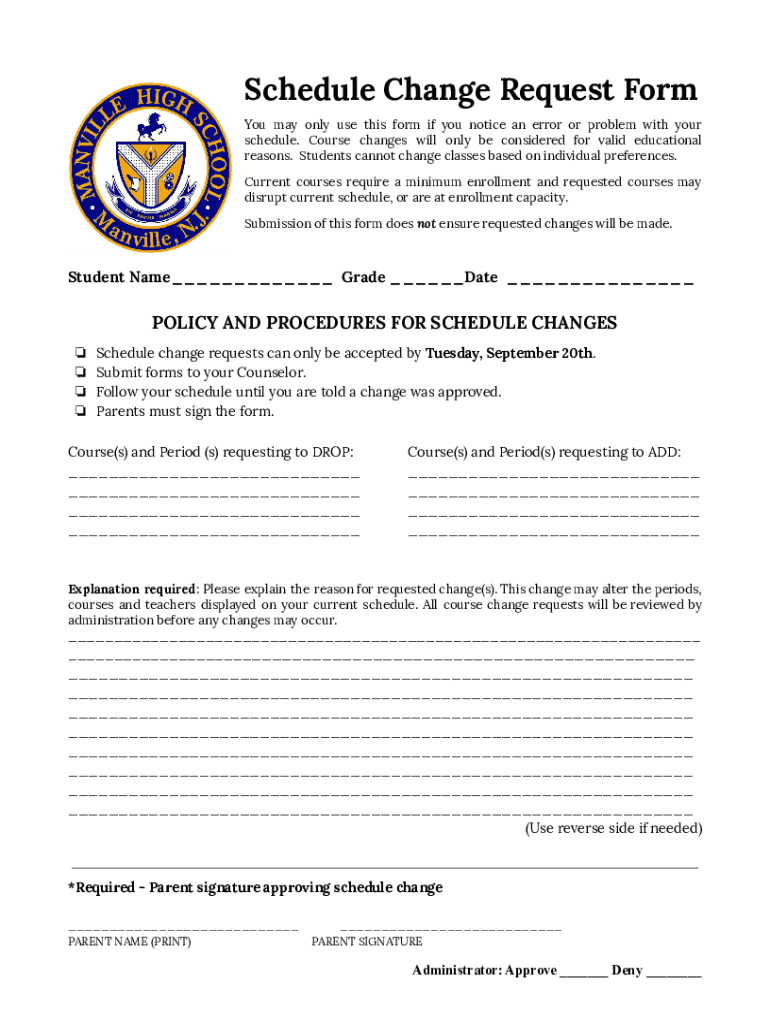

Get the free Enrolled agents: Frequently asked questions

Get, Create, Make and Sign enrolled agents frequently asked

Editing enrolled agents frequently asked online

Uncompromising security for your PDF editing and eSignature needs

How to fill out enrolled agents frequently asked

How to fill out enrolled agents frequently asked

Who needs enrolled agents frequently asked?

Enrolled Agents Frequently Asked Form

Understanding enrolled agents

An Enrolled Agent (EA) is a tax advisor who is a federally-authorized tax practitioner. Unlike other tax professionals, EAs have the ability to represent taxpayers before the Internal Revenue Service (IRS) in matters such as audits, collections, and appeals. They are recognized for their expertise in tax preparation and law, having passed a rigorous examination.

The history of enrolled agents goes back to the Civil War, when Congress approved a plan to allow individuals who are skilled in handling tax matters to represent others before the IRS. This underscores the importance of EAs in the tax preparation industry, as they serve not only individuals but businesses and organizations as well.

The role of EAs has evolved significantly, especially in our increasingly complex tax code environment. They help clients navigate tax obligations, ensuring compliance while minimizing liabilities.

Overview of the enrolled agent examination process

The enrolled agent examination process consists of three distinct parts, focusing on different aspects of tax knowledge. These include individual taxes, business taxes, and representation, practices, and procedures. Each part tests candidates on various subjects pertaining to tax law and IRS regulations.

To register for the EA exam, candidates must first obtain a Preparer Tax Identification Number (PTIN). The application steps include filling out Form 23 and paying the registration fee, which can be done online. Key dates and deadlines for exam registration usually align with testing periods set by the IRS, making it essential to stay informed on specific timelines to avoid missing opportunities.

Preparing for the enrolled agent exam

Effective preparation is vital for success in the EA exam. There are numerous study materials available, including recommended textbooks, online courses, and practice exams tailored specifically for the EA exam. Resources can typically be found on various educational platforms and forums.

Creating an effective study plan is essential. Allocate dedicated time for each part of the exam while employing study techniques like flashcards, quizzes, and peer discussions. Balancing study time with work commitments can be challenging, but maintaining a structured schedule can help in managing both effectively.

Taking the enrolled agent exam

On the exam day, preparation is key. Your exam day checklist should include valid identification, confirmation details, and any necessary materials like a calculator or scratch paper. Understanding the exam format is crucial; the questions will consist of multiple-choice questions and simulations that often reflect real-world scenarios.

Time management is critical during the exam; each part has a specific time limit, and familiarity with the scoring method can alleviate anxiety. Scores are typically reported within a few weeks, allowing candidates to understand their performance and if they need to retake any sections.

After the EA exam: Next steps

Passing the EA exam is a significant achievement. Candidates will receive their certificate of completion from the IRS, further solidifying their credentials as a tax professional. Celebrating this accomplishment provides motivation for embarking on a successful career path.

For those who do not pass the EA exam, understanding the reasons behind incorrect answers is crucial. Candidates can review their performance and retake the exam according to IRS policies, which allow a limited number of attempts. Continuing education remains essential to maintain EA status, ensuring that practitioners stay updated with changing tax laws.

Becoming a successful enrolled agent

Establishing a successful career as an enrolled agent requires more than just passing the exam. Building a personal brand is vital. Networking strategies, such as attending industry conferences and joining organizations like the National Association of Enrolled Agents (NAEA), can enhance your professional visibility.

Technical skills in tax preparation are essential, but soft skills, such as effective communication and client management, are equally important. EAs must understand client needs and respond to inquiries promptly, which fosters trust and builds lasting relationships.

Frequently asked questions about becoming an enrolled agent

Prospective and current enrolled agents often have several questions regarding the profession. One common inquiry is whether being an enrolled agent is worth it. The answer generally leans towards the positive, as EAs enjoy greater job security, flexible working conditions, and the ability to represent clients with tax issues.

Many also ask about the differences between an enrolled agent (EA) and a Certified Public Accountant (CPA). While both can represent clients, EAs focus mainly on taxation, whereas CPAs may have a broader scope of services, including audits and financial planning.

Interactive tools for aspiring EAs

Utilizing interactive tools can enhance the preparation experience for aspiring enrolled agents. Online calculators allow candidates to quickly verify figures, while progress trackers help in organizing study schedules. Community forums provide valuable peer support, fostering discussions that can enhance knowledge and confidence.

Engaging with these resources enables candidates to enhance their knowledge and connect with fellow aspiring EAs. It's also an excellent opportunity to share experiences, insights, and study tips in a collaborative environment.

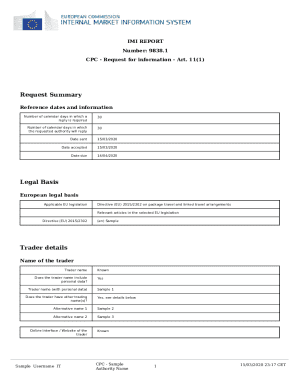

Utilizing pdfFiller for enrolled agents

pdfFiller provides an excellent resource for enrolled agents looking to streamline their document management process. From editing tax forms to eSigning and collaborating with clients, pdfFiller allows EAs to manage their practice efficiently from a single cloud-based platform.

The benefits of using pdfFiller extend beyond basic editing. Its accessibility from anywhere means that EAs can work on documents at the office or while traveling, ensuring that client communication remains seamless and effective.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my enrolled agents frequently asked in Gmail?

How do I edit enrolled agents frequently asked online?

How do I complete enrolled agents frequently asked on an iOS device?

What is enrolled agents frequently asked?

Who is required to file enrolled agents frequently asked?

How to fill out enrolled agents frequently asked?

What is the purpose of enrolled agents frequently asked?

What information must be reported on enrolled agents frequently asked?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.