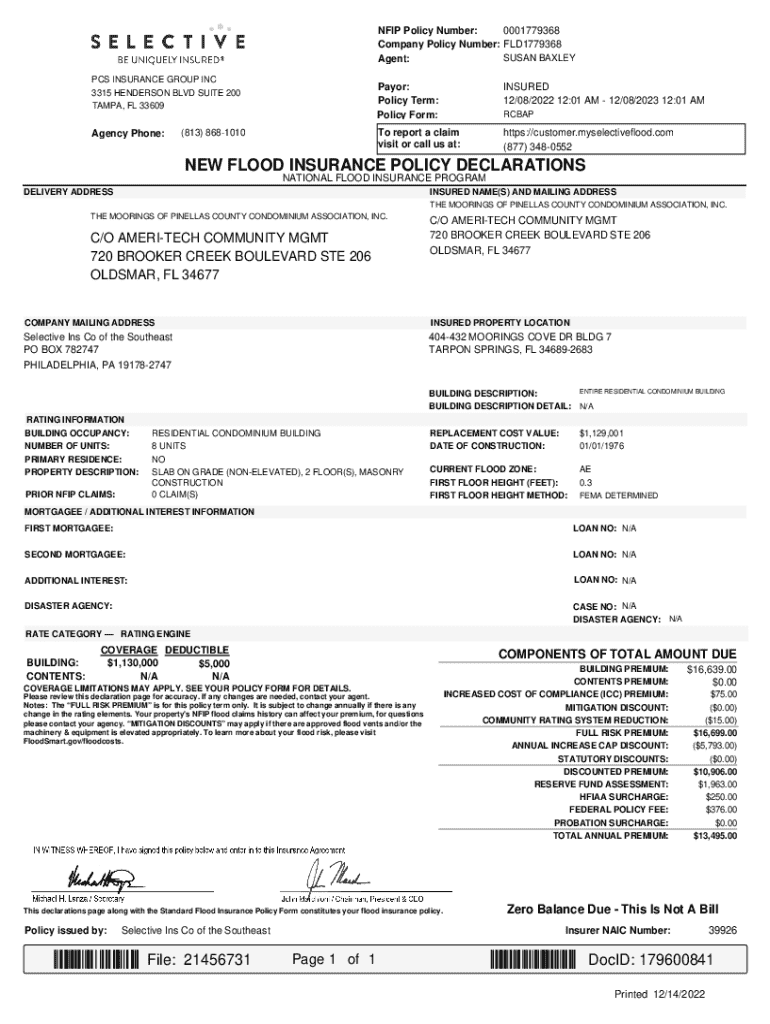

Get the free NEW FLOOD INSURANCE POLICY DECLARATIONS

Get, Create, Make and Sign new flood insurance policy

How to edit new flood insurance policy online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new flood insurance policy

How to fill out new flood insurance policy

Who needs new flood insurance policy?

Understanding the New Flood Insurance Policy Form

Understanding flood insurance

Flood insurance is a specialized insurance policy that protects property owners from financial losses due to flooding. Unlike standard homeowners insurance policies, which typically exclude flood damage, flood insurance is vital for homes located in flood-prone areas. Its significance cannot be overstated, especially for residents in regions vulnerable to extreme weather, rising sea levels, or local flooding. The National Flood Insurance Program (NFIP), managed by the Federal Emergency Management Agency (FEMA), provides flood insurance coverage, aiming to reduce the socio-economic impact of flooding on communities and individuals.

The NFIP allows policyholders to obtain affordable coverage, promoting community resilience against disasters. Understanding the nuances of flood insurance is crucial for homeowners, especially given that many mortgage lenders require proof of flood insurance for properties within designated flood zones. Furthermore, the new flood insurance policy form introduced by FEMA contains enhanced features designed to simplify the application process for users.

Key elements of the new flood insurance policy form

The new flood insurance policy form introduces several features aimed at improving user experience and facilitating efficient completion. This comprehensive form means to address the challenges faced by policyholders and agents alike. Some key changes from previous versions include a more streamlined layout that makes it easier to navigate, clearer instructions, and additional sections that capture critical information specific to current risk assessments.

The purpose of the new policy form is not just administrative; it seeks to ensure that applicants provide accurate and relevant information about their property to determine appropriate coverage. By standardizing this information collection, the NFIP aims to enhance claims processing while making the experience less daunting for applicants.

Guidelines for completing the new flood insurance policy form

Filling out the new flood insurance policy form may initially seem overwhelming, but by following these step-by-step instructions, you can ensure a smooth process that minimizes errors.

1. **Personal Information Section**: This section requires basic personal details such as your name, address, and contact information. Ensure that all information is up-to-date and accurate to avoid issues in claims processing.

2. **Property Information Section**: Here, you'll identify your flood zone designation using flood maps provided by FEMA. Additionally, you must provide information about the building, including its age, structure type, and occupancy status.

3. **Coverage Options Section**: This part outlines the coverage types available, including building and contents coverage. You will also select the deductibles for each type of coverage based on your financial comfort and risk assessment.

4. **Payment Information Section**: Specify your preferred payment method, whether you choose to pay annually or in installments. Familiarize yourself with your bank's requirements and processing times to ensure timely payments.

5. **Signing and Date Section**: Finally, your signature and date signify your agreement with the information provided. Double-check this section to ensure no crucial details are overlooked.

Interactive tools for form completion

Utilizing interactive tools can significantly enhance your experience when completing the new flood insurance policy form. PDF technology is particularly valuable in assisting users to edit forms directly, providing options for annotations, and ensuring clarity. Features to consider include:

Error prevention tips

Filling out the new flood insurance policy form without making common errors is crucial for a successful application process. Here are some tips to minimize mistakes:

Managing your flood insurance policy

Once you've submitted the new flood insurance policy form, staying organized is key for future management. Here are several strategies to help you manage your policy effectively:

Navigating claims with your flood insurance policy

Understanding how to navigate the claims process with your flood insurance policy is vital for any policyholder. Familiarize yourself with:

Understanding the impact of risk rating 2.0

FEMA's Risk Rating 2.0 represents a significant transformation in how flood insurance premiums are calculated. This updated approach focuses on individual property risk rather than broad regional assessments. Understanding how this impacts your insurance is critical:

Additional considerations

As you complete the new flood insurance policy form, be mindful of several additional considerations to ensure comprehensive coverage:

FAQs about the new flood insurance policy form

Addressing common concerns surrounding the new flood insurance policy form can alleviate confusion for potential applicants. Here are some frequently asked questions:

User testimonials

Real experiences can provide valuable insights into how the new flood insurance policy form impacts users. Here are a few testimonials from individuals who have navigated the form:

Related resources on flood insurance and preparedness

Maximizing your understanding of flood insurance and preparedness involves tapping into diverse resources available to you. Consider exploring the following links and materials for further information:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the new flood insurance policy in Chrome?

Can I create an electronic signature for signing my new flood insurance policy in Gmail?

How can I fill out new flood insurance policy on an iOS device?

What is new flood insurance policy?

Who is required to file new flood insurance policy?

How to fill out new flood insurance policy?

What is the purpose of new flood insurance policy?

What information must be reported on new flood insurance policy?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.