Get the free Insurance Intermediary Information

Get, Create, Make and Sign insurance intermediary information

Editing insurance intermediary information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out insurance intermediary information

How to fill out insurance intermediary information

Who needs insurance intermediary information?

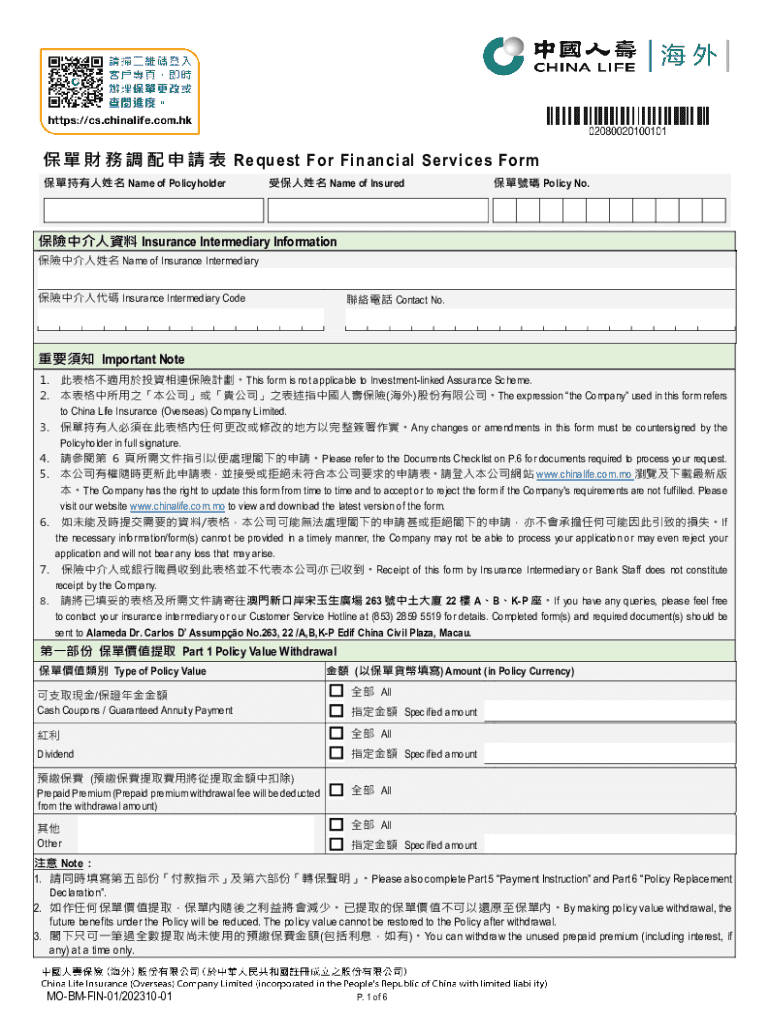

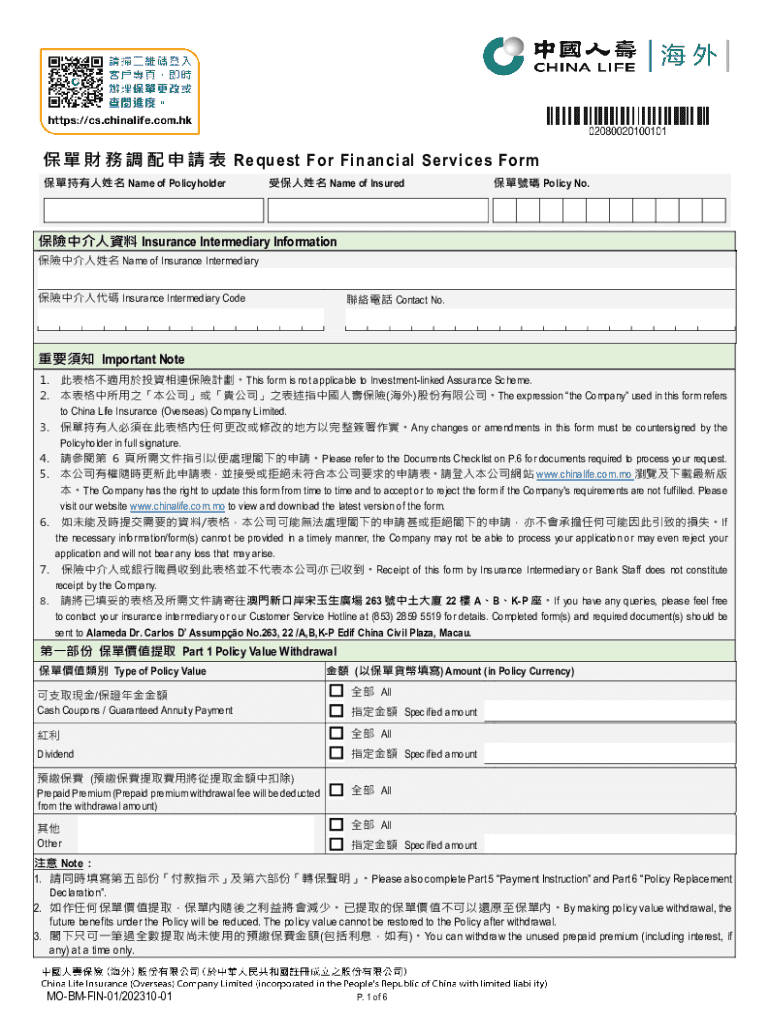

Understanding the Insurance Intermediary Information Form

1. Understanding the Insurance Intermediary Information Form

The Insurance Intermediary Information Form serves as a critical document within the insurance sector. This form is designed to collect pertinent data about insurance intermediaries, such as agents and brokers, who are involved in the transaction of insurance policies. By standardizing the information requested, the form enhances transparency and helps to maintain regulatory compliance across the industry.

Its importance cannot be overstated; it acts as a backbone for the registration and oversight of intermediaries, ensuring they meet necessary legal and ethical standards. Moreover, organizations often rely on this information to vet intermediaries and ensure they align with their operational framework, making the form not just a formality, but a key component in maintaining a trustworthy environment for both clients and service providers.

So, who exactly needs to fill out this form? Primarily, it is intended for licensed insurance agents, brokers, and possibly company representatives who facilitate the selling of insurance products. In some jurisdictions, even independent agents who work on a commission basis may be required to submit this form to satisfy regulatory bodies.

2. Components of the Insurance Intermediary Information Form

The Insurance Intermediary Information Form is segmented into several essential components, each designed to capture a specific category of information crucial for evaluating an intermediary's qualifications and compliance capabilities.

Each component plays a pivotal role in assessing the intermediary's professional credibility and ensuring that they adhere to the regulatory standards mandated by governing bodies. It’s critical that all sections are filled with accurate and up-to-date information.

3. Steps to Fill Out the Insurance Intermediary Information Form

Filling out the Insurance Intermediary Information Form requires careful preparation and methodical execution. Following a systematic approach can simplify the process, ensuring that all necessary information is correctly provided.

Attention to detail is paramount during the submission process. Even small errors can lead to delays or issues with your intermediary status.

4. Advanced features of pdfFiller for managing your Insurance Intermediary form

One of the standout tools for managing the Insurance Intermediary Information Form is pdfFiller. This platform offers advanced functionalities that facilitate easy filling, editing, and collaboration on the document.

These features not only elevate the document management process but also ensure that all parties involved can contribute effectively without the hassle of traditional paper methods.

5. Managing your Insurance Intermediary Information Form after submission

After successfully submitting the Insurance Intermediary Information Form, ongoing management of your submission becomes important. Tracking progress and maintaining up-to-date information are both aspects that can impact your role as an insurance intermediary.

When changes occur, efficiently adjusting your profile ensures compliance, thereby preserving your ability to operate within the industry.

6. Frequently asked questions

Common inquiries regarding the Insurance Intermediary Information Form reveal many nuances in its application. It's essential to clarify these frequently asked questions for a smoother submission experience.

Addressing these common questions helps set expectations and reduces anxiety around the form-filling process.

7. Best practices for filling out the Insurance Intermediary Information Form

Industry best practices offer invaluable insights for effectively filling out the Insurance Intermediary Information Form. Following these can minimize errors and ensure compliance.

By implementing these best practices, insurance intermediaries can significantly reduce the likelihood of errors and enhance their professional credibility.

8. Utilizing pdfFiller for other related forms

pdfFiller isn’t just ideal for the Insurance Intermediary Information Form; it also provides templates for various other related documents. This functionality creates a holistic solution for document management.

By leveraging pdfFiller’s extensive capabilities, individuals and teams can improve their document management processes and boost overall efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify insurance intermediary information without leaving Google Drive?

How can I edit insurance intermediary information on a smartphone?

How do I edit insurance intermediary information on an iOS device?

What is insurance intermediary information?

Who is required to file insurance intermediary information?

How to fill out insurance intermediary information?

What is the purpose of insurance intermediary information?

What information must be reported on insurance intermediary information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.