Get the free Filling out IRS Form 8832: An Easy-to-Follow Guide

Get, Create, Make and Sign filling out irs form

Editing filling out irs form online

Uncompromising security for your PDF editing and eSignature needs

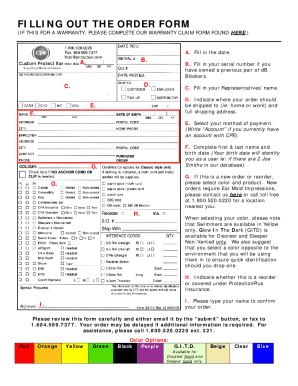

How to fill out filling out irs form

How to fill out filling out irs form

Who needs filling out irs form?

Filling Out IRS Forms: A Complete Guide

Overview of IRS forms

IRS forms play a crucial role in the tax filing process, enabling individuals and entities to report income, calculate taxes owed, and claim deductions or credits. The Internal Revenue Service (IRS) provides various forms tailored to different tax situations, ensuring compliance with federal tax laws.

Common IRS forms include Form 1040 for individual income tax returns, Form W-2 for wage and salary reporting, and Form 1099 for reporting various types of income. Each form serves a unique purpose and is significant in ensuring accurate tax reporting.

Understanding the specific form: Form 1040

Form 1040 is the standard form used by individuals in the United States to report their annual income and determine their tax liability. All individuals with a taxable income exceeding the IRS minimum threshold are required to fill out this form for accurate tax reporting.

Key deadlines for filing Form 1040 typically align with the tax year ending on December 31, with April 15 being the usual due date for submitting returns. Failure to submit the form on time can result in penalties, interest on unpaid taxes, and potential complications in managing future tax liabilities.

Preparing to fill out the IRS form

Before you start filling out Form 1040, it’s essential to gather the necessary documentation to ensure a smooth filing process. Common documents required include W-2s from employers, 1099 forms for any freelance work, previous tax returns, and receipts for deductible expenses.

Understanding your filing status is another crucial step. Your filing status affects your tax rate and which deductions you're eligible for. The IRS recognizes five filing statuses: Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow(er). Knowing where you fit in this categorization can significantly impact your overall tax liability.

Step-by-step instructions for filling out Form 1040

The first section of Form 1040 requires you to provide your personal information. Fill in your name, Social Security Number, and address accurately. Ensure that this information matches the records the IRS has to avoid discrepancies.

Section 2 focuses on reporting your income. You need to categorize your income into various streams such as wages, salaries, business income, dividends, and other sources. Each income type has specific lines on the form, so take care to read the instructions accompanying the form carefully.

In Section 3, you will list all applicable deductions and credits. Deductions can significantly reduce your taxable income, making it vital to claim any you are entitled to, such as student loan interest or mortgage deductions. Understanding which deductions apply to your situation can save you money.

The last section may contain additional questions concerning your income and personal information that can further assist the IRS in processing your return. Be sure to read these questions carefully and answer them accurately to avoid any issues.

Common pitfalls to avoid

When filling out IRS forms, accuracy is paramount. One of the most common mistakes occurs in entering personal information, such as your name or Social Security Number. Even small typos can lead to significant issues.

Another frequent mistake is underreporting income, which could result in penalties upon audit. Always report all income sources thoroughly and be cautious about missing income statements such as 1099s. Incorrect deductions claimed are also a major pitfall; ensure you have documentation to back up any deductions.

To avoid these mistakes, make it a habit to double-check your form before submission. Consider using a checklist approach, revisiting each section to confirm accuracy.

Submitting your form

Once your Form 1040 is complete, you must decide how to submit it. E-filing is a popular and efficient method, allowing you to submit your form electronically. This method can speed up processing time and facilitate any refunds you may be due.

Using pdfFiller allows you to e-file seamlessly. Its platform guides you through uploading your filled form and submitting it directly to the IRS. If you opt for paper filing, ensure you send the form to the correct IRS address, depending on your location and whether you are enclosing a payment.

After submission, you can track the status of your filing via the IRS website, ensuring you stay informed about any processing changes or potential issues.

Managing your IRS forms post-submission

After submitting your form, it's important to keep a copy for your records. The IRS recommends retaining copies of tax returns and supporting documentation for at least three years in case of an audit.

If you discover an error after submission, you can amend your return using Form 1040-X. This process allows you to make corrections without penalty, as long as the amendments are made promptly. Additionally, be prepared to deal with potential follow-up correspondence from the IRS, which may require you to provide additional information or clarification.

Using interactive tools for assistance

When filling out IRS forms like Form 1040, using tools like pdfFiller can streamline the process significantly. The platform provides editing capabilities for PDFs, allowing you to make changes easily. You can also eSign your completed forms directly on the platform, eliminating the need for printing and scanning.

Collaboration features available in pdfFiller attract organizational teams that need to manage multiple forms and documents. By facilitating teamwork on document management, pdfFiller becomes an essential tool in ensuring that everyone involved stays aligned with filings and tax obligations.

Frequently asked questions (FAQs)

Many individuals have questions about the filing process, especially regarding specific timelines and potential penalties. One common query is about the deadline for filing; generally, it is April 15, but extensions can be requested if necessary.

Another frequent concern is the consequences of late filing. The IRS imposes steep penalties, which include a percentage of taxes owed for each month the return is late. Understanding these aspects can help you stay compliant and avoid unnecessary financial burdens.

Additional tips for future tax filings

Being organized year-round is essential for efficient tax preparation. Keep track of your receipts, bank statements, and income documents throughout the year to simplify the filing process. Set reminders for key deadlines, and consider using tax software that can help you stay on track.

Consulting a tax professional when you have complex financial situations can provide significant advantages, especially if you have multiple income streams, rental properties, or other unique circumstances. This step can reduce the likelihood of errors and ensure that you are taking advantage of all possible deductions.

Conclusion

Navigating the complexities of filling out IRS forms can be daunting. However, utilizing tools like pdfFiller can simplify the process, enabling users to edit, eSign, and manage their documents more effortlessly. With the right resources and tools, you can empower yourself for future tax seasons, ensuring a smooth filing experience.

Remember, staying organized and proactive about tax preparation can greatly ease the burden when tax time arrives. With pdfFiller at your side, managing documents and forms becomes a seamless process, giving you peace of mind as you tackle your tax obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my filling out irs form directly from Gmail?

Where do I find filling out irs form?

Can I sign the filling out irs form electronically in Chrome?

What is filling out irs form?

Who is required to file filling out irs form?

How to fill out filling out irs form?

What is the purpose of filling out irs form?

What information must be reported on filling out irs form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.