Get the free effect of tax policy reforms on tax revenue in kenya

Get, Create, Make and Sign effect of tax policy

How to edit effect of tax policy online

Uncompromising security for your PDF editing and eSignature needs

How to fill out effect of tax policy

How to fill out effect of tax policy

Who needs effect of tax policy?

Effect of tax policy form: A comprehensive guide

Understanding tax policy forms

Tax policy forms are critical tools utilized by individuals and businesses to navigate the complex landscape of taxation. These forms serve as the official documentation required by government bodies to assess and collect taxes. They are essential not only for compliance but also for strategic financial planning.

Common tax policies include personal income tax, corporate tax, sales tax, and property tax. Each has its own set of required forms that need to be correctly filled out and submitted. The proper use of these forms helps ensure that taxpayers are aware of their obligations, can take advantage of available deductions, and avoid penalties.

How tax policies impact individuals and businesses

For individuals, tax policy forms dictate the amount of tax owed or refunded based on personal income. The primary form for personal income tax is the Form 1040, alongside various schedules for different types of income and deductions. Understanding how to properly fill out these forms can have a significant impact on financial outcomes and compliance.

Tax deductions, such as those for mortgage interest and educational expenses, allow individuals to reduce their taxable income, thus maximizing their potential tax refunds. Furthermore, the tax filing process can be daunting; however, utilizing resources like pdfFiller facilitates easier access to relevant forms, reducing errors in submissions.

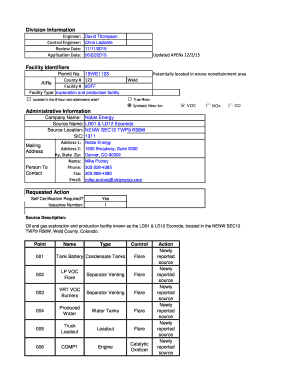

For businesses, tax policies influence corporate tax structures significantly. Businesses often have to navigate more complex tax filings, such as the Form 1120 for corporations or the Form 1065 for partnerships. The implications of these forms can affect strategic decisions, from business structure to operational expenditures, as various tax rates can either facilitate or hinder growth.

Tax compliance is essential for businesses to avoid audits and penalties. Utilizing form management solutions, such as pdfFiller, helps businesses not only stay compliant but also strategically plan to minimize their tax liabilities through careful documentation and form submissions.

Navigating the tax policy form process

Filling out tax forms may seem overwhelming, but breaking the process down into manageable steps can help alleviate confusion. Start by identifying the correct form for your situation, whether it’s for personal taxes or business taxes. Resources like pdfFiller provide a comprehensive library of forms to ensure you select the right one.

Once submitted, if you identify any mistakes on your forms, it’s crucial to correct them efficiently. Understanding how to amend forms and the implications of such actions can save you from future complications. Amendments are typically submitted using Form 1040-X for personal taxes and have specific timelines that must be adhered to.

Resources at pdfFiller simplify this process, allowing for easy corrections and updates to your documents without red tape.

Interactive tools for tax policy management

Numerous digital tools exist to assist taxpayers in managing their obligations effectively. Online calculators allow individuals to estimate their tax liabilities based on their income, while simulators can help evaluate expected refunds based on various scenarios. Utilizing these tools can lead to informed decision-making and financial planning.

On the document management side, digital tools for organizing tax paperwork offer significant advantages. Collaborative features allow teams to work on tax documents simultaneously, ensuring accuracy and timeliness. Furthermore, eSigning functionalities guarantee secure submissions, a necessity in today’s digital realm where data privacy is paramount.

Regional differences in tax policies

Tax policies vary significantly from one region to another, requiring individuals and businesses to be aware of local regulations. State and local variations can influence tax obligations and available deductions, which means understanding jurisdictional impacts is essential for accurate compliance.

For international entities, tax treaties can have significant effects on taxation. Businesses operating across borders need to navigate compliance in multiple jurisdictions, often requiring specialized knowledge of international tax laws and the forms needed to maintain compliance.

Reviewing and managing your tax obligations

Choosing the right organizational structure is crucial for maximizing tax efficiency. Different legal forms, such as sole proprietorships, partnerships, and corporations, have unique tax implications. Understanding the differences can guide individuals and businesses in structuring their affairs to minimize tax liabilities.

Proactive tax planning is an essential part of financial management. Approaching taxes with a long-term strategy can help both individuals and businesses reduce their tax liabilities effectively. This involves understanding available deductions, credits, and how changes in tax policy can affect future planning.

Real-world scenarios and case studies

Analyzing how different tax policies from various administrations have impacted citizens provides essential insights into the efficacy of tax reforms. For instance, the effect of recent tax cuts can be observed through changes in disposable income and consumer spending. Understanding the implications of these changes on different demographics is crucial for assessing policy effectiveness.

Furthermore, navigating audits can be one of the most stressful aspects of tax compliance. Businesses and individuals alike often face common challenges during audits. Preparing for an audit involves understanding necessary documentation and maintaining accurate records to support all reported figures.

Frequently asked questions (FAQs)

Many concerns arise regarding tax policy forms, from identifying the right forms to understanding the implications of different tax rates. Addressing common concerns directly helps taxpayers navigate these issues more effectively. For instance, knowing which forms apply to your situation can prevent costly mistakes and duplicative efforts.

Continuous education on tax policies is essential for staying compliant. Resources and workshops about upcoming changes in tax laws and their implications can help individuals and businesses prepare for necessary adjustments.

Learning more: related topics

Investment strategies are directly influenced by tax policies. Understanding how various tax structures affect investment returns is vital for strategic financial planning. Additionally, the role of tax policies in economic development should not be overlooked; effective taxation can incentivize growth while also addressing issues of income redistribution.

Finally, fundamental concepts surrounding income redistribution through taxation shape social policies. Engaging with these topics enriches one's understanding of the broader impacts of tax policy on society and underscores the importance of informed tax planning.

Additional publications and insights

For those looking to delve deeper into tax-related topics, accessing guides on similar issues can provide valuable insights. Keeping updated with news on tax policy changes is essential, as it can directly affect both individual and business financial strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit effect of tax policy from Google Drive?

How can I send effect of tax policy for eSignature?

Can I edit effect of tax policy on an iOS device?

What is effect of tax policy?

Who is required to file effect of tax policy?

How to fill out effect of tax policy?

What is the purpose of effect of tax policy?

What information must be reported on effect of tax policy?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.