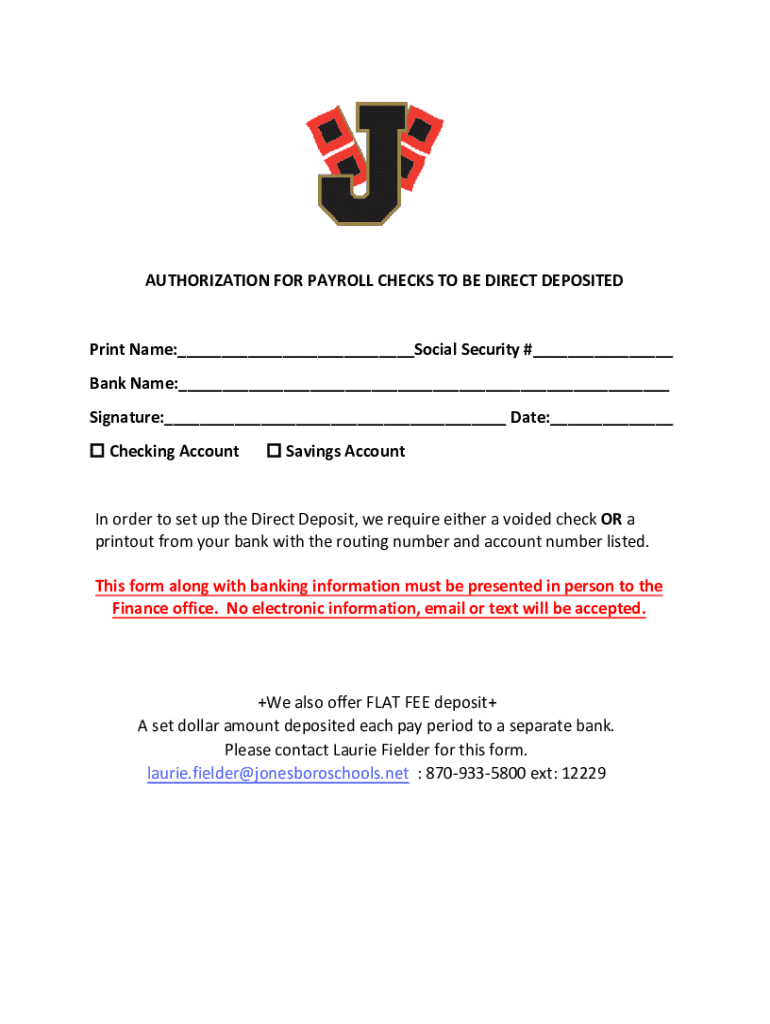

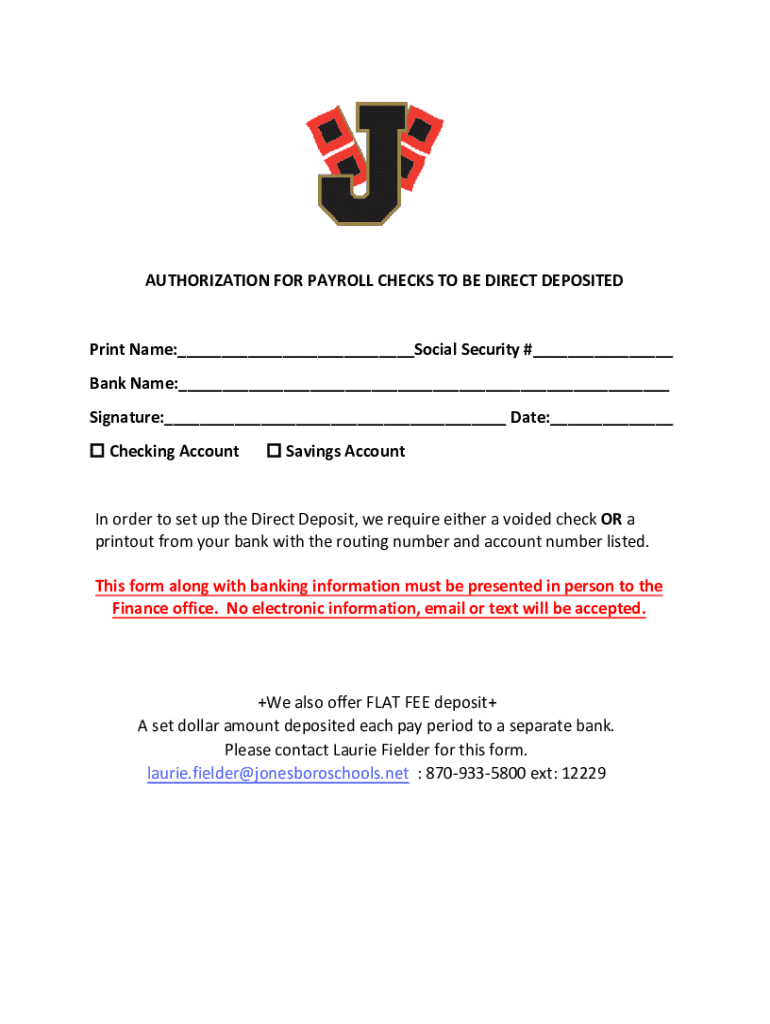

Get the free AUTHORIZATION FOR PAYROLL CHECKS TO BE DIRECT DEPOSITED

Get, Create, Make and Sign authorization for payroll checks

Editing authorization for payroll checks online

Uncompromising security for your PDF editing and eSignature needs

How to fill out authorization for payroll checks

How to fill out authorization for payroll checks

Who needs authorization for payroll checks?

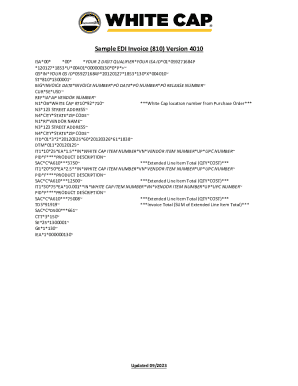

Understanding the Authorization for Payroll Checks Form

Understanding payroll checks and their importance

Payroll checks are crucial financial instruments used by employers to compensate their employees for work performed. These checks can be issued regularly, such as biweekly or monthly, and are essential for managing employee wages, benefits, and other deductions. Proper payroll check issuance ensures not only lawful compliance with wage laws but also motivates employees through timely payment.

The authorization for payroll checks form serves a vital role in this process. By requiring this form, employers can confirm that all payroll disbursements are validated and authorized by the appropriate parties. This document acts as a safeguard in the payroll process, reducing errors and potential disputes that might arise concerning payments.

Accurate payroll processing is not only a legal requirement but also impacts employee morale and financial planning for a business. Modern businesses must manage this process efficiently to maintain productivity and uphold trust among employees.

What is the authorization for payroll checks form?

The authorization for payroll checks form is a document used to secure approval for payroll disbursements. This form typically includes essential information and signatures that validate the payment before it is issued to employees.

Key components of the form include employee identification information, salary or payment amounts, and the methods of payment selected by the employee. This form ensures that employers have documented consent to process payroll accurately.

Step-by-step guide to completing the authorization for payroll checks form

Completing the authorization for payroll checks form requires careful attention to detail. Start by gathering necessary information to ensure that the process is smooth and accurate.

Next, fill out the form section by section: Start with employee identification, moving on to salary details—including hours worked, pay rates, and payment method choices. Make sure to have all relevant signatures completed by both the employee and the supervisor to ensure authenticity.

Editing and managing the authorization for payroll checks form with pdfFiller

Using pdfFiller to manage the authorization for payroll checks form offers great flexibility and ease of use. Begin by uploading the completed form into the platform. This allows for seamless editing and management of payroll documents.

pdfFiller provides robust editing tools, which include options for adding text, modifying fields, and integrating electronic signatures. These tools make it simple to ensure that all information remains current and accurate as employee details or payment methods change.

Collaboration is simplified with pdfFiller, allowing team members to access the form easily, provide feedback, and finalize changes without the need for cumbersome email threads.

eSigning the authorization for payroll checks form

eSigning the authorization for payroll checks form not only expedites the approval process but also ensures documents remain secure and legally binding. A robust eSigning solution helps streamline the workflow and reduces the need for paper, enhancing productivity.

It's essential to know the legal considerations when eSigning payroll documents. Many jurisdictions have specific regulations regarding electronic signatures, so employers should ensure compliance with relevant laws to avoid potential issues.

Common questions about the authorization for payroll checks form

Organizations often encounter common queries regarding the authorization for payroll checks form. For instance, employees may wish to change their payment method; it's essential to have a clear procedure in place to process these requests efficiently.

Legal and compliance aspects of payroll authorization

Understanding the legal framework surrounding payroll authorizations is crucial for compliance. Federal regulations dictate basic labor standards, while many states enact additional protective measures for employees. Employers must stay informed about these laws to avoid violations.

Tracking payroll transactions and ensuring accuracy

Tracking payroll transactions accurately is vital for maintaining financial integrity within any organization. Establishing a system for reconciling authorization records with actual payroll checks provides a failsafe against the risk of errors.

FAQs about using pdfFiller for payroll documentation

Leveraging pdfFiller for payroll documentation comes with various conveniences. Users often inquire about the available support systems and security features that protect sensitive information during transmission and storage.

Conclusion: The power of streamlined payroll authorization with pdfFiller

Streamlining payroll authorization processes with pdfFiller empowers businesses by ensuring accurate and timely disbursements. The platform's editing, eSigning, and collaboration features enhance operational efficiency while maintaining legal compliance.

As businesses continue to embrace digital solutions, the future of payroll management lies in platforms like pdfFiller that facilitate seamless document creation, editing, and management—all in one secure, cloud-based environment. By improving payroll processes and eliminating friction, businesses can focus more on growth and employee satisfaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify authorization for payroll checks without leaving Google Drive?

How do I complete authorization for payroll checks online?

How do I make changes in authorization for payroll checks?

What is authorization for payroll checks?

Who is required to file authorization for payroll checks?

How to fill out authorization for payroll checks?

What is the purpose of authorization for payroll checks?

What information must be reported on authorization for payroll checks?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.