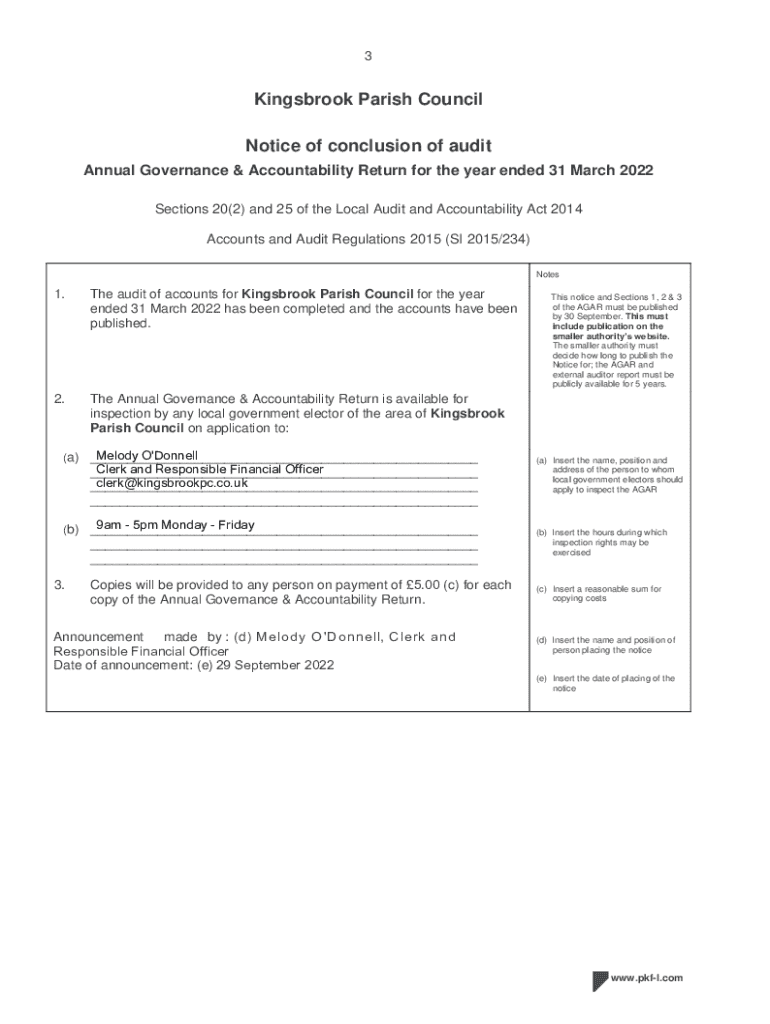

Get the free Annual Governance & Accountability Return (AGAR)

Get, Create, Make and Sign annual governance amp accountability

How to edit annual governance amp accountability online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual governance amp accountability

How to fill out annual governance amp accountability

Who needs annual governance amp accountability?

The Complete Guide to the Annual Governance & Accountability Form

Understanding the annual governance & accountability form

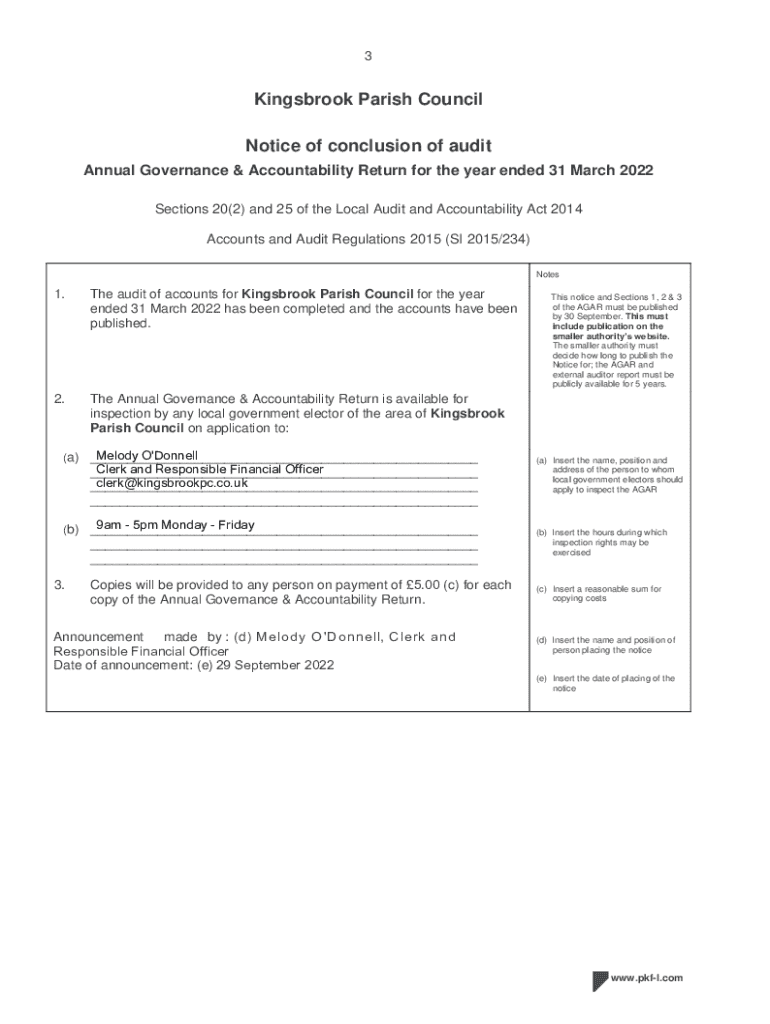

The Annual Governance & Accountability Form, often referred to as AGAF, is a critical document used by organizations to demonstrate their commitment to transparency and accountability within their governance frameworks. It serves as a comprehensive report outlining the organization’s operations, financial stewardship, and adherence to regulatory requirements. By requiring organizations to assemble and report this information annually, the form fosters a culture of accountability, ensuring that stakeholders are informed about governance practices.

This form is vital for various entities, including nonprofits, charities, and other organizations that must comply with legal requirements. Filling out the AGAF accurately not only meets regulatory obligations but also enhances credibility with funders, partners, and the public. Accountability is not just a requirement; it is essential for organizational integrity.

Key components of the form

The AGAF comprises several key sections, each designed to elicit specific information. These components may vary slightly by organization type but generally include:

Importance of the annual governance & accountability form

Fulfilling the requirements of the Annual Governance & Accountability Form is paramount for promoting sound organizational governance. Through comprehensive reporting, organizations communicate their commitment to transparency, which fosters trust among stakeholders. When stakeholders, including employees, donors, and the community, understand how resources are managed and decisions are made, it builds credibility and enhances organizational integrity.

Moreover, there are legal implications tied to the form. Organizations must comply with specific regulatory requirements. Failure to submit the AGAF can result in penalties, including loss of tax-exempt status for nonprofits, additional scrutiny from funding agencies, and diminished public trust. Therefore, understanding the legal expectations is as crucial as filling out the form correctly.

Legal implications and requirements

Different organizations may face varying legal obligations when completing the AGAF. For instance, nonprofit entities in the United States are typically required to submit annual financial statements to the IRS and state agencies, which could mean completing the AGAF accurately is non-negotiable. Each organization must stay informed about the applicable laws in their jurisdiction to ensure compliance.

Preparing to complete the annual governance & accountability form

Preparation is key to completing the Annual Governance & Accountability Form effectively. Start by gathering all necessary documentation. This includes previous forms, financial reports, meeting minutes, and any regulatory correspondence. Ensuring you have everything at hand lets you present the most accurate and comprehensive account of your organization’s activities and status.

Moreover, organizing this data can save time and prevent errors in the submission process. Consider setting up a dedicated folder for these documents, both physically and digitally, allowing you to access them swiftly when needed. This initial organization will streamline the entire process of filling out the form.

Key stakeholders to involve

Identifying the right stakeholders is crucial for completing the AGAF accurately. Key individuals may include the finance officer, executive leadership, and members of the governance board. Each person plays a vital role in providing insights and necessary data as required by the form. Engaging these stakeholders not only enriches the information but invites collaborative input.

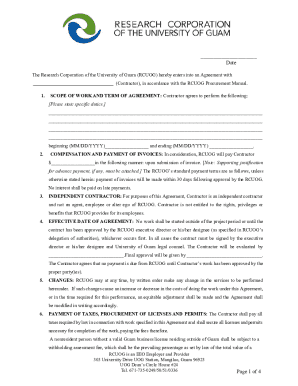

Step-by-step guide to filling out the form

With all necessary documents and stakeholders aligned, it's time to focus on the substantive task of filling out the Annual Governance & Accountability Form. Start by reviewing the form’s instructions thoroughly. Each section typically correlates with the organization’s operations and governance structures. Pay close attention to the specific requirements of each part, as failing to provide requested information can delay approval or raise questions.

Section-by-section guidance

Take your time completing each section methodically. For example, when entering financial data, ensure that all figures match your records. It is beneficial to cross-reference these data with financial statements to maintain consistency.

Utilizing pdfFiller for easy editing

The process can be remarkably streamlined through pdfFiller. This platform allows users to upload the Annual Governance & Accountability Form, edit fields directly online, and make changes quickly. You can easily correct errors or update figures without needing to print and re-scan documents, thereby saving considerable time.

While using pdfFiller, you can utilize features like templates and form-specific guides to ensure you don’t miss any essential fields. This cloud-based solution also provides a collaborative environment, allowing multiple stakeholders to review and provide input on the document in real-time.

Interactive tools for enhanced understanding

In addition to utilizing pdfFiller to manage the Annual Governance & Accountability Form, users have access to a variety of interactive tools that can facilitate understanding and execution. Resources such as templates and filled examples are invaluable for ensuring clarity in what is required and how to present information effectively.

Reviewing and finalizing your submission

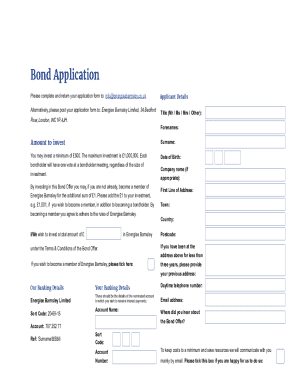

The importance of a thorough review process cannot be overstated. This phase is essential for ensuring that your Annual Governance & Accountability Form is both accurate and effective. It’s beneficial to have multiple stakeholders review the form to catch any oversights or discrepancies that might have been missed initially.

After reviewing, utilize pdfFiller’s eSign feature for obtaining electronic signatures from key stakeholders. This method speeds up the signing process while maintaining the document's security and integrity. Remember to set reminders for submission deadlines to avoid any last-minute scrambles.

Proofreading the completed form

After involving all relevant stakeholders, take one more round to proofread the form. Carefully read through each section for any typos, numerical errors, or formatting inconsistencies. Cross-reference the information with your previous documents to ensure continuity and accuracy.

Signing and submitting the form

Once everyone has signed the document via pdfFiller, prepare to submit it according to your organization’s specific requirements or those dictated by relevant authorities. Ensure that you are aware of what format is required for submission, whether electronic or physical. Keeping a record of the submission will also be beneficial for future reference.

Post-submission steps and future considerations

After submitting your Annual Governance & Accountability Form, it is crucial to track your submission status. Many organizations allow for tracking the form's progress, so staying proactive is essential. If follow-ups are required, prepare your responses or additional documentation promptly to maintain good relationships with stakeholders.

Additionally, consider the entire process a learning opportunity. Gather feedback from the team on areas for improvement in form preparation for next year. Continuous records can help transition into next year’s form completion.

Preparing for next year

As you close out the current year’s submissions, maintain your files and documents for future use. Keeping detailed records can facilitate a smoother process for the upcoming year's Annual Governance & Accountability Form. Use your experiences to improve your data collection processes, enhance stakeholder involvement, and refine the timeline for completion.

Additional tips for successful document management

Effective document management is pivotal for organizations striving to meet their governance and accountability obligations. Best practices can streamline this process significantly. One tip is to categorize and store all governance-related documents in a structured way within pdfFiller’s online platform, allowing easy access wherever you are.

Consider sharing access to templates and forms with team members within pdfFiller. Setting appropriate permissions ensures that everyone involved can edit or review documents without compromising security.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in annual governance amp accountability without leaving Chrome?

How do I fill out the annual governance amp accountability form on my smartphone?

Can I edit annual governance amp accountability on an iOS device?

What is annual governance & accountability?

Who is required to file annual governance & accountability?

How to fill out annual governance & accountability?

What is the purpose of annual governance & accountability?

What information must be reported on annual governance & accountability?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.