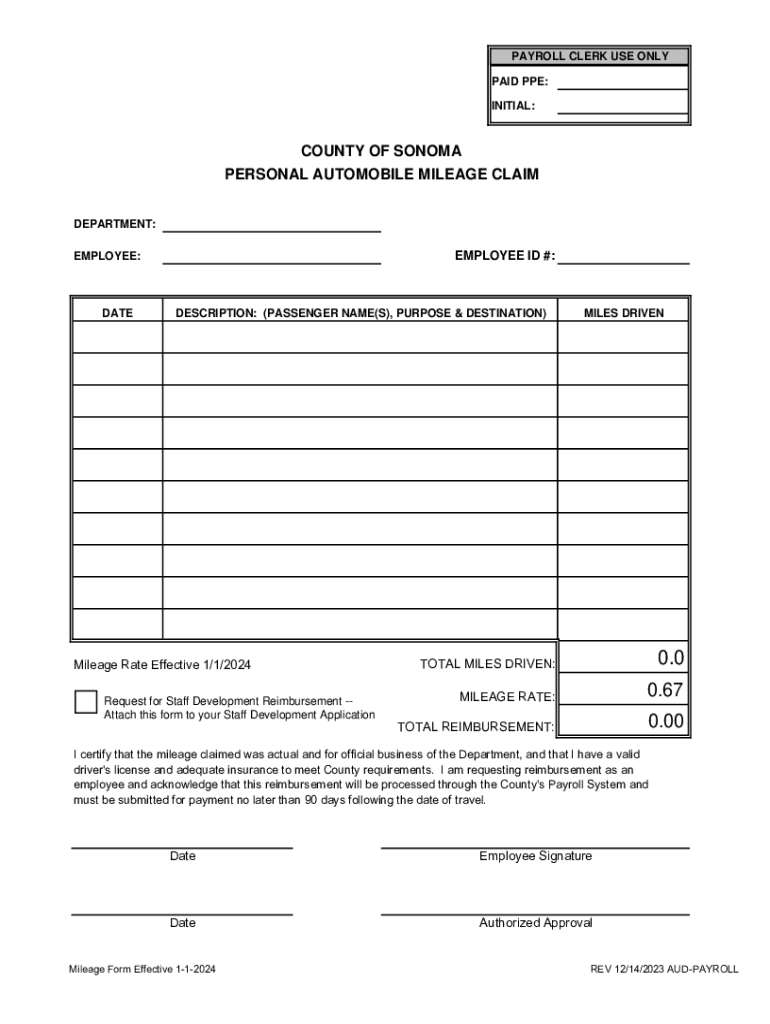

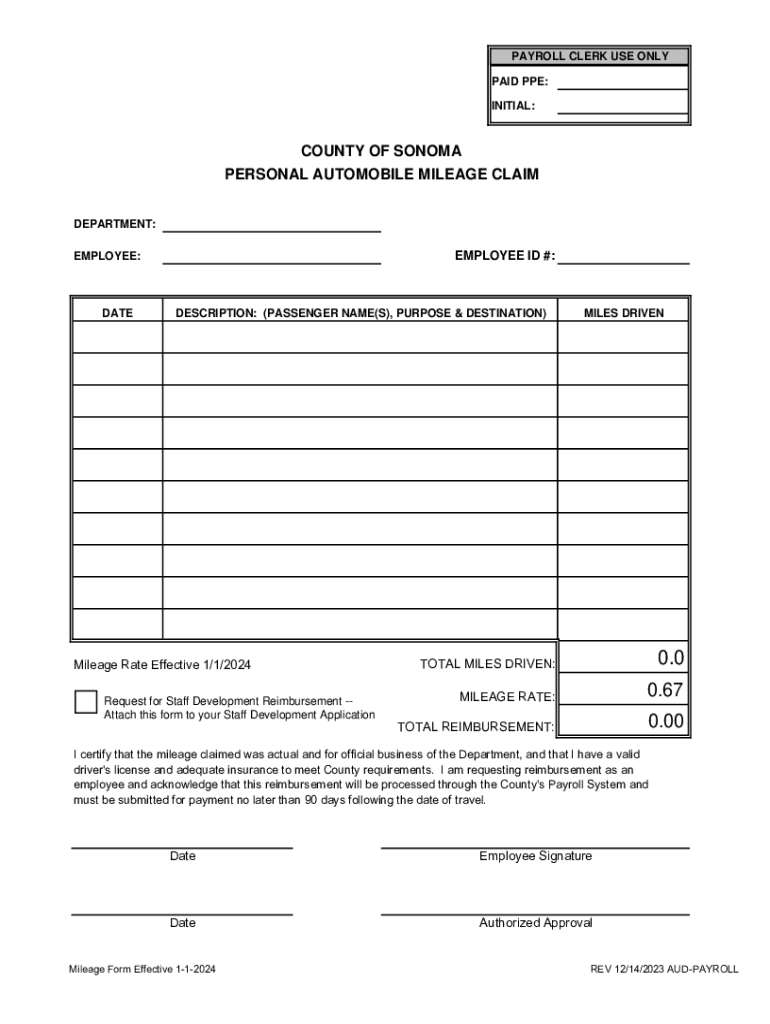

Get the free PAYROLL CLERK USE ONLY

Get, Create, Make and Sign payroll clerk use only

How to edit payroll clerk use only online

Uncompromising security for your PDF editing and eSignature needs

How to fill out payroll clerk use only

How to fill out payroll clerk use only

Who needs payroll clerk use only?

Understanding the Payroll Clerk Use Only Form

Understanding payroll clerk role

A payroll clerk plays a vital role in managing and processing employee compensation within an organization. This position is responsible for ensuring that payroll is executed correctly, on time, and in compliance with applicable laws and regulations. The accuracy and timeliness of payroll directly impact employee satisfaction and retention, thus underscoring the significance of this role.

Key responsibilities of a payroll clerk include collecting and verifying timekeeping information, processing employee paychecks, managing deductions, and maintaining payroll records. Additionally, clerks stay updated on tax regulations and employment laws to ensure compliance. The skills required for success in this role typically include attention to detail, problem-solving capabilities, and proficiency with payroll software.

Accurate payroll management is crucial, as mistakes can lead to legal penalties, financial discrepancies, and employee dissatisfaction.

Overview of the payroll clerk use only form

The 'Payroll Clerk Use Only Form' serves as an internal document utilized by payroll clerks to manage specific data related to employee payroll processing. Its purpose is to streamline the workflow and ensure that all necessary information is collected in one place for accurate processing.

This form is typically used when setting up new employees in the payroll system or when making changes to an existing employee's payroll details, such as updates to salary, benefits, or tax allowances. Misuse of this form can carry legal implications, such as violations of labor laws or errors in payroll that can lead to penalties for the organization.

Detailed instructions for completing the payroll clerk use only form

Completing the Payroll Clerk Use Only Form involves several critical steps to ensure accuracy and compliance. Following a structured approach allows clerks to manage payroll data effectively.

For best practices, it is advisable to have a checklist or guidelines to verify compliance with local laws and internal policies.

Tools for filling out and managing payroll forms

Using a robust document management tool like pdfFiller can significantly enhance the efficiency of filling out and managing payroll forms. pdfFiller provides a suite of features tailored for this purpose, making it easier for payroll clerks to streamline their processes.

With pdfFiller, users can edit and customize forms effortlessly. It allows payroll clerks to add electronic signatures, which helps in maintaining the legality and authenticity of the documents. Additionally, the platform supports collaboration among team members, enabling multiple users to work on the same document.

Embracing a cloud-based solution like pdfFiller not only facilitates efficient document management but also ensures accessibility from anywhere, making it a perfect fit for teams working remotely.

FAQs related to the payroll clerk use only form

To assist payroll clerks, here are some common questions concerning the Payroll Clerk Use Only Form, along with answers to facilitate best practices.

Implementing these best practices ensures smooth payroll operations and minimizes the potential for errors.

Related topics and forms

In addition to the Payroll Clerk Use Only Form, several other critical payroll documents help organizations maintain compliance and efficiency in managing employee payroll.

Choosing the right payroll management software, coupled with proper training on forms, is crucial for the HR and finance teams in executing efficient payroll processing.

Advanced payroll management techniques

To optimize payroll processes, considering advanced techniques is paramount. Streamlining workflows allows payroll clerks to save time and improve accuracy.

These techniques empower payroll clerks to enhance their efficiency and deliver high-quality results.

The future of payroll clerk roles

As payroll management continues to evolve, payroll clerks must adapt to emerging trends such as increased automation and AI-driven solutions. Automation is reshaping how payroll processing is conducted, driving efficiency while allowing payroll professionals to focus on strategic functions.

Understanding the future landscape will provide payroll clerks with insights into skill development needs and potential career paths.

Glossary of payroll terms

Familiarizing oneself with payroll terms can improve communication and understanding within the payroll department.

Mastering these terms enhances a payroll clerk's credibility and efficiency.

Case studies: success stories in payroll management

Analyzing real-world examples of effective payroll management can reveal best practices and common challenges faced by payroll departments.

Organizations that have streamlined their payroll processes through technology integration often report improved accuracy and employee satisfaction.

Identifying these success stories and the solutions implemented can guide payroll clerks in improving their own practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify payroll clerk use only without leaving Google Drive?

Can I sign the payroll clerk use only electronically in Chrome?

How do I fill out payroll clerk use only using my mobile device?

What is payroll clerk use only?

Who is required to file payroll clerk use only?

How to fill out payroll clerk use only?

What is the purpose of payroll clerk use only?

What information must be reported on payroll clerk use only?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.