Get the free Final 7/14/14

Get, Create, Make and Sign final 71414

How to edit final 71414 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out final 71414

How to fill out final 71414

Who needs final 71414?

Detailed How-to Guide for the Final 71414 Form

Understanding the Final 71414 Form

The Final 71414 Form serves a crucial role in various administrative processes, providing a standardized method for individuals and businesses to submit important financial and personal information. Often associated with finalizing tax declarations or the completion of financial obligations, this form ensures that all required documentation is accurately gathered and submitted to relevant authorities.

The primary purpose of the Final 71414 Form is to formalize the conclusion of any ongoing financial interactions with a government agency or financial institution. This may include final tax obligations or confirmations regarding financial settlements. Understanding who needs to fill out this form typically involves identifying anyone who has had financial dealings requiring formal closure, be it individuals, self-employed professionals, or businesses.

Key components of the Final 71414 Form

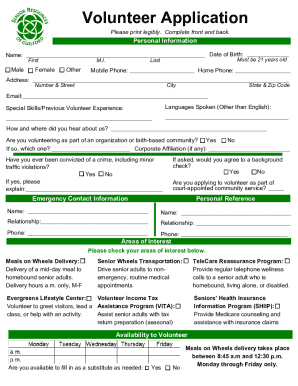

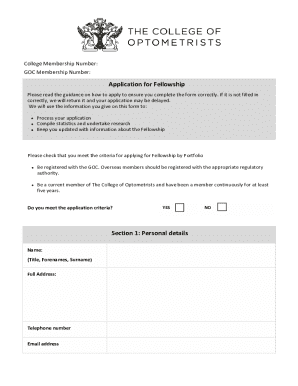

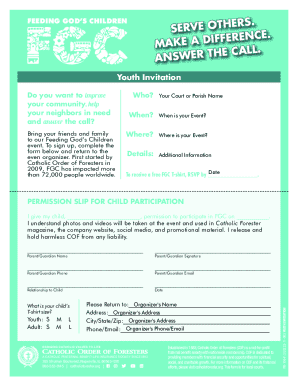

To effectively navigate the Final 71414 Form, it's vital to break it down into its essential components. The form consists of several sections, including personal information, specific financial details, and the necessary signatures to validate the submission.

Understanding definitions relevant to the Final 71414 Form and familiarizing yourself with common terminology can also help streamline the filing process. Terms such as ‘liability’, ‘obligation’, and ‘disclosure’ often appear and carry specific meanings critical to completing the form correctly.

Step-by-step guide to filling out the Final 71414 Form

Filling out the Final 71414 Form properly is crucial to ensuring that your submission is accepted without issues. Let's walk through each step required for accurate completion.

Editing and modifying the Final 71414 Form

Once your Final 71414 Form is completed, you may find yourself needing to edit or modify certain sections. Being able to effectively use pdfFiller’s editing tools can save time and improve accuracy.

Managing and storing the Final 71414 Form

Effective management and secure storage of your Final 71414 Form are essential for future reference and compliance. Utilizing cloud-based solutions like those offered by pdfFiller can greatly simplify this process.

FAQs about the Final 71414 Form

To support users navigating the Final 71414 Form, here are some frequently asked questions that can provide additional clarity and guidance.

Advanced tools for optimal form management

Beyond basic functionality, pdfFiller offers advanced features that can help optimize the management of your Final 71414 Form, making workflows smoother for individuals and teams alike.

Resources for further support

To gain more insights into filling out the Final 71414 Form and to ensure compliance with all necessary regulations, refer to official guidelines provided by governmental agencies. These resources often explain the rationale behind certain requirements and offer assistance in understanding complex financial obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find final 71414?

Can I sign the final 71414 electronically in Chrome?

How do I complete final 71414 on an Android device?

What is final 71414?

Who is required to file final 71414?

How to fill out final 71414?

What is the purpose of final 71414?

What information must be reported on final 71414?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.