Get the free Insurance - Consumer Protection Code

Get, Create, Make and Sign insurance - consumer protection

Editing insurance - consumer protection online

Uncompromising security for your PDF editing and eSignature needs

How to fill out insurance - consumer protection

How to fill out insurance - consumer protection

Who needs insurance - consumer protection?

Insurance - Consumer Protection Form: A Comprehensive Guide

Understanding consumer protection in insurance

Consumer protection in the insurance sector refers to the safeguards in place that protect policyholders from unfair practices by insurance companies. It ensures that consumers are treated fairly, receive the coverage they pay for, and have recourse if things go wrong.

The consumer protection form is a critical element of this landscape, acting as a channel for policyholders to express their grievances and seek resolutions. It empowers consumers by providing structured avenues to address issues like claims denials and premium disputes, thus fostering a transparent and fair insurance marketplace.

Overview of the consumer protection form

The consumer protection form serves as a pivotal tool for addressing disputes with insurance companies. Its primary purpose is to assist consumers in presenting their claims formally, ensuring that their grievances are recognized and acted upon appropriately. This form addresses several common issues, such as claims denials, premium disputes, and policy non-renewals, offering a streamlined process for consumers to make their voices heard.

Knowing when to use the consumer protection form is essential; it should be submitted when informal resolutions, such as direct communication with the insurance provider, fail. By capturing the issue in this formalized manner, consumers can escalate their complaints to regulatory bodies if necessary, enhancing the likelihood of a resolution.

Preparing to complete the consumer protection form

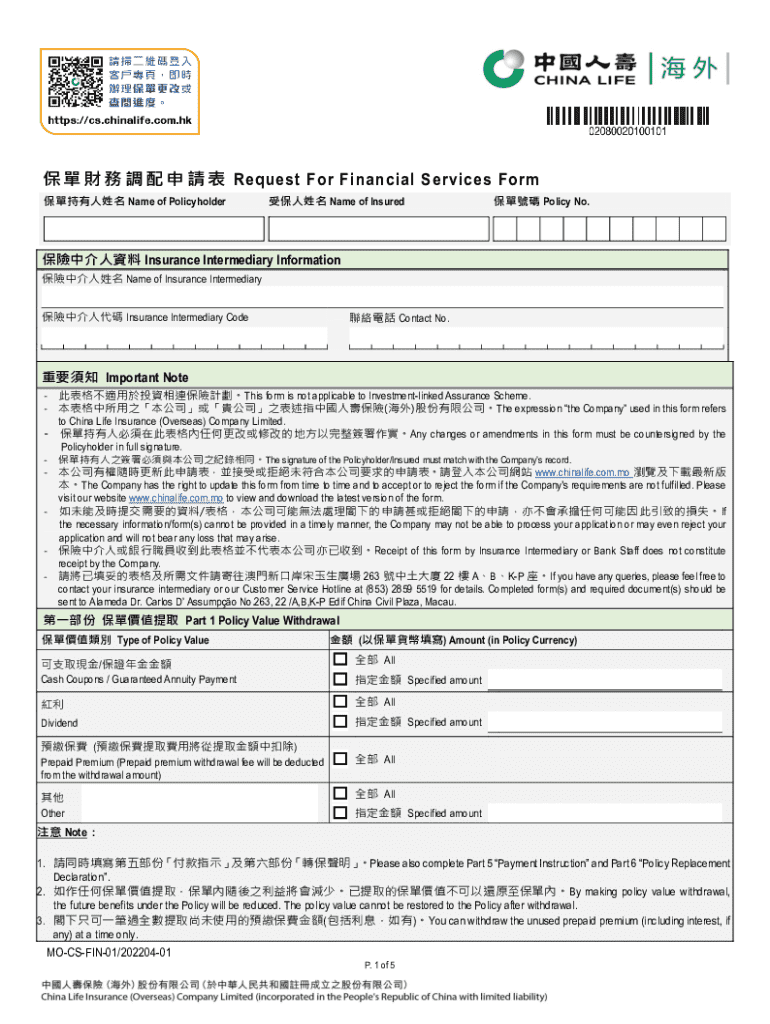

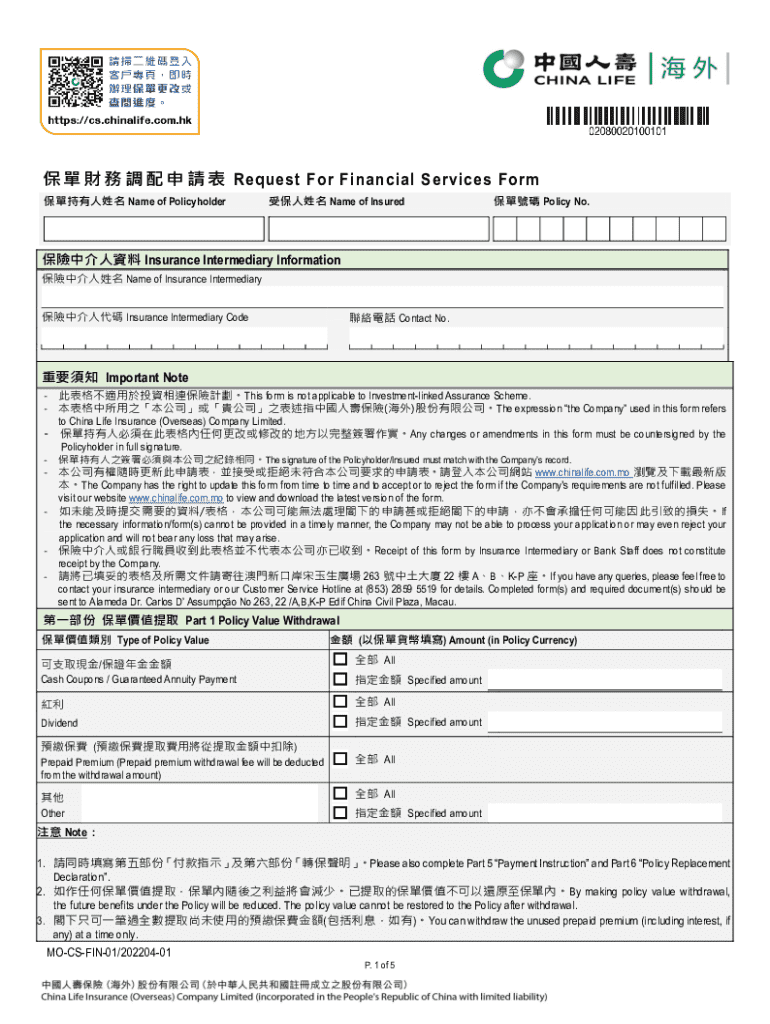

Before you get started on the consumer protection form, it's crucial to gather all necessary information and documentation. This includes personal details like your name, address, and policy number. Documentation should encompass your insurance policies, any correspondence related to the issue, and previous communication with the insurance company. Collecting these documents beforehand will help ensure that your complaint is well-supported and clear.

Assessing the nature of your complaint is equally important. You need to determine whether your issue falls within the scope of typical consumer complaints, such as inappropriate claims handling or unjustified premium increases. Familiarizing yourself with eligibility criteria is key to ensuring your form submission is valid and adheres to guidelines set forth by regulatory bodies.

Step-by-step guide to filling out the consumer protection form

Filling out the consumer protection form can seem daunting, but breaking it down into sections can simplify the process. Here’s a step-by-step guide to help you through:

Interactive tools for assistance

Utilizing technology can significantly ease the process of completing the consumer protection form. For instance, pdfFiller offers interactive fillable forms that guide you through each step seamlessly. You can easily edit your entries and eSign the document digitally, speeding up the submission process.

Additionally, accessing FAQs and troubleshooting tips through pdfFiller can provide instant assistance and clarify any uncertainties you might have during the form-filling process.

Submitting your consumer protection form

Submitting your completed consumer protection form is the next crucial step in addressing your complaint. There are mainly two options available for submission: online or via mail. If submitting online, follow the specific procedures outlined by your insurer or relevant regulatory agency.

If you choose to mail your form, ensure you follow the postal instructions carefully to avoid delays. Successful submission also requires you to keep a copy of the submitted form and any correspondence for your records, confirming that your complaint was received. Tracking your submission can be vital, particularly if it was sent via registered mail.

After filing: what to expect

Once you’ve filed your consumer protection form, be prepared for a waiting period as your complaint is processed. The timeline can vary, depending on the insurer and the complexity of your complaint. It's essential to familiarize yourself with their communication protocols, which should outline how they will notify you of any updates or actions taken regarding your issue.

If you don’t hear back within the expected timeframe, don’t hesitate to follow up. Bringing awareness to your case aids in keeping it prioritized as it goes through the processing chain.

Resolution options if your complaint is not addressed

Should your complaint not be satisfactorily addressed, it’s vital to understand your rights as a consumer. This may include seeking alternative dispute resolution (ADR) processes, such as mediation or arbitration, which can provide less formal avenues to resolve complaints without involving the court system.

Additionally, consider contacting regulatory agencies relevant to your state or country to escalate unresolved issues. These agencies can provide oversight and support in navigating your complaint, ensuring that your rights are enforced.

Additional support and resources

Accessing further information on consumer rights in insurance is crucial for staying informed. Many organizations provide resources, guidelines, and support networks designed to assist consumers dealing with insurance issues. Familiarize yourself with these platforms, as they can provide valuable insights into your rights and effective communication strategies with insurance providers.

Online support networks, forums, and advocacy groups can also serve as excellent resources to share experiences, find advice, and strengthen your understanding of consumer protections in insurance.

Frequently asked questions (FAQs)

Navigating the consumer protection form can raise several questions for policyholders. Common queries involve specific procedures to follow, the types of complaints that are acceptable, and misconceptions about the claims process. Many policyholders also seek clarity on their legal rights within consumer protection cases.

Ensuring you have the right answers to these FAQs can empower you as you navigate your insurance experience. Don't hesitate to consult resources available through pdfFiller and other trusted platforms to find comprehensive answers to your questions.

Tips for effective communication with your insurance company

To effectively communicate with your insurance company, preparation is key. Have a list of important questions ready before you make any calls or face-to-face meetings with representatives. Key questions might include clarifications on your policy details, reasons for complaint resolution, and available steps to escalate your complaints.

Make sure to have documentation on hand, such as your policy documents and previous correspondence that relates directly to your complaint. This not only aids in presenting a well-supported case but demonstrates your diligence in approaching the issue.

Utilizing pdfFiller to manage your documents

Managing your consumer protection form and related documents is simplified through pdfFiller, a cloud-based platform that allows seamless editing of PDFs and eSigning. You can access all necessary forms and collaborate on documents with ease, streamlining your overall experience.

With pdfFiller, keeping track of multiple versions of your forms is easy. The platform supports cloud access, enabling you to manage your documents anytime, anywhere, thus empowering you to stay organized and prepared throughout the complaint resolution process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify insurance - consumer protection without leaving Google Drive?

How do I edit insurance - consumer protection online?

How do I complete insurance - consumer protection on an iOS device?

What is insurance - consumer protection?

Who is required to file insurance - consumer protection?

How to fill out insurance - consumer protection?

What is the purpose of insurance - consumer protection?

What information must be reported on insurance - consumer protection?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.