Get the free Uganda - Investing in Forests and Protected Areas for Climate ...

Get, Create, Make and Sign uganda - investing in

Editing uganda - investing in online

Uncompromising security for your PDF editing and eSignature needs

How to fill out uganda - investing in

How to fill out uganda - investing in

Who needs uganda - investing in?

Uganda - Investing in Form

Understanding the investment landscape in Uganda

Uganda's economic environment is shaped by a diverse range of resources and potential, making it an enticing prospect for investors. The nation boasts a young, dynamic population coupled with a stable macroeconomic framework that supports growth. The 2022 World Bank report highlighted Uganda as one of the fastest-growing economies in East Africa, with a projected GDP growth of around 5.2% in the coming years.

The benefits of investing in Uganda are plentiful. Investors can take advantage of an array of sectors poised for significant expansion, including agriculture, tourism, energy, and infrastructure. Additionally, Uganda has established various investment incentives, including tax breaks, which could lead to significant long-term returns on investment.

Getting started with your investment in Uganda

Initiating your investment journey in Uganda requires careful preparation and research. Start by identifying the sectors that align with your expertise and analysis of market trends. Utilize local resources such as chambers of commerce and investment forums to gather insights into potential opportunities.

Next, assess market demand by conducting thorough market research. Understanding the needs and preferences of Ugandan consumers is crucial; their purchasing behavior can significantly influence your business success. Engaging local partnerships may help in navigating this journey more effectively.

The investment process: A comprehensive guide

The investment process in Uganda starts with initial application procedures that require careful adherence to local regulations. Begin by submitting a comprehensive business plan to the Uganda Investment Authority (UIA), which should underscore your proposal's viability. Once approved, a feasibility study serves as a well-rounded tool to validate your business model.

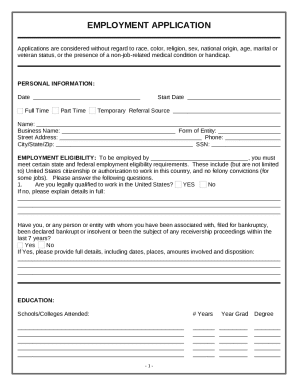

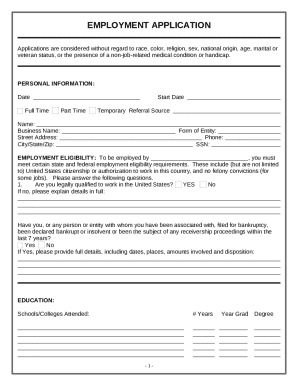

Investors must complete several necessary forms to formalize their engagement. Key among these is the Non-Individual TIN Registration Form, essential for tax compliance. Understanding the specifics of these forms and ensuring proper documentation will facilitate a smoother registration process.

Company incorporation in Uganda

Successfully registering a company in Uganda involves a number of critical steps. First, pre-registration considerations such as choosing the right company structure and securing a business name are crucial. Engage with the Uganda Registration Services Bureau (URSB) to ensure your chosen name is unique and compliant with legal guidelines.

Once the business name is approved, the next step involves submitting the registration documents, which typically include the company’s constitution, identification documents, and completion of specific forms. Understanding the local nuances in this process can significantly mitigate delays.

Tax registration and compliance

Tax registration is a fundamental step that cannot be overlooked by investors. Understanding the different types of taxes applicable—such as income tax, VAT, and withholding tax—is essential. Establishing a Tax Identification Number (TIN) is necessary for compliance and should be pursued soon after company registration.

The steps to register a TIN involve completing the relevant forms, accompanied by necessary identification documents. Engaging a local tax advisor can streamline this process and ensure you’re fully compliant with Ugandan tax obligations.

Obtaining an investment license

Acquiring an investment license involves a series of steps, starting with understanding the eligibility criteria. Investors must demonstrate their capability and readiness to invest significantly in the economy. Common challenges include document inaccuracy and prolonged processing times; therefore, meticulous attention to detail is required.

For those seeking to renew their investment licenses, the process is straightforward but requires timely submissions of required documents. Keeping track of deadlines and maintaining accurate records will ease stress during this stage.

Secondary licenses and regulatory requirements

In addition to your primary investment license, you may require secondary licenses depending on the nature of your business. Each sector may have specific regulatory requirements, thus making it imperative to consult respective government agencies early in your investment journey to avoid compliance issues.

These agencies will guide you in understanding what other licenses are necessary. Be proactive in acquiring these to ensure your operations commence without hitches, thus enabling a strong foundation for your investment in Uganda.

Work permits: What you need to know

Understanding work permits is vital for foreign investors looking to hire skilled labor. Uganda offers different categories of work permits, tailored specifically for skilled and unskilled labor. The government emphasizes improving local employment, so positioning your hiring practices accordingly is essential.

Preparing the necessary documentation is critical for the work permit application process. Ensuring compliance with labor laws will enhance your reputation as a responsible employer and can assist in attracting talent to your business.

The Investor One Stop Centre

The Investor One Stop Centre (OSC) is a pivotal resource for facilitating investment in Uganda. This government initiative aims to streamline the investment process, providing investors with all the necessary services under one roof. Services span from application processing to licensing and regulatory compliance.

Moreover, the OSC provides a plethora of online resources which investors can access for guidance and to complete their documentation needs efficiently. Leveraging these resources can save time and reduce potential errors in your paperwork.

Business licensing: Processes and innovations

Uganda's commitment to improving the business environment extends to its online business licensing process. This innovation has streamlined operations significantly, cutting down on the time and expense associated with obtaining a license. Investors can manage many aspects of licensing online, accessing information and submitting applications with greater ease.

Adopting the digital route not only enhances efficiency but also aligns with modern business practices. It’s advisable for investors to familiarize themselves with the online platform to take full advantage of its benefits in their licensing journey.

Employment considerations for investors

Navigating the Ugandan labor market requires an understanding of local hiring practices. Investors should be aware of the demographics and skills available, with attention to gender considerations in employment strategies playing a significant role. Employing balanced gender representation is increasingly becoming a social responsibility as well as a regulatory expectation.

In addition, maintaining compliance with reporting requirements regarding male and female employment statistics is essential. Doing so can not only assist with regulatory compliance but also enhance your organization’s reputation among stakeholders and clients.

Financial considerations for investors

When it comes to financing an investment in Uganda, investors should understand share capitalization and sourcing funding. Various financing options are available, such as local banks, venture capital, and governmental incentives aimed at foreign investors.

Investors must also adhere to reporting regulations and maintain compliance with financial authorities. Understanding these financial considerations is crucial in ensuring the actual value of your investments is effectively utilized and reported.

Challenges and constraints to investments

While Uganda presents a wealth of opportunities, there are also common barriers that investors frequently encounter. Regulatory hurdles can often surprise new entrants, making it essential to stay informed about ever-evolving local laws and practices. Additionally, economic fluctuations and political considerations should not be overlooked; they can greatly influence investment viability.

These challenges necessitate that investors prepare meticulously, implementing risk management strategies that can cushion them against potential setbacks.

Interactive tools and resources for investors

Leveraging tools like pdfFiller can significantly ease the complexities of managing investment-related forms. With capabilities for editing documents, eSigning, and collaborating within teams, pdfFiller streamlines the process of handling necessary paperwork efficiently.

Furthermore, pdfFiller’s cloud-based platform ensures that all documentation is accessible from anywhere, making it a valuable tool for investors operating in diverse environments. Such features not only save time but also aid in maintaining a high level of accuracy and compliance.

Frequently asked questions

Investors often have common queries about the investment process in Uganda. Among the most recurring questions is, 'What are the key forms I need to submit?' Understanding which forms are essential — primarily those related to tax registration and investment licenses — is fundamental to a successful investment start.

Another frequent query concerns differences in process for individual versus corporate investors. While certain aspects are standard, understanding the nuances that apply to your investor type can greatly streamline your journey. Ensuring compliance with local regulations is a universal priority for all investors, regardless of their structure.

Engaging with local partners and advisors

Building relationships with local partners is imperative for successfully navigating Uganda's business environment. Engaging with local businesses not only enhances your understanding of market dynamics but can also open doors to additional resources and networks.

Finding reliable legal and financial advisors knowledgeable about local regulations is equally crucial. Such partnerships can guide you in compliance, facilitating smoother operations and fostering goodwill and trust within community and governmental structures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify uganda - investing in without leaving Google Drive?

How do I edit uganda - investing in straight from my smartphone?

How do I edit uganda - investing in on an Android device?

What is Uganda - investing in?

Who is required to file Uganda - investing in?

How to fill out Uganda - investing in?

What is the purpose of Uganda - investing in?

What information must be reported on Uganda - investing in?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.