Get the free Annual Payment and Book Rental charges for 3rd Class

Get, Create, Make and Sign annual payment and book

Editing annual payment and book online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual payment and book

How to fill out annual payment and book

Who needs annual payment and book?

Understanding Annual Payments and the Book Form

Understanding annual payments

Annual payments refer to the fixed sum of money that is paid once a year for services, insurance, loans, or memberships. These payments might cover various commitments such as tuition fees, subscriptions, and insurance premiums. The convenience of annual payments allows individuals and organizations to manage their finances effectively, often leading to discounts or reduced rates.

In various contexts, annual payments play a significant role. For instance, businesses often need to pay annual fees for licenses, which allows them to operate legally. Individuals might pay annual property taxes, ensuring compliance with local regulations. Understanding the importance of these payments can help avoid late fees or penalties associated with them.

Utilizing the proper form for annual payments streamlines the process, ensuring that all necessary information is collected accurately. This not only fosters clarity but also mitigates the risk of errors that can lead to financial repercussions.

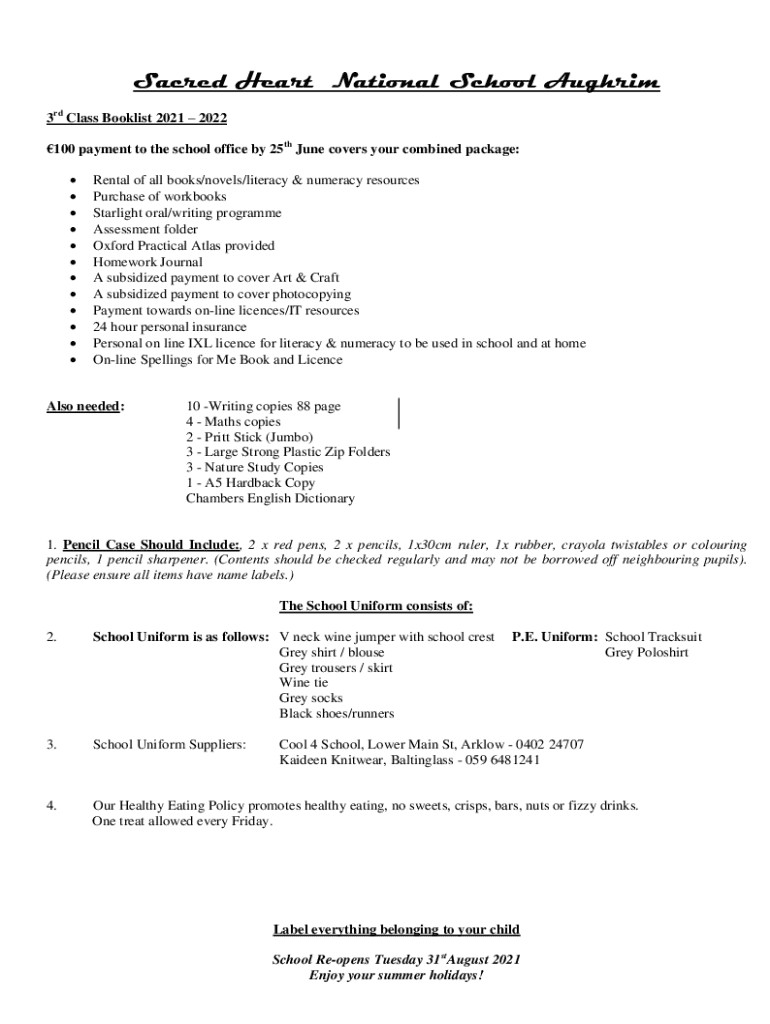

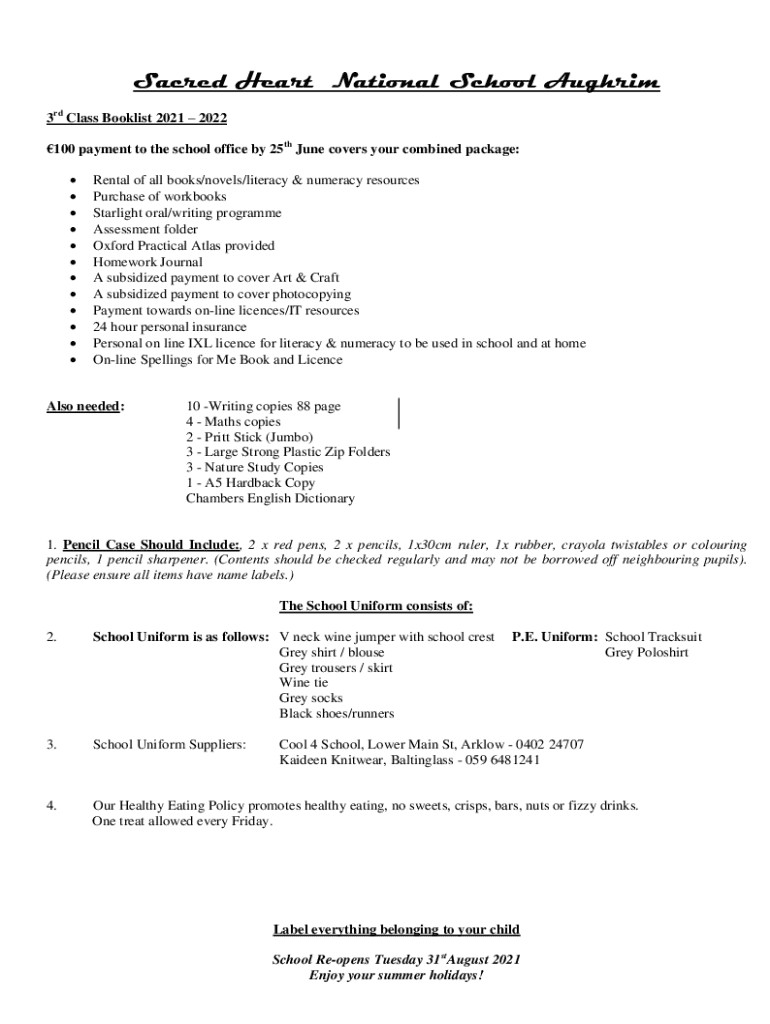

Overview of the book form

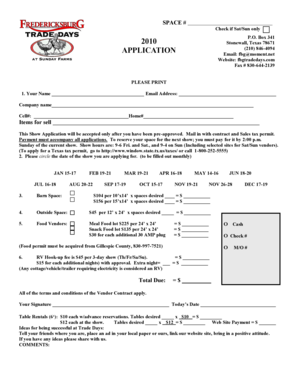

A book form is a structured document designed to facilitate the entry, tracking, and processing of information related to annual payments. Its primary purpose is to ensure that all necessary details are captured concisely and uniformly, providing a straightforward reference for both payers and payees.

Key components of a book form usually include fields for personal identification, amount due, payment dates, and method of payment. Additionally, the book form may have areas designated for signatures, confirming receipt or agreement. One major difference between digital and traditional book forms is that digital forms often feature auto-fill capabilities and electronic signature options, simplifying the filling and submission process.

Preparing to fill out the annual payment book form

Before filling out the annual payment book form, it is crucial to gather all necessary information and documents. Essential identification details may include your full name, address, and contact information, while financial records like bank statements or pay stubs help verify your payment capability. Additionally, reviewing your previous payment history can provide insights into any adjustments or updates needed for the current payment period.

To ensure accuracy, consider the following tips: double-check all entries before submission, use clear and legible handwriting if filling out a paper form, and confirm that all required fields are completed. Incorrect information can lead to delays, penalties, or even disputes.

Step-by-step guide to filling out the annual payment book form

Filling out the annual payment book form requires careful attention to detail. Here's a step-by-step guide:

Signing and submitting the form

The completion of the annual payment book form culminates in the signing and submission process. An electronic signature validates your consent and is often legally binding, providing a seamless alternative to traditional handwritten signatures. pdfFiller offers an intuitive eSignature feature, allowing users to sign documents electronically, enhancing efficiency and security.

Once signed, submission of the form may vary based on the institution. Common submission options include emailing the completed document, faxing it, or uploading directly to a designated portal. It is essential to confirm the submission process to ensure timely processing of your payment.

Managing your annual payment records

After submitting your annual payment form, managing your records becomes paramount. Securely storing your submitted form is essential; consider saving it in a protected cloud storage location for easy access later. This way, you can track payment confirmations and reference past forms swiftly when necessary.

Furthermore, pdfFiller provides an organized platform for accessing past forms and payments. This capability not only facilitates easy tracking of payment history but also allows for efficient management of subsequent payments or submissions.

Frequently asked questions regarding annual payment book forms

As you navigate through the annual payment process, you may have several questions. For instance, if you encounter issues while filling out the form, identify the specific section causing confusion, and reach out to customer support for clarification. Handling payment disputes or errors requires immediate communication with the relevant organization to rectify any discrepancies.

Additionally, familiarize yourself with allowable payment methods and deadlines, as these can vary based on the institution you’re dealing with. Often, payment can be made through credit cards, bank transfers, or checks, providing flexibility tailored to your preferences.

Additional tools and features from pdfFiller

pdfFiller stands out not only with its comprehensive book form feature but also with a suite of collaborative document management solutions. Organizations can benefit greatly from real-time collaboration, allowing multiple users to edit and review documents simultaneously.

Moreover, pdfFiller integrates seamlessly with various platforms, enhancing workflows and minimizing data entry redundancies. To maximize your experience, explore the extensive array of tools pdfFiller provides, such as template customization, performance tracking, and secure sharing features.

Contact support for assistance

If you find yourself needing assistance while filling out the annual payment book form, pdfFiller's customer support is readily available to help. You can reach out to their support team via email, phone, or by utilizing their help center resources.

The help center offers a plethora of articles, guides, and FAQs that can assist in troubleshooting common issues. Taking advantage of these resources can enhance your understanding and usage of the platform, minimizing frustration.

Case studies/examples

Understanding practical applications can illuminate the relevance of annual payment book forms. For example, local businesses utilizing annual payment forms saw a reduction in late payments by over 30%. This decrease stemmed from enhanced organization and clarity offered by properly filled forms.

Testimonies from pdfFiller users reflect similar experiences, highlighting the time saved and the ease of managing annual payments through a centralized platform. These personalized stories emphasize the crucial role that effective document management plays in achieving financial peace of mind.

Keeping updated on payment regulations and forms

It is vital to stay informed about any changes in payment regulations related to your annual payments. Changes in tax laws or insurance fee structures can directly impact your obligations. Regularly checking official websites or reliable news sources can help ensure compliance.

Resources such as government portals or financial advisory services can provide ongoing updates and learning opportunities. By proactively engaging with these resources, you can navigate changes seamlessly and continue to manage your annual payments effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit annual payment and book from Google Drive?

How do I complete annual payment and book online?

How do I fill out annual payment and book using my mobile device?

What is annual payment and book?

Who is required to file annual payment and book?

How to fill out annual payment and book?

What is the purpose of annual payment and book?

What information must be reported on annual payment and book?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.