Get the free 32 ANNUAL REPORT

Get, Create, Make and Sign 32 annual report

Editing 32 annual report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 32 annual report

How to fill out 32 annual report

Who needs 32 annual report?

Complete Guide to the 32 Annual Report Form

Understanding the 32 annual report form

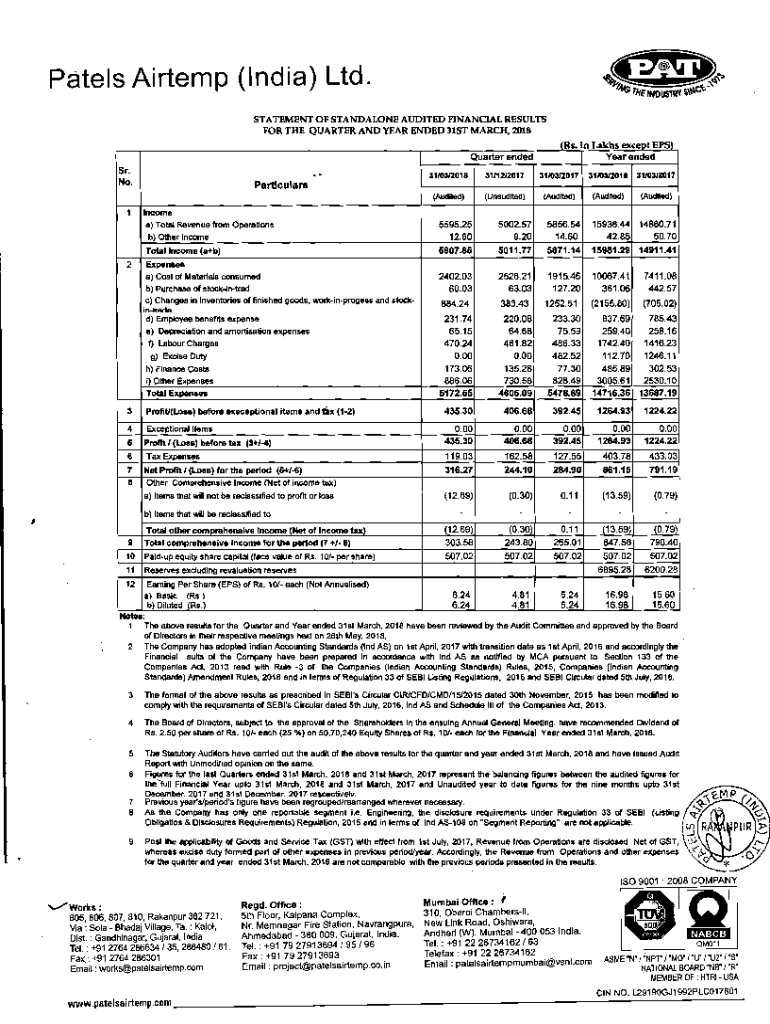

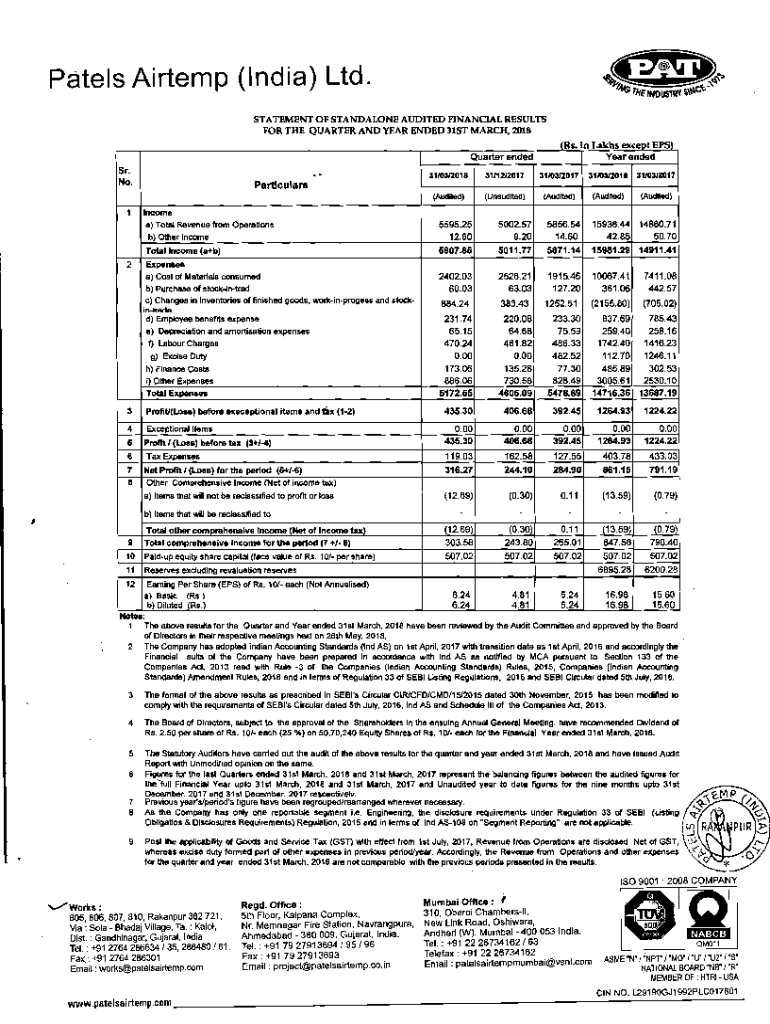

The 32 Annual Report Form is a crucial document that businesses must complete annually to disclose relevant financial and operational information to regulatory bodies. This form outlines a company’s performance, ensuring transparency and accountability. Moreover, it provides stakeholders—such as investors, creditors, and the government—with vital insights into the company’s health and strategy.

Filing the 32 Annual Report is essential for maintaining good standing with regulatory authorities. It serves not only as a report on past performance but as a tool for future planning and assessment. Completing this form accurately can enhance credibility and support business growth, while also simplifying compliance with local regulations.

Who needs to file the 32 annual report form

The requirement to file the 32 Annual Report Form applies mainly to corporations, partnerships, and some other business entities depending on the jurisdiction. Specifically, every registered business engaged in commercial activities is mandated to file this report annually. Understanding who is obligated to file is vital for ensuring compliance.

Different types of businesses—such as sole proprietorships, limited liability companies (LLCs), and non-profit organizations—may have distinct filing requirements. For example, while LLCs typically face fewer regulations, they must still file the 32 Annual Report to maintain their good standing. Failing to do so could result in penalties, loss of status, or even administrative dissolution.

Step-by-step guide to filling out the 32 annual report form

Filling out the 32 Annual Report Form requires careful attention to detail, as inaccuracies can lead to compliance issues. The form is typically divided into several sections, ensuring that all relevant areas are covered thoroughly. Begin by gathering all necessary documents and information before you start filling out the form.

The standard sections of the form include:

To ensure accurate data entry, double-check all figures and consider using accounting software to pull financial data directly. Furthermore, common mistakes to avoid include misreporting figures, incomplete sections, and forgetting signatures.

Editing and customizing the 32 annual report form using pdfFiller

pdfFiller provides a user-friendly platform for accessing and editing the 32 Annual Report Form online. With its array of editing features, users can make necessary changes and enhancements easily, ensuring that the form reflects accurate and up-to-date information.

To access and edit the form using pdfFiller, follow these steps:

eSigning the 32 annual report form

Electronic signing, or eSigning, is an efficient way to validate documents while ensuring compliance. The use of eSignatures is legally recognized in many jurisdictions, making it a secure option for filing the 32 Annual Report Form.

Using pdfFiller, the eSigning process is straightforward:

Managing submitted 32 annual report forms

Once the 32 Annual Report Form is submitted, managing its status and contents becomes essential. pdfFiller offers users the capability to track submission statuses efficiently, ensuring that no important details are overlooked.

You can manage your submitted forms through the following steps:

Frequently asked questions (FAQs) about the 32 annual report form

As users engage with the 32 Annual Report Form, several common questions arise that are important to address to ensure compliance and clarity.

Government and regulatory guidance for the 32 annual report

For precise guidelines on filing the 32 Annual Report Form, users should refer to relevant government and regulatory bodies. Official resources provide the most up-to-date information regarding any changes in filing requirements, deadlines, and associated penalties.

Access to a variety of official sites will give you insight into your obligations. Regularly check these sites for updates to avoid non-compliance. Furthermore, they provide sample forms and other resources that can help clarify specific areas of concern.

Case studies: Successful compliance with the 32 annual report form

Reviewing real-life examples of businesses that successfully filed their 32 Annual Report Forms can provide valuable lessons and insights into effective practices. Various companies have documented their filing journeys, showcasing both the challenges they faced and the strategies they implemented to remain compliant.

Notably, organizations that meticulously prepared documentation and initiated early reviews positioned themselves favorably. Not only did they avoid penalties, but they often achieved faster approval times. Pulling from their experiences, businesses are encouraged to adopt best practices such as maintaining accurate records, engaging consultants if needed, and familiarizing themselves with any new regulations that might affect filings.

Contact information for further assistance

For users seeking further assistance with the 32 Annual Report Form, multiple resources are available that can guide and support the process. Primary regulatory offices for your business's jurisdiction typically have help desks that can address specific inquiries.

Additionally, pdfFiller offers customer support and guidance on their platform, helping you navigate through documentation challenges. Make sure to reach out for assistance if you encounter uncertainties during the filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 32 annual report without leaving Google Drive?

How do I make changes in 32 annual report?

How do I edit 32 annual report on an Android device?

What is 32 annual report?

Who is required to file 32 annual report?

How to fill out 32 annual report?

What is the purpose of 32 annual report?

What information must be reported on 32 annual report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.