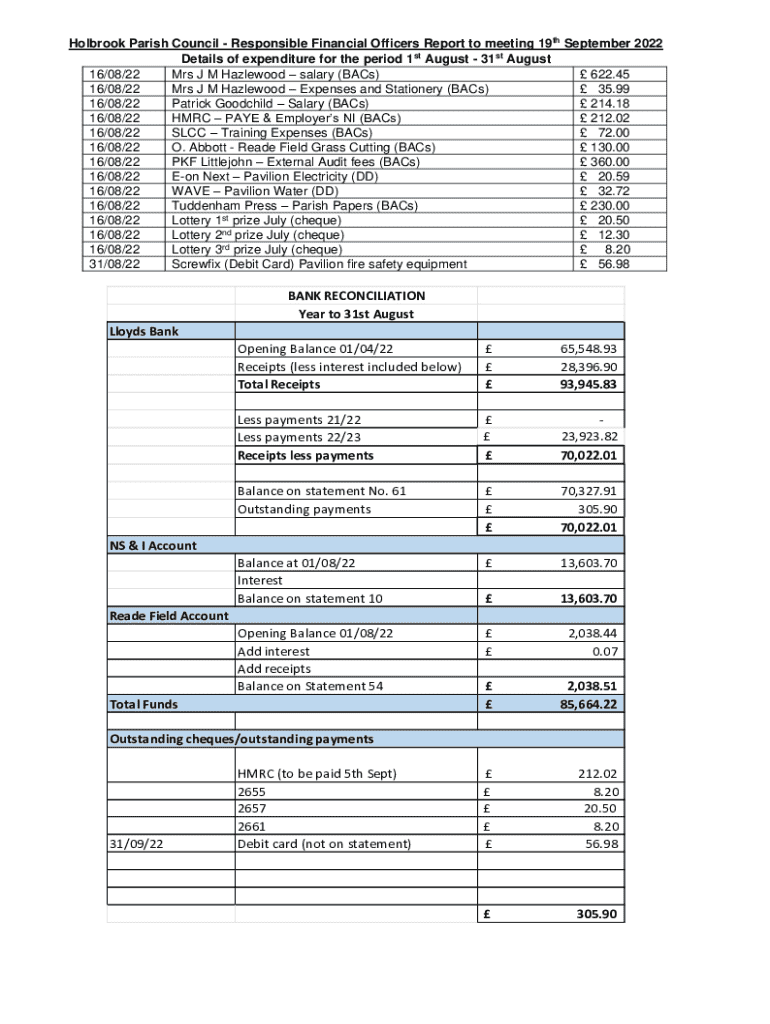

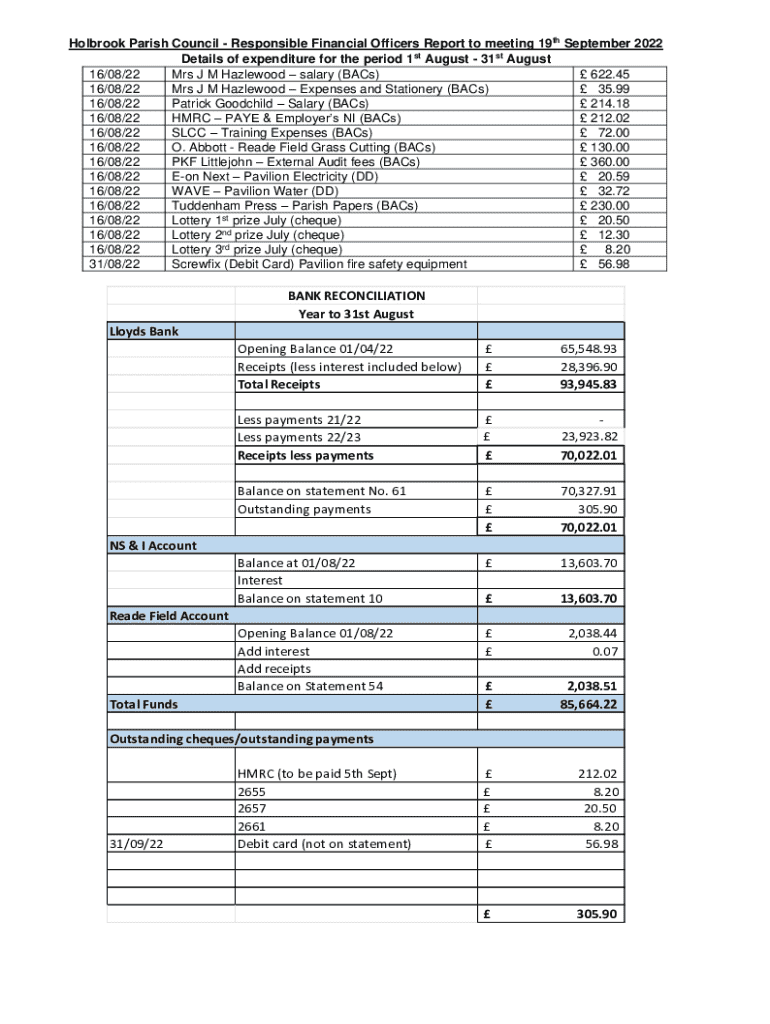

Get the free BANK RECONCILIATION Year to 31st August Lloyds ... - Holbrook

Get, Create, Make and Sign bank reconciliation year to

Editing bank reconciliation year to online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bank reconciliation year to

How to fill out bank reconciliation year to

Who needs bank reconciliation year to?

Comprehensive Guide to Bank Reconciliation Year to Form

Understanding bank reconciliation

Bank reconciliation is the process of matching and comparing the transactions recorded in a company’s financial books with those listed in the bank statement. This ensures that any discrepancies are identified and resolved, keeping financial records precise and up to date. Regular bank reconciliation plays a crucial role in effective financial management, as it reveals errors, prevents fraud, and assists in budgeting.

The significance of bank reconciliation cannot be overstated. By conducting this process regularly, businesses can maintain accurate cash flow data, enabling better decision-making. Key terms associated with bank reconciliation include 'bank statement,' 'outstanding checks,' 'deposits in transit,' and 'adjusted bank balance.'

Reasons for discrepancies in bank reconciliation

Discrepancies between bank statements and company records can arise for various reasons. Common causes include timing differences, where transactions are recorded in one period but processed in another, resulting in mismatched balances. Additionally, banks may charge fees or apply interest that has not yet been recorded in the company’s books, further complicating reconciliation.

Understanding these discrepancies is essential for accurate financial tracking; failing to do so can lead to misleading financial information. Banks also have policies regarding processing times that can impact the company’s cash balance, so identifying bank fees and charges is a vital part of the reconciliation process.

The bank reconciliation process

The bank reconciliation process involves several key steps to ensure clarity and accuracy. The first step is gathering all necessary documents, including the bank statement and the company's cash book. Following this, reviewing bank statements meticulously to understand recorded transactions is crucial.

Next, compare the company records with the bank data. Any discrepancies found should be documented for further investigation. Adjusting entries for corrections should be made accordingly, ensuring any misrecorded transactions are rectified. Finally, finalize the reconciliation statement by ensuring all discrepancies have been addressed and the balances match.

Example of a bank reconciliation statement

To illustrate how bank reconciliation works, consider a sample reconciliation statement. Begin by listing the bank balance as per the bank statement, followed by documented outstanding checks and deposits in transit. Subtract outstanding checks from the bank balance and add any deposits in transit to calculate the adjusted bank balance.

Understanding the common line items in such a statement is essential. They typically include the bank balance, adjustments for outstanding checks, deposits in transit, and the reconciled balance. To ensure clarity, creators should aim for structure and conciseness while documenting transactions and adjustments.

Automation in bank reconciliation

Automating the bank reconciliation process offers numerous benefits, significantly increasing efficiency and saving time. With real-time updates, businesses can track their cash position with greater accuracy. Moreover, integration of data reduces errors, making the reconciliation process more reliable.

pdfFiller enhances automated bank reconciliation by providing interactive tools for document management. Users benefit from seamless collaboration and eSigning capabilities, which streamline the reconciliation workflow and provide access to necessary documents anywhere, anytime.

Common errors to avoid in bank reconciliation

There are several common errors that can derail the bank reconciliation process. Failing to record all transactions leads to incomplete records, while misrecording transactions can result in significant discrepancies. Ignoring bank fees and charges or misstarting balance can further complicate reconciliations. Overlooking discrepancies is particularly detrimental, as is neglecting to review reconciliation reports regularly.

Step-by-step guide to performing bank reconciliation

Performing bank reconciliation can be simplified through a step-by-step approach. Start by collecting all financial records and bank statements. Then review all transactions thoroughly. Identify any discrepancies or unusual transactions that may require investigation. Document all findings comprehensively and prepare adjusting entries to reconcile the differences. Continue to finalize your reconciliation statement carefully to ensure accuracy is maintained.

To enhance this process, utilize interactive templates and tools provided by pdfFiller, which assist with document editing as well as eSignature options. Streamlining documentation in this manner saves time and minimizes potential errors.

Frequency of bank reconciliation

Determining the frequency of bank reconciliation is essential for maintaining accurate records. Although some businesses opt for monthly reconciliations, others may choose to conduct them quarterly or annually, depending on the volume of transactions. Factors influencing the frequency include transaction volume, cash flow variability, and financial management needs.

Monthly reconciliations are often recommended for businesses with numerous transactions, as they allow for early detection of discrepancies. On the other hand, annual reconciliations may be more appropriate for smaller businesses with fewer transactional activities.

Advanced techniques for streamlining bank reconciliation

To further streamline bank reconciliation, businesses can implement advanced techniques such as documenting and standardizing the reconciliation process. Establishing clear workflow procedures helps minimize bottlenecks and ensures a consistent approach to bank reconciliation. Leveraging technology also enhances efficiency; automating routine tasks where possible frees up valuable time for teams.

Utilizing platforms like pdfFiller provides an efficient means of managing documentation and streamlining the reconciliation process, ensuring that all data is accessible and standardized for all users involved.

FAQs about bank reconciliation

Related articles and resources

For those looking to enhance their knowledge further, there are many resources available on finance and accounting best practices. These can help in understanding various aspects of financial management, including document management techniques necessary for ensuring financial accuracy.

The future of bank reconciliations points toward greater integration of technology, which will likely facilitate more streamlined processes and allow for real-time financial tracking.

Contact an expert

If you need further assistance, pdfFiller provides opportunities to consult with financial experts. Whether you’re looking for tailored solutions or on-demand demos and webinars, a wealth of resources and expertise is available to support you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send bank reconciliation year to for eSignature?

How can I edit bank reconciliation year to on a smartphone?

How can I fill out bank reconciliation year to on an iOS device?

What is bank reconciliation year to?

Who is required to file bank reconciliation year to?

How to fill out bank reconciliation year to?

What is the purpose of bank reconciliation year to?

What information must be reported on bank reconciliation year to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.