Get the free PNB Gilts - RFP - Appointment o

Get, Create, Make and Sign pnb gilts - rfp

How to edit pnb gilts - rfp online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pnb gilts - rfp

How to fill out pnb gilts - rfp

Who needs pnb gilts - rfp?

PNB Gilts - RFP Form: A Comprehensive How-to Guide

Understanding PNB Gilts and RFP Forms

PNB Gilts represent secure investment instruments issued by public sector banks, primarily aimed at investors looking for stable returns with minimal risk. These government securities are pivotal in the financial market, as they offer an avenue for both individual and institutional investors to participate in fixed-income investments. Investing in gilts is a strategic decision for building a balanced portfolio, since they typically promise lower volatility and consistent coupon payments, ensuring secure returns over time.

An RFP (Request for Proposal) form serves a crucial role in the investment landscape, especially in the context of public investments like PNB Gilts. It acts as a formal request, inviting potential bidders to present their proposals for various financial services or product offerings. By clearly outlining project specifications, it helps ensure that investors can evaluate the credibility and relevance of different proposals effectively.

The importance of completing the PNB Gilts RFP form

Filling out the RFP form for PNB Gilts is essential for a streamlined investment process. Completing the form accurately enhances your chances of securing favorable funding and optimal investment opportunities. Inaccuracies or incomplete details can delay responses or even disqualify your proposal, risking valuable investment opportunities. Therefore, being meticulous in this process is necessary to ensure that your needs are met effectively.

Common use cases for the RFP form include situations where investors want to explore financing options or seek partnerships with banks for project funding. For instance, if a company is looking to initiate a large-scale infrastructure project and requires assistance in funding it via PNB Gilts, the RFP form becomes vital in submitting a structured request to the relevant financial institutions.

Step-by-step guide to filling out the PNB Gilts RFP form

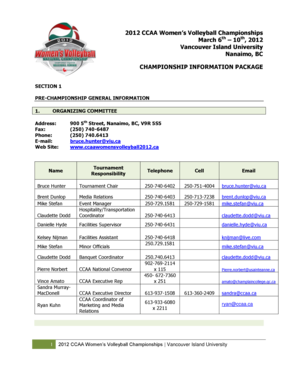

Preparation is key when it comes to completing the PNB Gilts RFP form. Start by gathering necessary information and documentation, such as your firm's registration details, financials, and relevant investment objectives. It’s also crucial to identify which specific PNB Gilts products are relevant to your intended investment, as this will streamline the filling process and ensure tailored responses.

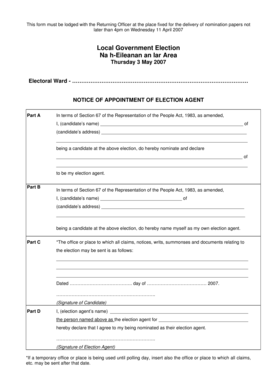

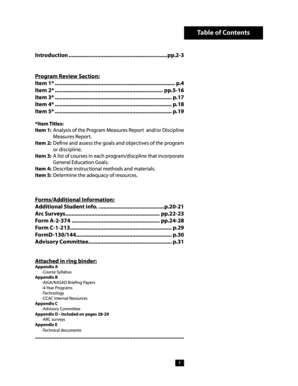

Following is a detailed breakdown of each section of the RFP form that you will need to fill out:

By ensuring each section is filled in thoroughly, investors can avoid common pitfalls, like leaving out critical information or misinterpreting sections. Careful completion of the RFP form can significantly enhance the quality of the proposals you receive, leading to more effective investment decisions.

Editing and formatting your RFP form

Once you have completed the PNB Gilts RFP form, editing and formatting it for clarity and professionalism is crucial. Using pdfFiller facilitates this process with its array of document preparation tools. You can easily access and upload your form to the platform, then take advantage of the editing features, like text boxes, highlighting, and comments, to enhance your document's visual appeal.

Collaboration is another vital aspect of editing. Team members can share the form in real-time, allowing everyone involved to suggest improvements or modifications instantly. The comments and suggestions features help to streamline feedback and ensure that everyone’s input is considered before submission. This collaborative approach reinforces teamwork and enhances the quality of the final document.

Signing the RFP form electronically

The use of eSignature features on pdfFiller makes adding your signature to the completed RFP form straightforward and efficient. The platform provides an overview of eSigning capabilities, allowing you to sign documents quickly, which is essential to maintain the investment momentum. To eSign your form, navigate to the eSign feature, follow the guided steps to create or upload your signature, and place it where necessary.

Understanding the legal validity of eSignatures is also paramount. They are recognized as legally binding in many jurisdictions, which means that when you sign your RFP electronically, it holds the same weight as a handwritten signature. This adherence to legal standards provides peace of mind that your transactions are secure and compliant with existing regulations.

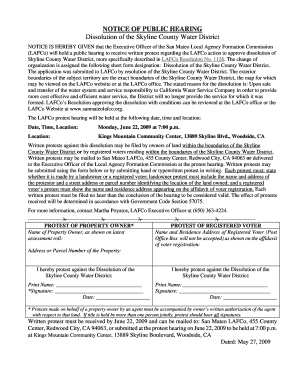

Submitting your RFP form

Preparation for submission is pivotal once your PNB Gilts RFP form is complete and signed. Depending on your specific requirements, submission can often be done through various channels, such as online platforms or via email. Ensure you know the respective submission protocols, as they can differ based on the institution handling the RFP.

After submission, it’s essential to follow up effectively. Typically, you would expect to receive confirmation of receipt from the institution, but it is prudent to track your proposal’s progress. Engage with institutional contacts or use any tracking tools offered to ensure that your regarding submission is monitored, thus enabling timely follow-up if necessary.

Managing and storing your RFP form

Cloud-based document management systems like pdfFiller offer benefits that are particularly valuable for managing PNB Gilts RFP forms. Storing your form on their platform allows you to keep all related documentation centralized and easily accessible. This accessibility is critical, particularly when revisiting proposals or responding to queries from potential investors.

Moreover, the ability to access your documents from multiple devices ensures that you can retrieve and review your submissions at any time, whether in the office or on the go. This flexibility is a huge advantage that enhances productivity and responsiveness in today’s fast-paced finance environment.

Frequently asked questions (FAQs)

Investors often have queries regarding their PNB Gilts RFP forms, particularly related to specific terms or troubleshooting issues during the filling process. Common questions include how to define certain financial metrics or what supporting documents are required with the form. Addressing these FAQs directly can streamline the RFP filling experience, ensuring that no critical detail is overlooked.

Best practices for effective RFP management

Building a sustainable RFP strategy requires regular updates and reviews of your forms to ensure compliance with evolving financial regulations and market conditions. This proactive approach not only aids in maintaining the relevance of your proposals but also strengthens your investment strategy over time, allowing for informed adjustments when necessary.

Additionally, utilizing tools that enhance RFP efficiency is key. Explore other features offered by pdfFiller that streamline document processes, such as automated reminders for deadlines, real-time collaborative editing, and customizable templates for standardizing your submissions. Implementing these strategies can greatly improve your overall efficiency in handling RFPs and enhance engagement with potential investors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the pnb gilts - rfp electronically in Chrome?

How can I edit pnb gilts - rfp on a smartphone?

How do I complete pnb gilts - rfp on an Android device?

What is pnb gilts - rfp?

Who is required to file pnb gilts - rfp?

How to fill out pnb gilts - rfp?

What is the purpose of pnb gilts - rfp?

What information must be reported on pnb gilts - rfp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.