Get the free Home ExemptionTax Relief and Forms

Get, Create, Make and Sign home exemptiontax relief and

Editing home exemptiontax relief and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out home exemptiontax relief and

How to fill out home exemptiontax relief and

Who needs home exemptiontax relief and?

Home Exemption Tax Relief and Form: A Comprehensive Guide

Understanding home exemption tax relief

Home exemption tax relief is a property tax benefit that allows homeowners to reduce their taxable property value, thus lowering their annual property tax bill. This relief is pivotal for qualifying homeowners, as it serves to ease the financial burden associated with property ownership. By removing a portion of the assessed property value from taxation, it directly impacts the homeowner's annual tax liability.

The major benefit of receiving home exemption tax relief is evident in the potential savings on one's property tax bill. This reduction can lead to significant savings over time, providing financial relief that may assist with mortgage payments, home improvements, or other essential expenses. Additionally, home exemptions may lead to increased equity by making homeownership more affordable and accessible for many homeowners.

There are, however, several misconceptions regarding home exemptions. One common belief is that all homeowners automatically qualify for these exemptions — a reality that is far from the truth. Different types of exemptions have varying eligibility criteria, and many homeowners may not realize that they need to apply to receive these savings. Misunderstanding these aspects can lead to missed opportunities for financial relief.

Types of home exemptions available

Various types of home exemptions exist to cater to different groups within the homeowner population. Key types include the General Homestead Exemption, which is available to many homeowners, allowing them to reduce their home's taxable value. Other specialized exemptions are designed for particular demographics, such as senior citizens, disabled persons, or military veterans, offering them additional financial support.

Eligibility criteria for home exemptions

To qualify for home exemptions, homeowners must meet specific criteria. Requirements can vary depending on the exemption type but generally include considerations around property type, income, and ownership status. These stipulations often ensure that exemptions are directed toward those in genuine need, providing meaningful financial aid.

For example, to be eligible for a General Homestead Exemption, you typically need to own and occupy your home as your primary residence. Some exemptions might impose income limits, requiring proof of income to ensure that financial aid is directed to low- or moderate-income households. It is essential for homeowners to regularly review their eligibility as changes in property ownership status, household income, or other factors may necessitate re-application.

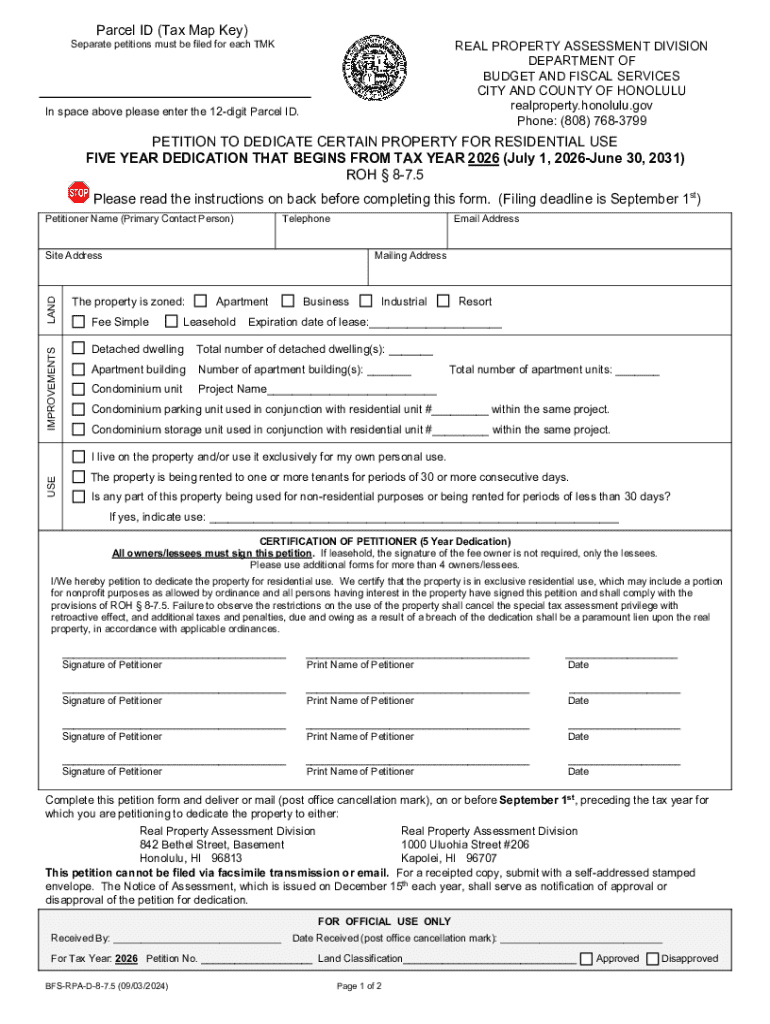

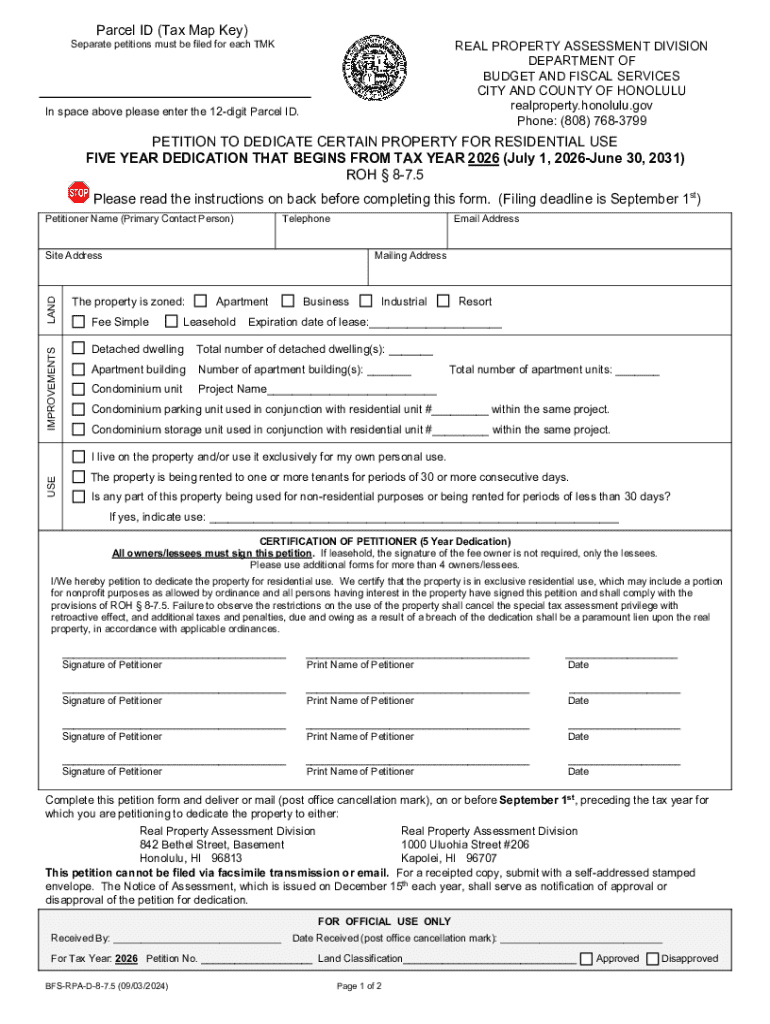

The home exemption application process

Navigating the home exemption application process requires preparation and organization. Homeowners must gather necessary documentation to support their application, ensuring they meet all eligibility requirements. Commonly required documents include proof of identity, property deed, and income statements, all of which substantiate the applicant's eligibility for the exemption.

Once documents are ready, homeowners can complete the application form, which can often be found on local governmental websites or through tax assessor offices. Submitting the application typically involves delivering it in person or via mail to the relevant office, but more jurisdictions are adopting online submission options. It is crucial to track the application status after submission to address any required follow-up or potential rejections.

Filling out the home exemption form

Filling out the home exemption form correctly is vital for achieving the intended tax relief. Each section of the form requires careful attention to detail, starting with personal information, followed by property details, and concluding with financial information regarding income. Failure to accurately complete any section may result in delays or denial of the exemption.

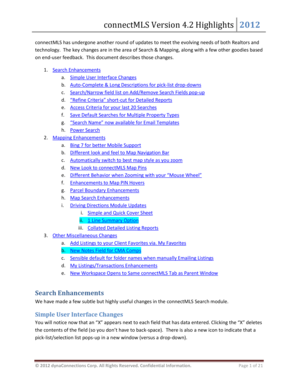

To avoid common mistakes, homeowners should double-check their application for accuracy and completeness. It helps to ensure all information corresponds with official documents and that numbers are legible. pdfFiller tools can facilitate form completion, allowing users to edit forms easily, add eSignatures, and track changes made throughout the process to reduce the risk of error and improve submission efficiency.

Managing your property tax after approval

Once homeowners receive approval for their home exemption, it's imperative to understand its impact on their property tax bill. Generally, the exemption will lead to a reduced taxable value, resulting in lower annual property taxes. However, it’s essential to monitor any changes, as property assessments may fluctuate over time, demanding that homeowners stay vigilant.

Moreover, maintaining exemption status often requires homeowners to re-apply periodically or update the tax authority about significant changes in their eligibility, such as income or ownership changes. In case an application is denied, homeowners should investigate the reasons for denial quickly, as they may have the right to appeal the decision through a formal process.

Resources for homeowners

Homeowners seeking home exemption tax relief can benefit from various resources to help them navigate the complex landscape of property taxes. First, contacting local tax assessor offices can provide specific information about available exemptions and the application process tailored to each locality. Many municipalities offer online tools or calculators to help estimate potential savings, making the process easier for residents.

Furthermore, frequently asked questions (FAQs) often address common concerns related to home exemptions, including whether reapplication is required annually or what steps to take if an exemption was not applied correctly. By staying informed and utilizing available resources, homeowners can effectively manage their property taxes and maximize their tax relief benefits.

Conclusion: Navigating home exemption tax relief with ease

Understanding the nuances of home exemption tax relief is essential for homeowners looking to alleviate their property tax burden. By being informed about the application process and the types of exemptions available, individuals can secure vital tax savings that contribute to financial stability. Utilizing resources like pdfFiller ensures that document management becomes streamlined, enhancing the overall experience of applying for and maintaining home exemptions.

Homeowners are encouraged to stay engaged and informed about their tax relief options. By leveraging the capabilities of pdfFiller for ongoing document management, individuals can ensure a smooth process when dealing with home exemption tax relief and other essential documentation. The purpose is clear: achieving financial relief in property ownership is both possible and attainable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete home exemptiontax relief and online?

Can I create an eSignature for the home exemptiontax relief and in Gmail?

How can I fill out home exemptiontax relief and on an iOS device?

What is home exemption tax relief?

Who is required to file home exemption tax relief?

How to fill out home exemption tax relief?

What is the purpose of home exemption tax relief?

What information must be reported on home exemption tax relief?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.