Get the free Investors-KYC-Service-request-forms. ...

Get, Create, Make and Sign investors-kyc-service-request-forms

How to edit investors-kyc-service-request-forms online

Uncompromising security for your PDF editing and eSignature needs

How to fill out investors-kyc-service-request-forms

How to fill out investors-kyc-service-request-forms

Who needs investors-kyc-service-request-forms?

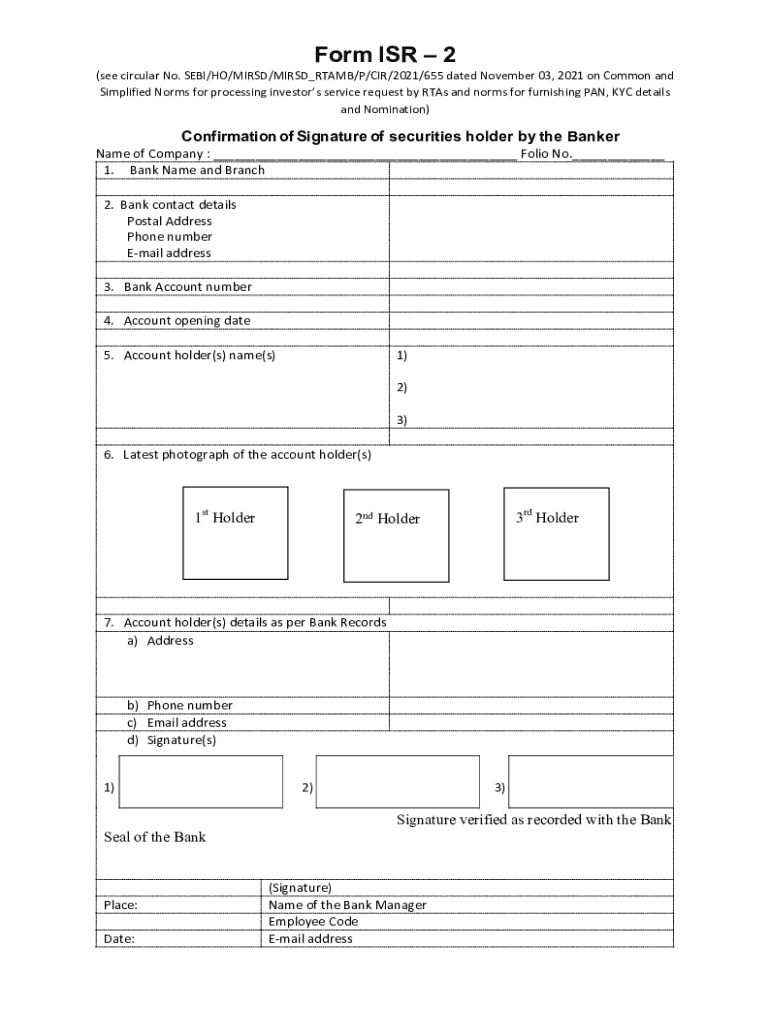

Investors KYC Service Request Forms: A Comprehensive Guide

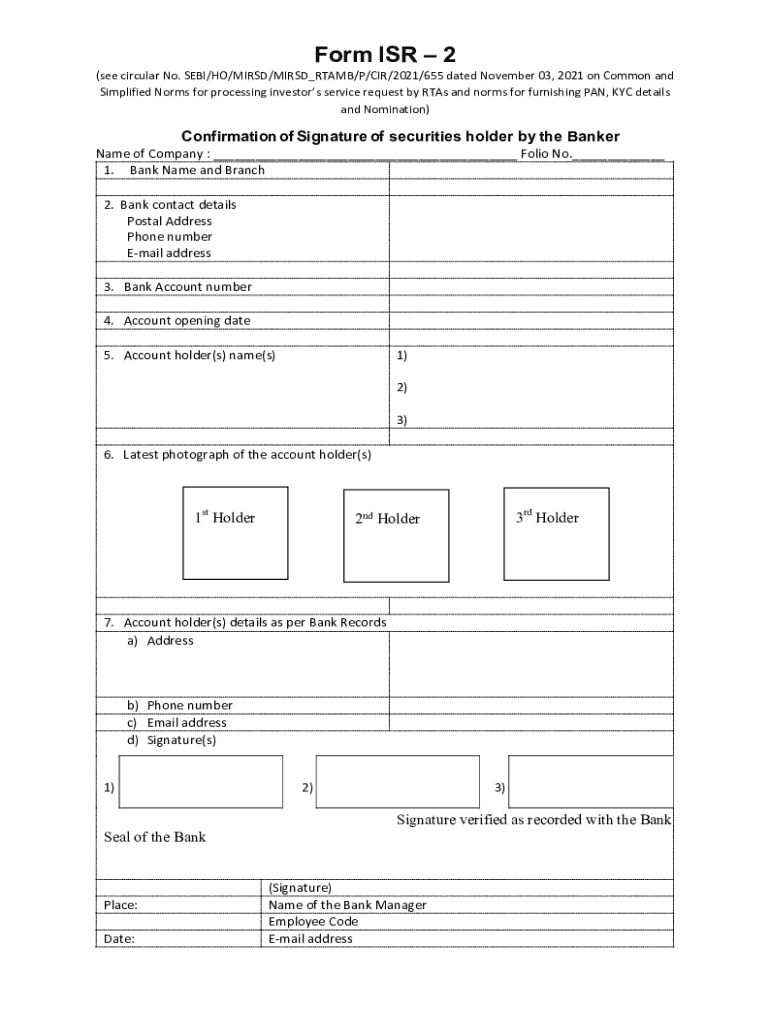

Overview of investors kyc service request forms

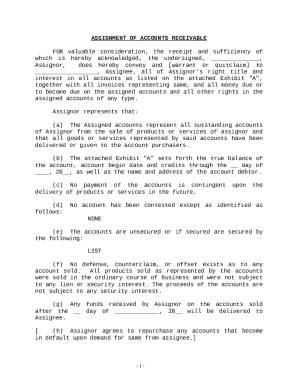

Investors KYC Service Request Forms are critical documents utilized in the financial industry to comply with Know Your Customer (KYC) regulations and ensure the legitimacy of investment activities. KYC is a process through which financial institutions verify the identity, suitability, and risks associated with maintaining a business relationship with customers. In the investment context, KYC is essential for safeguarding both the institution and the investor against fraud, money laundering, and other illegal activities.

KYC documentation is crucial for investors as it helps to establish trust and accountability in financial transactions. It not only protects investors by ensuring they are dealing with legitimate entities, but it also enhances the overall integrity of the financial system. By adhering to KYC regulations, investors can enjoy a smoother onboarding process while reassuring regulators and institutions that they are compliant and responsible.

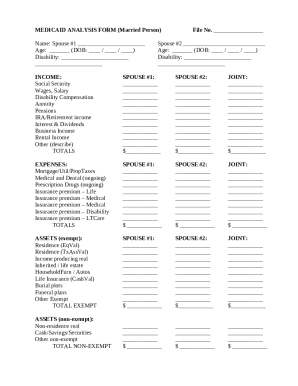

Key components of the service request form

Investors KYC Service Request Forms comprise several essential components, each designed to capture crucial investor information necessary for verification and classification. Providing accurate and thorough details not only facilitates a smooth review process but also helps avoid delays or complications.

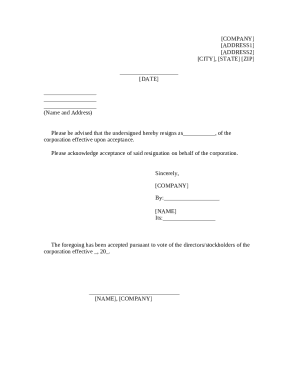

Step-by-step guide to completing investors kyc service request forms

Completing an Investors KYC Service Request Form can be straightforward if you follow these steps carefully. Having the right documentation and understanding the form will assist you greatly.

Interactive tools available for investors

Using modern technology can simplify the KYC process. Tools like pdfFiller offer several features that help investors fill out and manage their KYC forms efficiently.

Frequent challenges and solutions

Completing KYC service request forms is not without its challenges. Many investors encounter common pitfalls that can lead to frustration or delays in processing.

Security and compliance considerations

In the realm of KYC, security and compliance are paramount. Investors need reassurance that their sensitive information remains protected during submission.

Additional tips for a smooth kyc experience

To facilitate a more manageable KYC experience, investors can adopt several best practices that streamline the process. Keeping information updated is essential, as well as knowing when resubmission is necessary.

Important links and resources

Accessing the right tools and information is pivotal for effective KYC management. pdfFiller provides a suite of resources designed specifically for KYC processes.

Customer support and contact information

If you have questions or face issues related to the KYC service request forms, pdfFiller offers robust customer support channels. Engaging with customer service can enhance your experience and provide clarity.

Breadcrumb navigation

Navigating through related sections or topics is streamlined to improve user experience. A logical breadcrumb trail allows you to explore other pertinent resources efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my investors-kyc-service-request-forms directly from Gmail?

Can I create an eSignature for the investors-kyc-service-request-forms in Gmail?

How do I complete investors-kyc-service-request-forms on an Android device?

What is investors-kyc-service-request-forms?

Who is required to file investors-kyc-service-request-forms?

How to fill out investors-kyc-service-request-forms?

What is the purpose of investors-kyc-service-request-forms?

What information must be reported on investors-kyc-service-request-forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.