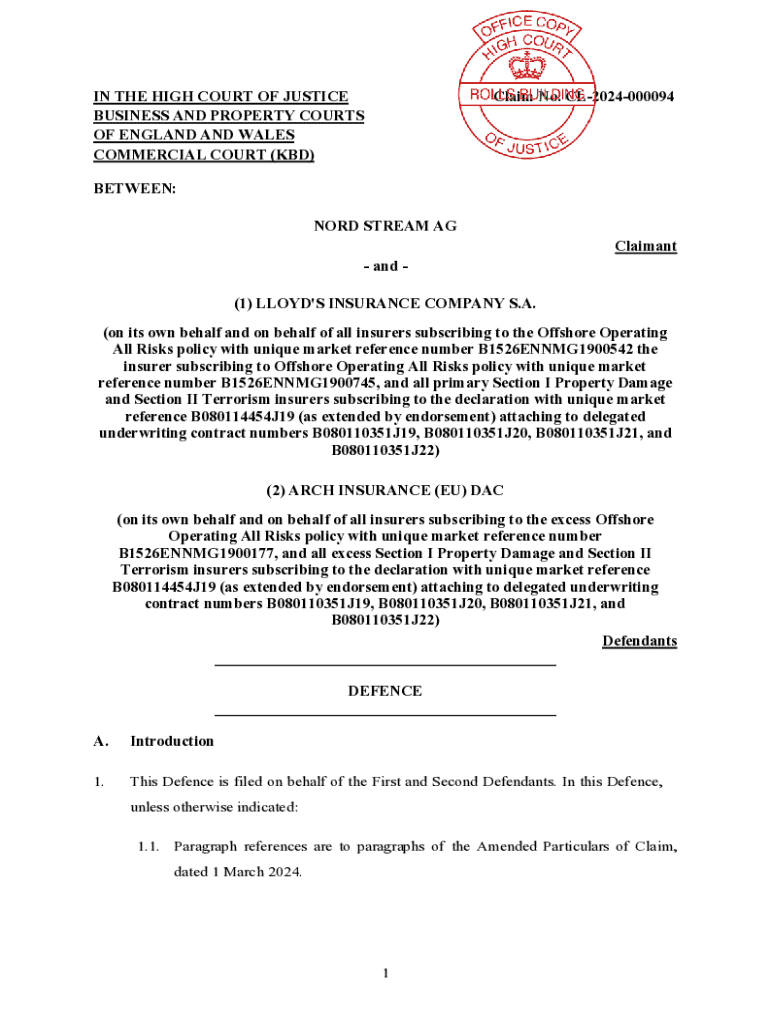

Get the free Insurers Deny Liability In 403M Nord Stream Pipeline Claim

Get, Create, Make and Sign insurers deny liability in

Editing insurers deny liability in online

Uncompromising security for your PDF editing and eSignature needs

How to fill out insurers deny liability in

How to fill out insurers deny liability in

Who needs insurers deny liability in?

Insurers deny liability in form: A comprehensive guide

Understanding insurance liability denial

Liability in insurance refers to the insurer's responsibility to cover losses as stipulated in the policy contract. Understanding this concept is essential when navigating the claims process. When insurers deny liability, it fundamentally implies that they believe they are not accountable for the claimed loss, creating a significant hurdle for policyholders.

Claims processing relies heavily on the clear determination of liability, which can hinge on numerous factors. This section will provide insight into why claims may be denied, including common reasons such as lack of evidence, policy exclusions, and solid technicalities in form submission.

Recognizing the tactics used by insurers

Insurers often employ various tactics to deny liability. For instance, they might use delay and deny strategies, where they extend the time frame for processing claims without a valid reason, leaving claimants in a state of uncertainty. This practice can be manipulative, making it crucial for policyholders to be aware of potential tactics.

Another common tactic involves the misinterpretation of policy terms. Insurers may narrow the definitions of covered incidents or losses, and thus deny legitimate claims. Additionally, lowballing settlement offers is a strategy aimed at minimizing insurer payout, often compelling policyholders to accept less than they deserve just to resolve the situation.

Reviewing the forms and documentation required

Having complete and accurate documentation is paramount when submitting an insurance claim. Insurers often seek specific forms and supporting documents to process a claim efficiently. This section outlines necessary forms and the importance of each in ensuring a smooth claims process.

Essentially, claim submission forms must be filled out meticulously. This involves double-checking policy numbers, ensuring clarity in what's being asserted, and providing all required supporting documents. Timelines and dates are particularly critical; these details can significantly affect the outcome of a claim.

Step-by-step guide to challenging denials

When faced with a denial, the initial step is to thoroughly review the denial letter. Understanding why your claim was denied is critical, as it will help you gather the necessary documentation to mount a compelling appeal. This process can feel daunting, but it's essential for ensuring that you are advocating for your rights effectively.

Once you've reviewed the denial, the next step involves gathering all documentation that supports your claim. This may include receipts, photographs, and any prior correspondence with the insurer. Drafting an appeal should clearly outline your rationale for why the denial should be overturned, using specific policy language where applicable.

When to involve a legal professional

Recognizing when it's time to consult with a legal professional can significantly impact the outcome of your claim. If you've exhausted all avenues of appeal and remain unsatisfied with the insurer's response, it may be prudent to seek legal counsel. An attorney specializing in insurance claims can provide invaluable expertise in navigating complex claim disputes.

Selecting the right insurance claim attorney involves asking pertinent questions. Understanding their experience with similar cases, fee structures, and their overall approach can help you make an informed decision. An attorney will not only assist with the appeal process but can also represent you in negotiations with your insurer.

Proactive measures to avoid future denials

Being proactive about your insurance policy can help minimize the risk of denials in the future. Familiarizing yourself with the nuances of your policy, including covered events and exclusions, is critical. Moreover, by adopting best practices for filing claims, you can create a smoother path should you need to file a claim.

Documenting everything related to your policy and claims is a best practice that ensures you maintain a clear paper trail. Regularly reviewing your policy terms can also help you stay informed about your coverage, and using tools like pdfFiller can facilitate efficient document management. This platform allows users to edit, sign, and organize documents from any location.

Handling the emotional impact of denial

Experiencing a denial can be emotionally taxing, causing stress and frustration. It’s important to recognize this emotional impact and seek support if needed. Support networks, including family, friends, or support groups, can provide valuable assistance during this challenging time.

Moreover, educating yourself about your rights and the claims process can empower you. Knowledge not only equips you to face your challenges but can also help alleviate anxiety, leading you to make informed decisions about how to proceed in the event of a denial.

Case examples of successful claim appeals

Examining real-life examples of successful claim appeals can provide insights into how to effectively navigate the process. One notable case involved an individual who appealed a denial due to insufficient documentation. By presenting additional evidence and doing a thorough policy review, they were able to overturn the initial denial.

These case studies highlight the importance of being persistent and organized as you tackle claim denials. The key takeaways include the necessity of detailed documentation and being ready to communicate clearly with insurers. Learning from these examples can guide your approach should you find yourself in a similar situation.

Latest trends in insurance liability and claims

Staying updated on the latest trends in insurance liability and claims can provide valuable context as you navigate potential denials. Recent changes in legislation have begun to empower policyholders by establishing stricter guidelines on how insurers process claims, which could affect liability decisions. Additionally, technological innovations have streamlined claim processing, enabling quicker outcomes for many policyholders.

As the landscape of insurance liability evolves, it's essential to be aware of emerging trends that could impact your coverage. These developments can include changes in consumer protections, improved filing procedures, and advancements in claims assessment methods.

Conclusion: Empower yourself through knowledge

Understanding your rights as a policyholder can significantly empower you when faced with insurance liability denials. As you navigate the claims process, knowledge equips you to advocate for your interests effectively. Utilize available tools such as pdfFiller to manage and submit your documentation seamlessly, preventing common pitfalls that might lead to future denials.

By being informed and prepared, you harness the power to challenge unjust denials and maximize your chances of a successful claims experience. Remember, staying proactive and informed is key to navigating the complexities of insurance liability and denial.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute insurers deny liability in online?

Can I create an electronic signature for the insurers deny liability in in Chrome?

How do I fill out the insurers deny liability in form on my smartphone?

What is insurers deny liability in?

Who is required to file insurers deny liability in?

How to fill out insurers deny liability in?

What is the purpose of insurers deny liability in?

What information must be reported on insurers deny liability in?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.