Get the free / Reserve Bank of India / Human Resource Management ...

Get, Create, Make and Sign reserve bank of india

How to edit reserve bank of india online

Uncompromising security for your PDF editing and eSignature needs

How to fill out reserve bank of india

How to fill out reserve bank of india

Who needs reserve bank of india?

Reserve Bank of India Form: A Comprehensive How-to Guide

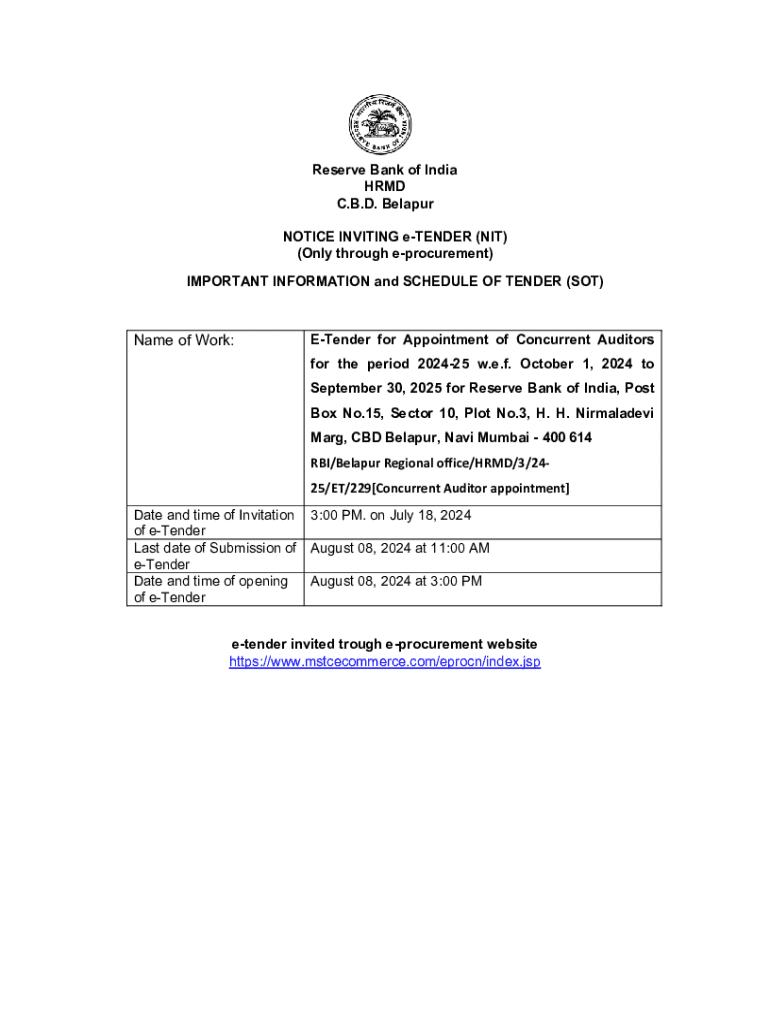

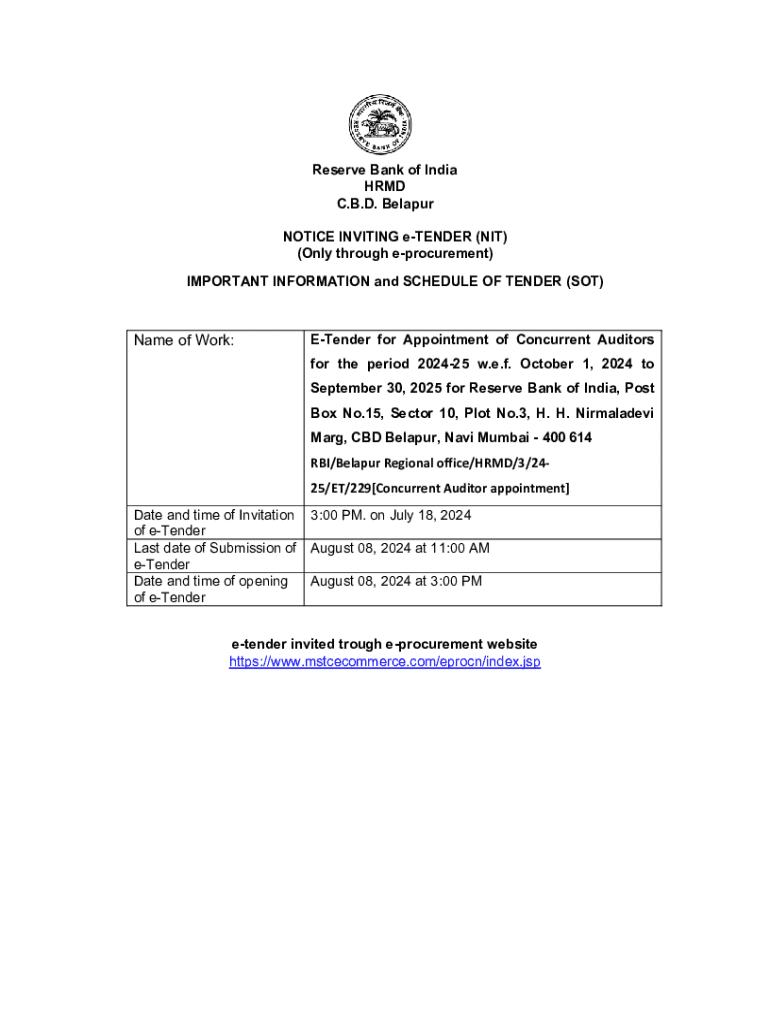

Understanding the Reserve Bank of India forms

The Reserve Bank of India (RBI) plays a crucial role in the country's financial system, regulating banks and ensuring the stability of the economy. The forms issued by the RBI are vital for maintaining compliance with banking regulations, facilitating various financial transactions, and ensuring that institutions adhere to local laws. Understanding these forms is essential for both individuals and financial entities.

RBI forms are categorized into different types, each serving a distinct purpose. For example, there are application forms for licenses or permissions, compliance forms for reporting purposes, and documents used for regulatory adherence. Knowing which form to use is critical in streamlining banking processes.

The process of accessing RBI forms

Accessing RBI forms is straightforward, primarily facilitated through the official RBI website. Users can navigate to the dedicated forms section to find a comprehensive list of available documents. Additionally, the website provides user guides and instructions to assist in form completion.

The RBI's official portal is user-friendly and offers a search functionality that allows users to locate specific forms quickly. This process is designed to enhance transparency and ease of access for the public and banking institutions alike.

Step-by-step guide to filling out RBI forms

Filling out RBI forms requires attention to detail to ensure accuracy. Common sections in these forms typically include applicant information, transaction details, and declarations. To avoid rejection or delays, it’s essential to provide complete and precise information.

Here are some general guidelines for effectively completing RBI forms:

Detailed instructions for specific common forms

Certain forms, such as the ‘Application for Authorisation,’ have specific sections that require careful attention. This form usually asks for details like the applicant's identification, purpose of application, and relevant financial history. Avoid common mistakes such as omitting signatures or submitting incomplete documentation.

For the ‘Form for Return of Income,’ it is important to break down sections effectively. This includes providing sources of income, deductions, and tax liabilities. Ensuring each section is filled out comprehensively can prevent delays in processing.

In addition to these, the Export Credit Guarantee Scheme Form requires specific information regarding export activities and financial commitments. Familiarizing oneself with each form's requirements can alleviate confusion and streamline submissions.

Editing RBI forms using pdfFiller

Editing RBI forms is hassle-free with pdfFiller, a cloud-based platform that empowers users to make necessary changes seamlessly. Users can upload the required RBI forms, making the most out of the editing tools available.

The tools on pdfFiller allow for easy modifications, including adding or removing text, annotating specific sections, and changing fields as necessary. This flexibility is invaluable for ensuring forms are accurate before submission.

Using pdfFiller templates for RBI forms

One of the significant advantages of using pdfFiller is access to customizable templates for various RBI forms. These templates can save time, especially for individuals and teams who may need to fill out multiple forms frequently.

Users can adjust templates to fit specific compliance needs, allowing for tailored experiences based on individual circumstances, such as financial reporting or application requirements. Utilizing templates also ensures that no critical information is overlooked.

Collaborating and signing RBI forms

Collaboration on RBI forms is streamlined with pdfFiller’s features, which allow multiple users to work on a single document simultaneously. This is particularly beneficial for teams managing financial reports or compliance documentation.

Real-time editing and feedback options foster a collaborative environment where team members can communicate about changes effectively, ensuring form submissions are integrated and accurate.

eSigning RBI forms

Digital signatures on RBI forms have gained prominence, thanks to their legal validity. pdfFiller provides an easy route to eSign forms, ensuring that signatories can authenticate documents effectively without needing to print and scan.

To eSign forms using pdfFiller, users must select the eSignature option, follow the prompts to create their digital signature, and place it appropriately on the document. This process not only enhances convenience but also maintains a level of security compliant with regulations.

Managing RBI forms efficiently

Efficient management of RBI forms is essential, especially for those dealing with multiple submissions. With pdfFiller's capabilities, users can store and organize their forms in a cloud-based environment, making retrieval effortless when needed.

Effective document management practices involve categorizing forms based on their type, urgency, or submission deadlines. Doing so can prevent last-minute scrambles and ensure all documents are readily available.

Security features in pdfFiller

Security is a top priority when handling financial documents. pdfFiller incorporates several security measures to protect sensitive information, including encryption protocols and access controls, ensuring compliance with RBI data protection standards.

Users can set permissions for who can view or edit forms within their team, safeguarding against unauthorized access while enabling collaborative efforts.

Frequently asked questions about RBI forms

Navigating the landscape of RBI forms can present challenges. Common queries often arise, such as 'What should I do if a form is rejected?' or 'What are the deadlines for submissions?' Understanding these aspects is critical for timely compliance.

If a form is rejected, it is essential to review the feedback provided, make the necessary corrections, and resubmit promptly. Additionally, staying informed about deadlines is key to maintaining compliance and avoiding penalties.

Resources for further assistance

For those seeking further assistance, the RBI offers a range of support options. Users can contact RBI’s support directly through provided contact information or engage with community forums for more interactive problem-solving.

These resources can provide invaluable insights and guidance about navigating the more complex aspects of dealing with various RBI forms.

Advanced tips for navigating RBI forms landscape

Staying updated with regulatory changes is crucial for anyone dealing with RBI forms. Resources like news updates from the RBI, financial news portals, and government announcements can provide timely information about modifications to compliance requirements.

Utilizing technology effectively can also ease the management of these forms. Techniques such as setting up reminders for deadlines, using document tracking features in pdfFiller, and following best practices for data entry can lead to an efficient workflow.

Trends in banking forms and documentation

The banking landscape is evolving, particularly with the digital transformation influencing how forms and documentation are handled. Many institutions are moving towards paperless processes, which not only streamline operations but also reduce physical storage needs.

The future of RBI forms may see more integrations with mobile banking technologies, allowing users greater flexibility. Predictively, forms will become even more user-friendly, incorporating features such as auto-fill and dynamic insights to assist users.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my reserve bank of india directly from Gmail?

Can I create an electronic signature for the reserve bank of india in Chrome?

How do I fill out reserve bank of india on an Android device?

What is reserve bank of india?

Who is required to file reserve bank of india?

How to fill out reserve bank of india?

What is the purpose of reserve bank of india?

What information must be reported on reserve bank of india?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.