Get the free NUVAMA WEALTH AND INVESTMENT LTD

Get, Create, Make and Sign nuvama wealth and investment

Editing nuvama wealth and investment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nuvama wealth and investment

How to fill out nuvama wealth and investment

Who needs nuvama wealth and investment?

Nuvama Wealth and Investment Form – How-to Guide

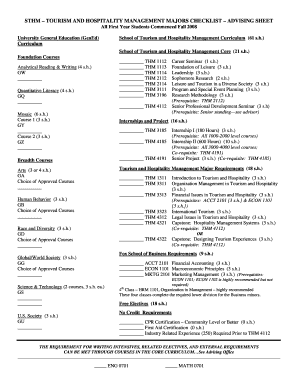

Understanding the Nuvama Wealth and Investment Form

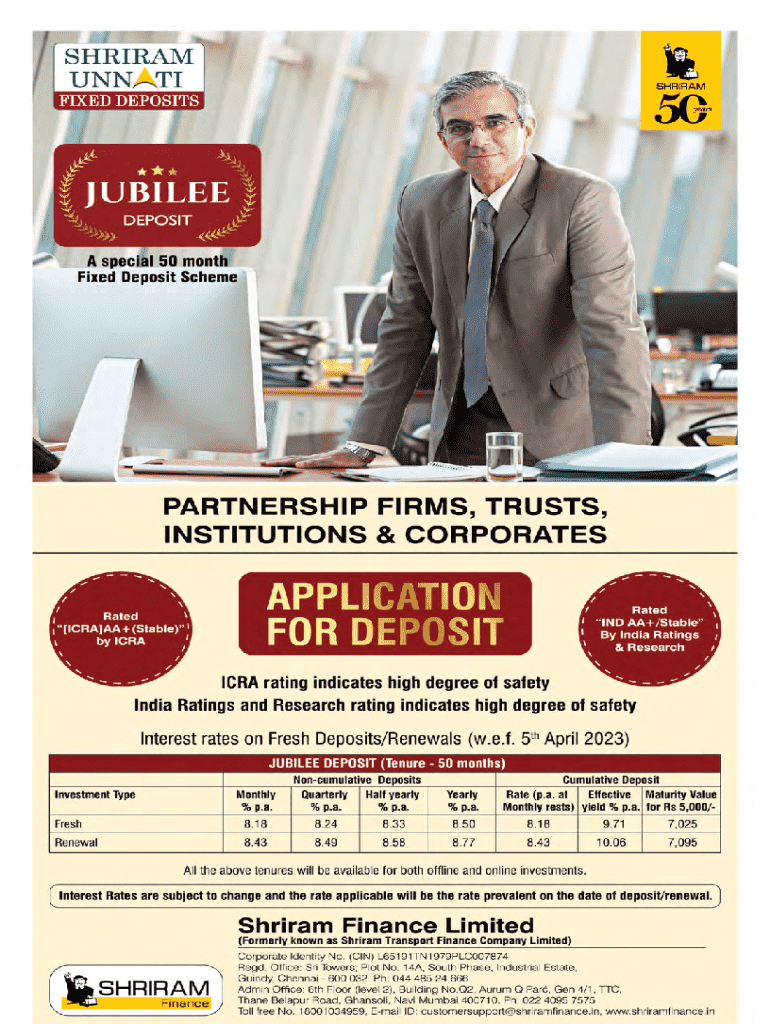

The Nuvama Wealth and Investment Form serves as a foundational tool within the realm of comprehensive wealth management. It plays a critical role in assessing an individual's financial profile, preferences, and investment readiness. Through this form, users can articulate their goals and expectations, facilitating personalized recommendations from Nuvama's wealth management team.

This form encompasses a variety of key sections that collect essential information, including personal identification, financial history, and investment preferences. By completing it accurately, clients lay the groundwork for an informed investment strategy tailored to their needs.

The primary users of the Nuvama Wealth and Investment Form are individuals and teams who are seeking to manage their financial assets more effectively. Whether new to investing or looking to reassess their portfolio, anyone aiming to engage with Nuvama's services must fill out this form.

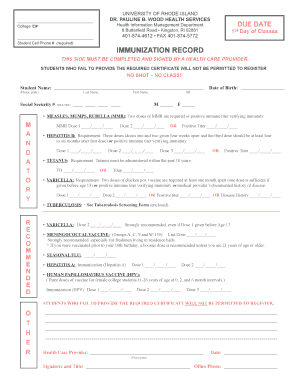

Preparing to fill out the Nuvama Wealth and Investment Form

Before diving into the form, it is essential to gather the necessary documents and information that will be required during the process. This preparation streamlines the experience and minimizes delays.

For efficient documentation gathering, consider organizing these documents in advance. Create digital copies for easy access and maintain a checklist to ensure nothing is overlooked as you prepare to complete the form.

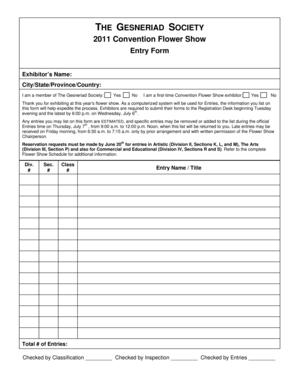

Step-by-step guide to completing the form

Basic information section

The first section of the Nuvama Wealth and Investment Form requires basic personal information. This includes fields such as your full name, gender, marital status, and date of birth. Ensure that all names are entered accurately as they appear on official identification to avoid complications.

Investment preferences section

In the investment preferences section, applicants can indicate their investment goals and preferences. Understand your risk appetite—are you conservative, moderate, or aggressive in terms of investments? This reflection is crucial for aligning your investment choices with your comfort level.

Financial profile section

This section focuses on providing comprehensive financial details. Be prepared to disclose your annual income, total assets, liabilities, and investment history. Accuracy is vital here, as this information will guide your financial adviser in crafting a suitable investment strategy.

KYC (Know Your Customer) requirements

Nuvama's compliance with regulations means that KYC documentation is mandatory. You will need to submit identity verification documents, such as a government-issued ID and proof of address, alongside the completed form. Ensure these are up-to-date to facilitate swift processing.

Terms and conditions acknowledgment

Understand the key terms of service associated with Nuvama. This section typically outlines the conditions governing your investments, fees, and potential risks. Carefully reading and acknowledging these terms is essential to avoid misunderstandings in the future.

Common mistakes to avoid when filling the Nuvama form

Many applicants stumble upon common errors while filling out the Nuvama Wealth and Investment Form. These can range from simple typos to incomplete sections, both of which can lead to delays or complications during processing.

Review the completed form for any potential mistakes before submission. A second pair of eyes can be helpful; consider asking a trusted friend to look over it as well.

Editing and signing the Nuvama Wealth and Investment Form

After completing the form, you might realize that changes are necessary. If so, pdfFiller offers intuitive tools that make editing the form simple. You can highlight information that needs correction and add in new details as required.

Utilizing pdfFiller tools for editing PDFs

Submission process for the Nuvama form

Once you’re satisfied with the filled-out Nuvama Wealth and Investment Form, it’s time for submission. You have both online and offline options available.

After submitting the form, you should receive a confirmation of receipt typically via email or text message. This acknowledgment will provide peace of mind, letting you know your application is being processed.

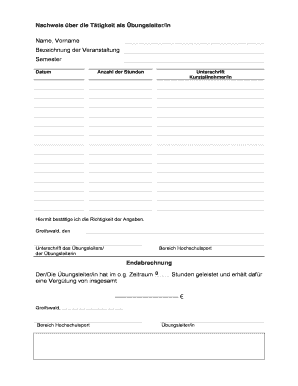

Managing your Nuvama Wealth and Investment Form post-submission

Post-submission management of your Nuvama Wealth and Investment Form is crucial for tracking its status and ensuring your investment goals are aligned with the information provided.

Frequently asked questions (FAQs) about the Nuvama Wealth and Investment Form

The Nuvama Wealth and Investment Form may raise several questions among users. Frequently asked questions typically include inquiries about typical processing times, required documents, and special circumstances for unique cases.

For further assistance or clarification, users can refer to Nuvama’s official resources or contact their support team.

Latest updates and news on Nuvama wealth management

Keeping abreast of recent updates regarding Nuvama’s processes and offerings is essential for prospective clients and current investors alike. Changes to the form may arise, as well as improvements in submission technology.

Additional tools for wealth management

In addition to the Nuvama Wealth and Investment Form, there are several other essential documents that can aid in comprehensive wealth management. Having access to the right tools can provide clarity and control over your financial situation.

Utilizing these tools in conjunction with the Nuvama Wealth and Investment Form can ensure that you are well-prepared for your financial journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find nuvama wealth and investment?

How do I execute nuvama wealth and investment online?

How do I fill out the nuvama wealth and investment form on my smartphone?

What is nuvama wealth and investment?

Who is required to file nuvama wealth and investment?

How to fill out nuvama wealth and investment?

What is the purpose of nuvama wealth and investment?

What information must be reported on nuvama wealth and investment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.