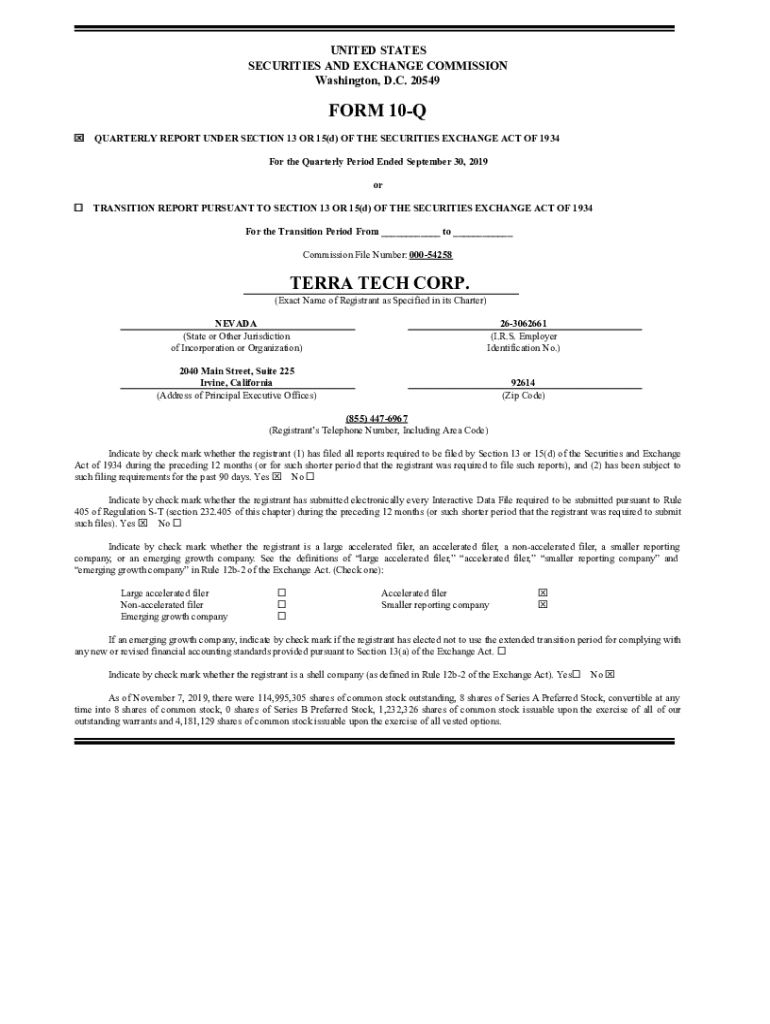

Get the free FORM 10-Q TERRA TECH CORP.

Get, Create, Make and Sign form 10-q terra tech

Editing form 10-q terra tech online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q terra tech

How to fill out form 10-q terra tech

Who needs form 10-q terra tech?

How to Fill Out the 10-Q Terra Tech Form

Understanding the 10-Q report

The 10-Q form is a mandatory quarterly report that public companies must file with the U.S. Securities and Exchange Commission (SEC). This report provides an overview of the company's financial performance and comprehensive details about its operations, with the objective of keeping investors informed about the company's journey throughout the fiscal year. Unlike the 10-K form, which is an annual report that offers a comprehensive overview of the company’s financial condition, the 10-Q is less exhaustive and must be filed three times a year.

The 10-Q is particularly important for companies like Terra Tech, which operates within a rapidly evolving industry where keeping stakeholders updated is critical. The 10-Q also aids in building investor confidence by facilitating transparency around the business's financial stability and growth prospects.

Overview of Terra Tech's 10-Q submission

Terra Tech has made significant strides in its financial reporting history, marked by key highlights in its previous 10-Q filings. These filings have included notable financial results stemming from the company's expansion, operational improvements, and adaptation to the evolving cannabis market. Recent filings underscore developments such as acquisitions, production scaling, and strategic partnerships that have shaped its quarterly performance.

Monitoring Terra Tech’s 10-Q reports is crucial for stakeholders. The insights gleaned from these documents can directly influence investment decisions by highlighting the company's adaptability and resilience in the cannabis industry, which has faced ups and downs amid market volatility and regulatory shifts.

Detailed breakdown of the 10-Q sections

The 10-Q is formatted into distinct sections that guide stakeholders through Terra Tech’s financial narrative. Item 1 includes key financial statements like balance sheets, income statements, and cash flow statements, presenting a snapshot of the company’s financial performance and position in the reporting period.

Item 2 features Management's Discussion and Analysis (MD&A), where the management provides insights into operational strategies, market conditions, and future outlooks. This is crucial in offering qualitative perspectives on financial results. Item 3 addresses quantitative and qualitative disclosures about market risk, aiding investors in assessing potential vulnerabilities. Lastly, Item 4 examines the effectiveness of internal controls, ensuring the integrity of financial reporting.

Step-by-step guide to filling out the 10-Q form

Filling out the 10-Q form requires diligent preparation. Step 1 involves gathering the necessary information, including financial data from the previous quarter and updates on ongoing business activities. This foundational data underpins the subsequent sections of the form.

Step 2 focuses on completing the financial statements accurately. Companies should ensure they enter data precisely in balance sheets and income statements, leveraging accounting software and financial statements as reference points. In Step 3, the writing of the MD&A necessitates clarity; essential points cover operational updates and how market conditions affect finances. Lastly, in Step 4, finalizing and reviewing the form is critical. A checklist for common errors helps avoid oversights, and peer reviews can enhance the quality before submission.

Tools for completing the 10-Q form

Using tools like pdfFiller can significantly streamline the process of editing and managing the 10-Q form. pdfFiller's comprehensive capabilities allow users to edit PDFs and securely sign documents from any location, bolstering productivity and ensuring accurate submissions.

The platform also offers templates specifically designed for 10-Q completion, simplifying the documentation process for users. Furthermore, interactive features enable real-time collaboration, allowing team members to contribute effectively to the document creation process.

Key considerations when filing a 10-Q

Timelines and deadlines are crucial when filing a 10-Q form. Companies must adhere to specific SEC deadlines to ensure compliance and avoid penalties. Key dates include the filing deadline for large accelerated filers, which is 40 days after the end of the quarter, and 45 days for accelerated and non-accelerated filers.

Understanding regulatory compliance is equally vital. Familiarity with SEC guidelines helps companies navigate the filing processes efficiently. Common pitfalls to avoid during this process include misreporting financial data, overlooking regulatory updates, and failing to allow adequate time for audits and final reviews.

Analyzing the impact of the 10-Q on company performance

Interpreting financial results published in the 10-Q involves analyzing growth trends and assessing the overall financial health of the company. Investors should pay attention to adjustments and non-GAAP measures that provide deeper insights into performance. This analysis enables a nuanced understanding of earning potentials and strategic positioning.

Utilizing the data gathered from the 10-Q is essential for future investment decisions. Investors should monitor essential metrics such as revenue growth, profit margins, and cash flow ratios to forecast the company's potential impact on share prices and market sentiment.

The future of financial reporting for cannabis companies

As the cannabis industry continues to evolve, so too does the landscape of 10-Q submissions. Regulatory changes are shaping how cannabis companies report their financials, often requiring adjustments in reporting practices to ensure compliance. Monitoring these trends is vital for companies to stay ahead in a competitive market.

Technology is likely to play a significant role in revolutionizing financial reporting practices, making it easier for cannabis companies to manage their documentation and compliance tracking. Innovations in document management platforms, like pdfFiller, will further ensure that companies can streamline their reporting processes without compromising accuracy or compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 10-q terra tech without leaving Google Drive?

How do I execute form 10-q terra tech online?

How can I fill out form 10-q terra tech on an iOS device?

What is form 10-q terra tech?

Who is required to file form 10-q terra tech?

How to fill out form 10-q terra tech?

What is the purpose of form 10-q terra tech?

What information must be reported on form 10-q terra tech?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.