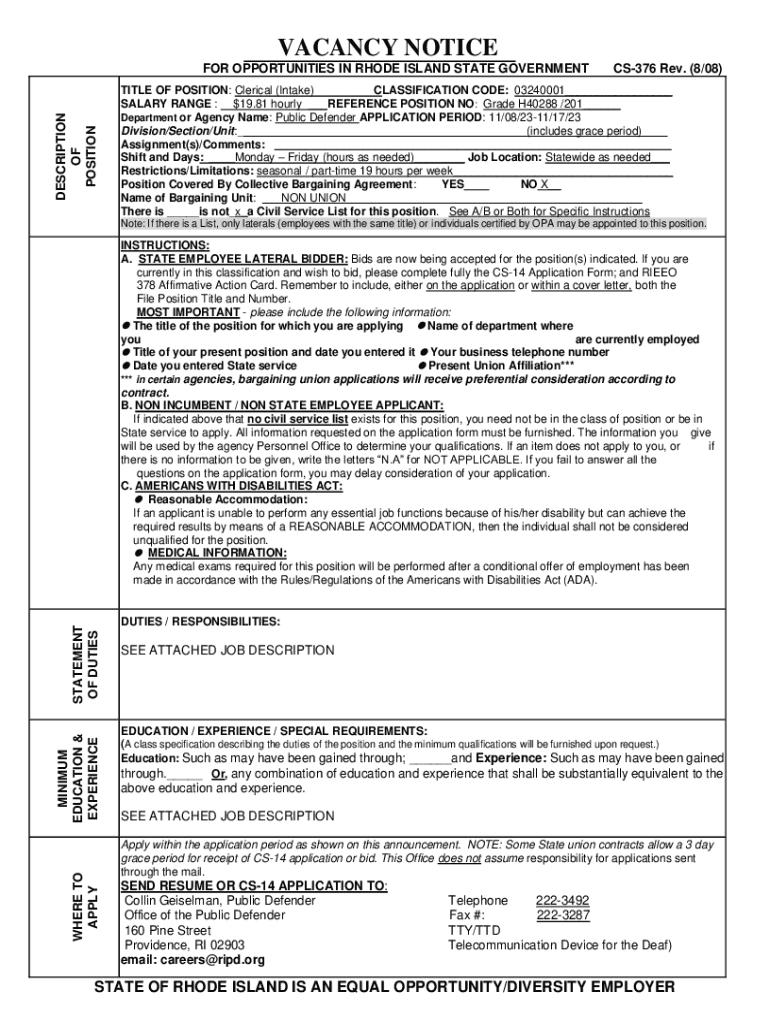

Get the free Salary Ranges - Classification & Compensation

Get, Create, Make and Sign salary ranges - classification

Editing salary ranges - classification online

Uncompromising security for your PDF editing and eSignature needs

How to fill out salary ranges - classification

How to fill out salary ranges - classification

Who needs salary ranges - classification?

Salary Ranges - Classification Form: A Comprehensive Guide

Understanding salary ranges

Salary ranges represent the variation in compensation offered for specific positions within an organization. Defined by minimum and maximum salary limits, these ranges provide a structured framework for wages that guides both employers and employees during salary negotiations.

The importance of salary ranges in employment cannot be overstated. They foster transparency, promote fairness, and help ensure that employees are compensated in accordance with their skills and expertise. Additionally, salary ranges serve as a critical tool in benchmarking compensation across similar roles in the industry.

It's important to differentiate between salary ranges and salary bands; the former refers specifically to the minimum and maximum thresholds for specific roles, while salary bands encompass broader categories of positions, allowing for variations based on experience and performance.

Overview of classification forms

A classification form is a structured document used by organizations to align job descriptions with corresponding salary ranges. This form is pivotal in creating clear hierarchies within an organization, ensuring that employees understand their position and corresponding pay grades.

The purpose of salary classification extends beyond mere administrative needs; it facilitates enhanced employee engagement and retention by offering a transparent pathway for career growth. A well-designed classification form typically includes key components such as job titles, responsibilities, required qualifications, and designated salary ranges.

Types of salary ranges

There are various types of salary ranges that organizations implement based on their compensation strategies and operational needs. One major category is fixed salary ranges, which offer a set pay scale without fluctuations based on performance or experience. This approach is straightforward and usually used for entry-level positions.

On the other hand, variable salary ranges allow for flexibility, incorporating components like bonuses or performance-based pay. Organizations may also implement geographic salary differentiation to account for regional variations in the cost of living, ensuring competitive pay across different areas.

Industry-specific salary ranges are another critical type, where salary levels are adjusted to reflect supply, demand, and industry standards. Understanding these various salary types helps organizations create competitive compensation packages that attract and retain talent.

Navigating the salary classification process

Filling out a salary classification form requires attention to detail and a clear understanding of one’s role. The first step is to prepare your information, gathering all necessary documentation such as your job description, current salary, and performance evaluations.

Next, identify your position and job title accurately. This is critical because mislabeling a job can lead to misclassification and potential salary mismatches. After establishing your role, clearly determine your responsibilities and duties, ensuring alignment with the expectations laid out in your job description.

Researching comparable salaries through salary surveys or industry reports helps to further validate your proposed range. It's crucial to avoid common mistakes such as exaggerating job responsibilities or undervaluing your contributions. Honesty and accuracy are key to effective salary classification.

Interactive tools for salary insights

Harnessing technology can significantly ease the process of salary classification. Salary calculators are powerful tools that allow individuals to estimate their worth based on their experience, location, and skills. Many organizations provide these online calculators, reflecting the latest market compensation data.

Interactive salary benchmarks are another valuable resource, offering insights into various roles and industries. By utilizing these tools, users can gain a broader view of salary expectations and make informed decisions regarding their compensation.

Managing and editing your salary classification form

Best practices in document management are crucial for maintaining accurate salary classification forms. Keeping electronic copies of all documentation ensures that you have access to the latest versions and can make adjustments as needed. Utilizing tools like pdfFiller enhances this process by allowing users to edit and eSign their forms seamlessly.

Collaboration with team members can also improve the accuracy of these forms. By working together, employees ensure that roles and responsibilities are appropriately defined and match the organizational standards. Finally, securely storing your document in the cloud guarantees the safety of sensitive information and keeps it accessible from anywhere.

Job family information and salary ranges

Recognizing job families and their associated salary ranges is vital for both employers and employees. Job families group similar positions together, simplifying the classification process and creating standardized salary ranges. This categorization can help promote equity within an organization.

Analyzing salary ranges by job family allows organizations to address disparities and adjust pay structures effectively. Examples of job family classifications can include finance, human resources, and information technology, each featuring distinct roles with specific salary metrics.

Shifts in job family structures over time can significantly influence salary ranges. For instance, technology’s evolution has led to increased demand for technical roles, often shifting corresponding salary expectations upward in response.

Additional considerations in salary classification

Annual salary structure updates are fundamental to maintaining a competitive edge in attracting talent. Organizations must routinely evaluate their salary ranges to remain aligned with market trends and regulatory changes. Temporary salary increases can also be implemented to acknowledge exceptional performance or corresponding market fluctuations.

The impact of labor contracts on salary ranges should not be underestimated, as unions often negotiate predefined salary structures. Additionally, state-specific considerations in salary classification, such as local minimum wage laws, further complicate the landscape, necessitating thorough research and documentation to navigate effectively.

Addressing FAQs related to salary ranges

Common questions surrounding salary classification often arise from confusion regarding how ranges are determined. Employees typically inquire about how their performance or tenure contributes to salary placement. Addressing these queries with transparency fosters trust and clarity in an organization.

Troubleshooting tips for salary challenges can include preparing documentation to present to HR or utilizing third-party resources like compensation benchmarks to clarify concerns. Conducting salary benefit reports can further assist in providing a holistic view of compensation, supporting equal pay analysis and reinforcing fairness in pay structure.

Contact and support

For individuals seeking assistance with salary classification queries, numerous resources are available. Organizations typically designate HR representatives to support employees through the classification process and provide clarity on specific policies.

Resources tailored for students, faculty, and staff can be critical for comprehending educational institution salary classifications. Additionally, accessing state and agency-specific salary information enhances understanding and supports effective salary negotiations.

Exploring related links and resources

To further enhance understanding of salary ranges and classification forms, several external salary databases offer valuable insights. These resources can empower employees to conduct personalized research beyond organizational norms, leading to informed discussions regarding salary classifications.

Additionally, familiarity with other forms relevant to salary classification can help streamline the overall process, ensuring that users are well-equipped to tackle specific documentation and answer potential queries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit salary ranges - classification from Google Drive?

How do I execute salary ranges - classification online?

How do I fill out salary ranges - classification on an Android device?

What is salary ranges - classification?

Who is required to file salary ranges - classification?

How to fill out salary ranges - classification?

What is the purpose of salary ranges - classification?

What information must be reported on salary ranges - classification?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.