Get the free Investing in Forests and Protected Areas for Climate

Get, Create, Make and Sign investing in forests and

Editing investing in forests and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out investing in forests and

How to fill out investing in forests and

Who needs investing in forests and?

Investing in forests and form: A how-to guide

Understanding forest investment

Forest investment encompasses the acquisition and management of forested land to generate financial returns, while contributing to environmental sustainability. This approach has gained traction due to the growing recognition of the economic and ecological benefits of forests. Historically, forestry as an asset class has evolved from being largely overlooked to becoming a vital component of sustainable investment portfolios, especially in an era where climate change and biodiversity loss are pressing concerns.

The value of forests

Investing in forests offers numerous environmental benefits critical to addressing global challenges. For instance, forests serve as essential carbon sinks, absorbing atmospheric carbon dioxide and thereby mitigating climate change impacts. Additionally, forests contribute to biodiversity preservation by providing habitats for countless species, ensuring ecosystem stability. The intrinsic value of forests is further underscored by their role in regulating water cycles and protecting against soil erosion.

From an economic perspective, sustainable forest investments can yield consistent, long-term financial returns. Timber markets have demonstrated resilience, with trends indicating increasing demand for sustainable timber products. Investors can benefit from the stable income generated through sustainable harvesting practices, which are increasingly sought after by environmentally conscious consumers.

Key considerations for potential investors

Before diving into forest investments, it’s crucial to assess your financial goals and align them with your environmental values. Whether you're motivated by a desire for profit, sustainability, or both, clarifying your objectives will guide your investment strategy. Investors should also consider the risks associated with forestry investments, such as market fluctuations and natural disasters, and develop robust risk management strategies to mitigate potential losses.

Navigating investment structures

Structuring your forest investment is critical in maximizing its potential benefits. Ownership models can vary widely; you may opt for private ownership, formal partnerships, or corporate entities. Each comes with distinct advantages and challenges. Legal frameworks around property rights, timber rights, and environmental regulations will also differ by jurisdiction, influencing your investment structure.

Financing options for forest investments are diverse. While traditional financing methods, like bank loans, are common, innovative funding mechanisms have emerged. Crowdfunding platforms specifically aimed at green investments allow individuals to pool resources for larger projects, while green bonds provide funding aimed explicitly at environmentally beneficial projects, including forestry.

Engaging with forest management

Effective forest management is vital to the success of your investment. Choosing the right practices involves evaluating sustainable versus conventional forestry methods. Sustainable practices not only enhance long-term productivity but also align with the growing global emphasis on environmental stewardship. Certification systems such as the Forest Stewardship Council (FSC) and the Programme for the Endorsement of Forest Certification (PEFC) provide frameworks for responsible forest management.

Tools and resources for investors

Investors can benefit from a plethora of tools designed to assist in assessing forest investments. Online platforms offering financial modeling can help you evaluate potential returns. Interactive calculators that factor in investment costs, expected yields, and market conditions enable you to create informed investment strategies. Furthermore, previous case studies can provide insights into successful investment approaches.

Real-world insights and experiences

Understanding real-world applications of forest investments can offer valuable lessons. Case studies highlighting successful investment strategies often reveal effective management techniques and robust financial models. By learning from the experiences of others, prospective investors can navigate common pitfalls and better prepare for their journeys.

Overcoming challenges in forest investment

Investing in forests comes with inherent risks. Understanding and addressing these risks is crucial for sustaining your investment. Natural disasters, such as wildfires or pest infestations, can significantly impact timber yields, while market fluctuations can affect profitability. Diversification strategies can be employed to protect your investments, spreading risk across different forest types or geographic areas.

Furthermore, navigating regulatory and compliance issues is vital. Each jurisdiction has its own set of environmental regulations that may influence your investment strategy. For investors considering cross-border opportunities, an understanding of international laws governing forest ownership and resource extraction is essential.

The future of forest investing

The forest investment landscape is continually evolving, driven by emerging markets and innovative investment options. Increased awareness of environmental, social, and governance (ESG) criteria fuels the growth of impact investing in forestry. As investors transition towards sustainability, opportunities for diversification and long-term financial stability grow exponentially.

Frequently asked questions about forest investment

Investors often have queries regarding the potential returns from investing in forests and how to ensure responsible management practices. Typically, expected returns can vary widely based on location, management practices, and market conditions, with some investors achieving returns comparable to traditional asset classes. Additionally, understanding and implementing responsible management practices, including adherence to certified sustainable forestry standards, can foster ecological benefits alongside financial gains.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit investing in forests and from Google Drive?

How can I send investing in forests and to be eSigned by others?

Where do I find investing in forests and?

What is investing in forests and?

Who is required to file investing in forests and?

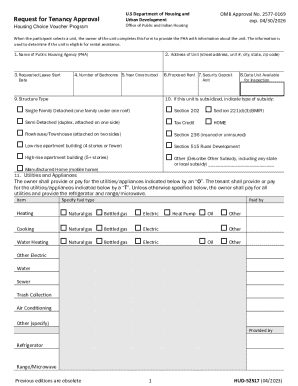

How to fill out investing in forests and?

What is the purpose of investing in forests and?

What information must be reported on investing in forests and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.