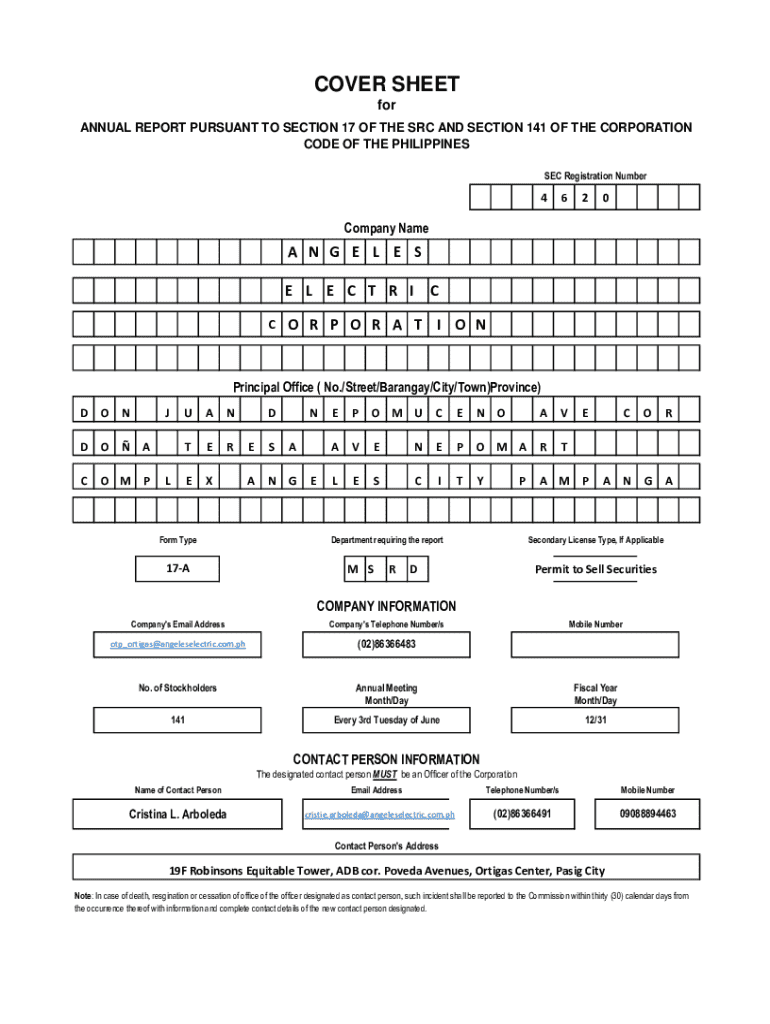

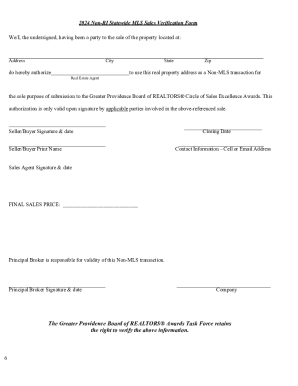

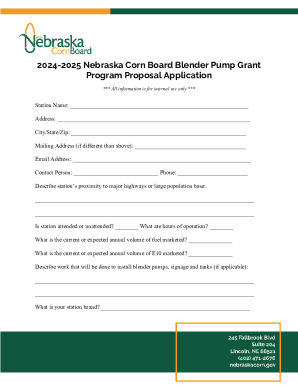

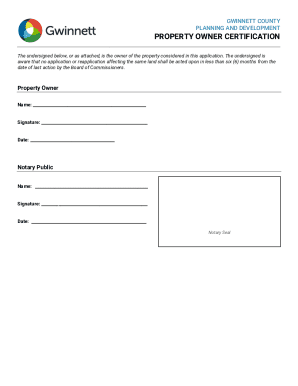

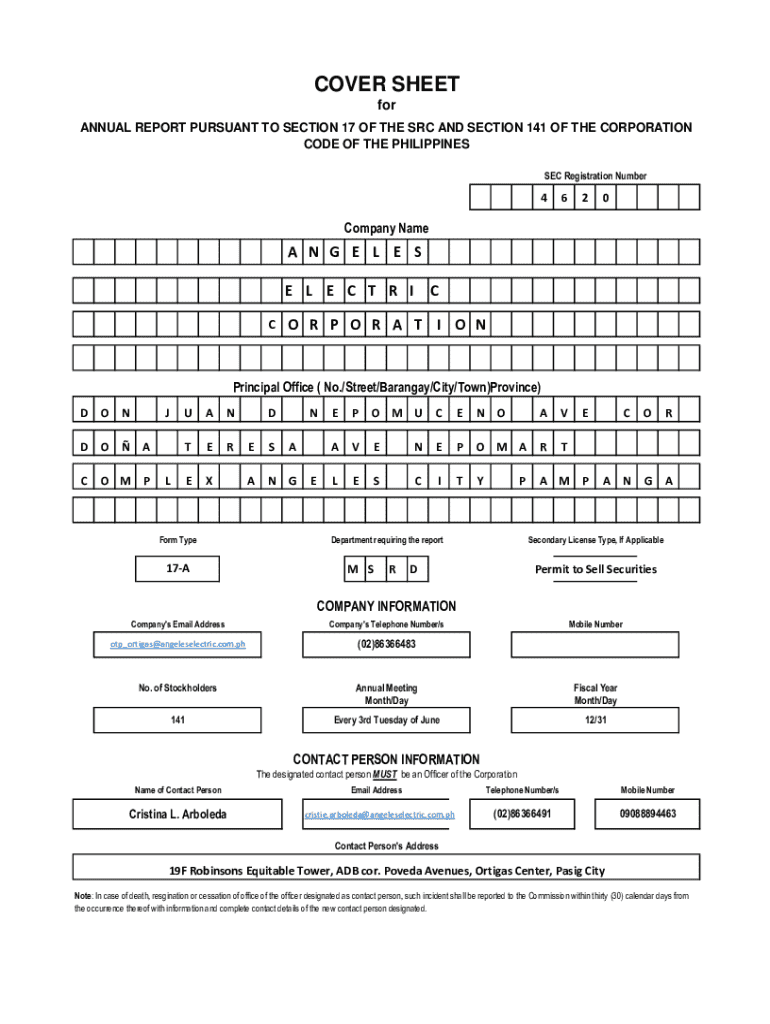

Get the free SEC Form 17-A 2024

Get, Create, Make and Sign sec form 17-a 2024

Editing sec form 17-a 2024 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 17-a 2024

How to fill out sec form 17-a 2024

Who needs sec form 17-a 2024?

SEC Form 17-A 2024 Form: A Comprehensive How-to Guide

Understanding SEC Form 17-A

SEC Form 17-A, mandated by the Securities and Exchange Commission of the Philippines, serves as an essential document for publicly listed companies in detailing their financial performance and corporate governance. This form ensures transparency and accountability in the financial activities of reporting companies, enhancing investor confidence and informing stakeholder decisions.

Typically, companies use SEC Form 17-A to inform the SEC and their investors of vital updates. This includes quarterly and annual disclosures about financial statuses, material events, and other relevant matters. The provision of this information showcases a company’s commitment to operational transparency and regulatory adherence.

Who needs to file SEC Form 17-A?

All publicly listed companies on the Philippines’ stock exchange are required to file SEC Form 17-A. Additionally, companies transitioning to a public status or those seeking significant fundraising may also fall under mandatory filing criteria to comply with regulatory expectations.

Entities such as corporations, partnerships, and other business structures must evaluate their status to comply fully. The requirements can vary based on company structure and ownership, making it crucial for stakeholders to consult the SEC's guidelines for clarity.

Key components of SEC Form 17-A 2024

The 2024 iteration of SEC Form 17-A consists of several key components that provide a structured template for companies to report their financial health and governance practices.

Companies must comply with the required disclosures in each section to fulfill SEC's expectations, thus avoiding penalties or sanctions.

A step-by-step guide to filling out SEC Form 17-A

Completing SEC Form 17-A requires thorough preparation and attention to detail. Organizations should start by gathering all necessary documents, including previous filing records, financial statements, and board meeting minutes.

When filling out the form, accuracy in financial reporting is paramount. Companies should adhere to the guidelines provided by the SEC, ensuring precise portrayal of financial standing.

For the management discussion and analysis section, it’s crucial to provide clear insights into the company’s performance, using concise language and factual data. Incorporate charts or graphs where necessary to enhance comprehension.

Lastly, when detailing corporate governance information, ensure that all board policies and practices reflect the company’s compliance and commitment to ethical business conduct.

Editing and reviewing your SEC Form 17-A

Errors in SEC Form 17-A can lead to regulatory scrutiny and potential fines. It is vital to be aware of common mistakes such as inaccurate financial reporting, missing signatures, or incomplete sections.

Best practices for reviewing the completed form include working collaboratively with relevant department heads to validate information and having an external auditor conduct a final review for objectivity.

Filing SEC Form 17-A

Filing SEC Form 17-A can be done electronically or via paper submission. Understanding the benefits and drawbacks of both methods is essential for a timely and efficient filing process.

Adhere to filing deadlines set by the SEC, as late filings can incur penalties. Companies should maintain a calendar highlighting critical submission dates and ensuring timely reminders for all stakeholders involved in the process.

Managing SEC Form 17-A post-filing

After filing SEC Form 17-A, maintaining thorough records is crucial for future reference. Companies should keep copies of the form filed, along with all supporting documentation for a minimum period as determined by regulatory requirements.

Being prepared for SEC inquiries is essential. If the SEC requests additional information or clarification, companies should respond promptly and with accurate documentation to uphold their commitment to compliance.

Interactive tools for SEC Form 17-A

Using digital platforms can significantly enhance the filing experience for SEC Form 17-A. pdfFiller enables users to create, edit, and manage forms electronically, streamlining the process.

Collaboration becomes seamless with pdfFiller, allowing teams to work on SEC Form 17-A concurrently, manage feedback, and incorporate edits efficiently without unnecessary email chains.

Staying updated on SEC regulations

Regularly updating oneself on SEC regulations is vital for all filing companies. Several reputable platforms provide continuous learning resources, including compliance seminars and workshops tailored for SEC form filings.

Being proactive in learning ensures that companies adapt seamlessly to any changes, positioning them favorably with regulatory bodies.

Frequently asked questions (FAQs)

New filers often have numerous queries regarding SEC Form 17-A. Addressing common concerns, such as clarification on filing requirements, helps alleviate potential stress.

By addressing these frequently asked questions, companies can implement best practices in preparing for their SEC Form 17-A filings.

Conclusion on the importance of accurate reporting

Accurate reporting through SEC Form 17-A is critical for ensuring transparency in the business sector. For investors, comprehensive reports reflect a company’s financial health and governance practices, which directly influence investment decisions.

Utilizing user-friendly tools like pdfFiller for managing compliance documents not only simplifies the process but also enhances accuracy. Companies are encouraged to invest in efficient document management solutions to uphold their commitment to transparency and regulatory compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my sec form 17-a 2024 in Gmail?

Can I create an electronic signature for signing my sec form 17-a 2024 in Gmail?

How do I edit sec form 17-a 2024 straight from my smartphone?

What is sec form 17-a 2024?

Who is required to file sec form 17-a 2024?

How to fill out sec form 17-a 2024?

What is the purpose of sec form 17-a 2024?

What information must be reported on sec form 17-a 2024?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.