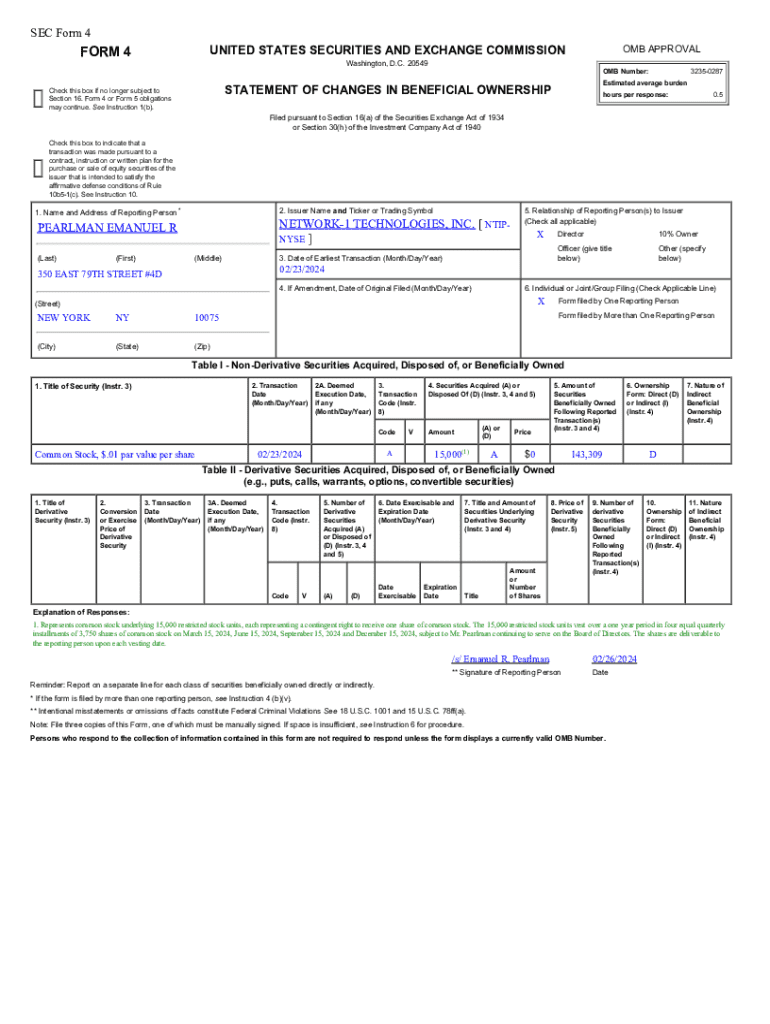

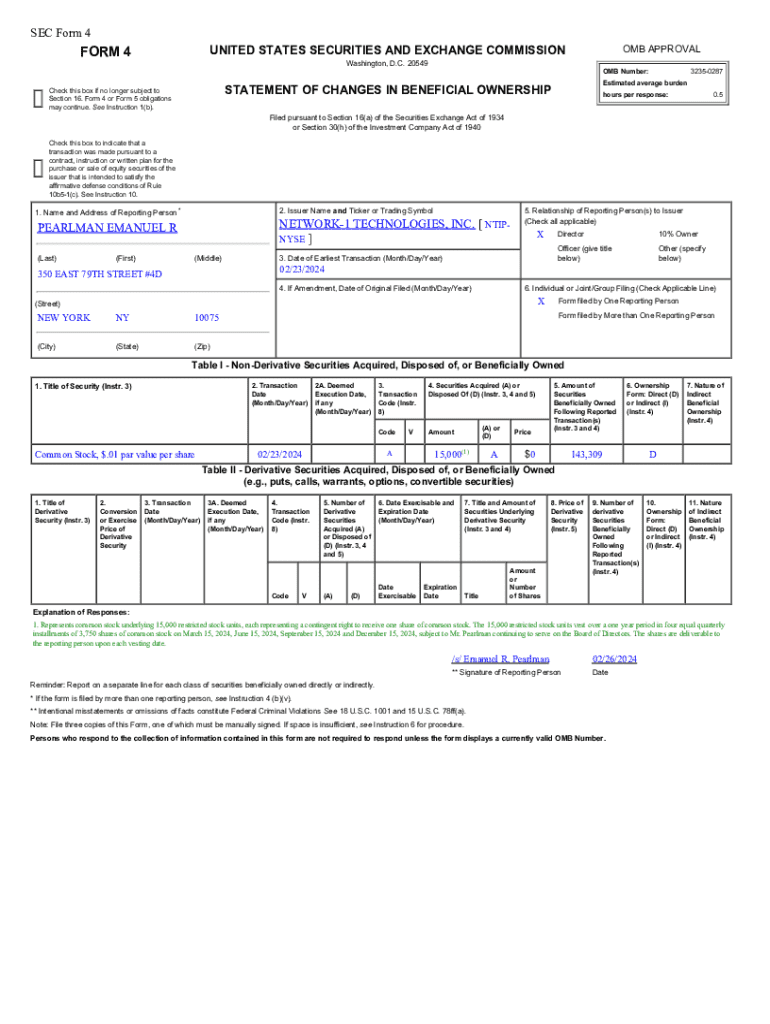

Get the free The 15,000 restricted stock units vest over a one year period in four equal quarterly

Get, Create, Make and Sign form 15000 restricted stock

Editing form 15000 restricted stock online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 15000 restricted stock

How to fill out form 15000 restricted stock

Who needs form 15000 restricted stock?

Understanding the Form 15000 Restricted Stock Form

Overview of restricted stock

Restricted stock refers to shares of a company that are issued to employees, but full ownership is contingent upon certain conditions. This type of compensation is often used as an incentive, aligning employee interests with that of the company's long-term growth. The Form 15000 plays a vital role in documenting these awards, ensuring both employees and employers adhere to tax regulations.

The importance of Form 15000 in stock compensation cannot be overstated. It not only provides clarity around the terms of the awarded stock but also serves as a record for tax and compliance purposes. Companies can offer various types of restricted stock awards, including time-based vesting, performance-based vesting, or even a combination of both, making it essential for employees to understand how each type affects their overall compensation structure.

Understanding the Form 15000

The Form 15000 serves multiple purposes, primarily focused on ensuring regulatory compliance and addressing tax considerations associated with restricted stock awards. Companies must complete this form to provide transparency regarding stock ownership and align with IRS guidelines.

Key sections of the form encompass personal information, stock specifics, the vesting schedule, and details regarding tax implications. This comprehensive approach not only protects the employer but also safeguards the employee’s rights and responsibilities, providing a clear framework for the restricted stock awarded.

Detailed instructions for completing the Form 15000

To accurately complete the Form 15000, employees must gather essential information beforehand. This includes verifying their personal identification details and obtaining specifics about the stock grant, such as the grant date and the type of stock awarded.

When filling out the form, follow these step-by-step instructions to ensure correctness:

Some common mistakes to avoid include misreporting personal information, overlooking to detail vesting conditions, and failing to consult with tax advisors about any potential implications.

Editing and customizing the Form 15000

Customized handling of the Form 15000 can be seamlessly managed using pdfFiller’s robust editing tools. Users appreciate the convenience of digital signatures, particularly in a workplace increasingly moving towards remote operations.

pdfFiller enables easy addition of digital signatures and offers features for collaboration with team members on stock documentation. After completing the form, saving and exporting options are widely available, covering various file formats to match your needs.

E-signing the Form 15000

E-signing has become an invaluable part of modern workplaces, streamlining approvals and documentation processes. To e-sign the Form 15000 using pdfFiller, follow this step-by-step guide to ensure a smooth signing experience.

Managing your Form 15000 and related documents

Effective management of Form 15000 and associated stock documentation is critical for ease of access and organization. Utilize tagging and categorizing features available through pdfFiller to streamline your filing process.

Sharing the form with stakeholders can be done effortlessly via pdfFiller, enhancing collaboration within teams. Archiving past stock forms allows easy retrieval for future reference, ensuring you always have the necessary documents readily available.

Additional considerations related to restricted stock

Employees need to be acutely aware of the tax implications associated with restricted stock. Different income reporting rules can apply based on the type of restricted stock awards, affecting the overall tax liability.

Other related forms, such as the 1099-MISC, should also be considered when preparing for tax season. Timing is crucial when dealing with stock vesting and related tax reporting; hence, consulting with a tax professional can help navigate complex scenarios effectively.

FAQs about the Form 15000 and restricted stock

Filling out the Form 15000 incorrectly can result in delays or complications with stock processing. Employees should always double-check their forms, and if mistakes are found, they should rectify them promptly by submitting a correction form.

Understanding the difference between restricted stock and stock options is fundamental. While restricted stock confers immediate stock ownership albeit with conditions, stock options grant the right to buy stocks at a predetermined price without immediate ownership.

In case of losing your Form 15000, it is advisable to contact your HR department or finance office immediately for a reissue to avoid any disruptions in compliance or stock management.

Real-world examples and case studies

Examining real-world scenarios of how companies manage restricted stock awards can provide valuable insights. Successful management of restricted stock awards involves clear communication, robust tracking systems, and maintaining compliance with tax guidelines.

Common scenarios include tracking performance-vested stocks or navigating situations where employees must make tax decisions based on vesting schedules. Documenting these processes in a user-friendly manner fosters better understanding and adherence to regulatory requirements.

Leveraging pdfFiller for your document management needs

Utilizing pdfFiller can significantly enhance the efficiency of managing restricted stock forms. The cloud-based platform is tailored to empower users through document creation, editing, and sharing processes.

Case studies reveal how teams have improved their collaboration methods profoundly through pdfFiller, enabling them to handle restricted stock forms more efficiently. Services like automatic cloud back-up and user-friendly interfaces create an ideal environment for document management in today's fast-paced corporate world.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 15000 restricted stock for eSignature?

How can I get form 15000 restricted stock?

How do I fill out the form 15000 restricted stock form on my smartphone?

What is form 15000 restricted stock?

Who is required to file form 15000 restricted stock?

How to fill out form 15000 restricted stock?

What is the purpose of form 15000 restricted stock?

What information must be reported on form 15000 restricted stock?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.