Get the free Mutual Funds - Invest in Mutual Funds OnlineICICI ...

Get, Create, Make and Sign mutual funds - invest

Editing mutual funds - invest online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mutual funds - invest

How to fill out mutual funds - invest

Who needs mutual funds - invest?

Mutual Funds - Invest Form: A Comprehensive How-To Guide

Understanding mutual funds

Mutual funds represent a form of investment that pools money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. This collective approach allows individuals to invest alongside others, gaining access to a professionally managed portfolio.

One of the primary advantages of mutual funds lies in their diversification. By spreading investments across a wide range of securities, mutual funds reduce the overall risk inherent in investing. Professional management offers another key benefit, as expert fund managers monitor and adjust the portfolio based on market conditions, thus saving individual investors the time and effort required to research and manage investments.

Liquidity is another significant benefit of mutual funds, enabling investors to easily buy and sell shares at the current Net Asset Value (NAV). In terms of types, mutual funds can be broadly categorized into equity, debt, balanced, and index funds, with each offering different risk and return profiles.

Understanding key terms like NAV, expense ratios, and risk assessment is essential for investors. NAV represents the fund's per-share value, while expense ratios inform investors of the total costs associated with managing the fund, impacting their overall returns.

The importance of using an invest form

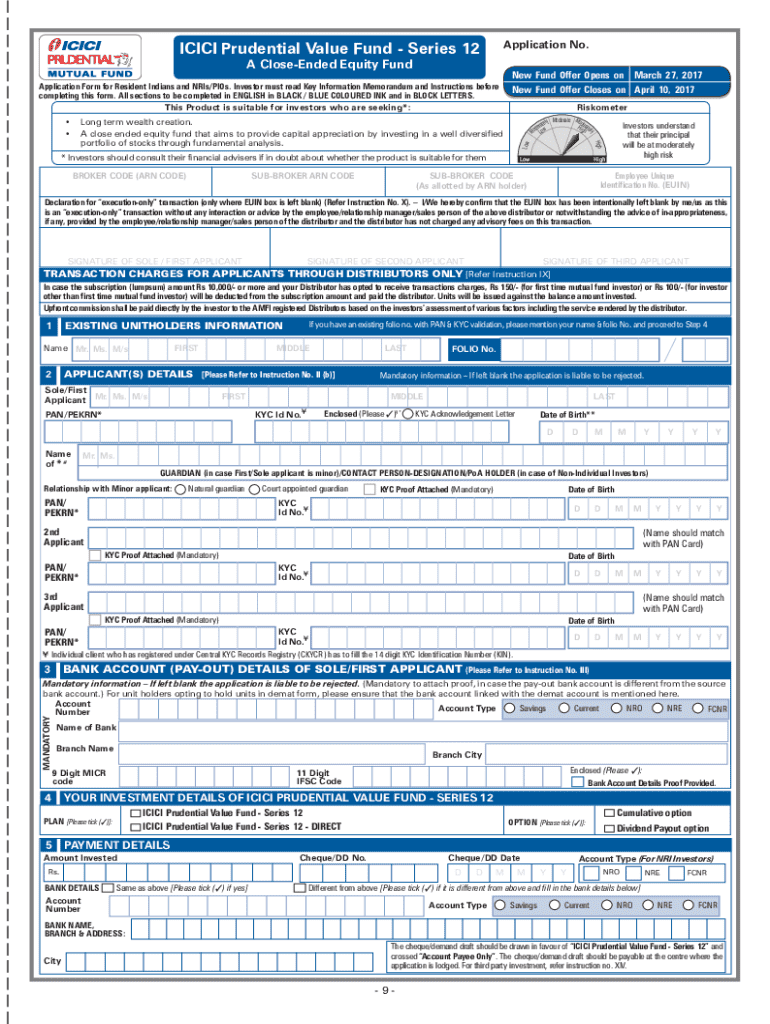

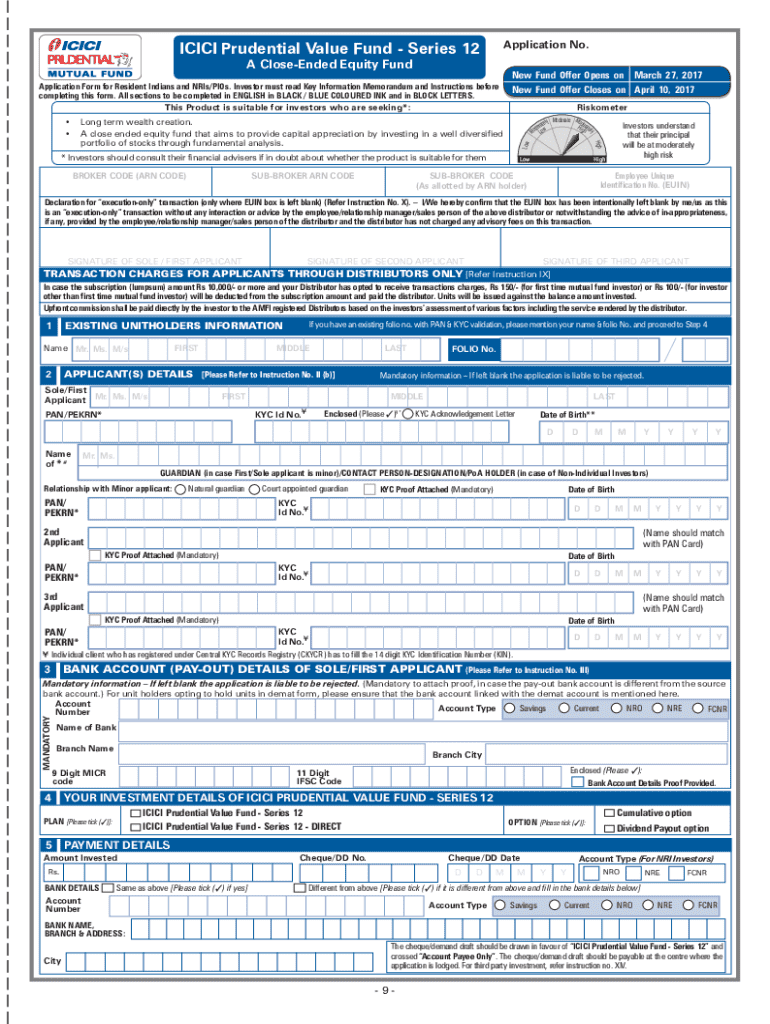

An invest form is a crucial component for any investor wishing to participate in mutual funds. It is essentially an application that enables individuals to indicate their interest in purchasing shares in a mutual fund. Using an invest form streamlines the investment process, ensuring that submissions are accurate and comprehensive.

Accuracy in information submission cannot be understated. Incorrect details could lead to delays or complications in processing the application. Thus, it is vital to avoid common mistakes such as incomplete fields and miscommunication of contact details, which can jeopardize investment opportunities.

Step-by-step guide to completing the mutual funds invest form

To successfully complete a mutual funds invest form, begin by gathering the required information. This should include your personal details such as name, address, Social Security number, and any relevant financial documentation. Additionally, it's essential to articulate your financial goals and assess your risk tolerance.

Next, access the mutual funds invest form. These forms are typically available on the websites of financial institutions or mutual fund companies. Filling out the form accurately is paramount. Each section will require information such as fund selection, amount to invest, and payment method, so paying attention to detail is key.

Finally, review the completed form for any errors before submission. Ensuring accuracy at this stage can expedite the investment process and minimize potential issues.

Editing and managing your invest form

After initial completion, you may need to make edits to your mutual funds invest form. Utilizing pdfFiller provides an efficient way to edit your forms. Begin by uploading your completed form to the platform.

The editing tools available within pdfFiller facilitate easy adjustments to text, allowing you to correct any mistakes or add information when necessary without the need to start from scratch. Collaborating with financial advisors can enhance this process further, as many tools allow for real-time collaboration and communication.

eSigning the invest form

eSignatures have become a fundamental aspect of the mutual fund investment process. They provide a secure and efficient method for confirming your commitments without needing physical paperwork. Using pdfFiller, signing the invest form via eSignature is straightforward.

The step-by-step process for eSigning typically involves selecting the signature option within the platform, placing your signature in the required field, and confirming it. eSignatures are legally valid, making them a reliable alternative to traditional signatures and facilitating a smoother investment process.

Submitting your invest form

Once your invest form is complete and signed, you can choose from several submission methods. Many financial institutions offer online submission, which is both convenient and efficient. Alternatively, you may opt to print and submit your form physically through traditional mail or in person.

After submission, you can expect a confirmation process to commence. This generally includes receiving an acknowledgment from the fund company or institution processing your investment. Tracking your application is also often possible through the institution's website or by contacting their support.

Managing your mutual fund investments

Monitoring your investments post-submission is crucial. pdfFiller offers various tools to assist in tracking your mutual funds effectively. This may include checking current NAVs or observing historical performance data to assess whether the investment aligns with your financial goals.

If changes are necessary after you have begun investing, such as updating your invest form or switching between funds, pdfFiller simplifies this management process. Investors can easily make modifications as needed, streamlining what could otherwise be an arduous task.

Additional tools for investors

For those looking to enhance their investment strategies, utilizing transaction calculators can help estimate returns and costs associated with mutual fund investments. Being informed aids in setting realistic financial goals.

Smart planners also come into play, allowing investors to analyze their portfolio and adjust strategies to meet changing market conditions. pdfFiller provides educational content, webinars, and ongoing support, offering a comprehensive suite of resources for investors at all stages.

Special considerations

Investors located in the United States or those residing in Canada should be aware of specific regulatory considerations when completing an invest form. Each country has distinct requirements that govern mutual fund investments, which may impact your investment choices.

Additionally, it’s crucial to factor in the tax implications of mutual fund investments. These can vary based on the type of mutual fund, the investor's income bracket, and the region of residence. Engaging a tax professional can help clarify these implications to ensure compliance and optimize returns.

Frequently asked questions (FAQs)

Many individuals have queries about the mutual funds invest form process. Common questions revolve around what information is required, how to navigate specific sections of the form, and the timelines associated with processing applications.

Clarification on terms and procedures is also vital for new investors. Resources for further learning on mutual funds, such as educational guides and FAQs, are readily available and can enhance your understanding of the investment landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit mutual funds - invest online?

How do I make edits in mutual funds - invest without leaving Chrome?

How do I edit mutual funds - invest straight from my smartphone?

What is mutual funds - invest?

Who is required to file mutual funds - invest?

How to fill out mutual funds - invest?

What is the purpose of mutual funds - invest?

What information must be reported on mutual funds - invest?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.