Get the free Travel Expense Policy and Form - General Synod 2025

Get, Create, Make and Sign travel expense policy and

Editing travel expense policy and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out travel expense policy and

How to fill out travel expense policy and

Who needs travel expense policy and?

Travel Expense Policy and Form: A Comprehensive How-To Guide

Understanding travel expense policies

A travel expense policy serves as a framework for managing organizational travel costs, establishing clear guidelines for employees and contractors. These policies aim to control spending, ensure accountability, and maintain adherence to both local and national regulations. A well-defined travel expense policy fosters compliance and transparency, minimizing the risk of costly discrepancies during audits.

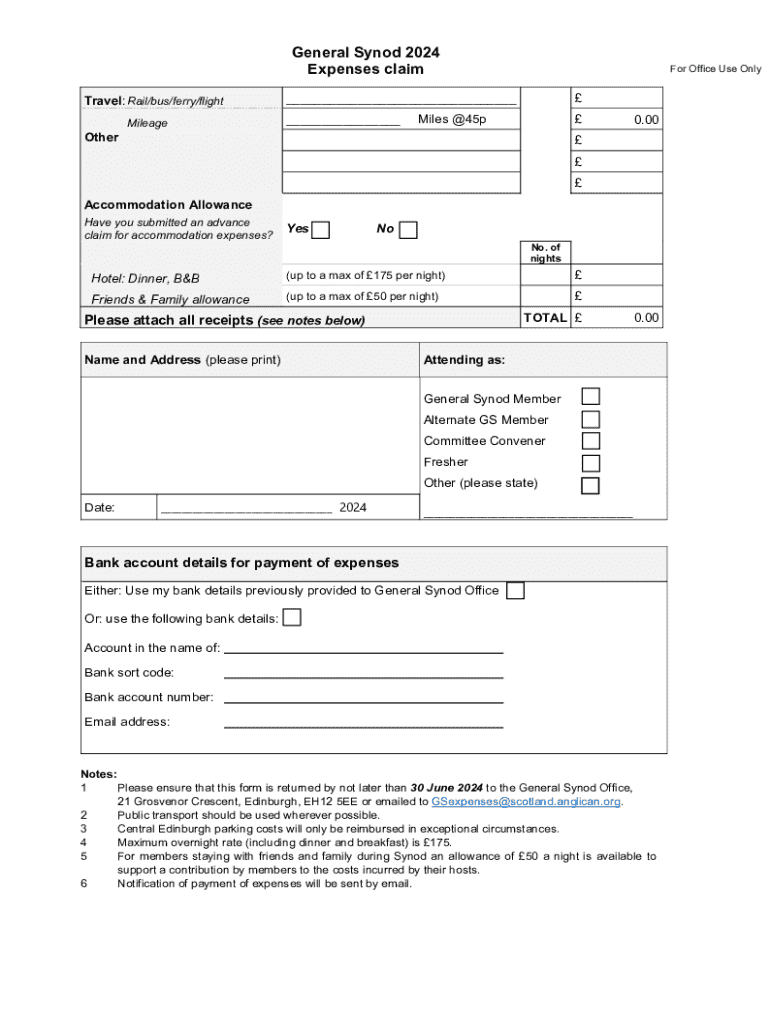

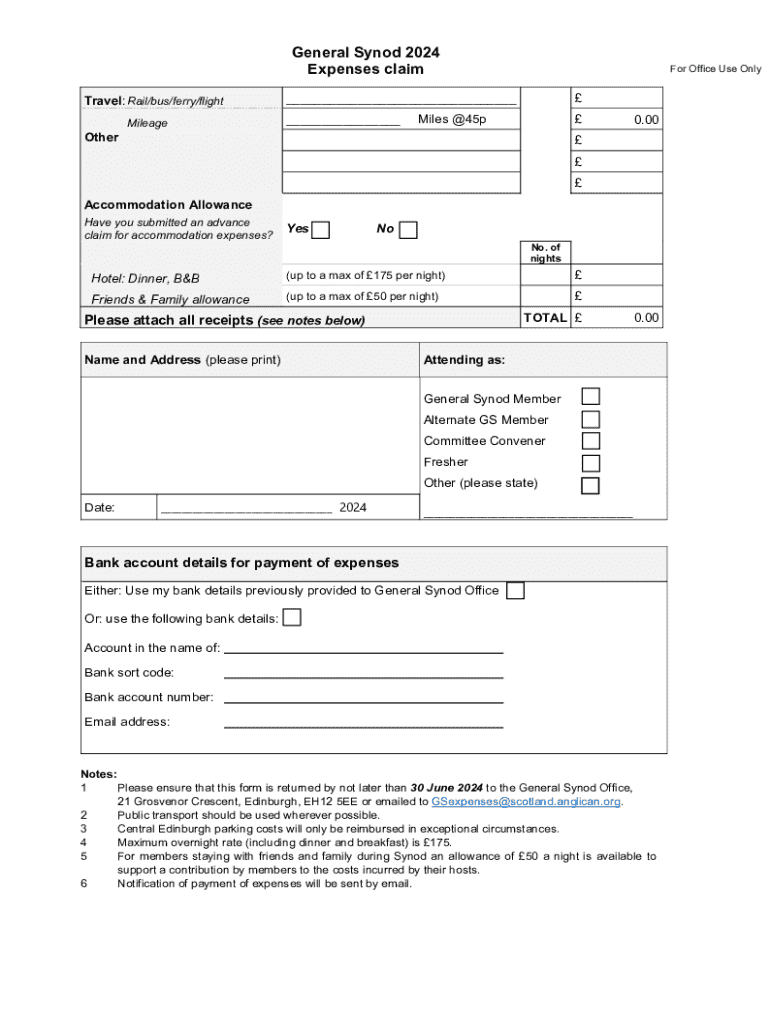

Types of expenses covered

A travel expense policy delineates the types of expenses that are allowable and those that are prohibited. Understanding these distinctions is crucial for employees to ensure that they do not incur personal costs that will not be reimbursed. Typically, allowable expenses encompass transportation, accommodation, and meal allowances, while non-allowable expenses may include entertainment and personal items.

Travel expense documentation

Maintaining proper documentation is essential for any travel expense claim. Employees are required to provide receipts for all expenses, along with travel itineraries and confirmations. This substantiation process not only streamlines reimbursement but also acts as a record for auditing purposes. Clear documentation reduces discrepancies and promotes efficient processing.

Completing the travel expense form

The travel expense form serves as the official documentation for reimbursement requests. Understanding its structure is vital for successful submissions. The form typically includes sections for personal details, trip details, and a detailed itemization of expenses incurred during the trip.

Approval workflow for travel expenses

Once the travel expense form is filled out, it must be submitted through a defined approval workflow. This often involves submitting to a direct supervisor, manager, or the finance department, depending on organizational structure. Understanding the required approvals and the typical timeline for reimbursement can help manage expectations and improve efficiency.

Travel advances and reimbursements

Travel advances can provide financial support before the trip takes place, allowing employees to manage upfront expenses. Organizations must clearly outline when and how to request travel advances. Additionally, the reimbursement process must be straightforward to ensure employees receive reimbursements in a timely manner.

Special considerations in travel expenses

When traveling internationally, additional considerations come into play, such as currency exchange rates and entry requirements. Expenses may need extra documentation to comply with local laws and regulations. Group travel for corporate events also requires careful handling of shared expenses and collective arrangements.

Examples of travel expense scenarios

Real-life examples can clarify the application of travel expense policies. Sample expense reports can help employees understand how to complete the form correctly. Case studies showcasing successful reimbursement scenarios, and adherence to policy guidelines can illustrate best practices.

Resources for travel expense management

Utilizing online tools and templates can enhance the efficiency of travel expense management. Employees can access specific templates relevant to their travels directly from pdfFiller, facilitating ease of completion. The platform also offers tools for editing, signing, and managing various documents.

Frequently asked questions

Common queries about travel expenses often arise when employees face unique situations, such as lost receipts or blending personal and business travel. Navigating these scenarios effectively can help maintain compliance and simplify the reimbursement process.

Policy updates and changes

Travel expense policies should be regularly reviewed and updated to reflect changes in the organizational structure or compliance requirements. Employees must stay informed about any amendments and how they may affect expense reporting and reimbursements. Maintaining an open line of communication about policy modifications is essential.

Conclusion of the travel expense process

In conclusion, a clear understanding of the travel expense policy and form is crucial for effective management of organizational travel costs. Before submission, it is essential for employees to conduct a thorough review, ensuring that all documentation is complete and accurate. Adherence to these policies not only streamlines the reimbursement process but also promotes a culture of accountability and transparency within the organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the travel expense policy and in Gmail?

How do I edit travel expense policy and on an Android device?

How do I fill out travel expense policy and on an Android device?

What is travel expense policy?

Who is required to file travel expense policy?

How to fill out travel expense policy?

What is the purpose of travel expense policy?

What information must be reported on travel expense policy?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.