Get the free Community Loan Fund honored with first SHE Change Award

Get, Create, Make and Sign community loan fund honored

Editing community loan fund honored online

Uncompromising security for your PDF editing and eSignature needs

How to fill out community loan fund honored

How to fill out community loan fund honored

Who needs community loan fund honored?

Understanding the Community Loan Fund Honored Form

Understanding Community Loan Fund (CLF)

A Community Loan Fund (CLF) is a vital financial resource designed to support economic empowerment within underserved communities. By providing accessible loans and financial education, CLFs aim to foster business development, community initiatives, and ultimately enhance the quality of life in local areas. Historically, these funds have played a crucial role in addressing the disparities faced by marginalized groups, community organizations, and small businesses that often struggle to secure traditional financing.

The impact of Community Loan Funds on economic development cannot be overstated. They serve as catalysts for growth by granting capital to initiatives that may not qualify for mainstream commercial loans. Their focus on community development ensures that funding is directed towards projects that provide lasting benefits, such as affordable housing, job creation, and sustainable resource management.

Navigating the Community Loan Fund Honored Form

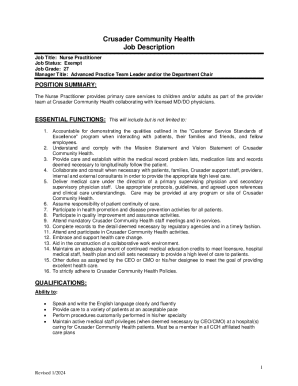

The Community Loan Fund Honored Form is a significant component of the application process for accessing CLF resources. This form acts as a comprehensive request for funding and assistance, laying out the applicant's needs, vision, and capabilities. By understanding the purpose and structure of the Honored Form, applicants can present their projects more effectively.

Key statistics reveal that projects funded through this form have led to notable outcomes, including increased employment rates and enhanced community infrastructure. Success stories from previous applicants showcase diverse projects, from new local businesses launching to community renovations that provide essential services.

Step-by-step guide to completing the Honored Form

Completing the Community Loan Fund Honored Form involves several key sections that require careful attention. Every detail you provide shapes the funders' understanding and evaluation of your request.

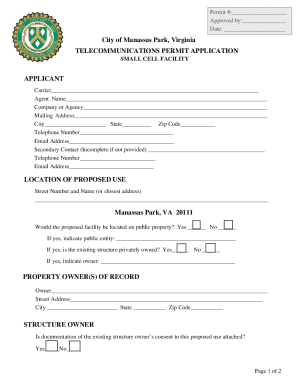

Section 1: Personal Information

In this section, you will need to provide essential personal details. This typically includes your name, address, contact information, and any relevant identification numbers. Accurate information is crucial, as discrepancies can delay your application’s review. To ensure precision, double-check the spelling of names and the accuracy of contact details.

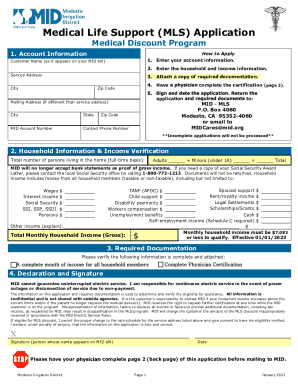

Section 2: Financial Information

The financial section requires a snapshot of your financial standing, including revenue, expenses, assets, and liabilities. Be prepared to provide historical financial records or projections if applicable. It’s important to avoid common mistakes like underreporting income or misclassifying expenses, as these can reduce your application's credibility.

Section 3: Project Description

Your project description should effectively communicate your mission and vision. Take care to explain the project’s objectives, target audience, and the anticipated impact on the community. Using bullet points can help emphasize critical aspects, such as project milestones and expected outcomes, allowing reviewers to grasp the main ideas quickly.

Section 4: Supporting Documentation

This section should include all documents that support your application, such as business plans, feasibility studies, or letters of support from community stakeholders. Organizing these documents logically and ensuring they are up to date can help strengthen your submission and provide context to your project.

Editing and reviewing your application

Before submitting your Honored Form, utilizing pdfFiller’s editing tools is crucial. With pdfFiller, you can make necessary edits directly on the document, ensuring clarity and professionalism. Take advantage of tools that allow you to highlight, annotate, or add comments that can guide your reviewers through your submission.

In addition, collaboration features within pdfFiller enable you to share the form with team members easily. By including colleagues or advisors in the review process, you can gather diverse insights and eliminate potential errors before the application is finalized.

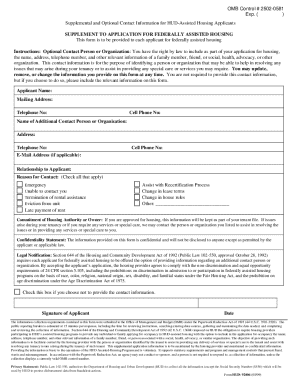

Signing and submitting the form

The process of eSigning the Community Loan Fund Honored Form provides a seamless and secure method to finalize your application. eSigning not only speeds up the process but also offers various safety features to protect your documents against unauthorized access. In contrast to traditional methods, eSigning eliminates the need for physical mailing, thereby streamlining submission.

When it comes time to submit, follow the provided guidelines meticulously. Ensure that you retain copies of the form and all supporting documents for your records. You typically need to submit your application electronically through a designated portal or via email, but check with your local CLF for specific submission methods.

Tracking your application

Understanding the review process can alleviate anxiety for applicants. Generally, the timeline for review varies, but many CLFs communicate expected decision dates. Be proactive by following up with the contact person listed in your application and checking your email regularly for updates.

Using online tools offered by some CLFs, you can also track your application status. This feature allows you to stay informed about any additional requests for information and helps in planning your next steps toward project implementation.

Financial assistance and resources

In addition to loans, Community Loan Funds often provide access to various grants and funding opportunities. These grants may be targeted toward specific community projects, such as environmental initiatives or educational programs. It’s essential to familiarize yourself with eligibility criteria for each grant and apply accordingly.

Moreover, many CLFs offer technical assistance and consultation services. This support can range from business planning to financial literacy programs. Do not hesitate to reach out to local CLF representatives who can provide valuable guidance as you navigate the funding landscape.

Staying informed and engaged

Remaining informed about the latest news and updates related to the Community Loan Fund is crucial for current and prospective applicants. Subscribing to newsletters, attending workshops, and participating in community meetings can keep you in the loop regarding new funding opportunities and program changes.

Additionally, engaging with the community through feedback channels allows applicants to share their experiences. This exchange can provide valuable insights into common challenges faced during the application process and help shape future improvements in funding procedures.

Conclusion: Empowering change through the Community Loan Fund

Successfully completing the Community Loan Fund Honored Form can unlock opportunities for transformative community development. With proper preparation and attention to detail, applicants can articulate their vision and boost their chances of receiving the funding necessary to initiate impactful projects.

Sharing your success story after receiving funding not only adds credibility to your application but also inspires others within your community to take initiative. By using the Community Loan Fund effectively, you contribute to a larger movement of empowerment and positive change.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get community loan fund honored?

How do I make changes in community loan fund honored?

How do I edit community loan fund honored in Chrome?

What is community loan fund honored?

Who is required to file community loan fund honored?

How to fill out community loan fund honored?

What is the purpose of community loan fund honored?

What information must be reported on community loan fund honored?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.