Get the free fraudulent financial practices and investor protection in the ...

Get, Create, Make and Sign fraudulent financial practices and

How to edit fraudulent financial practices and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fraudulent financial practices and

How to fill out fraudulent financial practices and

Who needs fraudulent financial practices and?

Fraudulent financial practices and form: A comprehensive guide

Understanding fraudulent financial practices

Fraudulent financial practices encompass a variety of illicit activities designed to deceive individuals or organizations for financial gain. This can range from simple scams to complex schemes involving multiple parties.

Historically, financial fraud has evolved with the advancement of technology and changes in financial regulations. The emergence of the internet and online banking has made it easier for fraudsters to perpetrate financial crimes, blurring the lines between traditional scams and modern digital fraud.

Key statistics highlight the prevalence and impact of these fraudulent practices. According to a report from the Association of Certified Fraud Examiners, organizations around the globe lose approximately 5% of their annual revenue to fraud. The effects extend beyond financial loss, often damaging reputations and eroding consumer trust.

Common types of fraudulent financial practices

Fraudulent financial practices vary in form and execution, but they commonly include the following categories:

Warning signs of financial fraud

Recognizing the warning signs of financial fraud can help mitigate risks. There are several indicators that may signal fraudulent activities:

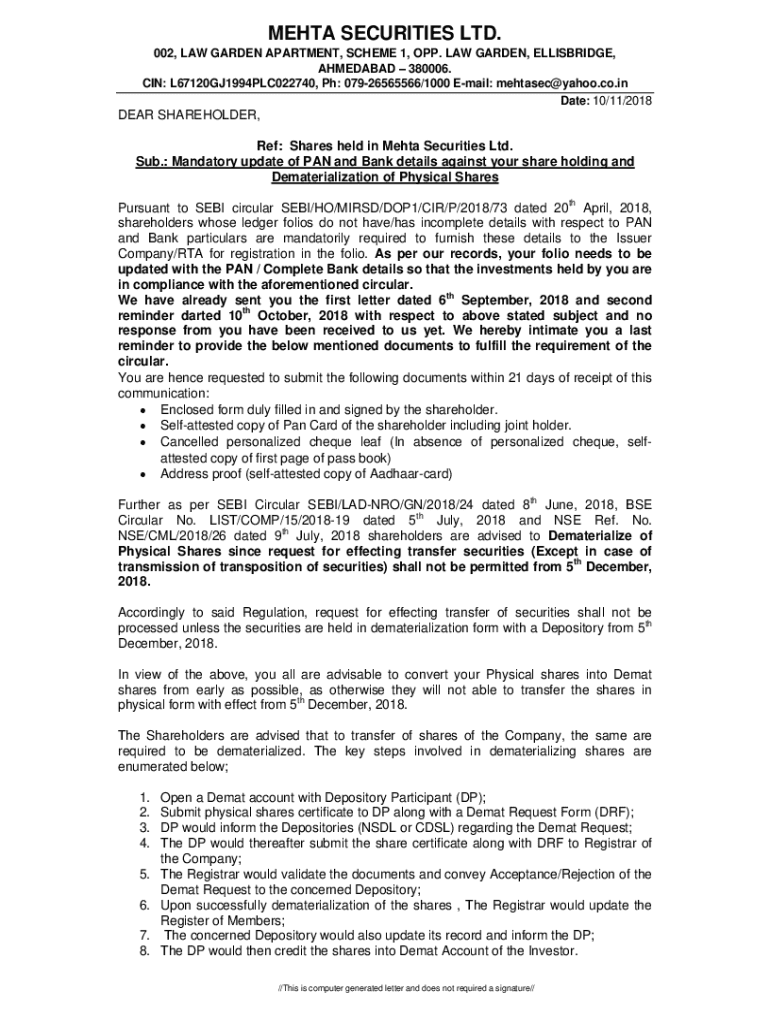

The role of documentation in addressing fraud

Proper documentation plays a crucial role in identifying and addressing fraudulent practices. Thorough records help verify transactions and track patterns that may point to fraud.

Being able to spot fraudulent documentation is essential. Indicators may include inconsistent data, missing signatures, or alterations that are not properly recorded.

Utilizing forms to report financial fraud is equally important. For example, PDF forms can simplify the reporting process. Specific forms designed for reporting fraudulent practices ensure that all relevant details are captured.

Navigating the form for reporting financial fraud

Filling out a fraud report form requires careful preparation. Follow these steps to ensure your report is thorough and effective:

Consider electronic submission for speed and convenience. Many platforms, including pdfFiller, facilitate this, but ensure to verify the submission method—whether electronic or paper—for effective reporting.

Legal consequences of fraudulent financial practices

Fraudulent financial practices open the door to various legal repercussions. Understanding the legal landscape surrounding these actions is crucial for both victims and perpetrators.

Numerous laws and regulations govern financial fraud, with penalties varying by jurisdiction and the severity of the crime. These can range from hefty fines to lengthy prison sentences.

Victims of fraud often have options for recovery, seeking compensation through civil suits or restitution. Consumer protection organizations frequently assist victims in navigating these challenging waters.

Preventive measures to avoid financial fraud

Taking proactive steps can significantly reduce the risk of falling victim to financial fraud. Here are some best practices:

Tools and resources to combat financial fraud

To combat financial fraud effectively, utilizing available tools and resources is essential. Interactive tools can help track expenditures, and sophisticated document management solutions bolster secure financial record handling.

Platforms like pdfFiller provide users with diverse resources for managing and protecting documents, featuring tools for creating, editing, and signing PDFs securely.

How pdfFiller facilitates secure document handling

pdfFiller enhances the document handling process through its powerful suite of tools designed for users engaged in financial activities. It allows for seamless editing, eSigning, and collaboration within teams, ensuring every document remains secure.

Via cloud-based access, users benefit from enhanced security and the convenience of accessing documents from anywhere, fostering a more flexible work environment.

Ways to report financial fraud

Reporting financial fraud is a crucial step in addressing these criminal acts. There are multiple avenues available for individuals wishing to report fraudulent activities:

Real-life examples and case studies

Notable cases of fraudulent financial practices serve as important learning tools. For instance, the infamous Bernie Madoff Ponzi scheme showcased the immense scale and complexity of investment fraud, impacting thousands of victims and resulting in billions in losses.

The lessons learned from these cases highlight the need for vigilance and skepticism, especially regarding high-return investment promises that seem too good to be true. Strategies for prevention include thorough research and seeking advice from experienced financial advisors.

Continuous learning and awareness

Staying informed about financial trends and scams is paramount in today's fast-paced financial environment. Regular participation in workshops and webinars can provide valuable knowledge to combat fraudulent activities.

Community resources, such as local consumer protection agencies or online forums, also offer ongoing support. Engaging with these resources aids individuals in better understanding their rights and the best practices for financial security.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my fraudulent financial practices and directly from Gmail?

Can I create an electronic signature for the fraudulent financial practices and in Chrome?

Can I edit fraudulent financial practices and on an iOS device?

What is fraudulent financial practices?

Who is required to file fraudulent financial practices?

How to fill out fraudulent financial practices?

What is the purpose of fraudulent financial practices?

What information must be reported on fraudulent financial practices?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.