Get the free Apply for a Card (Minors)Nashville Public Library

Get, Create, Make and Sign apply for a card

How to edit apply for a card online

Uncompromising security for your PDF editing and eSignature needs

How to fill out apply for a card

How to fill out apply for a card

Who needs apply for a card?

Apply for a Card Form: A Comprehensive Guide

Understanding the importance of applying for a card

Having a card is not just a convenience but a significant aspect of modern financial management. Whether it’s for personal expenses, online purchases, or team-related expenses, a card can provide seamless access to funds. The ability to make instant payments enhances your purchasing power, providing opportunities to manage your budget more effectively.

The benefits of easy accessibility extend to various facets of life. From travel to online shopping, having a card simplifies transactions and often comes with rewards and bonuses that can enhance your financial well-being. Applying for a card form is the first step toward these advantages, allowing individuals to unlock financial flexibility.

Card types available

When considering applying for a card form, it's critical to understand the different types of cards available and their unique features.

Eligibility criteria for various cards

Before you apply for a card form, it's essential to be aware of the eligibility criteria that vary by card type. Common requirements include age, residency, income levels, and credit history.

What you need before applying

Preparation is key when applying for a card. Collecting necessary documents not only streamlines your application process but also enhances your chances of approval.

Where to apply: Online vs. in-person

Choosing between online or in-person application methods can significantly impact your experience and efficiency in applying for a card.

The step-by-step application process

Navigating the application process effectively requires following specific steps tailored to your needs.

Managing your card post-application

Once you've received your card, managing it responsibly is crucial for maintaining good financial health.

Frequently asked questions (FAQs)

New applicants often have a range of questions when it comes to applying for a card. Addressing common concerns can demystify the process.

Respecting your privacy during the application process

Your privacy should be a top priority during the application process. Understanding data privacy standards and protections is vital.

Most financial institutions comply with stringent data privacy standards, ensuring that your information is stored securely and used only for the purposes stated in the application. Always review privacy policies to know how your data will be handled.

Getting help: Customer support channels

Access to customer support can make a significant difference in your application experience.

User experiences: What others are saying

Personal experiences can provide invaluable insights into the application process. Many users have shared their experiences with applying for a card form through various platforms.

Testimonials highlight the convenience of applying through platforms like pdfFiller, where the document creation process is seamless. Success stories detail how users not only obtained their desired cards but also learned effective management strategies.

Additional considerations when applying for a card

While applying for a card might seem straightforward, several factors can influence your success and ongoing management.

Topics related to card management

Managing your card effectively involves a solid understanding of several related topics.

Stay updated with the latest financial news

Staying informed about financial news and updates can help you make better decisions regarding your card management.

Subscribing to email updates from reputable financial news sources can expose you to trends, changes in interest rates, and other important topics that could impact card users. Empowering yourself with knowledge is vital for maintaining financial health in an evolving landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify apply for a card without leaving Google Drive?

How do I edit apply for a card in Chrome?

Can I create an electronic signature for signing my apply for a card in Gmail?

What is apply for a card?

Who is required to file apply for a card?

How to fill out apply for a card?

What is the purpose of apply for a card?

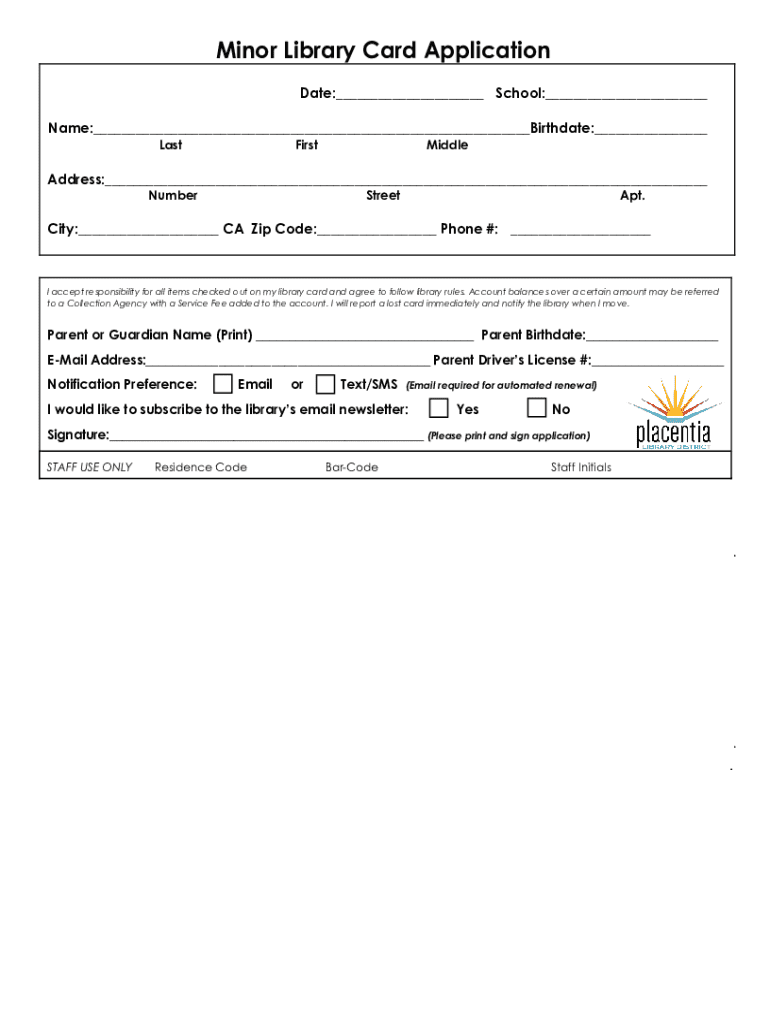

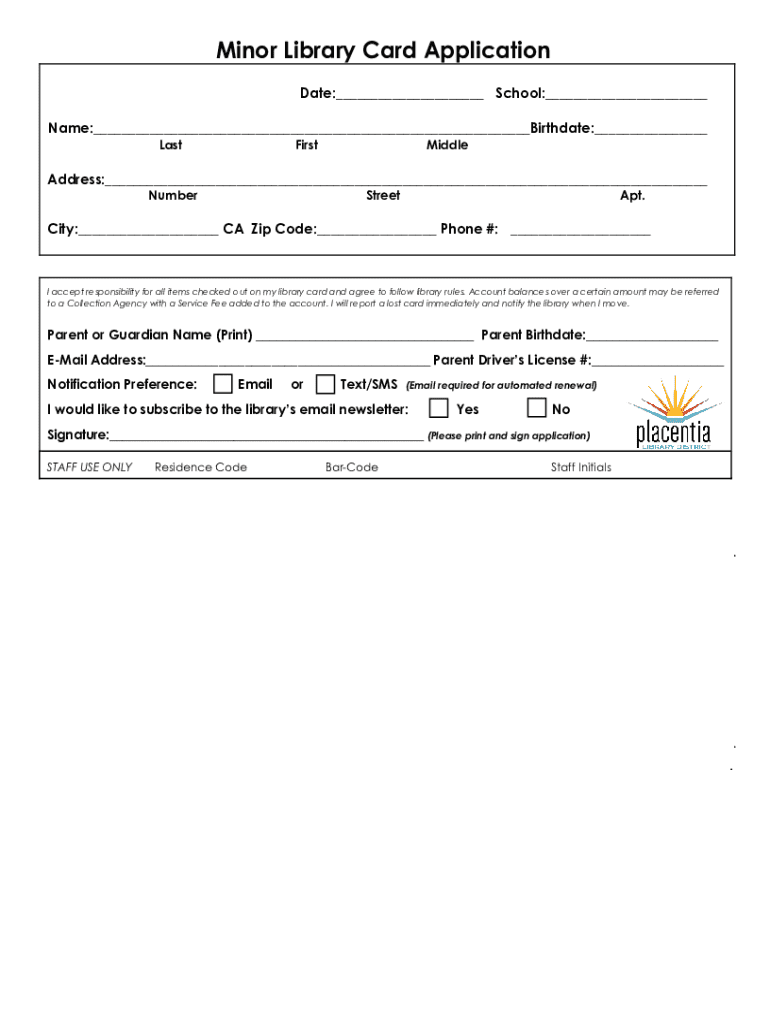

What information must be reported on apply for a card?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.