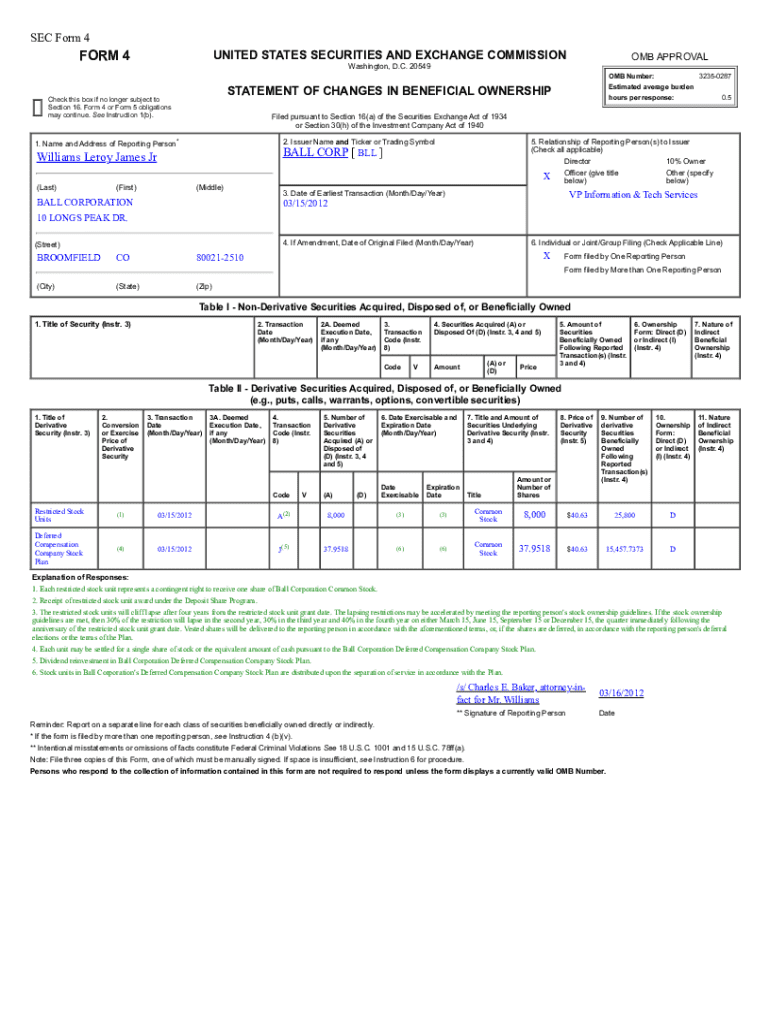

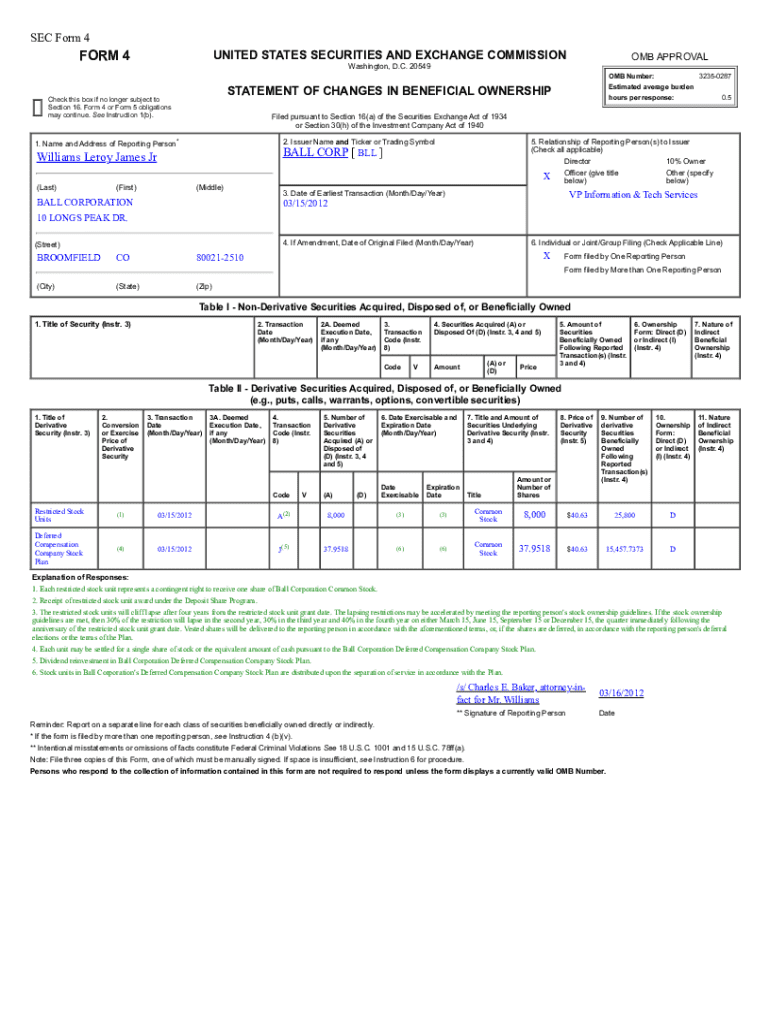

Get the free The restricted stock units will cliff lapse after four years from the restricted sto...

Get, Create, Make and Sign form restricted stock units

How to edit form restricted stock units online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form restricted stock units

How to fill out form restricted stock units

Who needs form restricted stock units?

How to fill out the Restricted Stock Units (RSUs) form

Understanding restricted stock units (RSUs)

Restricted Stock Units (RSUs) are a form of equity compensation offered by companies to their employees, which provide them with an entitlement to receive shares of the company at a future date. Unlike stock options, which are a right to purchase a stock at a set price, RSUs represent a promise from the employer to grant shares once certain conditions, typically related to time or performance, are met.

One of the key differences between RSUs and other forms of equity compensation, like stock options, is that RSUs usually have no exercise price and are considered taxable income once they vest. This makes understanding RSUs critical for employees to align their expectations and financial planning effectively.

Benefits of RSUs for employees

One of the most significant benefits of RSUs is their tax advantage. In many jurisdictions, RSUs are taxed upon vesting rather than at the grant date or when sold, providing employees with time to prepare for their tax bills. Additionally, these units serve as a potent incentive for employee retention; the longer employees stay with the company, the more benefits they receive, promoting loyalty and commitment.

The structure of RSUs often results in employees feeling a greater sense of ownership and alignment with company performance, as their financial success is directly tied to the company's success.

Common misconceptions about RSUs

There are several misconceptions surrounding RSUs. A prevalent myth is that RSUs are the same as stock options; this is not true. RSUs do not require an exercise fee and automatically convert into stocks upon vesting. Another common misconception is that employees will never benefit from RSUs; if structured correctly, RSUs can provide substantial value, especially if the company's stock price appreciates significantly.

The importance of the RSU form

The RSU form is essential in the compensation process as it serves as a legal document that outlines the specifics of the equity grant. Completing the RSU form correctly ensures that both the employer and employee have a clear understanding of the terms and conditions associated with the shares.

On the RSU form, employees need to provide necessary information, including personal details, the number of RSUs granted, and the vesting schedule. Failing to fill out this form correctly can lead to a plethora of issues, such as legal disputes regarding stock ownership or unexpected tax liabilities.

Preparing to complete your RSU form

Before even thinking about filling out the RSU form, it’s crucial to gather all necessary documents. These may include recent pay stubs, tax forms, and any existing employment agreements. Having these documents at hand will make the process smoother and ensure accuracy in reporting your equity compensation.

Understanding your company’s equity compensation plan and the specific terms and conditions tied to your RSUs will significantly impact the completion of your RSU form. Each plan can have different vesting conditions, exercise prices (if applicable), and tax implications.

Identifying your vesting schedule

The vesting schedule is a critical component of RSUs. It dictates when the RSUs convert into actual shares, and understanding this timeline is essential for form completion. If your vesting is performance-based or time-based, it impacts when and how you fill out the form as well as the tax implications you'll face.

Step-by-step guide to filling out the RSU form

Section one: Personal information

The first section typically requires personal information, including your full name, employee ID, and contact details. Accuracy here is paramount as any errors can lead to complications when processing your RSUs.

Section two: Stock options

If you have previously been granted stock options, you need to accurately report these on the form. Ensure you include the number and types of options provided, making sure all entries are consistent with company records.

Section three: Vesting information

Documenting your vesting information is crucial. List each RSU grant along with its respective vesting date. Clarity here will help prevent misunderstandings later on, especially regarding tax implications down the line.

Section four: Tax considerations

Your RSU form should also account for tax implications associated with your RSUs. Be prepared to report on taxes related to RSU income; for most employees, this means including shares' value as income at the time of vesting.

Section five: Signature and date

Completing your RSU form requires your signature and date. Make sure this step is not overlooked, as it confirms the authenticity of the document and ensures compliance with company policies.

Editing and modifying your RSU form

Once you have filled out the RSU form, it’s not uncommon for changes to be necessary. Using platforms like pdfFiller, you can efficiently edit your RSU form. Simply upload your filled-out form into pdfFiller, and make the necessary amendments, ensuring that all information is up-to-date.

Collaborating with team members becomes easier with pdfFiller as well. You can quickly share the document for feedback or the required signatures, enhancing the overall workflow and reducing turnaround time.

Saving different versions of your RSU form

Version control is vital, particularly with documents like RSU forms that could change based on vesting schedules or tax implications. With pdfFiller, you can save different versions of your RSU form, ensuring that you keep track of amendments and have access to previous iterations when needed.

Signing and submitting your RSU form

Selecting the appropriate signing method is crucial when finalizing your RSU form. pdfFiller offers eSigning options that are legally compliant and user-friendly. Choose a method that best suits your preferences and ensures a seamless signing experience.

Best practices when submitting your RSU form include double-checking for accuracy and completeness. Common mistakes to avoid involve missing signatures or not including vital information, which can delay processing and lead to complications with your shares.

Managing your RSUs post-submission

After submission, it's essential to track your RSU progress and vesting schedules actively. Tools like pdfFiller can assist with document management, allowing you to maintain an organized view of your equity compensation and direct access to your forms.

Beyond tracking, understanding how to report RSUs on your taxes is crucial once they vest. Employees should consult a tax professional familiar with stock compensation to navigate potential tax liabilities, which often arise at vesting.

Future modifications and what to do if your information changes

It’s important to note that if your personal or job-related information changes, promptly update your RSU form and inform your HR department to reflect these changes adequately. This ensures that all future communications or distributions reflect your current status.

FAQ on restricted stock units and the RSU form

There are several common questions about RSUs. For instance, what happens if you leave your company before your RSUs vest? Generally, unvested RSUs are forfeited when employment ends. How are RSUs taxed? The taxable amount is typically the market value of the shares at vesting.

Employees may encounter various issues with their RSU forms, such as discrepancies in the number of shares reported. In such cases, it's essential to reach out to your HR department or the relevant personnel to resolve discrepancies promptly.

Final thoughts on RSUs and form management

Managing your RSUs proactively can have a substantial impact on your financial future. Understanding how to navigate the RSU form, from completion to submission and beyond, is key. Platforms like pdfFiller empower users to manage these crucial documents seamlessly, ensuring that each step in the equity compensation process is handled with efficiency and precision.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form restricted stock units directly from Gmail?

How can I get form restricted stock units?

How do I make changes in form restricted stock units?

What is form restricted stock units?

Who is required to file form restricted stock units?

How to fill out form restricted stock units?

What is the purpose of form restricted stock units?

What information must be reported on form restricted stock units?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.