Get the free Chapter 4 Status (FATCA status) (See instructions for details and complete the certi...

Get, Create, Make and Sign chapter 4 status fatca

Editing chapter 4 status fatca online

Uncompromising security for your PDF editing and eSignature needs

How to fill out chapter 4 status fatca

How to fill out chapter 4 status fatca

Who needs chapter 4 status fatca?

Chapter 4 Status FATCA Form: A Comprehensive Guide

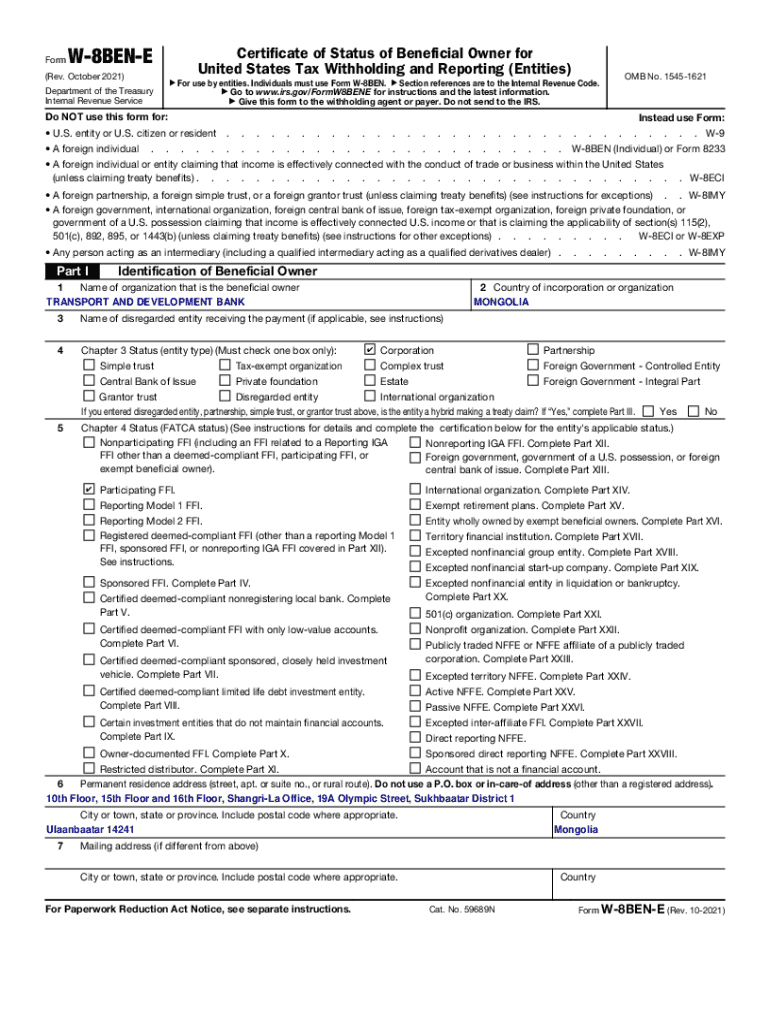

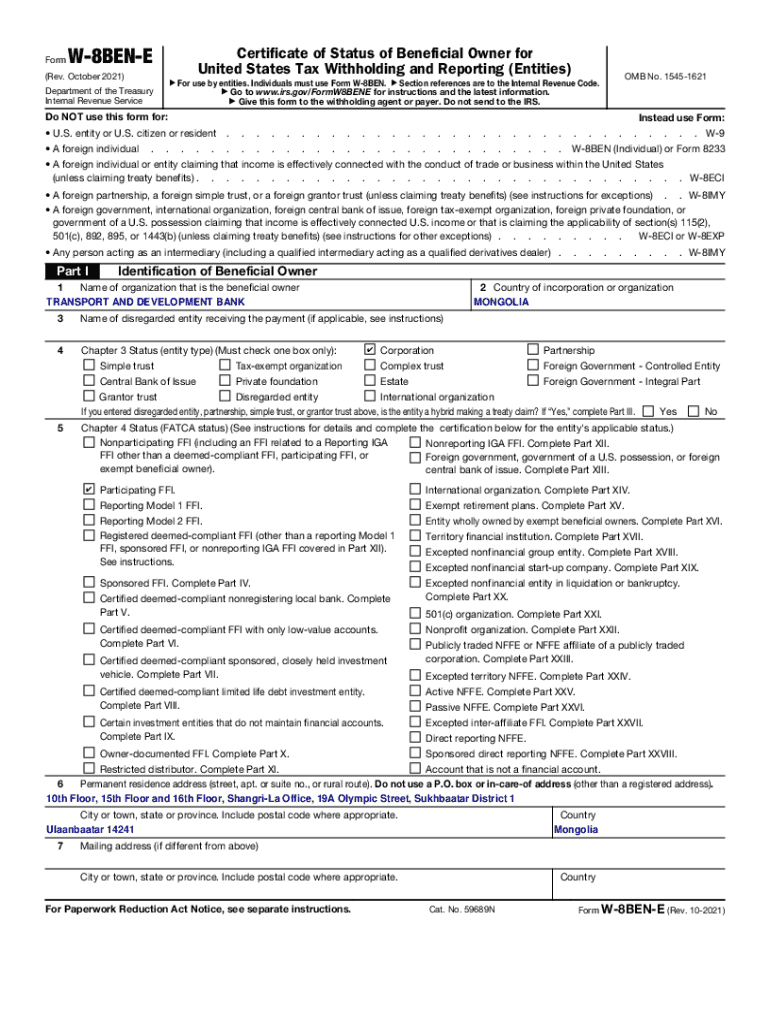

Understanding the FATCA form: Chapter 4 status

The Foreign Account Tax Compliance Act (FATCA) was enacted to promote transparency in international financial transactions and combat tax evasion by U.S. taxpayers with foreign accounts. The chapter 4 status FATCA form is critical for individuals and entities to report their financial status and ensure compliance with U.S. tax laws. Its primary purpose is to collect information about foreign entities and their beneficial owners to assist in determining potential tax liabilities.

Chapter 4 status specifically pertains to the classification of entities under FATCA, significantly influencing reporting obligations. Correctly identifying an entity's status streamlines the compliance process, reducing potential penalties associated with filing inaccuracies.

Key terminology in FATCA compliance

Understanding the terminology used within the context of FATCA is crucial for accurately navigating the chapter 4 status FATCA form. Two terms frequently encountered are Active NFFE and Passive NFFE, both of which define types of foreign entities based on their income sources. An Active Non-Financial Foreign Entity (Active NFFE) earns primarily non-passive income, often through business operations, while a Passive NFFE typically gets most of its income from passive sources like dividends or interest.

Who needs to complete the chapter 4 status FATCA form?

Individuals and entities involved in foreign financial operations must complete the chapter 4 status FATCA form. U.S. persons, whether individuals or corporations, with foreign accounts or partnerships must comply with these reporting requirements. Foreign financial institutions (FFIs) are also mandated to report their account holders who are U.S. taxpayers, adding an additional layer of complexity.

Certain exemptions exist, such as for small and low-risk entities, but these are case-specific and should be evaluated with care to avoid penalties. Due diligence should be exercised to ensure accurate classification and ultimate compliance.

Step-by-step guide to filling out the chapter 4 status FATCA form

Filling out the chapter 4 status FATCA form can seem daunting, yet following a systematic approach simplifies the process. Begin by gathering essential information like organization details and tax identification numbers. Ensure you have a clear understanding of the entity’s structure, as this information influences how you'll complete each section of the form.

Each section of the form demands specific details. Start with the name of the organization and the country of incorporation. Subsequently, you will need to certify Chapter 4 status. Depending on the classification, this entails either an Active NFFE certification or a Passive NFFE certification.

Lastly, attention to detail is paramount. Double-check the information for accuracy to avoid costly mistakes, which can lead to delays or penalties.

Managing your chapter 4 status FATCA form submission

After completing the chapter 4 status FATCA form, review all information before submission. Utilizing tools like pdfFiller streamlines the editing process, allowing for easy corrections or adjustments as needed. If you’re utilizing their platform, take advantage of available features such as legal eSignatures, which help ensure that your form meets all legal requirements for submission.

When submitting your FATCA form, consider the delivery options available, including electronic submissions through IRS e-filing or mail through standard postal services. Familiarize yourself with the format requirements whether you are submitting in pdf or another prescribed format.

What happens after submitting your FATCA form?

Once your chapter 4 status FATCA form is submitted, you can expect an acknowledgment of receipt from the IRS or the financial institution to which you submitted the form. This acknowledgment is crucial as it serves as proof of compliance.

Be prepared for potential follow-ups from the IRS or financial institutions, as they may request additional information or documentation to complete their due diligence process. Keeping your records organized will facilitate any requested follow-ups.

Best practices for compliance and record-keeping

Maintaining meticulous records is vital to ensure compliance with FATCA regulations. Keep accurate documentation of all submitted forms, as well as any correspondence from financial institutions or tax authorities. Establish a well-organized filing system (digital or otherwise) to access these documents when necessary.

It's also essential to monitor the validity of your chapter 4 status information. Entities must reevaluate and potentially revise their FATCA form as their circumstances change, ensuring timely updates to avoid lapses in compliance.

Common FAQs related to chapter 4 status FATCA forms

Understanding common questions surrounding the chapter 4 status FATCA form can ease the process. If your status changes, you must update and resubmit your form. Frequently, entities wonder how often they should resubmit; generally, it’s recommended every three years or whenever there are significant changes in circumstances.

Non-compliance can lead to severe consequences, including financial penalties or increased scrutiny from tax authorities. Thus, staying informed and proactive in managing your FATCA obligations cannot be overstated.

Leveraging technology for effective management of FATCA forms

Harnessing technology can simplify FATCA form management significantly. pdfFiller provides an array of tools designed to enhance the document management process, offering an easy-to-use interface for creating, editing, and signing documents online. This flexibility ensures that users can efficiently handle their paperwork from anywhere, a crucial feature for managing international obligations.

Employing interactive tools for document collaboration can facilitate team efforts in managing FATCA compliance, ensuring all stakeholders are on the same page. Easily accessible, cloud-based solutions allow users to retrieve and edit documents in real-time, essential for maintaining organizational efficacy.

Contact us for further assistance

If you're still uncertain about completing the chapter 4 status FATCA form or navigating the complexities of FATCA compliance, pdfFiller is here to help. Our experts are available to assist you, ensuring that you have access to educational resources, tutorials, and expert support for all your FATCA needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send chapter 4 status fatca to be eSigned by others?

How do I fill out chapter 4 status fatca using my mobile device?

How do I complete chapter 4 status fatca on an iOS device?

What is chapter 4 status fatca?

Who is required to file chapter 4 status fatca?

How to fill out chapter 4 status fatca?

What is the purpose of chapter 4 status fatca?

What information must be reported on chapter 4 status fatca?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.