller for your individual life form

With pdfFiller, editing your PDF application becomes a seamless experience. Its user-friendly interface allows for easy adjustments to documents without the hassle of traditional forms.

Seamless document editing

Editing your application with pdfFiller is straightforward. The cloud-based platform allows you to make changes anytime, anywhere, eliminating the need for paper-based forms. This is particularly useful for correcting mistakes or updating information as needed.

eSigning your application

Securing your application with an eSignature is simple with pdfFiller. The platform ensures that your eSigned documents hold legal validity, providing you with peace of mind knowing your application is complete.

Collaborative tools for teams

The application process often involves collaboration with various stakeholders, such as financial advisors or family members. Utilizing pdfFiller makes collaboration easy, allowing multiple parties to contribute to the application.

Participants in the application process

Identifying who needs to collaborate on the form is critical. In many cases, family members may need to discuss preferences for beneficiaries or consult with financial advisors about coverage limits.

How pdfFiller facilitates collaboration

pdfFiller offers features that enhance teamwork, such as sharing options and review functionalities. By allowing easy access to the application form, pdfFiller ensures an efficient and streamlined application process.

Managing your insurance documents

Once your application for an individual life form is approved, organizing your insurance documents becomes paramount. Staying organized prevents loss of important information and enables easier claim processing when needed.

Organizing your policies and forms

Centralizing all your insurance documents in one secure location simplifies management. pdfFiller's document management system allows you to store and access documents effortlessly, ensuring crucial paperwork is at your fingertips.

Keeping your information updated

Regularly updating your personal information is vital to maintaining the relevance of your policy. Changes in marital status, address, or health conditions should be promptly reported to your insurer, and pdfFiller makes this process easy through its editable forms.

Common queries about individual life forms

Individuals often have numerous questions regarding the application process for individual life forms. Addressing common queries can demystify the process and reduce anxiety associated with applying.

FAQs related to application process

Common inquiries include eligibility requirements, costs associated with policies, and the typical timelines for application approval. Understanding these factors can better prepare applicants and help set realistic expectations.

Addressing concerns and misconceptions

Many applicants fear intricate insurance jargon. Familiarizing yourself with common terms and definitions can ease this apprehension. Additionally, demystifying complex clauses in policies ensures you comprehend your coverage fully.

Exploring additional resources

Continuous education about life insurance can immensely benefit individuals navigating the application process. There are numerous educational materials available that explain the nuances of individual life insurance.

Educational materials on life insurance

Consider exploring online courses, webinars, or even articles dedicated to life insurance. These resources can enhance your understanding and ability to make informed decisions regarding your coverage.

Connecting with professionals

Knowing when to seek advice from insurance brokers or agents is also crucial. These professionals can provide personalized recommendations based on your personal circumstances and help clarify any uncertainties you may have regarding the application process.

Utilizing interactive tools

Interactive tools available through pdfFiller enhance the decision-making process by providing insights that allow potential applicants to assess their options effectively.

Policy comparison tool

Using the pdfFiller tool to compare different insurance products can help users make informed choices based on their unique financial needs. This feature allows for side-by-side comparisons, highlighting coverage limits and premium costs.

Cost estimator for individual life insurance

Furthermore, pdfFiller offers interactive calculators that guide users in estimating premiums based on their chosen policy attributes. This can aid in budgeting and financial planning for potential applicants.

Success stories: Real-life applications and outcomes

Understanding the real-life impact of individual life insurance can encourage potential applicants to make informed decisions. Many families have benefited from life insurance during critical times, showcasing its importance.

Case studies of individuals who benefited from life insurance

For example, one case study highlights a family that faced financial difficulties after the sudden loss of a wage earner. The life insurance policy they had established before his passing provided them with the necessary funds to stay afloat and manage living expenses.

Testimonials on using pdfFiller for life insurance applications

Users have reported high satisfaction levels with pdfFiller's platforms, particularly appreciating how intuitive and efficient the system is for filling out applications. These testimonials underscore the effectiveness of the service in simplifying the application process for individuals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in application for individual life without leaving Chrome?

How do I fill out application for individual life using my mobile device?

How do I complete application for individual life on an iOS device?

What is application for individual life?

Who is required to file application for individual life?

How to fill out application for individual life?

What is the purpose of application for individual life?

What information must be reported on application for individual life?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.