Get the free Notification of late filing sec file number - Cloudfront.net

Get, Create, Make and Sign notification of late filing

Editing notification of late filing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notification of late filing

How to fill out notification of late filing

Who needs notification of late filing?

Notification of Late Filing Form - How-to Guide Long-Read

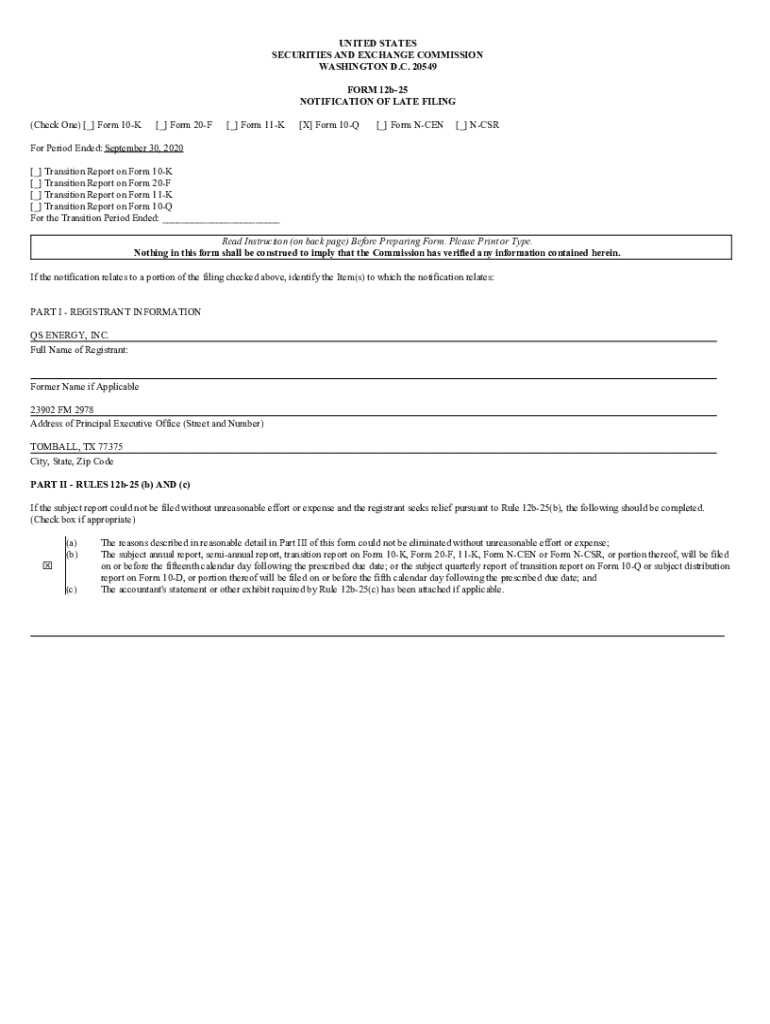

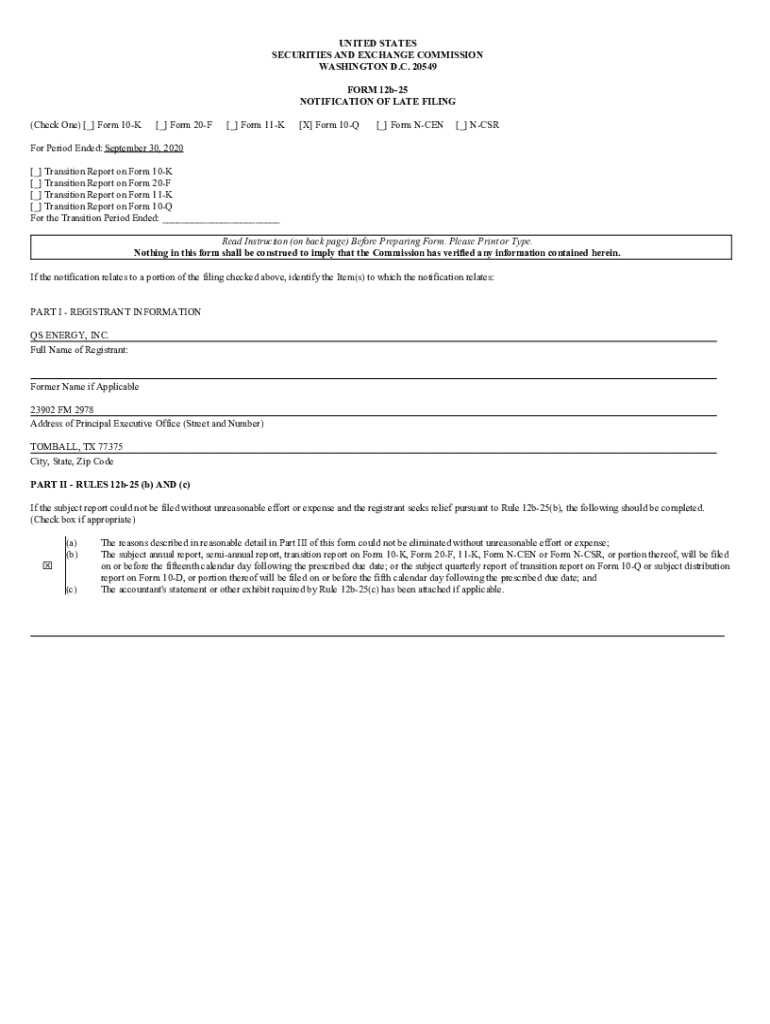

Overview of late filing notifications

A notification of late filing form serves as an official communication to regulatory bodies indicating that a required filing will be submitted beyond the designated deadline. It reflects an organization's intention to address the unexpected delay in compliance with corporate and financial regulations.

Timely filings are essential for maintaining transparency and accountability, both in corporate governance and financial reporting. When companies adhere to filing deadlines, they demonstrate reliability and build trust with stakeholders, investors, and regulatory authorities.

Failing to adhere to these deadlines can result in serious repercussions, including legal investigations, hefty penalties, and damage to a company’s reputation. Understanding the importance of timely filing can ultimately safeguard your business against unnecessary risks.

Understanding the late filing process

Several key regulations govern corporate filing requirements, including the Securities Exchange Act and other industry-specific legal frameworks. Organizations must be keenly aware of these regulations to navigate the complex landscape of compliance effectively.

Forms that typically require notifications include annual reports, quarterly earnings releases, and certifications. All staff members, particularly those involved in accounting and compliance, should recognize that delays in filing do not only impact the organization’s health but also affect their personal reputations.

Moreover, stakeholders, investors, shareholders, and regulatory bodies are all affected by late filings. Ensuring clear communication around any potential delays can alleviate concerns and provide assurance that compliance is a priority.

Key components of the late filing notification form

The late filing notification form comprises several critical sections, each serving a specific purpose. Encouraging thorough and accurate completion of this form is imperative for successful communication with regulatory authorities.

Common reasons for late filing

Organizations encounter various challenges leading to late filings, some of which may be unavoidable. Financial or operational delays often stem from internal processes that do not sync well with reporting deadlines.

Miscommunication within teams can further exacerbate the situation. When departments such as accounting, finance, and compliance fail to collaborate effectively, it may result in incomplete information being submitted.

Additionally, technical issues with filing platforms can derail even the most prepared organizations. System outages or incompatibilities with filers' devices can result in last-minute difficulties that inhibit meeting deadlines.

Implications of filing a late notification

The implications of filing a late notification are far-reaching. Legally, an organization may face scrutiny from regulatory entities or even undergo investigations if filing requirements are not met appropriately.

Financial penalties and fees are another significant concern. Organizations may incur fine amounts that escalate with each day a filing is delayed, turning a manageable issue into a fiscal burden.

Moreover, the organization's reputation can take a substantial hit. Stakeholders might perceive consistent late filings as a sign of mismanagement, which can have cascading effects on investor confidence and market valuation.

How to complete the late filing notification form

Filling the late filing notification form correctly is vital in ensuring compliance and mitigating potential penalties. Here’s a step-by-step guide to help streamline the process.

To avoid common mistakes, ensure clarity in your explanations, utilize a professional tone, and maintain a polished presentation.

Managing late filings with pdfFiller

Utilizing pdfFiller for document management can significantly streamline the process of handling late filing notifications. The platform offers various benefits that aid in ensuring compliance.

Furthermore, pdfFiller provides interactive tools, including customizable templates specifically tailored for different filing needs and compliance checklists to ensure all areas have been adequately addressed.

Need professional help with filing?

In some cases, it may be beneficial to seek professional assistance when navigating late filings. Not only can legal experts offer guidance on regulatory requirements, but they can also provide peace of mind.

Various types of professional services are available. Options range from financial consultants to legal advisors who specialize in compliance. Knowing when to seek help can save time and money in the long run.

pdfFiller can connect users to a network of professionals, facilitating access to the right expertise when needed, enhancing the overall filing experience.

Languages and accessibility features

Inclusivity in filing processes is essential. pdfFiller enhances accessibility by offering the filing notification process in multiple languages, ensuring comprehension for non-English speakers.

Additionally, accessibility tools are embedded to accommodate users with various needs, allowing everyone to navigate the filing process without barriers, thus fostering an inclusive environment.

Related products and solutions

pdfFiller hosts a multitude of relevant forms and templates designed to address various filing needs. Users can explore a library of customizable documents that suit their specific requirements.

Furthermore, the platform integrates seamlessly with additional document management tools, creating a cohesive ecosystem that enhances overall efficiency and compliance in document handling.

Staying informed about filing requirements

Keeping track of filing deadlines is crucial for compliance. Best practices include setting reminders, subscribing to relevant regulatory updates, and maintaining an internal calendar for key dates.

Utilizing compliance management tools can streamline this process. Such solutions help organizations stay up-to-date and avoid the pitfalls associated with late filings.

Stay connected with pdfFiller

Engaging with pdfFiller ensures users remain informed about the latest features and tools available for document management. Subscribing to updates allows users to benefit from new enhancements tailored for seamless filing experiences.

Following pdfFiller on social media provides an easy way to access tips and insights shared by industry professionals and fellow users, fostering a community dedicated to efficiency in document management.

Popular content related to filings

For those seeking more information on filing notifications, popular content covering frequently asked questions on filing notifications and customer success stories showcases effective management of late filings.

Additionally, expert articles discussing document management best practices offer valuable insights. Staying updated on such content allows users to continuously learn and improve their compliance processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find notification of late filing?

How do I execute notification of late filing online?

How do I fill out notification of late filing using my mobile device?

What is notification of late filing?

Who is required to file notification of late filing?

How to fill out notification of late filing?

What is the purpose of notification of late filing?

What information must be reported on notification of late filing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.