Get the free Holiday-subsidy-application-form-for-children-of-deceased- ...

Get, Create, Make and Sign holiday-subsidy-application-form-for-children-of-deceased

Editing holiday-subsidy-application-form-for-children-of-deceased online

Uncompromising security for your PDF editing and eSignature needs

How to fill out holiday-subsidy-application-form-for-children-of-deceased

How to fill out holiday-subsidy-application-form-for-children-of-deceased

Who needs holiday-subsidy-application-form-for-children-of-deceased?

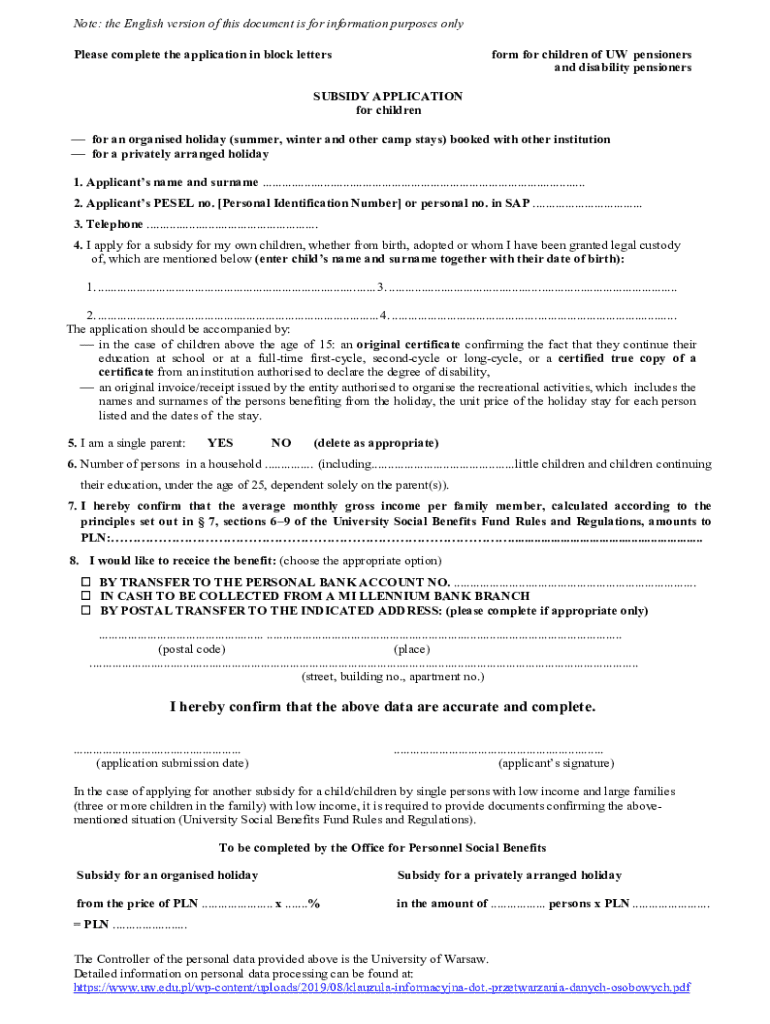

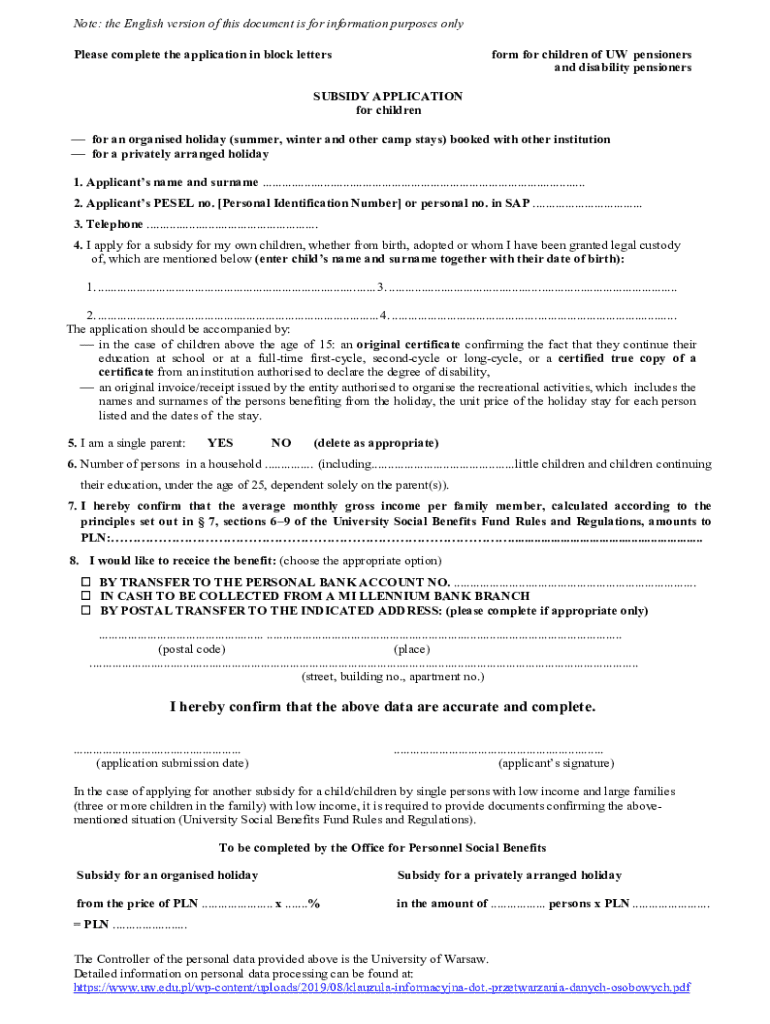

Comprehensive Guide to the Holiday Subsidy Application Form for Children of Deceased Individuals

Overview of the holiday subsidy

The holiday subsidy is a financial program designed to provide support to children who have lost a parent or guardian. This initiative aims to ease the financial burden associated with holiday celebrations, ensuring that these children experience the joy and warmth of festive traditions despite their loss.

For children of deceased individuals, the holiday season can be especially challenging. The subsidy acts as a lifeline, allowing recipients to partake in activities that foster joy and connection during a time of emotional hardship. It helps cover the costs associated with holidays, such as gifts, meals, and essential services.

Understanding the holiday subsidy application process

Navigating the holiday subsidy application process can seem daunting, but breaking it down into manageable steps can make it easier. The first step is to gather the required documentation that substantiates your eligibility for the subsidy.

Next, complete the application form. Ensure you provide all requested information accurately, as incomplete applications can delay the process or lead to rejection. After filling out the form, you have various submission methods at your disposal.

Detailed insights on the holiday subsidy application form

The holiday subsidy application form contains several components that require your careful attention. The first section is the personal information area. Here, you will input details like your name, contact information, and the names of the children applying for the subsidy.

The next major component captures information about the deceased individual. This will include their full name, date of birth, and date of passing. Providing accurate information is crucial as it ensures that your application is processed without delays. Lastly, you’ll need to fill out the financial details section, which may involve providing documentation of income and necessary expenses.

Interactive tools and resources available

Using digital tools can significantly expedite the holiday subsidy application process. pdfFiller offers an online form editor that allows users to edit, sign, and convert documents with ease. This functionality is particularly helpful for those needing to adjust their application before submission.

Utilizing interactive tools can enhance the efficiency of the application process. When filling out the holiday-subsidy-application-form-for-children-of-deceased form, take advantage of features such as digital signature options, which enable secure, legally recognized signing from anywhere.

Additionally, there are FAQs available on the pdfFiller site concerning digital tools, providing users with valuable insights into addressing potential challenges during the application process.

Collaboration and support

Applying for the holiday subsidy is often a collective effort involving family members or legal representatives. It may be beneficial to collaborate with others who can provide additional documents or help clarify your situation. Communication amongst family members ensures that everyone involved understands their roles and responsibilities in the application process.

Managing your subsidy application

After submitting your application for the holiday-subsidy-application-form-for-children-of-deceased form, tracking its status is essential. Many agencies provide online portals where you can check the progress of your application. Regularly following up ensures that any issues can be addressed promptly.

Additional considerations

When receiving a holiday subsidy, it’s essential to be aware of potential tax implications. Generally, subsidies are not considered taxable income, but consulting a tax professional can provide clarity for your specific situation. Additionally, keep an eye on potential future changes in legislation that could impact subsidy eligibility or amounts.

Furthermore, being part of advocacy and support groups can offer valuable insights and camaraderie with others in similar situations. These communities often provide current information on ongoing legislative efforts to improve support for children facing financial difficulties due to parental loss.

Common questions about the holiday subsidy

As you consider applying for the holiday subsidy, you may have several questions regarding eligibility, amounts, and the application process. One common inquiry is about the maximum subsidy amount available, which can vary based on specific criteria set by the governing body of the subsidy.

Further assistance and contact information

If you require further assistance, numerous resources are available to guide you through the process. The first step is contacting the program office that oversees the holiday subsidy. Important contact numbers can often be found on official websites or through community organizations.

Moreover, many organizations now offer online chat options for immediate support. Understanding the support hours can also significantly impact your ability to receive timely information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify holiday-subsidy-application-form-for-children-of-deceased without leaving Google Drive?

Can I edit holiday-subsidy-application-form-for-children-of-deceased on an iOS device?

Can I edit holiday-subsidy-application-form-for-children-of-deceased on an Android device?

What is holiday-subsidy-application-form-for-children-of-deceased?

Who is required to file holiday-subsidy-application-form-for-children-of-deceased?

How to fill out holiday-subsidy-application-form-for-children-of-deceased?

What is the purpose of holiday-subsidy-application-form-for-children-of-deceased?

What information must be reported on holiday-subsidy-application-form-for-children-of-deceased?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.