Get the free State Bank Of India vs Jai Balaji Industries Ltd. & Ors on 8 ...

Get, Create, Make and Sign state bank of india

How to edit state bank of india online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state bank of india

How to fill out state bank of india

Who needs state bank of india?

State Bank of India Form - How-to Guide Long Read

Overview of State Bank of India forms

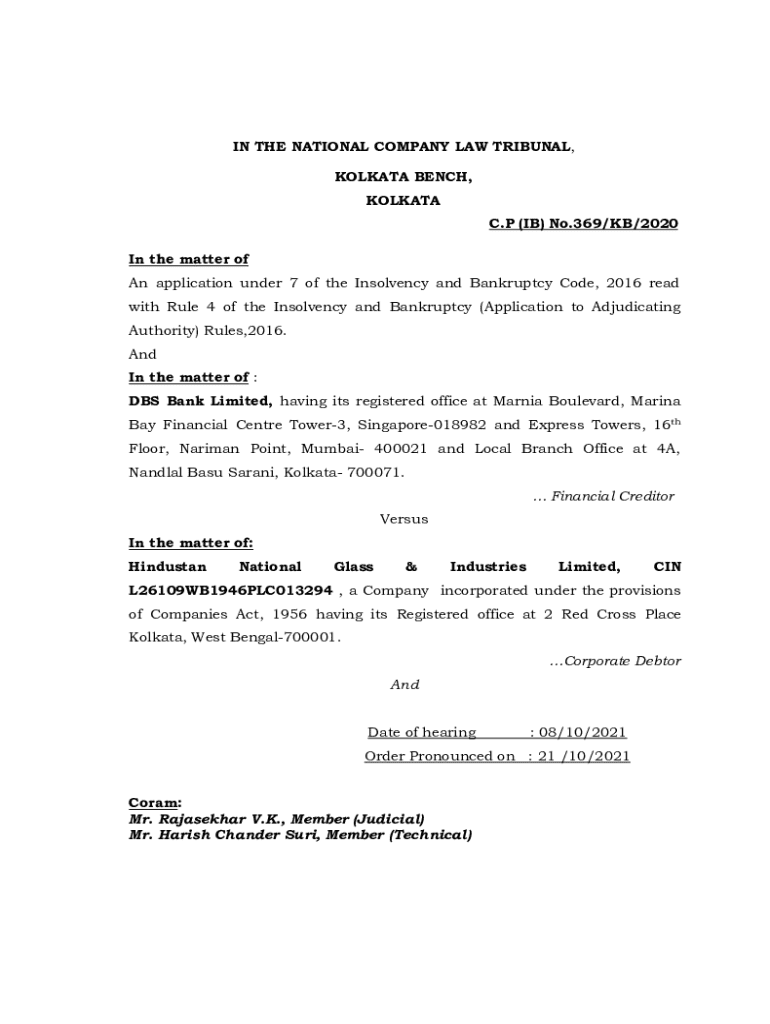

Forms are a critical part of banking operations, serving as an essential means of communication between customers and institutions. The State Bank of India (SBI), one of the largest public sector banks in India, uses various forms to streamline its services, ensuring customer needs are met efficiently. These forms not only facilitate transactions but also serve as official documentation for various banking processes.

The range of forms provided by SBI includes account opening forms, loan application forms, and fund transfer forms, among others. Each form is designed to collect specific information pertinent to the service being requested, making it imperative that customers fill them out correctly to avoid delays or complications.

Proper completion of these forms ensures the bank can process requests promptly, maintaining account accuracy and integrity. Understanding the significance of each form prepares customers to navigate their banking experience more smoothly.

Understanding specific State Bank of India forms

Diving deeper into the specific types of forms utilized by SBI reveals how each serves unique customer needs. Understanding these forms can significantly enhance the banking experience by ensuring that the correct information is submitted for each financial transaction or service.

For example, the Account Opening Form is crucial for new customers enrolling in banking services, while the Loan Application Form caters to those seeking financial assistance. Additionally, relocating customers must use the Change of Address Form to keep their bank records accurate, and individuals making transfers should be familiar with the Fund Transfer Form.

Each of these forms requires specific details to be filled out accurately. For instance, the loan application will typically ask for financial details, employment information, and contact details. Understanding what is needed can prevent unnecessary back-and-forth communication with the bank.

How to access State Bank of India forms

Accessing State Bank of India forms is straightforward. Whether you prefer to do this online or in person, SBI makes it easy for customers to obtain the necessary paperwork for their banking needs.

For online access, customers can easily navigate the official SBI website. The user-friendly interface allows visitors to find forms quickly. Utilizing the site's search function with keywords such as 'form' or 'application' will direct users to the relevant resources.

If you prefer obtaining forms physically, visit your nearest SBI branch. All branches are equipped with the necessary forms for customer requests and transactions. Should you need assistance, the bank staff can provide guidance on which form to use for your desired service.

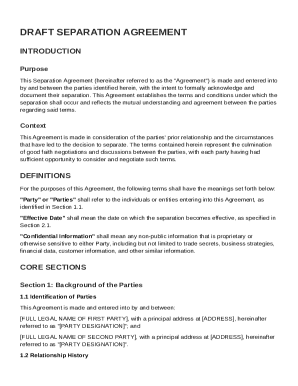

Detailed instructions for filling out forms

Filling out SBI forms may seem daunting, but with a structured approach, it becomes manageable. Start by reading the entire form to understand what information is required. This initial review helps identify which documents may be needed for reference.

As you begin to fill out the form, ensure that you use clear handwriting or type the information if it's a digital form. Always double-check spelling, especially for names and addresses, as mistakes can lead to complications. Avoid common pitfalls such as leaving fields blank or providing vague details.

To further assist with filling out SBI forms, platforms like pdfFiller offer interactive tools that allow users to fill, edit, and manage forms seamlessly. These tools are highly valuable for individuals and businesses alike, enabling easy navigation and corrections during the filling process.

Editing and managing completed forms

Once your form is filled, you may need to modify or edit your information. Editing PDFs can be done easily using platforms like pdfFiller. The site offers a range of editing features that empower users to adjust any part of their forms as required.

Most forms may require an eSignature, especially for loan applications. This digital signature process is secure and convenient, eliminating the need for physical signatures in many cases. Users can follow a straightforward step-by-step guide to sign forms electronically on pdfFiller.

Utilizing pdfFiller not only makes editing convenient but also enhances your ability to manage multiple forms in one place. The platform's design focuses on user experience, making form handling efficient and straightforward.

Collaboration features for teams

For teams handling documents, collaborative features are invaluable. Managing forms as a team allows for better organization and more effective communication. Platforms like pdfFiller enhance this collaboration, enabling multiple users to work on forms simultaneously.

Collaboration tools available within pdfFiller allow users to share forms, leave comments, and track edits. This means that team members can collectively ensure that every detail is correct before submission, drastically reducing the likelihood of errors.

Enhanced teamwork fosters efficiency and accuracy, ultimately leading to better results in banking operations.

Submitting your form

After filling out your SBI form, the next critical step is submission. SBI provides various methods for form submission, ensuring that customers can choose the most convenient option for them. Whether you prefer online submission or in-person delivery, understanding your choices will make the process smoother.

Online submissions via the SBI website or mobile app can be quicker and allow for better tracking of your request. Alternatively, if you wish to submit forms physically, visiting a local SBI branch is advisable. Be sure to retain copies of submitted forms for your records.

To monitor the status of submitted forms, customers can inquire through the SBI helpline or track their application status via the website, adding an extra layer of convenience to the banking process.

Frequently asked questions

Navigating banking forms can prompt several questions from users. Many customers often inquire about the specifics of completing or submitting their forms. Common queries include how to retrieve a form after submission, what to do if a form is filled incorrectly, or how to change an application after it's been submitted.

For troubleshooting form-related issues, customers are encouraged to contact SBI's customer service. Moreover, the pdfFiller platform has extensive support documentation that can guide users through various challenges they may encounter.

Addressing these concerns will ensure a smoother experience with banking services, allowing customers to focus on their financial goals.

Additional services offered by State Bank of India

Beyond traditional banking services, SBI also embraces the digital era, offering various online banking options. These services integrate with form management, providing customers with a more comprehensive banking experience. From mobile banking to e-wallets, the digital suite complements the essential paperwork needed for banking transactions.

By integrating form management with online banking, customers can effectively track both transactions and documentation. Utilizing tools like pdfFiller enhances this synergy, allowing clients to manage forms effortlessly alongside their banking accounts.

This seamless connection between online banking and document management not only simplifies user experience but also enhances the efficiency of managing finance-related tasks.

Testimonials and user experiences

Real-world experiences from users illustrate the impact of efficient form management. Many customers have shared their success stories regarding the use of pdfFiller to expedite their dealings with SBI. Whether it be avoiding mistakes during form filling or expedient electronic signatures, the benefits are clear.

Users have expressed how pdfFiller streamlined their interactions with SBI, making the usually cumbersome process of filling out forms far more manageable. On platforms where collaboration is essential, teams report a significant boost in productivity and accuracy thanks to the intuitive design of pdfFiller.

Overall, testimonials show a trend of satisfaction and success, encouraging more users to adopt modern solutions like pdfFiller in their banking interactions.

Compliance and security considerations

When dealing with bank forms, security and compliance become critical factors. SBI emphasizes the importance of data security in handling customer information, which normally leads to stringent measures being implemented across their systems. Users should also be aware of regulations concerning data privacy.

Similarly, pdfFiller adheres to high standards of compliance, ensuring that users’ data is protected through encryption and secure access protocols. Understanding these considerations gives users peace of mind when submitting sensitive documents.

With data security at the forefront, customers can confidently engage in banking processes, knowing that their information is well protected.

Conclusion: empowering document management

The process of managing State Bank of India forms does not have to be overwhelming. With the aid of platforms like pdfFiller, customers can navigate the various forms with ease, ensuring their information is accurately represented and securely handled. This cloud-based solution maximizes efficiency, allowing users to focus on their financial goals rather than paperwork.

Ultimately, adopting a systematic approach to handling banking forms, paired with advanced tools for management, can significantly streamline one's banking experience. Embrace the efficiency of pdfFiller and take control of your document management to enjoy a more organized banking experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit state bank of india straight from my smartphone?

Can I edit state bank of india on an iOS device?

How do I fill out state bank of india on an Android device?

What is state bank of india?

Who is required to file state bank of india?

How to fill out state bank of india?

What is the purpose of state bank of india?

What information must be reported on state bank of india?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.