Get the free Proceedings of the Annual Conclave of the Grand ...

Get, Create, Make and Sign proceedings of form annual

How to edit proceedings of form annual online

Uncompromising security for your PDF editing and eSignature needs

How to fill out proceedings of form annual

How to fill out proceedings of form annual

Who needs proceedings of form annual?

Proceedings of Form Annual Form: A Comprehensive How-to Guide

Understanding the annual form proceedings

Annual forms are crucial documents that organizations must file every year to comply with governmental and regulatory requirements. These forms often summarize financial activities, governance, and compliance statuses. The importance of these forms cannot be overstated, as they ensure transparency and accountability within businesses and organizations of all types. Properly completing and submitting the annual form can affect a company's ability to operate lawfully and secure funding.

Key components of most annual forms include financial statements, details about executive officers and board members, and confirmations of compliance with pertinent laws and regulations. Each segment plays a unique role, showcasing the organization's financial health and operational integrity, thereby setting a benchmark for stakeholders, including investors and regulatory bodies.

Preparing to fill out the annual form

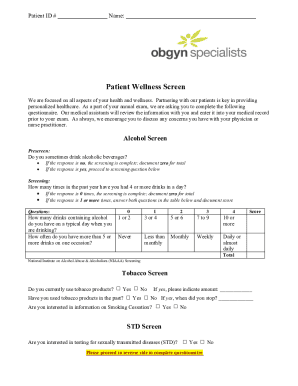

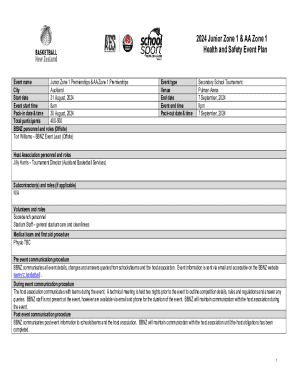

Before you start the process of filling out the annual form, it is essential to gather the necessary information and documentation. Personal Identifiable Information (PII) is generally required, which may include names, addresses, Social Security numbers for individuals, and taxpayer identification numbers for businesses. Alongside PII, financial records such as balance sheets, income statements, and recent tax filings are vital for accurate reporting.

Next, check the eligibility requirements for filing the annual form. Most entities, including corporations, LLCs, and nonprofits, are required to file, though some may be exempt depending on their size, structure, or the nature of their operations. Understanding who is obligated to file ensures that you meet compliance without facing any unnecessary penalties.

Step-by-step instructions for filling out the annual form

Filling out the annual form can be straightforward if approached methodically. Begin by breaking down the sections of the form. Part 1 typically requires basic information about the organization, such as its legal name, address, and nature of business. Ensuring accuracy in this section is crucial as it establishes the organization’s identity.

Part 2 focuses on the financial overview, where you will need to report income, expenses, and overall profitability. Each figure should be carefully calculated, reflecting the organization’s financial position. In Part 3, compliance affirmations must be made. This includes confirming adherence to laws, bylaws, and any other pertinent regulations.

Beware of common mistakes, such as neglecting to provide necessary signatures and leaving critical sections incomplete. Both can result in delays or rejections of your form, necessitating further steps to resolve.

Tools for filling and editing the annual form

In today’s digital age, utilizing interactive tools can significantly ease the process of completing the annual form. pdfFiller offers cloud-based features that allow you to edit and fill forms online, making changes as needed without the hassle of paperwork. The platform's eSignature functionality means that you can sign documents electronically, streamlining the approval process.

Collaboration is even more efficient with pdfFiller's shared access capabilities. Teams can work together in real time, allowing for multiple contributors to fill different sections of the form simultaneously. This feature ensures that contributions are consolidated, minimizing delays and enhancing accuracy.

Submitting the annual form

Once the annual form is filled out completely and accurately, it’s time to submit. Most jurisdictions offer online submission processes through government websites. Follow the guidelines carefully, as each jurisdiction may have unique submission requirements. Alternatively, you may choose to submit by postal mail. Ensure that you have the correct addresses and enough time for delivery.

After submission, tracking your form's status is crucial. Many online systems allow you to verify that your submission was received successfully. Additionally, understanding the confirmation messages can provide peace of mind and help identify if there are any outstanding issues requiring your attention.

Understanding implications of late or non-filing

Filing your annual form late or not at all can lead to severe consequences. Financial penalties are common for late submissions, and these fees can escalate into significant sums if the delay extends. More critically, non-filing can tarnish an organization’s reputation, making it challenging to secure future funding or partnerships.

If you find yourself in a situation where you have missed the deadline, it’s crucial to take remedial actions promptly. Rectifying late submissions may involve completing the form accurately and submitting it with an explanation. Often, regulatory authorities are open to negotiations regarding penalties, especially if you can demonstrate a valid reason for the delay.

Related forms and requests

Annual forms may sometimes require amendments or revisions post-submission. Familiarize yourself with the processes for making changes to your submitted forms, as this can save time and effort in the future. To request copies of previously submitted forms or additional clarifications, ensure you follow the right procedures as outlined by the relevant regulatory authorities.

Additionally, understanding other associated forms you may need to submit can streamline your compliance process further. For example, certain states might have supplemental forms that must accompany the annual form based on specific state regulations.

Special considerations for different business types

Different business structures have unique requirements when it comes to filling annual forms. For instance, LLCs and corporations are subject to different reporting and compliance standards. Corporations might require more detailed financial disclosures compared to LLCs, depending on their size and scope of operation.

Nonprofit organizations also face their own regulations regarding annual forms. For these entities, it’s vital to adhere to specific guidelines laid out by the IRS, including additional disclosures on activities and funding sources that may not apply to for-profit structures. Understanding these distinctions can save nonprofits from penalties and ensure ongoing compliance.

FAQ: Common queries related to the annual form

The annual filing process raises various questions for individuals and businesses alike. Common queries often concern specific deadlines, the types of documentation required, and filing fees associated with submissions. Clarifying these points can alleviate much of the stress surrounding annual filings.

It is also vital to address exceptions that might apply to certain entities or under unique circumstances. Many jurisdictions allow for extensions under specific conditions, which can offer relief for organizations facing challenges meeting deadlines.

Legal obligations and recommendations

When submitting annual forms, understanding the legal obligations at play is fundamental. Each jurisdiction has its specific laws governing the information required, deadlines, and possible penalties for non-compliance. Keeping abreast of these regulations is crucial to ensure that your organization not only remains compliant but also minimizes exposure to legal risks.

Best practices include maintaining organized financial records throughout the year, utilizing reliable tools such as pdfFiller for document management, and consulting with legal or financial experts when needed. By doing so, you enhance your readiness for audits and ensure that your filings represent your organization accurately and responsibly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute proceedings of form annual online?

Can I edit proceedings of form annual on an iOS device?

How do I edit proceedings of form annual on an Android device?

What is proceedings of form annual?

Who is required to file proceedings of form annual?

How to fill out proceedings of form annual?

What is the purpose of proceedings of form annual?

What information must be reported on proceedings of form annual?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.