Get the free Online Tax Form 8937-Series D Preferred Redemption ...

Get, Create, Make and Sign online tax form 8937-series

Editing online tax form 8937-series online

Uncompromising security for your PDF editing and eSignature needs

How to fill out online tax form 8937-series

How to fill out online tax form 8937-series

Who needs online tax form 8937-series?

Comprehensive Guide to the Online Tax Form 8937-Series Form

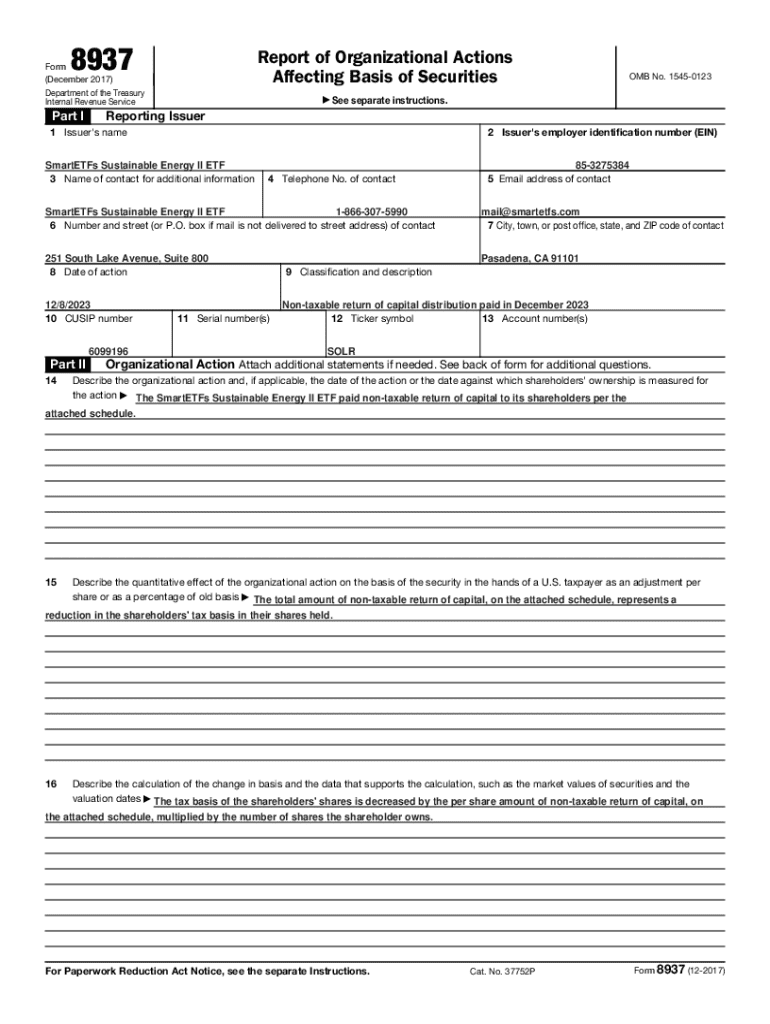

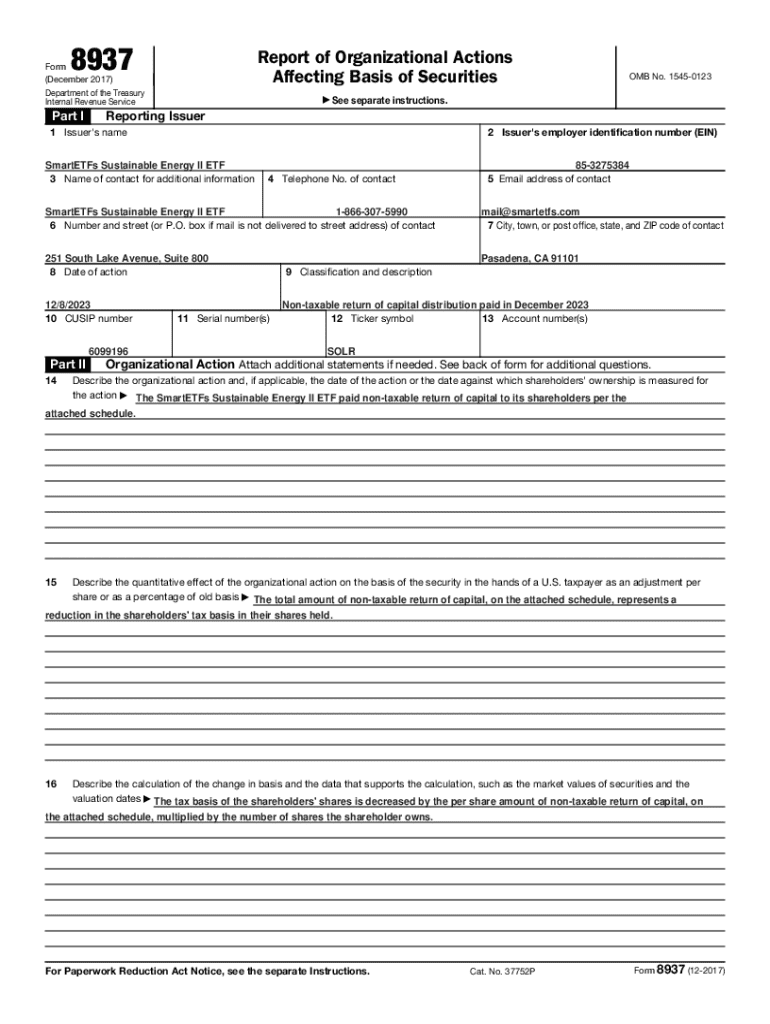

Understanding IRS Form 8937

IRS Form 8937, officially known as the 'Report of Organizational Actions Affecting Basis of Securities,' is a crucial document for corporations and partnerships that undergo organizational actions impacting the basis of their securities. This form provides essential information to shareholders about changes in their stock basis due to significant corporate events like mergers, stock splits, or dividend distributions.

The primary purpose of Form 8937 is to report the tax implications of these organizational actions on the securities held by shareholders. It ensures that investors have accurate basis information to report their capital gains or losses accurately when they sell the securities.

Key details of Form 8937

Form 8937 is segmented into multiple sections, each designed to capture critical information pertaining to the corporation’s actions. Understanding these sections is essential for accurate completion.

The main sections of Form 8937 include:

Familiarity with relevant terminology, such as tax year and recordkeeping requirements, is key. The tax year discussed typically refers to the company's fiscal year, and maintaining a comprehensive record of all transactions organizes tax duties effectively.

Preparing to complete Form 8937

Preparation is crucial for filling out Form 8937 accurately. Start by gathering all necessary documentation related to the corporate action. This might include records of previous filings, financial statements, and communications regarding the actions affecting the securities’ basis.

Understanding the specific corporate actions that mandate the filing of Form 8937 aids in correctly filling out the form. These actions can be diverse, including stock splits, mergers, or substantial cash distributions.

Step-by-step guide to filling out Form 8937

Completing Form 8937 can be easily managed by breaking it down into clear steps. The systematic approach not only simplifies the process but also minimizes errors.

Here’s a detailed guide to help you navigate forming 8937:

Utilizing pdfFiller for Form 8937

Filing Form 8937 can be even more streamlined with pdfFiller. This intuitive platform allows users to access and fill out complicated tax forms from anywhere, anytime. pdfFiller provides an online tax form 8937-series form you can easily use.

The interactive features of pdfFiller enhance your filling experience significantly.

Another advantage of pdfFiller is its cloud-based capabilities. Access your forms from any device with an internet connection, making it ideal for teams operating remotely.

Common mistakes to avoid when filing Form 8937

Filing Form 8937 accurately is paramount, given the potential repercussions of mistakes. Awareness of prevalent errors can help mitigate these risks.

Some common mistakes include:

If the IRS rejects the form or raises queries, promptly addressing the issues is critical to evading further complications.

Additional considerations after filing

Once Form 8937 has been submitted, it’s important to monitor its status. Ensure that you keep track of any acknowledgments from the IRS. This proactive approach allows you to resolve any potential issues quickly.

Planning for future tax years also involves reflecting on submissions made in the current year—consider how any updates to tax laws could affect your future filings.

Frequently asked questions (FAQs)

Understanding Form 8937’s requirements often raises pertinent questions.

Accessing support and resources

When questions arise about Form 8937 or its completion, users can access a wealth of support resources through pdfFiller.

Customer support options and links to IRS resources provide guidance while community forums often offer shared experiences and expert advice for specific concerns.

Emphasizing the value proposition

In conclusion, pdfFiller stands out as an all-in-one solution for streamlining the process of filling and managing Form 8937. With features tailored to enhance user experience, individuals and teams can work with tax documentation more effectively.

By utilizing a cloud-based platform, users reap the benefits of easy access, enhanced collaboration, and a significant reduction in paperwork hassles, all while ensuring compliance with tax regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit online tax form 8937-series from Google Drive?

Can I create an electronic signature for signing my online tax form 8937-series in Gmail?

How do I edit online tax form 8937-series on an Android device?

What is online tax form 8937-series?

Who is required to file online tax form 8937-series?

How to fill out online tax form 8937-series?

What is the purpose of online tax form 8937-series?

What information must be reported on online tax form 8937-series?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.