Get the free Taxation On Dvidend DistributionPDFDividendTaxes

Get, Create, Make and Sign taxation on dvidend distributionpdfdividendtaxes

How to edit taxation on dvidend distributionpdfdividendtaxes online

Uncompromising security for your PDF editing and eSignature needs

How to fill out taxation on dvidend distributionpdfdividendtaxes

How to fill out taxation on dvidend distributionpdfdividendtaxes

Who needs taxation on dvidend distributionpdfdividendtaxes?

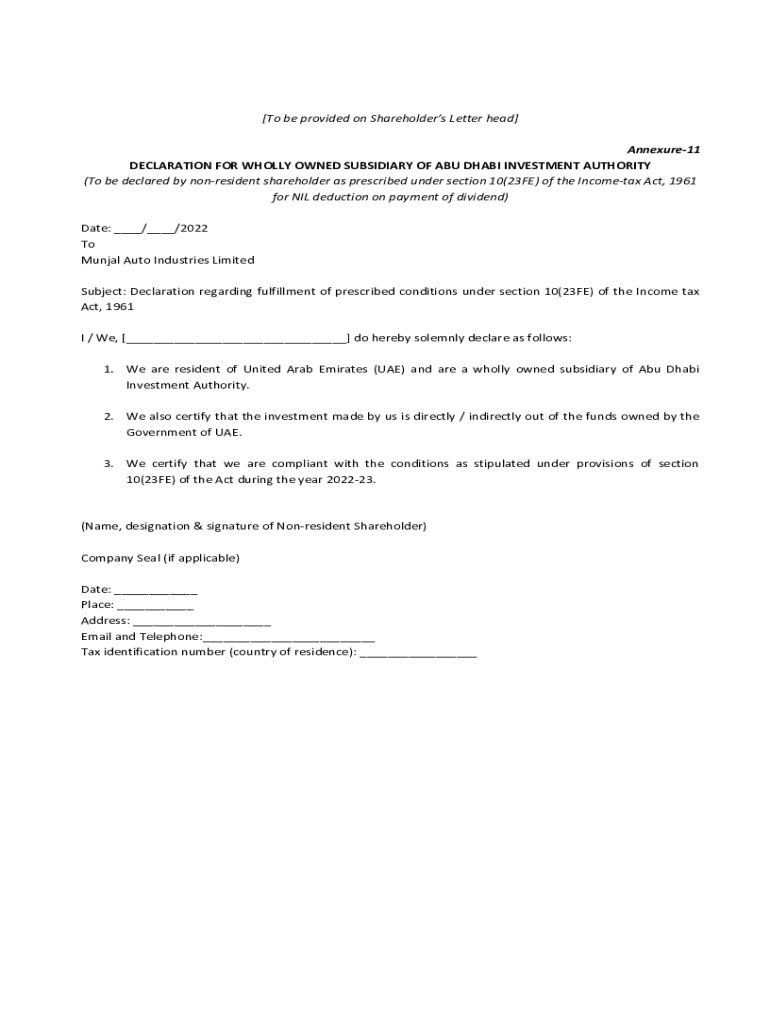

Taxation on Dividend Distribution: PDF Guide and Tax Form

Understanding dividend taxation

Dividend tax refers to the tax levied on the income received from dividends. In essence, when a company distributes part of its profits to shareholders, this distribution is generally subject to taxation. Understanding the nuances of dividend taxation is crucial, as it affects investors' net returns and corporations' financial strategies. Reporting these dividends accurately in financial documents ensures compliance and transparency.

Who is subject to dividend tax?

The primary taxable entities for dividend distributions include individual shareholders and corporate shareholders. Individuals receiving dividends from their investments are typically subject to personal income tax on those dividends. Corporations receiving dividends may also face tax implications, especially depending on whether the dividends are classified as qualified or ordinary.

Beneficial owners, those who enjoy the benefits of ownership regardless of the name in which assets are held, play a vital role in this process. Their tax liability may differ based on their specific financial circumstances, making understanding this aspect vital for investors.

The process of paying dividend tax

To ensure timely compliance with tax obligations, understanding the timeline for payment is critical. Typically, dividend taxes are due during the annual tax filing period, with specific deadlines varying by jurisdiction. Familiarizing yourself with these dates helps avoid penalties.

Calculating dividend tax involves knowing your taxable dividend amount and applying the applicable tax rate. For example, if you received $1,000 in dividends and are in a 15% tax bracket for dividends, you would owe $150 in taxes. Each individual’s situation may vary, so reviewing your tax strategy with a professional can be advantageous.

Specific steps in reporting dividend income

Documentation is a critical aspect of reporting dividend income. Accurate record-keeping, including copies of 1099-DIV forms (for U.S. taxpayers), is essential for both personal and corporate tax filings. These documents provide the necessary information to substantiate reported income.

When filing your dividend tax returns, follow a systematic approach. Ensure you have all necessary forms, fill them out accurately, and review them to avoid common oversights, such as misreporting the amount received or failing to include related documentation. Missing data may result in fines or delayed refunds.

Exemptions and special considerations

Not all dividends are taxable. Some dividend types, such as qualifying dividends, are taxed at a lower rate. Understanding these can be crucial for effective tax planning. Tax-free thresholds also apply, meaning small dividends might not be subject to tax depending on the amount and the recipient’s total income.

For international shareholders, special considerations around withholding taxes apply. Navigating these regulations may require understanding treaties and agreements that can lower or eliminate withholding taxes on dividend payments.

Common questions about dividend taxation

Questions surrounding dividend taxation are common among individual investors and companies alike. For instance, who is liable for dividend tax? Typically, the shareholders who receive the dividends are responsible. A common query also includes what constitutes a dividend, which is defined as a distribution of profits by a corporation.

One may also ask about the rates associated with dividend tax, as these can vary based on the type of dividends received. Understanding when dividend tax becomes applicable is crucial as it dictates tax compliance timelines.

The differences between dividend tax and other corporate taxes

Dividend tax fundamentally differs from corporate taxes, such as the secondary tax on companies. While corporate tax is assessed on a corporation's taxable income, dividend tax is applied to the income shareholders receive. This distinction is critical for financial planning at both corporate and individual levels.

Understanding these differences allows corporations and individuals to better strategize their tax positions and manage their finances efficiently. The implications of these taxes on overall financial health must be considered by any investor.

Leveraging technology for efficient management

Managing documents associated with dividend taxation doesn’t have to be overwhelming. Utilizing PDF tools for tax forms offers a streamlined approach to both creation and filing. For instance, pdfFiller provides capabilities for editing PDF forms, eSigning, and collaborating seamlessly with team members, making it easier to ensure accuracy.

The benefits of a cloud-based document solution like pdfFiller extend beyond mere access; they offer enhanced security measures to protect sensitive information, ensuring that documents are safely managed and can be retrieved easily anytime, anywhere.

Relevant documentation for dividend tax

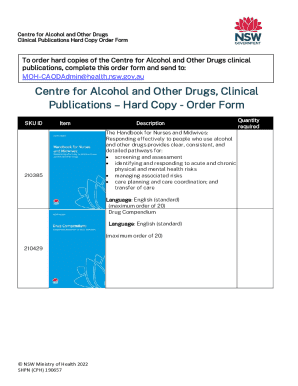

When filing for dividend tax, several forms are necessary to ensure compliance. Commonly used forms like the 1099-DIV serve to report dividends received and are important for maintaining proper tax records. Utilizing tools like pdfFiller allows users to access these forms, fill them out, and manage them efficiently.

Having additional resources at your disposal can be beneficial. Templates related to tax preparation can make the filing process smoother, providing a clear understanding of what to include and how to navigate through tax requirements effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my taxation on dvidend distributionpdfdividendtaxes in Gmail?

How can I edit taxation on dvidend distributionpdfdividendtaxes on a smartphone?

Can I edit taxation on dvidend distributionpdfdividendtaxes on an Android device?

What is taxation on dividend distribution?

Who is required to file taxation on dividend distribution?

How to fill out taxation on dividend distribution?

What is the purpose of taxation on dividend distribution?

What information must be reported on taxation on dividend distribution?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.