Get the free Liquid Capital Statement

Get, Create, Make and Sign liquid capital statement

Editing liquid capital statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out liquid capital statement

How to fill out liquid capital statement

Who needs liquid capital statement?

Understanding the Liquid Capital Statement Form: A Comprehensive Guide

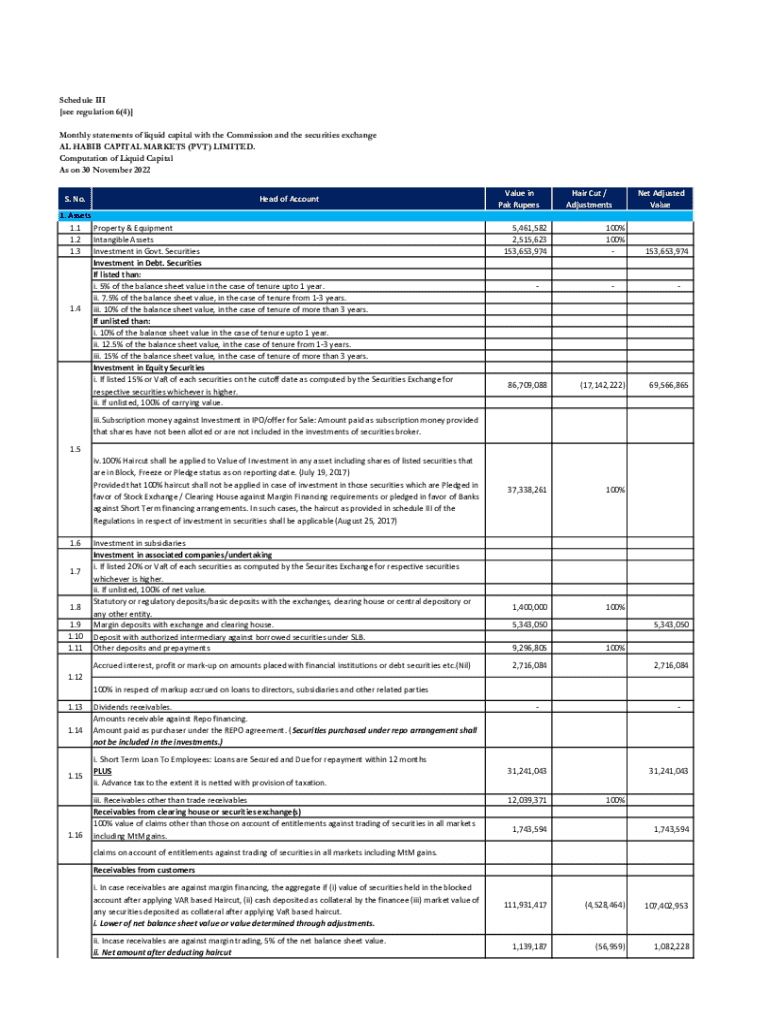

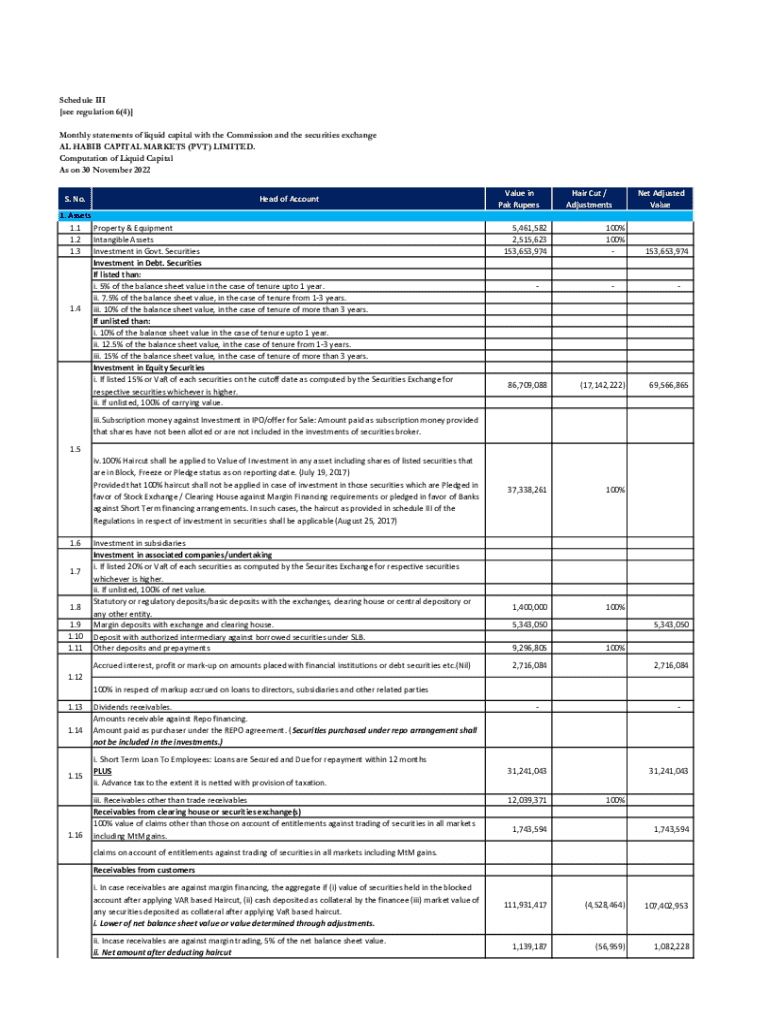

Understanding liquid capital statements

Liquid capital refers to assets that can be quickly converted into cash without significant loss of value. This includes cash in bank accounts, easily tradable stocks, and other investments that can be liquidated promptly. A liquid capital statement is crucial for assessing the financial health of individuals or businesses, providing a clear picture of available resources that can be utilized for immediate needs.

The importance of liquid capital statements extends beyond mere asset assessment. They play a pivotal role in financial decision-making, helping individuals and businesses determine their capacity for investment, expansion, or meeting urgent financial obligations. Additionally, regulatory bodies often require these statements during financial audits or assessments, ensuring compliance with fiscal standards.

Overview of the liquid capital statement form

The liquid capital statement form is specifically designed to provide a comprehensive slate of an individual’s or entity’s liquid assets and liabilities. Its primary purpose is to give a concise but thorough snapshot of one's financial standing, particularly highlighting liquid assets. This is often required in various contexts, from applying for financing solutions to reassessing business valuations.

Key components of the liquid capital statement form

Filling out a liquid capital statement form accurately is essential. It generally begins with a personal information section, collecting necessary details such as your name, contact information, and business details if applicable. This foundational data creates a clear point of reference for evaluators.

The assets section is critical and includes the following:

On the liability side, you’ll need to report any outstanding debts or financial obligations. These include credit card debts, loans, and other payable amounts. To calculate your liquid capital, simply use the formula: Liquid Capital = Total Liquid Assets - Total Liabilities, providing clarity on state financial position.

Steps for filling out the liquid capital statement form

To ensure an accurate and effective Liquid Capital Statement, begin by preparing your financial information. Gather all necessary documents, such as bank statements, investment summaries, and loan agreements. Ensuring the accuracy of these documents will provide a reliable foundation for filling out the form.

Next, fill in the form methodically. In the asset sections, list cash and liquid investments, and in liabilities, report any outstanding debts. After listing your assets and liabilities, calculate your liquid capital based on the previously mentioned formula. Reviewing the form before submission is critical; double-check your entries and, if needed, seek professional advice to ensure everything is correctly represented.

Editing and customizing your liquid capital statement

When utilizing pdfFiller, editing your liquid capital statement form can be accomplished effortlessly through its online platform. Users can easily access their forms, modify text, and adjust fields as necessary to reflect accurate data. This makes it convenient for ongoing updates or changes.

Incorporating digital signatures is another beneficial feature of pdfFiller. E-signing offers a quick and secure way to authenticate your document, and adding a signature is a straightforward process that can be completed within the platform. Once you finalize your form, you also have multiple exporting options, whether you need a PDF, Word document, or directly saving it in a cloud storage solution.

Managing and sharing your liquid capital statement

pdfFiller also provides several collaborative features that are ideal for teams needing to work together on financial documents. Users can invite team members to share access, allowing for real-time edits and commenting on the document. This facilitates a streamlined approach to maintain accurate and up-to-date records.

Security is a paramount concern when sharing sensitive financial data. pdfFiller offers secure file-sharing options that ensure your information remains protected while transmitting documents. Its commitment to privacy and data protection serves to reassure users that their financial information is handled with care.

Frequently asked questions

Mistakes can happen on any form, including the liquid capital statement form. If you find an error, it’s crucial to correct it before submission. Check the specific requirements of the entity requesting the statement to determine if resubmission is necessary. Regular updates are also recommended; aim to refresh your statement whenever there are significant financial changes.

Troubleshooting common issues

Technical difficulties may arise when using pdfFiller, such as loading issues or trouble with editing features. Should you encounter any form submission errors, revisit the form for accuracy and try re-submitting. If problems persist, contacting customer support can provide assistance to resolve ongoing issues swiftly.

Users should not hesitate to reach out to customer support for help with any technical difficulties or discerning how to best navigate the pdfFiller platform. Prompt assistance can ensure your liquid capital statement form remains efficient and effective.

Additional tips for success

Maintaining organized financial records is a best practice that greatly aids in preparation for filling out your liquid capital statement. Regularly updating your records will help you leverage financial insights when engaging in discussions with lenders or investors, showcasing your financial prowess.

Lastly, the significance of timely updates cannot be stressed enough. Accurate and current information supports better decision-making, allowing stakeholders to make informed choices concerning investments or loans. With pdfFiller, users have the advantage of a seamless, cloud-based document management system to facilitate these processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my liquid capital statement directly from Gmail?

How do I fill out the liquid capital statement form on my smartphone?

How can I fill out liquid capital statement on an iOS device?

What is liquid capital statement?

Who is required to file liquid capital statement?

How to fill out liquid capital statement?

What is the purpose of liquid capital statement?

What information must be reported on liquid capital statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.