Get the free Credit Card Balance Transfer Form - Blossom

Get, Create, Make and Sign credit card balance transfer

Editing credit card balance transfer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card balance transfer

How to fill out credit card balance transfer

Who needs credit card balance transfer?

Credit Card Balance Transfer Form: How-to Guide

Understanding credit card balance transfers

A credit card balance transfer is a financial tool that allows individuals to move debt from one credit card to another, typically to benefit from lower interest rates. The primary purpose is to save money on interest costs and streamline various debts into a single, manageable payment, often with promotional interest rates listed as 0% APR for an introductory period.

Balance transfers can significantly reduce the total cost of borrowing. They provide an opportunity for debt consolidation which can help improve personal cash flow while simultaneously having a positive impact on an individual’s credit score when managed responsibly.

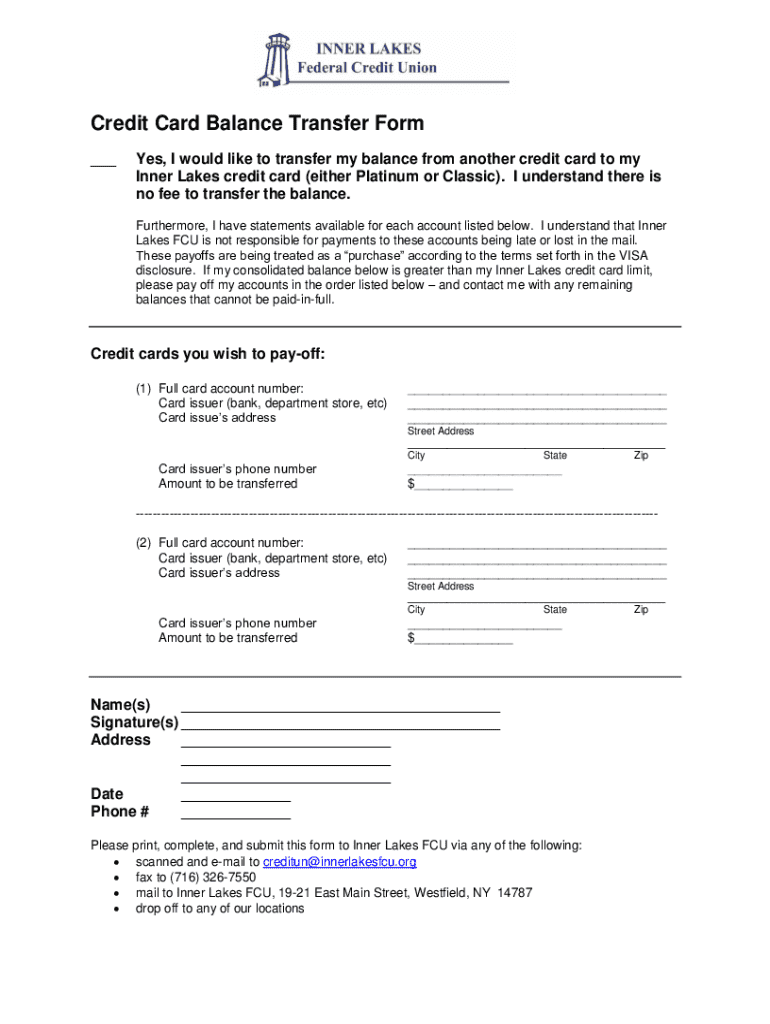

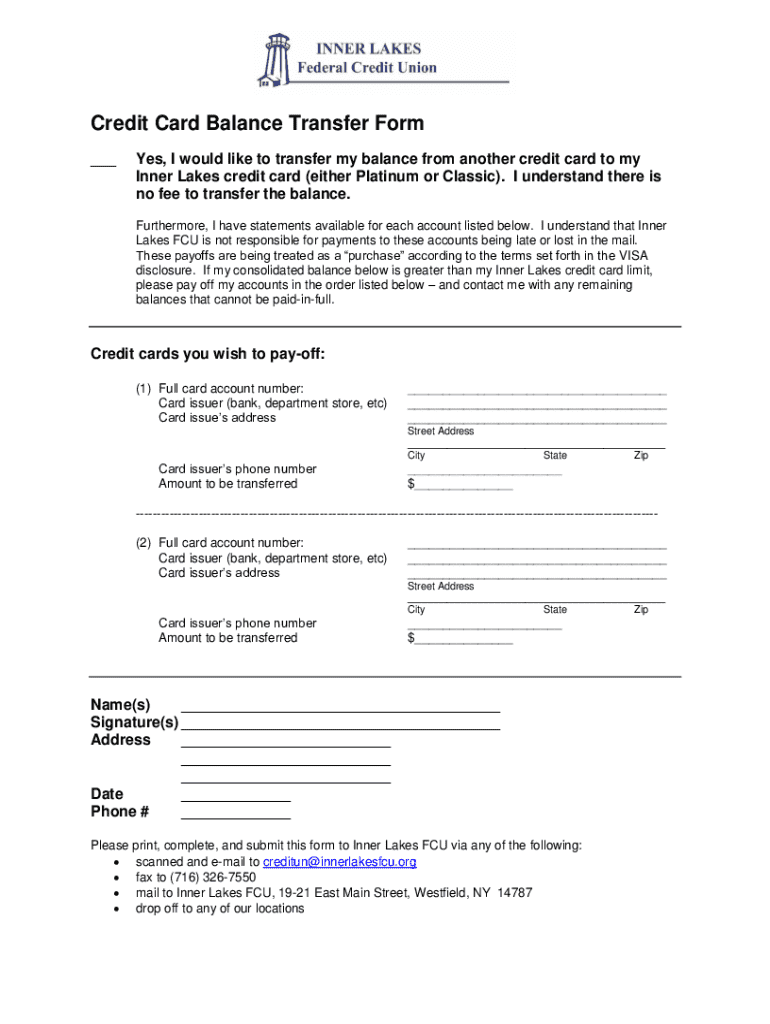

The importance of the balance transfer form

The balance transfer form is a crucial component of the credit card transfer process. It serves as the formal request to your new credit card issuer to transfer the specified amount from your existing credit account. Without correctly filling out this form, the transfer process cannot proceed.

Typically, the form will require details such as your personal information, the credit card number from which you are transferring the balance, and the amount you wish to transfer. Ensuring that this information is accurate is vital, as any discrepancies could delay the transfer process or lead to outright rejection.

Preparing for the credit card balance transfer

Before filling out the credit card balance transfer form, it is essential to assess your current financial situation. Start by calculating your existing balances and the interest rates associated with each credit card to understand how a balance transfer may benefit you.

Additionally, reviewing your credit score is crucial as it can affect your eligibility for desirable balance transfer offers. A higher credit score typically garners better interest rates and terms.

Filling out the credit card balance transfer form step-by-step

When you're ready to fill out the balance transfer form, begin by gathering all necessary personal information and details about your existing credit accounts. This process ensures you can complete the form accurately without delays.

Filling out the form requires you to provide essential information such as your full name, address, current credit card number, and the amount you want to transfer. Be particularly careful to check for any errors in your current credit card numbers to avoid complications.

Managing the transition after submission

Once you submit the balance transfer form, it's essential to understand the timeline for approval and processing. Typically, issuers will take a few days to review your request. You should receive communication from your new credit card issuer, confirming the transfer. Keep in mind that these steps can vary between card issuers.

During the transfer, monitor both your new and old accounts closely. Checking your balances will help you ensure that payments are processed correctly, and you don’t incur late fees because of the transfer. Staying organized during this transition is key.

Maximizing financial benefits post-transfer

Creating an effective payment plan is vital after successfully transferring your credit balance. This might involve setting a budget that prioritizes repayments to ensure you can pay off the transferred balance within the promotional period.

Additionally, understanding any promotional rates and their expiration dates is necessary. Late payments can lead to higher interest rates after the introductory period ends. Moreover, consider reassessing your financial strategy periodically to set new credit goals.

Interactive tools and resources

Utilizing online balance transfer calculators can help you estimate potential savings when considering different credit offers. These tools allow users to input their remaining balances and interest rates, providing a clearer picture of potential savings during the transfer process.

Additionally, many platforms like pdfFiller offer templates and printable forms to facilitate a streamlined filling process. Engaging with community forums can also provide insights and tips shared by others who have navigated similar situations.

Utilizing pdfFiller for your balance transfer needs

pdfFiller offers an intuitive platform designed for easy editing and management of your balance transfer form. With its cloud-based capabilities, users can edit, e-sign, and collaborate on documents, ensuring a seamless transfer experience.

Getting started on pdfFiller is simple. After registering, users can navigate directly to balance transfer forms and utilize various tools to manage their documents effectively. The enhanced management features allow for easy template usage and quick corrections, promoting accuracy and efficiency.

Further assistance and support

For users needing additional help with their balance transfer forms, pdfFiller offers responsive customer support. Whether you require assistance with technical issues or guidance on filling out forms, accessing live support can help clarify any concerns.

Additionally, community forums provide users with a chance to share tips and strategies, enhancing collective knowledge. Engaging with other pdfFiller users can present new ideas and solutions for managing balance transfers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit card balance transfer without leaving Google Drive?

How do I fill out the credit card balance transfer form on my smartphone?

How do I complete credit card balance transfer on an Android device?

What is credit card balance transfer?

Who is required to file credit card balance transfer?

How to fill out credit card balance transfer?

What is the purpose of credit card balance transfer?

What information must be reported on credit card balance transfer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.