Get the free Overdrafts FAQs: Balance Connect, Limits, Fees & Settings

Get, Create, Make and Sign overdrafts faqs balance connect

How to edit overdrafts faqs balance connect online

Uncompromising security for your PDF editing and eSignature needs

How to fill out overdrafts faqs balance connect

How to fill out overdrafts faqs balance connect

Who needs overdrafts faqs balance connect?

Overdrafts FAQs: Balance Connect Form Explained

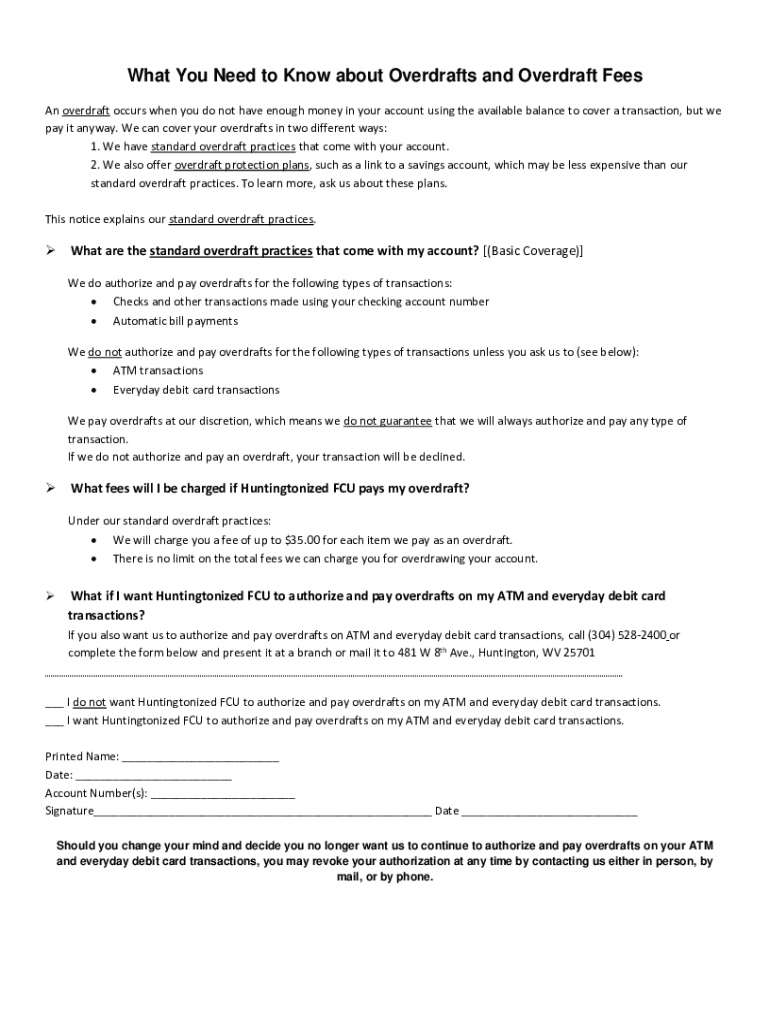

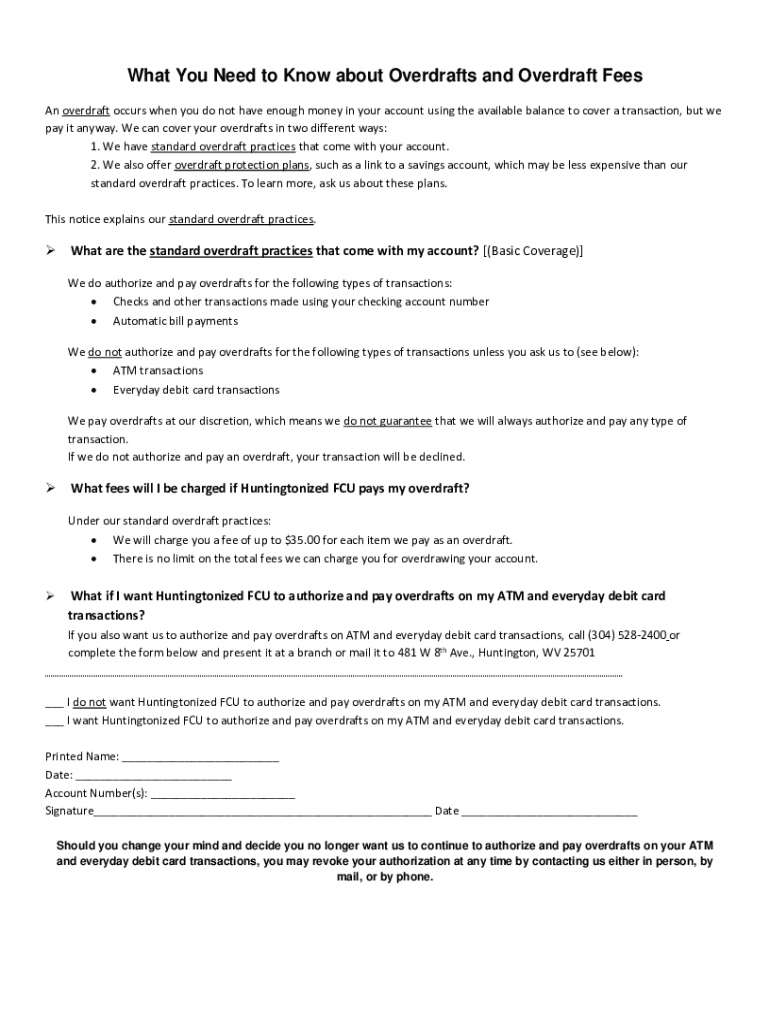

Understanding overdrafts

An overdraft occurs when you withdraw more money from your bank account than what is available. This financial tool can help cover temporary shortages in funds, making it crucial for personal finance management. Understanding the types of overdrafts is essential for maximizing its benefits while minimizing its risks.

In personal finance, overdrafts can serve as temporary cash flow solutions, particularly in emergencies. However, one must recognize both the benefits, such as access to emergency funds, and the risks, including accumulating fees and potential damage to your credit score.

Overdraft FAQs

Understanding frequently asked questions about overdrafts can clarify concerns and help you utilize this financial tool effectively.

It’s important to note the eligibility requirements for overdrafts. Typically, you must have an active account in good standing, and your bank may consider factors such as your credit history and income level.

Managing your overdraft

Managing your overdraft effectively is key to maintaining financial health. Simple strategies can help you avoid unnecessary overdrafts and associated fees.

Customizing alert settings in your banking app can provide an added layer of control. Alerts can help you take timely actions when your funds dwindle, reducing the chances of incurring costly overdraft fees.

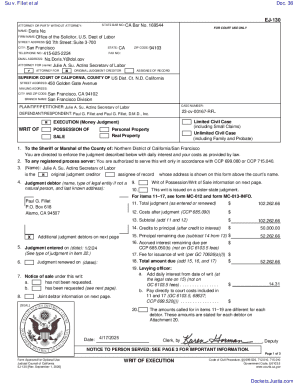

How to apply for an overdraft

Applying for an overdraft can be straightforward if you follow the right steps. Here’s a streamlined process to help you get started.

For those who prefer a more personal touch, banks often provide the option to apply over the phone or in-branch, where you can ask any questions directly and receive immediate assistance.

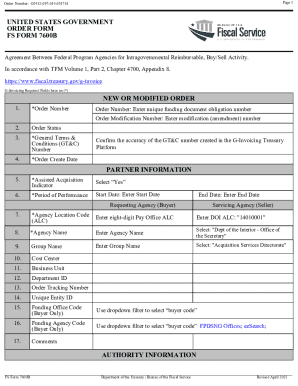

Specific forms and templates

The Overdraft Balance Connect Form is a key document that allows you to manage your overdraft efficiently.

Utilizing tools like pdfFiller, you can easily edit and collaborate on this form, making the entire process more efficient. Secure e-signature options are also available, ensuring your data remains protected.

Real-life scenarios of overdraft use

Exploring real-life scenarios can provide valuable lessons on the effective use of overdrafts. Consider the following examples:

These scenarios illustrate the potential advantages and pitfalls of overdraft usage. Proper management and understanding of the conditions can lead to success, while carelessness can result in negative outcomes.

Resources for overdraft education

Education in financial management is critical. Many resources are available to help you navigate overdrafts successfully.

If you have more questions or need personalized assistance, reaching out to a banker or a financial advisor can provide tailored advice and insights.

Evaluating your overdraft options

Deciding whether an overdraft is suitable for you requires careful thought.

Evaluating these factors can help prevent potential financial strain and determine whether overdrafts align with your financial goals.

Innovations in overdraft management

Digital banking has revolutionized the way individuals manage overdrafts, making it easier to access funds and monitor spending.

These technological innovations are making overdraft access more user-friendly and transparent, which can lead to better financial decisions.

Customer care and support

If you have questions regarding overdrafts or need support in navigating your options, various customer care channels are available.

Utilizing these resources wisely can enhance your banking experience and help you manage your financial affairs more effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get overdrafts faqs balance connect?

Can I create an eSignature for the overdrafts faqs balance connect in Gmail?

How do I complete overdrafts faqs balance connect on an Android device?

What is overdrafts faqs balance connect?

Who is required to file overdrafts faqs balance connect?

How to fill out overdrafts faqs balance connect?

What is the purpose of overdrafts faqs balance connect?

What information must be reported on overdrafts faqs balance connect?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.