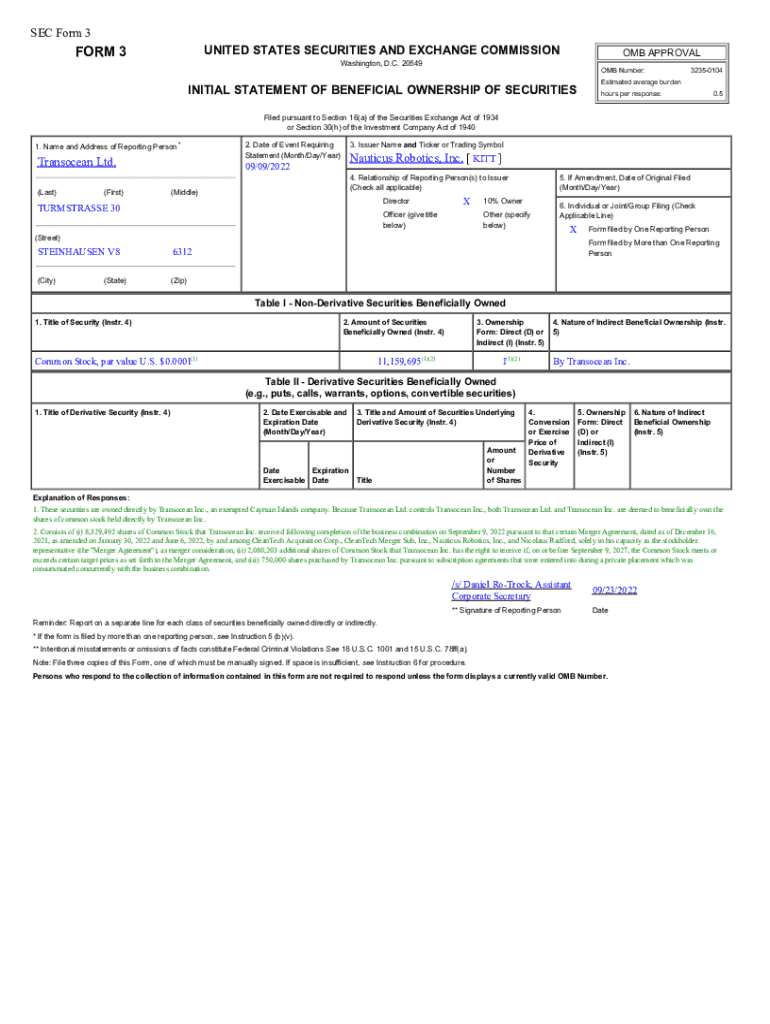

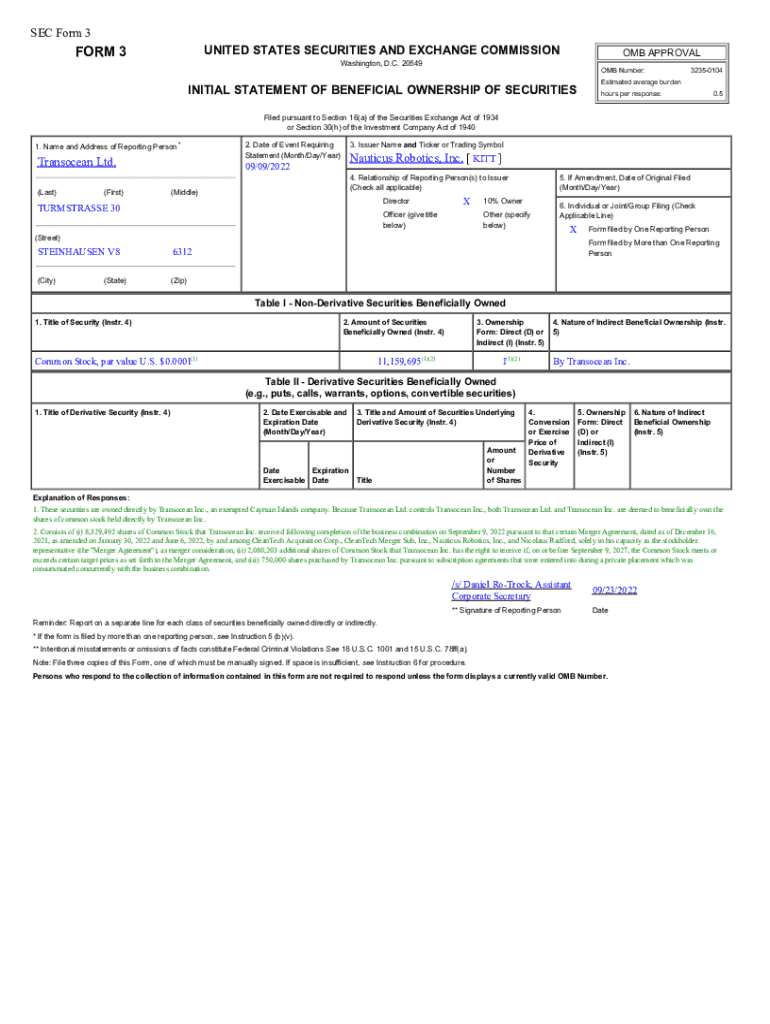

Get the free Common Stock, par value U

Get, Create, Make and Sign common stock par value

Editing common stock par value online

Uncompromising security for your PDF editing and eSignature needs

How to fill out common stock par value

How to fill out common stock par value

Who needs common stock par value?

Common Stock Par Value Form: Understanding Its Importance and Application

Understanding common stock and par value

Common stock represents an ownership stake in a corporation, granting shareholders voting rights and potential dividends. Typically, it is the most prevalent type of stock issued by companies. Investors who purchase common stock have a claim on the company's assets and earnings, reflecting their part-ownership in the organization. Key characteristics of common stock include variable dividends, which may not be guaranteed, and the potential for capital appreciation, where the value of the stock can increase over time based on company performance.

Par value, often set at a nominal level (e.g., $0.01), is the minimum price per share established by the issuing company upon creation of the stock. Historically, par value held significant importance in terms of corporate bonding and the delineation between debt and equity. In modern frameworks, however, many jurisdictions have minimal legal significance attached to par value, allowing firms greater flexibility in structuring capital. Today, the relevance of par value primarily lies in its utility for accounting and regulatory compliance.

The importance of par value in common stock

Understanding why par value matters for investors is pivotal in evaluating a company's financial health. Par value plays a role in how potential investors perceive a company’s stability and governance. A higher par value may reflect a company’s robust capital buffer, whereas a low par value might signal that a company is potentially more volatile. Additionally, par value may influence stock market perception and valuation, affecting a company's stock price and market capitalization.

From a legal perspective, par value can influence corporate governance. Many states enforce regulations whereby par value impacts capital structuring decisions, shareholder rights, and voluntary compliance with stock issuance laws. For financial reporting, par value is recorded in the equity section of balance sheets and is critical in determining additional paid-in capital (APIC) when shares are issued above par value, impacting net assets.

Determining the par value of common stock

Several factors influence the determination of par value, including market conditions, corporate strategies, and applicable state regulations. A company might opt for a higher par value to foster an image of stability or engage in strategic financial planning to optimize funding aligned with growth objectives. Additionally, state laws dictate minimum allowable par values or permit no-par stock options, directly impacting decisions on stock issuance arrangements.

Common practices for issuing par value stock

Issuing stock at par value is a straightforward approach that can simplify accounting but may limit the capital raised. Companies issuing stock at par value raise precisely the par value amount per share without incremental gains from investor interest. While simpler, this method may not maximize potential for funding or investor capital. Conversely, issuing stock above par value can yield additional paid-in capital, providing critical funds for operational growth.

For instance, if a company issues shares with a par value of $1 at a sale price of $5, the APIC would be $4 per share. The associated journal entry for this transaction would reflect the par value and APIC as separate line items within the equity section of the company's balance sheet. However, selling stocks below par value incurs regulatory issues as it may violate state laws and dilute shareholder equity, impacting company liquidity and integrity.

Calculating and managing par value

Calculating par value typically involves straightforward methodologies, usually reflecting a nominal amount decided by the board of directors upon issuing new shares. The par value can be calculated using the formula: Total Par Value = Number of Shares Issued x Par Value per Share. It is crucial to distinguish between this par value and the market value, which can fluctuate significantly due to various market conditions and company performance.

The implications of par value are critical in making informed financial decisions, as it affects the company's capital structure and overall risk. A well-strategized par value can enhance shareholder equity and facilitate corporate funding strategies, guiding future growth endeavors. Understanding how par value plays into shareholder equity can better equip board members and executives in shaping company strategy.

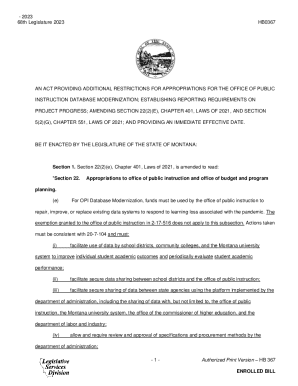

Regulatory and legal considerations

Different states govern the regulations surrounding par value, creating a landscape where compliance varies significantly. Certain states may enforce strict minimums, whereas others allow companies to issue no-par stock. This variance necessitates a thorough understanding of local laws to avoid purely technical violations that could incur penalties or disrupt stock issuance.

Moreover, the Securities and Exchange Commission (SEC) lays out rules and guidelines that pertain to par value and stock issuance. Firms must ensure that their practices align fully with SEC requirements to prevent sanctions or repercussions from regulatory bodies. Companies overlooked in compliance may face unfavorable perceptions that could affect stock performance and investor trust.

Real-world applications and scenarios

Numerous examples exemplify the strategic decisions made by companies regarding common stock par value. For instance, when companies merge or acquire others, assessments of par value can significantly impact equity distribution, earnings per share, and overall valuation metrics. A thoughtful approach to par value during these processes can facilitate smoother corporate transitions while ensuring shareholder rights are balanced.

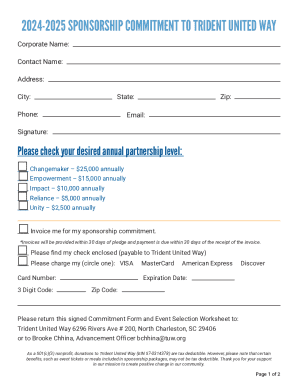

Interactive tools available on platforms like pdfFiller empower users to calculate and fill out par value forms effectively. This accessibility furthers the understanding of par value and streamlines management processes, particularly for teams and individuals dealing with extensive documentation. Available document templates help in establishing correct filing procedures and regulatory compliance, enhancing overall efficiency.

Enhancing your understanding of common stock and par value

For individuals and teams seeking to deepen their understanding of stock valuation and par value implications, engaging with educational resources can provide insights into best practices. Books, online courses, and industry articles relating to corporate finance can enhance knowledge, alongside time spent analyzing case studies of successful corporations, which often offer revelations into sound financial decision-making surrounding common stock.

Common misconceptions surrounding par value may lead some investors to undervalue its importance. Clarifying these myths aligns investor education with reality, showing that while par value alone may not dictate a company's stock price, its role in corporate finance decisions and equity management is indeed significant. By understanding how par value affects investor behavior and company performance, executives can make informed, strategic decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find common stock par value?

Can I create an electronic signature for the common stock par value in Chrome?

How can I fill out common stock par value on an iOS device?

What is common stock par value?

Who is required to file common stock par value?

How to fill out common stock par value?

What is the purpose of common stock par value?

What information must be reported on common stock par value?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.